Quebec Precious Metals Corp. (QPM:TSX.V; CJCFF:OTCQB; YXEP:FSE) was created through a transaction that brought together two mining companies, along with the consolidation of additional assets in the James Bay region of Quebec. The company has large, prospective land holdings in a mining-friendly jurisdiction that is rich in infrastructure thanks to significant hydroelectric projects nearby. The flagship Sakami project has been the focus of exploration work in recent years and has produced multiple high-grade gold showings. With an analyst estimate of ~1.3 million ounces of open-pit gold mineralization, and an active 2021 exploration program, QPM has a line of sight on over 2 million ounces of resource and is planning on advancing work on an NI 43-101 resource study later this year.

QPM has a market cap of ~$20 million, net cash of over $4.0 million, excluding the CA$8 million in cash that QPM expects to receive from the monetization of its non-core rare earth Kipawa project. At an estimated enterprise value to ounce in the ground of ~$10 for just the open-pit resource (with significant underground potential), QPM trades at a significant discount to a peer group that is in the $20–$80 range.

QPM also has a group of strong strategic shareholders: Newmont is the largest shareholder with a 12.5% stake. The Caisse, Investissement Quebec and Sidex also own a combined 12%+. In total, more than 40% of stock is tied up with strategics and insiders.

Key Highlights

- Extensive land package: A 1,100 km2 highly prospective land package, bordering well-developed infrastructure and a flagship project only 90km from Newmont’s Eleonore mine.

- Visibility towards 2 million ounces at Sakami: Drilling done to date suggests total mineralization could be in the ~1.3 million ounce range using a cut-off depth of 300 meters for open-pit material. There is no published resource estimate but getting to an indicative 2 million ounce mark will be a catalyst to initiate an NI 43-101 resource study, expected in 1H/22.

- The growth potential of the target is supported by a 13km mineralized trend. Correlation between soil geochem, sampling, mag and IP, along with positive drill results, is demonstrating the multimillion-ounce potential.

- Strong strategic shareholders: Newmont Goldcorp is the largest shareholder with a 12.5% stake. The Caisse, Investissement Quebec and Sidex also own a combined 12%+.

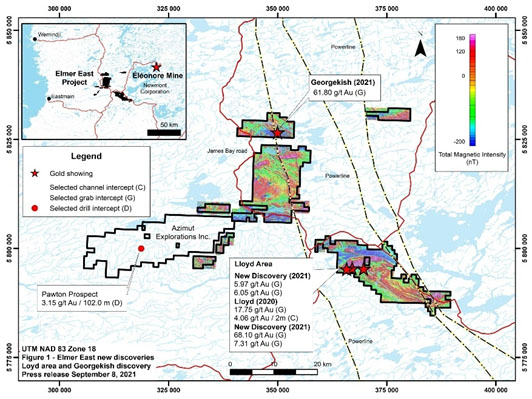

- Elmer East project: recently announced grab samples at QPM’s secondary project (Elmer East) included 68.1 g/t Au, 13.4 g/t Ag, 0.26 % Zn, 0.34 % Pb and also identified a new gold-bearing vein grading 61.8 g/t Au and 35.8 g/t Ag at the Georgekish showing in the north-central claim block of the project (Sept. 2021).

- Proven record of unlocking value from non-core assets: Management has been diligent in sharpening its focus to a small number of projects and has demonstrated an ability to monetize non-core assets as a source of non-dilutive funding:

- In August 2021, QPM announced the sale of its non-core Kipawa project for CA$8 million in cash.

- Including Kipawa, QPM has now sold and optioned off multiple assets for a total of roughly $10 million in cash and stock in the last 24 months.

- Another two assets are currently listed as non-core, which could unlock significant value relative to the current market cap.

- A balance sheet with over CA$4 million in cash, with another CA$5 million due in the next 12 months from the sale of Kipawa = no immediate funding required for the exploration program.

- Valuation: Using the rough mineralization estimate of 2 million oz, QPM is trading at only $10/oz in the ground vs a peer average of ~$50.

Recent Developments:

1. Kipawa Sale for CA$8 million in CASH proceeds

On Aug 10, 2021, Quebec Precious Metals (QPM-V) announced that it has agreed to sell its 68% interest in the Kipawa exploration project (Investissement Quebec owns the remaining 32%) and 100% interest in the Zeus exploration project to Vital Metals (ASX: VML) for total cash consideration of CA$8 million.

Both Kipawa and Zeus are heavy rare-earth projects and non-core to QPM. This transaction is another example of QPM successfully executing its stated strategy since 2018 of monetizing non-core assets to focus on its flagship Sakami exploration project in the James Bay region of Quebec.

Subject to final due diligence, the total purchase price of CA$8 million in cash is payable as follows:

- CA$150,000 deposit on signing the Term Sheet (completed);

- CA$2.35 million on acquisition of the projects;

- CA$2.5 million on the 1st anniversary of acquisition;

- CA$1 million on the 2nd anniversary of acquisition;

- CA$1 million on the 3rd anniversary of acquisition; and

- CA$1 million on the 4th anniversary of acquisition.

The completion of this transaction further bolsters Quebec Precious Metals' strong balance sheet and market position and gives the company increased financial flexibility to further expand its James Bay QC exploration program.

2. Elmer East Discovery

On Sept 8, 2021, QPM announced that it had received very encouraging results from its early exploration work on its Elmer East property, a secondary asset in the QPM portfolio.

Based on work that was completed in 2020 at its Elmer East project (in collaboration with GoldSpot Discoveries Group – TSXV:SPOT), the Quebec Precious Metals team went back into the field to collect samples to improve our geological understanding of this extensive mineralized system and to identify the best drill targets for future exploration.

The most significant samples are as follows:

- 1 g/t Au, 13.4 g/t Ag, 0.26 % Zn, 0.34 % Pb

- 17 g/t Au, 41.2 g/t Ag, 0.21 % Zn, 1.65 % Pb

- 31 g/t Au, 18.3 g/t Ag, 0.28 % Zn, 0.46 % Pb

- 05 g/t Au, 4.6 g/t Ag

- 97 g/t Au, 31.8 g/t Ag, 0.13 % Pb

In addition, a new gold-bearing vein grading 61.8 g/t Au and 35.8 g/t Ag was discovered at the Georgekish showing in the north-central claim block of the project.

The 2021 summer surface sampling program expanded the mineralized corridor at the Lloyd discovery area from 60 meters to 4.2 km and remains open in all directions.

Note that these discoveries at Elmer East are in addition to the company’s flagship Sakami project, also in James Bay, QC, where QPM already has a clear target on an economic resource in excess of 2+mm ounces AU based on extensive drilling done to date.

3. Flagship Sakami Drill Results

On June 9, 2021, Quebec Precious Metals (QPM-TSXV) released assays from the final seven holes of its 2020 drill program, which included two of the best holes to date for the company's flagship Sakami project, 90km NE of Eleonore in James Bay, QC. The Sakami project continues to get both bigger and better, with these results clearly validating management's geological interpretation of the deposit. We are encouraged to see some of the best holes come out just as the company kicks off its 2021 drilling campaign.

Notable Drill Results:

A total of seven were released recently, three of which showed high-grade intervals. Two of the holes (PT-21-177 & PT-21-182) had high-grade intercepts over impressive widths and look to be two of the best holes released to date at Sakami:

- 83 g/t Au over 58.6 m including 2.40 g/t over 30.9 m

- 15 g/t Au over 42.2 m including 5.17 g/t over 14.5 m

The deposit remains open at depth and in both directions along the 3500m+ strike length. The intersection of high-grade material at depth is an interesting development and, with further success, could present a possibility to add underground potential in the future. Overall, we see these results along with the previous drilling advancing QPM closer to the 2M+ oz estimate that would be a key milestone and catalyst to move forward on a PEA.

The deposit remains open at depth and in both directions along the 3500m+ strike length. The intersection of high-grade material at depth is an interesting development and, with further success, could present a possibility to add underground potential in the future. Overall, we see these results along with the previous drilling advancing QPM closer to the 2M+ oz estimate that would be a key milestone and catalyst to move forward on a PEA.

Background

QPM was formed in 2018 through the merger of Matamec Exploration (MAT-TSXV) and Canadian Strategic Metals (CJC-TSXV), along with the gold assets of Sphinx Resources and a consolidation of a 100% interest in the Cheechoo-Eleonore trend. The newly formed company was created with a mandate to consolidate and focus on a portfolio of promising gold assets in the James Bay region of Quebec, including the flagship Sakami project. The resulting company had interests in 17 separate projects across multiple commodities. A refreshed management team, with the backing of strategic shareholders, has focused on a small number of well-defined gold projects, while also aggressively monetizing non-core assets. As part of the business arrangement, Goldcorp (now Newmont) acquired a 14% stake in the new company.

The business combination also provided a revamped management team and board led by Normand Champigny, CEO and director. Mr. Champigny, a geological engineer by training, has significant leadership experience within the mining industry and was most recently the CEO of Sphinx Resources before the spinout to QPM. He holds degrees from École Polytechnique in Montreal, University of British Columbia, and Paris School of Mines (Specialized Diploma in Geostatistics). Mr. Champigny has also served as an executive committee member of PDAC, chair of the board of Minalliance, and is currently a director of Bonterra Resources (BTR-TSX-V).

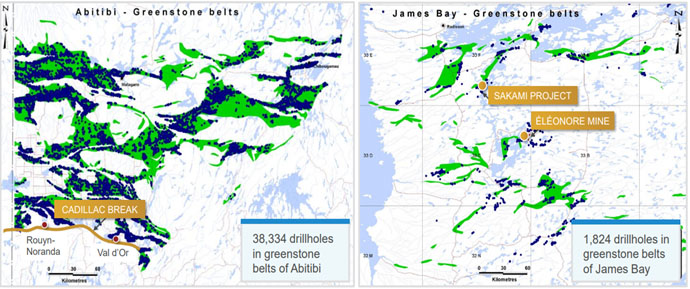

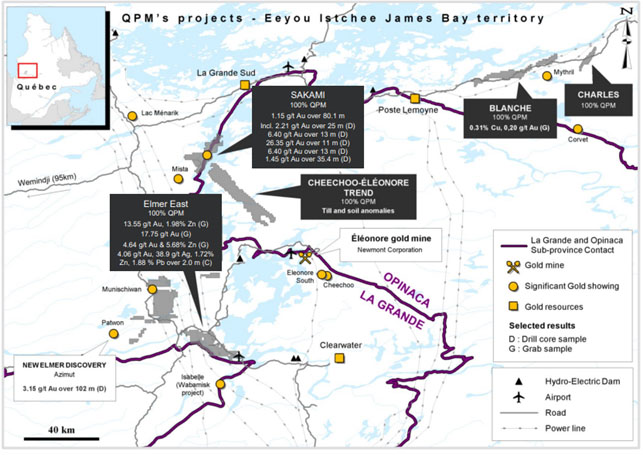

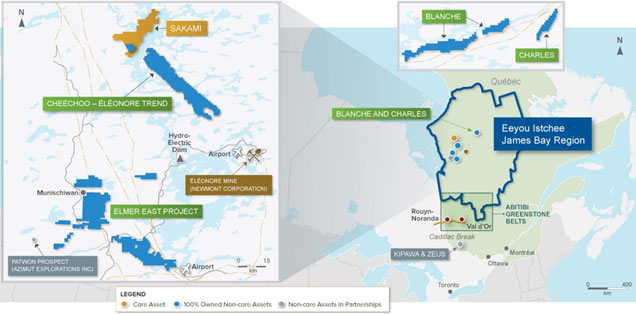

James Bay – Eeyou Istchee Territory

The James Bay region is a vast region in Western Quebec and largely underexplored compared to the Abitibi greenstone belts. For a large area with limited mining history, the region has extensive infrastructure thanks to the development of the huge James Bay Hydroelectric Project, which has created a significant network of roads, power lines and airports that has opened up the region.

The map above illustrates the disparity in activity between the Abitibi Greenstone belts, which has over 38,000 drillholes and the James Bay Greenstone belts with only 1,800 and its potential for exploration upside. QPM has narrowed its focus to Sakami and a small number of highly prospective gold projects in close proximity.

The map above illustrates the disparity in activity between the Abitibi Greenstone belts, which has over 38,000 drillholes and the James Bay Greenstone belts with only 1,800 and its potential for exploration upside. QPM has narrowed its focus to Sakami and a small number of highly prospective gold projects in close proximity.

Sakami

The 100% owned flagship Sakami gold project sits in the James Bay region only ~90km northwest from Newmont’s Eleonore mine and in a mining-friendly jurisdiction with extensive infrastructure including nearby roads, airports, and power lines. The property hosts a highly prospective 23km contact between the La Grande and Opinaca geological sub-provinces with multimillion-ounce potential. Exploration has focused on 13km of the structure with multiple high-grade gold showings and the identification of several mineralized bodies and additional targets.

It was only in 1999 that Matamec initially discovered gold showings on the Western side of the Sakami Lake. In 2001, following extensive channeling sampling, a 13-hole drill program commenced on what is now the La Pointe deposit. Regular exploration lapsed for several years until the formation of QPM and the 2018 drilling program.

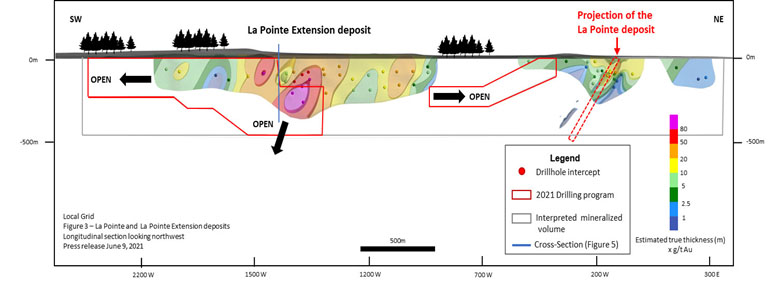

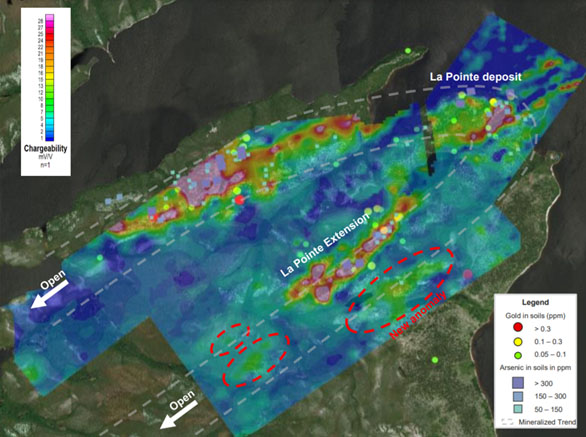

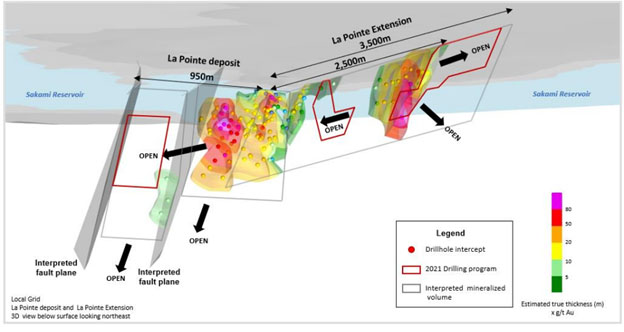

La Pointe has been the focus of exploration work to date and there have now been over 130 holes and 42,000m drilled on the deposit. Drilling results to date suggest that gold mineralization extends over a 950m strike length, open to the west, and down to a depth of 450m. Average thickness of mineralization is between 30m and 50m and up to 100m thick.

The company is advancing toward a formal resource, but back of the envelope calculations for La Pointe using 18.4 million tonnes at a 2.1 g/t grade suggests roughly 1.2M total ounces to a depth of 450m or 900,000 open-pitable ounces when using a cutoff depth of 300m.

Despite having to reduce the number of meters drilled in 2020 due to COVID-19, the 2020 exploration campaign produced several excellent results, including the discovery of the La Point Extension, located roughly 2km to the southwest of La Pointe and showing similar geological characteristics. Results of the summer and fall drilling program extended the strike length at La Pointe Extension to over 1km with mineralization from surface to a depth of 250m, and open in all directions.

Following the discovery, an induced polarization (IP) survey was conducted to evaluate the potential size of the zone. The survey extended the zone of interest 800m to the northwest delineating a 2 km-long anomaly with an interpreted parallel structure.

Drilling Highlights:

La Pointe:

- 94 g/t Au over 21 m

- 01 g/t Au over 23 m

- 16 g/t Au over 21 m

- 51 g/t Au over 48 m

- 89 g/t Au over 14.9 m

- 22 g/t Au over 31.5 m

- 59 g/t Au over 27.0 m

La Pointe Extension:

- 83 g/t Au over 58.6 m including 2.40 g/t over 30.9 m

- 15 g/t Au over 42.2 m including 5.17 g/t over 14.5 m

- 15 g/t Au over 80.1 m

- 45 g/t Au over 35.4 m

- 14 g/t Au over 70.3 m

- 03 g/t Au over 53.8 m

- 93 g/t Au over 101.0 m

- 31 g/t Au over 42.0 m

The ultimate goal for Sakami is to achieve a level of mineralization that supports an open-pit project with a standalone mill, which would mean exceeding 2 million ounces. We believe the company has visibility to the 2 million ounce level.

The ultimate goal for Sakami is to achieve a level of mineralization that supports an open-pit project with a standalone mill, which would mean exceeding 2 million ounces. We believe the company has visibility to the 2 million ounce level.

Rough estimates for La Pointe Extension suggest 350-400k ounces of mineralization with 5 drill holes from the fall program still awaiting assays.

That would equal a total open-pittable ounce count of approximately 1.3 million for Sakami based on the released drill results for La Pointe and La Pointe Extension.

The recently released exploration plan will see continued focus on La Pointe and La Pointe Extension with two drilling rigs running to complete 14,000m and 40+ holes. While that amount of drilling may be small relative to larger peers, it is significant relative to the 25,000m drilled since the creation of the company in 2018. It is also at a level that is easily scaled up and further non-core asset sales could be a catalyst to accelerate activity. The company has also commenced preliminary metallurgical work with results expected in the first half of this year.

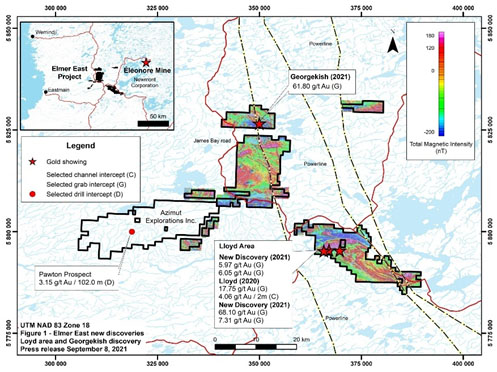

Elmer East

The 100% QPM-owned Elmer East project is located along trend of the recent Patwon prospect gold discovery made by Azimut Exploration on its Elmer project. Fieldwork at Elmer East commenced last year with a total of 425 grab samples collected during the summer and resulted in the Lloyd discovery. A fall channel sampling program had several highlight samples including one of 4.06 g/t Au, 38.9 g/t Ag, 1.72 % Zn, 1.88 % Pb over 2.0 m.

Based on work that was completed in 2020 at its Elmer East project (in collaboration with GoldSpot Discoveries Group – TSXV:SPOT), the Quebec Precious Metals team went back into the field to collect samples to improve our geological understanding of this extensive mineralized system and to identify the best drill targets for future exploration.

The most significant samples are as follows:

- 1 g/t Au, 13.4 g/t Ag, 0.26 % Zn, 0.34 % Pb

- 17 g/t Au, 41.2 g/t Ag, 0.21 % Zn, 1.65 % Pb

- 31 g/t Au, 18.3 g/t Ag, 0.28 % Zn, 0.46 % Pb

- 05 g/t Au, 4.6 g/t Ag

- 97 g/t Au, 31.8 g/t Ag, 0.13 % Pb

In addition, a new gold-bearing vein grading 61.8 g/t Au and 35.8 g/t Ag was discovered at the Georgekish showing in the north-central claim block of the project.

QPM has now completed an airborne survey, targeting study, grab sampling and channel sampling. Exploration plans for 2022 include geological mapping and trenching along the Lloyd discovery.

QPM has now completed an airborne survey, targeting study, grab sampling and channel sampling. Exploration plans for 2022 include geological mapping and trenching along the Lloyd discovery.

Non-Core Assets

QPM has an extensive holding of properties and projects in Quebec, and a small joint venture in Ontario (Matheson, 50% QPM). Of these projects, Sakami is considered the core holding, but exploration is also budgeted for the Elmer East and Cheechoo-Eleonore projects. Management has been extremely active in monetizing and optioning out non-core assets to unlock value and sharpen the company’s focus on gold exploration in James Bay.

The company has several non-gold assets and has been successful in realizing over $10 million in value from transactions over the past eighteen months, over 80% in cash proceeds. All non-core assets are being analyzed for possible sales and the Kipawa asset sale is complete pending final due diligence.

Kipawa (68% QPM, 32% Investissment Quebec) & Zeus (100% QPM) – Rare Earths

In August 2021, Quebec Precious Metals agreed to sell its 68% interest in the Kipawa exploration project (Investissement Quebec owns the remaining 32%) and 100% interest in the Zeus exploration project to Vital Metals (ASX: VML) for total cash consideration of CA$8 million.

Both Kipawa and Zeus are heavy rare-earth projects and non-core to QPM. This transaction is another example of QPM successfully executing its stated strategy since 2018 of monetizing non-core assets to focus on its flagship Sakami exploration project in the James Bay region of Quebec.

The completion of this transaction further bolsters Quebec Precious Metals' strong balance sheet and market position and gives the company increased financial flexibility to further expand its James Bay QC exploration program.

Blanche and Charles (100% QPM) – Copper-Gold

Blanche and Charles (100% QPM) – Copper-Gold

The two fully owned properties are 120-150km northeast of the Eleonore mine and only 7km north of Midland Explorations Mythrill copper-gold discovery. BHP Billiton invested $5.9 million in Midland following the Mythrill discovery to advance drilling on the project.

Matheson JV (50% QPM) - Gold

Located in the Timmins mine camp, the Matheson JV is only 5km to the northeast of the Hoyle Pond mine, which has produced over 4 million ounces and is one of the highest-grade deposits in the Timmins camp. Three higher potential corridors have been identified based on favorable volcanic lithologies and significant gold-in-till anomalies are present.

Liquidity

QPM raised a total of $3.25 million through an over-subscribed private placement (the company was targeting $1.5 million) in April 2021 and has over CA$4 million on the balance sheet EXCLUDING proceeds from the Kipawa sale. Quebec Precious Metals is now fully financed well beyond the 2021 exploration program.

Valuation

While a NI 43-101 resource has yet to be completed to provide a valuation, analyst Barry Allan at Laurentian Bank Securities had last estimated a resource of 1.3 million oz based on an open pit cut-off of 300m. The 2020/21 drill results have expanded the strike length and depth of the deposit – yet QPM is trading at an EV/oz of under $10 with NO value being ascribed to the non-core assets.

Catalysts

- Exploration work will continue to be a major catalyst for QPM over the next 12 months. The 2021 program consists of another 14,000m of drilling at Sakami. This drilling budget could be expanded given QPM’s strong balance sheet and the sale proceeds from Kipawa.

- Continued success from the drill bit should also advance QPM towards its first resource estimate. This would be a major valuation milestone and positive de-risking event and is expected in 1H/22.

- In addition to a resource, metallurgical testing is also underway with results expected in the second half of THIS year.

- The finalization of the Kipawa sale and further asset sales could be another major catalyst for QPM.

Jeffrey White founded Hinge Markets, a capital markets advisory and investor relations firm, in 2019. A lawyer by training, White has spent over 20 years in the Canadian capital markets, initially in corporate finance/M&A, and then in senior executive and institutional equity roles. Prior to launching Hinge Markets, White was the managing director and co-head of institutional sales at Laurentian Bank Securities. He was formerly the president and CEO of Stonecap Securities, and also served as the head of institutional equity sales at Blackmont Capital, the predecessor firm to Stonecap, for over seven years. White earned an MBA from the Ivey Business School in 1999. He holds a law degree (LL.B.) from the University of British Columbia and was called to the Bar of Ontario in 1995.

Disclosure: 1) Jeffrey White: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Quebec Precious Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Quebec Precious Metals' engagement with Hinge Markets ended on Oct. 31. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Quebec Precious Metals. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quebec Precious Metals, a company mentioned in this article.