After almost two months of exploration at the Esperanza property at the Flecha de Oro project in Argentina, results are starting to come in for Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE). The ongoing trenching program is currently in phase 1 and focused on a nine square kilometer area where numerous gold-bearing quartz veins have been identified at surface. There were several interesting and economic intercepts reported, which incentivizes management to continue searching for the heart of the mineralized system.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

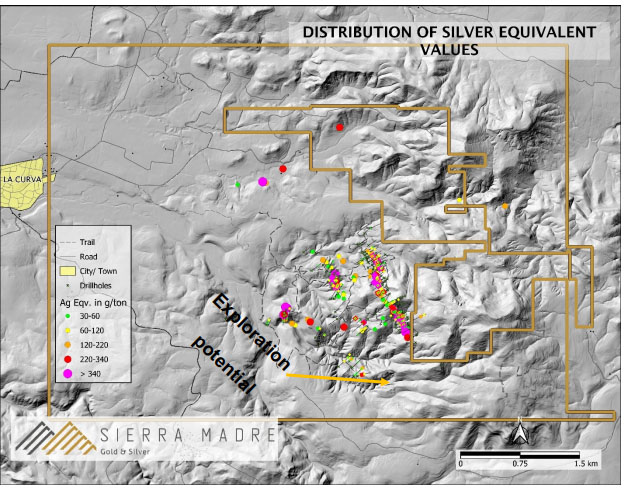

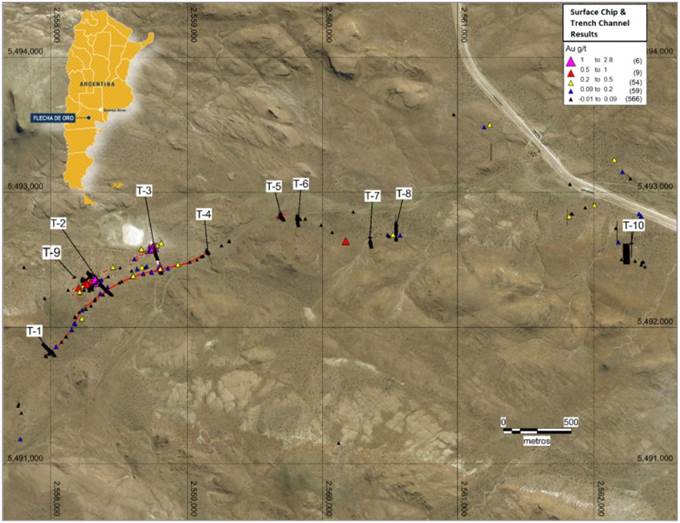

The Flecha de Oro project includes the La Esperanza, Puzzle and Maquinchao properties, and the company has been trenching at the Puzzle property last December and January, and also trenching since March at La Esperanza. The trenching program of Puzzle commenced on December 7, 2020, and was planned to include 18 trenches totaling up to 2,500 meters, excavated across a vein corridor along 6.2 kilometers of strike length, to delineate targets for a potential 2021 drilling program. The locations of the first 10 trenches can be seen on the following map:

Results from these first 10 trenches identified gold in multiple samples over significant widths in several trenches, but unfortunately at grades below the targeted thresholds. Besides this, VP Exploration Brian McEwen stated in my last update on the company that sampling at Puzzle brought a lot of surprises they needed to figure out. I asked McEwen if not reaching the thresholds was the cause of not completing the other eight planned trenches or maybe the discussed surprises (what were they?) played a role as well, if they were planning on doing more work on Puzzle in the near future, and what the targeted thresholds actually were. He answered that grades and widths recently found at La Esperanza are more in line with what the company is looking for, so for now, they will be focusing there, with no plans for Puzzle in the near future.

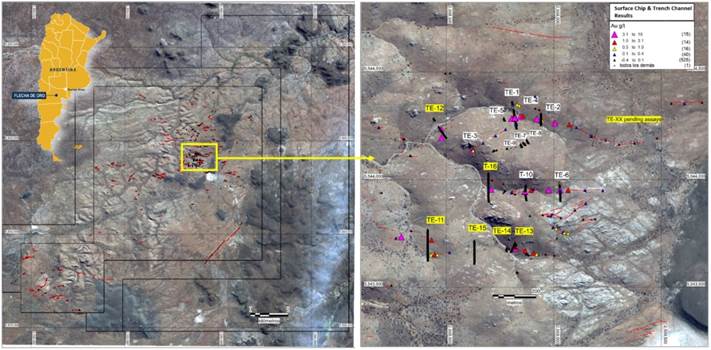

Since Puzzle didn't return the desired results, McEwen decided to prioritize Esperanza for ongoing exploration. This property hosts multiple vein corridors defined by outcropping quartz veins, boulders and quartz float (quartz float are discrete pieces of quartz vein at surface, likely from closer to the source than a boulder).

Since the commencement of trenching at Esperanza on March 1st, 2021, Golden Arrow has completed 20 trenches totaling 1,693 meters across surface quartz veins and sheeted veinlets that range from a few centimeters to two meters in width. Assays have been received for 10 of these trenches. An additional 15 trenches are underway, and the phase 1 program is expected to continue through most of May.

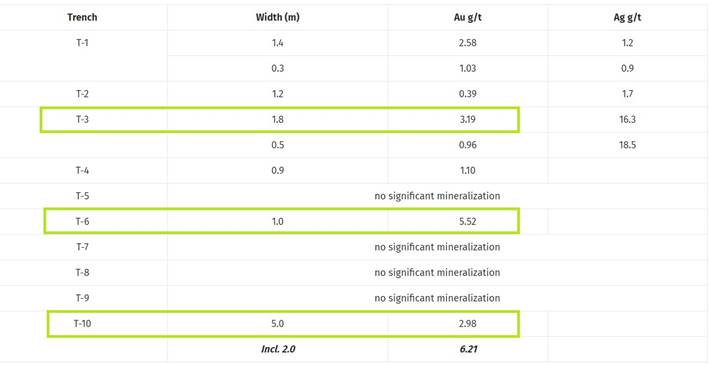

A summary of the results from the first 10 trenches is shown in the table below, with the highlights marked in green:

These results were somewhat below my expectations considering the surface sampling results from 2019 and 2020, with the following highlights:

- 24.0 g/t Au over 2 m

- 18.0 g/t Au over 0.7 m including visible gold (proximal to Trench T-1)

- 13.09 g/t Au over 5 m (proximal to Trench T-2)

- 99 g/t Ag and 2.8% Cu over 0.2m

- 129 g/t Ag, 3.5% Cu and 0.2% Bi over 1.2m

The three mentioned highlights not proximal to one of the 10 completed trenches were sampled from a different area. According to management, the program is not finished, and later trenches are/will be in other areas, including near to the 24 g/t sample mentioned above. The other two highlights mentioned were base metal focused and may not be targeted as such.

Despite the differences, McEwen is positive, as he commented:

"We have seen from our previous surface sampling that there is widespread gold in the system at Esperanza, so we are encouraged to find some broader intervals in the near-surface that will help us vector into the heart of the system."

I wondered what exactly would cause improved vectoring after the successful sampling program from 2019ľ2020. He stated that there are a lot of veins in the area, so the results will indicate which ones warrant a closer look, including, potentially, drilling. I also wanted to know what's next after completing the trenching program this month, when, for example, drilling can be expected, a potential indication of how many meters. According to McEwen, this will be determined once the trenching program is complete and the results evaluated.

In addition to its exploration program at Esperanza, the company is continuing with its project acquisition efforts in the region by constantly reviewing new opportunities to add to its exploration pipeline.

Besides Flecha de Oro, Golden Arrow is actively exploring two other projects, the Rosales copper project in Chile and the Tierra Dorada Gold project in Paraguay.

As a reminder, the Rosales Copper project is located on the Margarita Trend, which is a structural trend that continues from the adjacent operating Margarita mine southwest onto the Rosales Project, where mineralized occurrences were sampled and returned high values from five rock chip samples in a target area. The company completed the first pass of sampling in February, and plans to follow up with a trenching program.

In the meantime, the company has awarded a TEM surface geophysical survey, to be commencing this month. According to the news release:

"The goal of the program is to detect and delineate prospective electromagnetic conductor responses, consistent with near-surface copper stockwork mineralization, potentially related to Manto-type mineralized copper systems at depth. The program will be executed in two phases:

- An initial test over approximately 300 hectares that includes known copper sulphide mineralization will be conducted and the results assessed to determine if the TEM technique successfully detects the mineralization.

- If successful, a second survey covering approximately 800 hectares will be completed."

This survey is designed to map structures related to mineralization, and once completed, its interpretation will be combined with results from the sampling program in order to delineate targets for trenching and future drilling. As copper is printing 10 year highs now, it would be a good thing to get some solid results asap.

Besides Rosales, management is also busy with the Tierra Dorada flagship project in Paraguay. As a reminder, recent highlights of the last drill program were DHTD18 returning 0.5m @143.5g/t Au from 3m, and DHTD35 returning 3.16m @11.8g/t Au from 1.7m.

The plan was to move ahead with drilling of shallow holes regardless of the granting of the exploration permits, which allow deeper drilling, but after further review of the initial shallow drilling results and the new targets identified by the IP geophysical survey, it was concluded it was better to wait for deeper drilling. The permits were delayed by COVID-19 outbreaks, and in the meantime the company commenced a detailed soil sampling program, besides ongoing mapping, trenching and surface sampling.

Financials: as per the last financials (December 2020) the company owns 675,580k shares of SSR Mining (SSRM.TO), this equity being worth C$13.18 million at the moment (May 2, 2021, share price C$19.51) as well as C$6.5 million in cash. As such it is clearly fully funded for upcoming exploration programs for at least the next two years. Keep in mind the current market cap is C$19.78 million, which is almost exactly the value of the SSR shares and cash, which is very rare for explorers, and thus assigning almost no value to the projects.

Conclusion

The first trenching results from the Esperanza target at the Flecha de Oro project in Argentina weren't spectacular, but decent enough to warrant follow up exploration. The company is aiming at drilling at not only Esperanza, but also its copper project Rosales in Chile, and its other gold project Tierra Dorada in Paraguay before year-end. For Rosales, a full exploration permit has been granted in April, and management is busy planning geophysical surveys. The permit for Tierra Dorada has been delayed because of another COVID-19 outbreak, so the company has to wait longer before drilling can start, and continues with surface exploration for the time being. So, in general progress has been slightly slower than planned, and the first stage exploration results aren't directly a homerun, but keep in mind there hasn't been much drilling yet on all three properties, and as drilling is by far the best indicator of mineralization and often isn't directly linked to reconnaissance exploration results, Golden Arrow still has sufficient opportunities to hopefully surprise the markets before year-end.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.