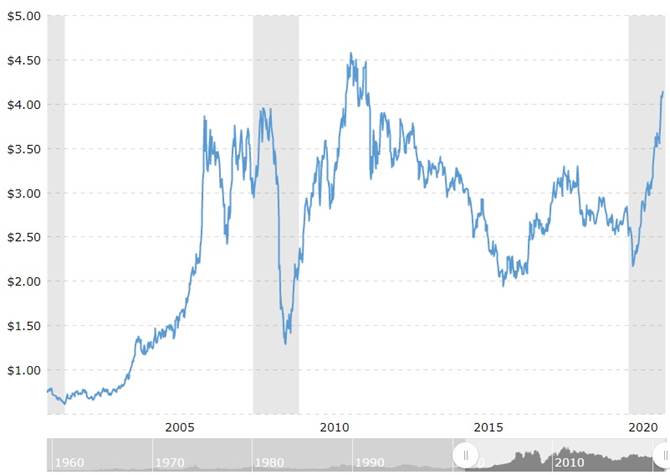

As copper is riding at nine-year highs lately, Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) acknowledged this fact and recently made an adjustment to its exploration strategy, which previously focused predominantly on its gold projects, Tierra Dorada in Paraguay and Flecha de Oro in Argentina, and to a lesser extent on its Rosales Copper project in Chile. This switch makes sense, as copper is even closing in on all-time highs now (US$4.63/lb Cu), as can be seen on this chart by Macrotrends:

After reaching US$4.30/lb Cu in February of this year, copper prices took a bit of a breather amidst inflation concerns, rising interest rates and a rebound in the U.S. dollar. This correction appeared to be short lived, neutralized by expectations of increasing industrial demand on the back of a strong economic revival in 2021, and as governments are increasingly aimed at EVs and green projects, this all favors long-term outlooks for copper. The U.S. House approved Biden's $1.9 trillion COVID-19 stimulus package, job numbers surprised and other important figures like new bank lending in China fell less than expected in February. Adding further pressure, copper production in top producers Chile and Peru have been declining since mid-2020 due to COVID-19 measures, and a possible strike at Antofagasta's Los Pelambres mine further threatens supply.

This is combined with increasing Chinese imports and increasing Chinese copper smelter output, as Chinese manufacturing activities have fully rebounded, and decreasing copper scrap collection and processing. When COVID-19 is over worldwide, and the world economy as a whole shifts gears, it seems a return to normal capacity from Chilean and Peruvian mines will not be enough to bring down copper prices to pre-COVID-19 levels again (US$2,75–3.25/lb Cu), and the mining industry could be enjoying levels over US$3,50/lb Cu for quite some time, as a long time deficit is looming, according to experts.

With this background, Golden Arrow management's decision seems to be justified, and the first thing they did was optioning out the Caballos copper-gold project in Argentina to a private Argentinian company called Hanaq Argentina SA. The Caballos project is one of the more early stage projects of Golden Arrow, and this JV deal provides Hanaq with earn-in potential up to 70% of the project, by spending US$4 million on exploration in the next six years. President and CEO Joseph Grosso was clear on the objective to farm Caballos out:

"This allows us to build value at those properties while freeing our team to concentrate on our core-focus precious metal projects in Argentina and Paraguay and on copper assets that we believe we can advance faster and more efficiently, such as our Rosales copper project in Chile."

If Hanaq finds something of interest, Golden Arrow is getting a cost- and risk-free ride to a still substantial 30% interest.

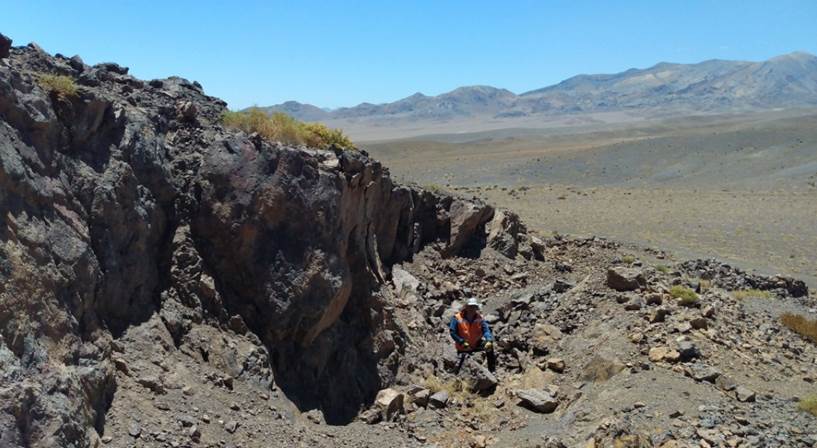

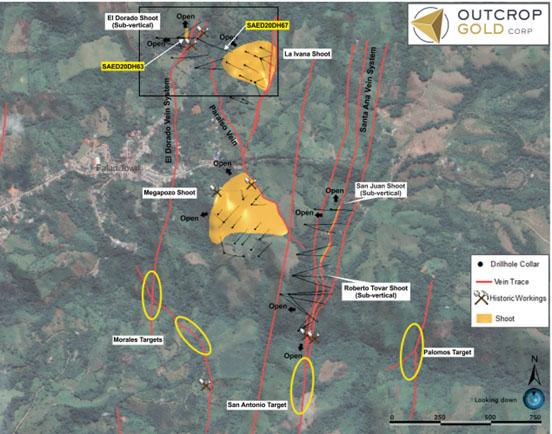

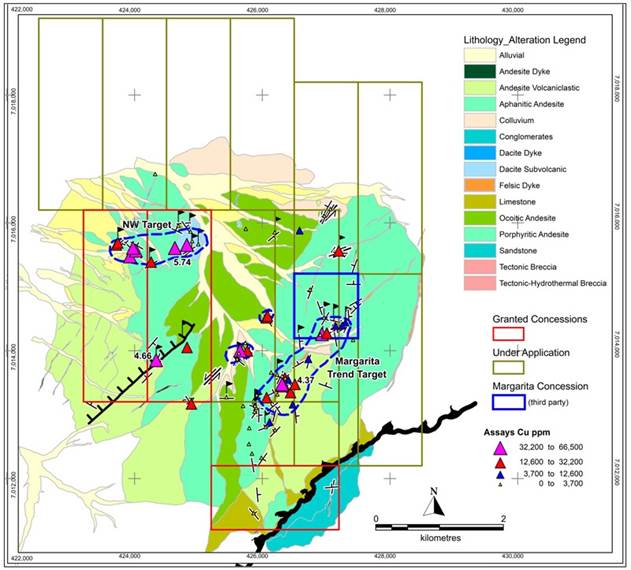

As mentioned, the Rosales copper project will get more focus now, and an exploration program is underway. The Rosales Project has several priority target areas with zones of near-surface copper mineralization, including the Margarita Trend target.

The Margarita Trend is a structural trend that continues from the adjacent operating Margarita mine southwest onto the Rosales Project, where mineralized occurrences were sampled and returned very high values from five rock chip samples in a target area. The company completed the first pass of sampling in February, and planned to follow up with a trenching program.

The environmental work for the full exploration permit for trenching and drilling has been submitted and is awaiting approval. BrianMcEwen, Golden Arrow's vice president for exploration and development, anticipates geophysics can start by the end of April and trenching by May if things work out with the permit.

In the meantime, a new detailed geophysical survey is being commissioned to map structures related to mineralization, and once completed, its interpretation will be combined with results from the sampling program in order to delineate targets for future drilling.

Besides Rosales, management is also busy with the Tierra Dorada flagship project in Paraguay. As a reminder, recent highlights of the last drill program were DHTD18 returning 0.5m @143.5g/t Au from 3m, and DHTD35 returning 3.16m @11.8g/t Au from 1.7m.

The company is now planning a second, more detailed, drilling program to both test the new geophysical anomalies and to step-out holes around the best recent intercepts. As a minimum of 2,000 meters of drilling has been planned to be commencing by the end of the first quarter of 2021, and the company had applied for a full exploration permit to allow deeper drilling for up to 100m depth, I wondered what the current status is. McEwen answered that it is still in the approval process but the plan is to move ahead with drilling of shallow holes.

With regards to the projects in Argentina, the Flecha de Oro project is currently the most important one. The most recent exploration program commenced on December 7, 2020, and is focusing on the Puzzle property, and involved a trenching program, including approximately 18 trenches totaling 2,500 meters, excavated across a vein corridor along 6.2 kilometers of strike length, to delineate targets for a potential 2021 drilling program. The program was completed in January, and the crew is now trenching the La Esperanza target.

Drilling permits have been applied for in December. According to McEwen, sampling at Puzzle brought a lot of surprises they need to figure out, and at Esperanza they should start getting results in the coming weeks.

It will be clear Golden Arrow is very busy at the moment, and a lot of news flow is expected in the coming months. As the company is all cashed up, fundraising and dilution will be out of the question for the next two years.

As of the last financials the company owns 676k shares of SSR Mining (SSRM.TO), this equity being worth C$12.84 million at the moment (March 16, 2021, share price C$19.01) as well as C$8.6 million in cash. As such it is clearly fully funded for upcoming exploration programs. Also keep in mind the current market cap is C$21.36 million, which is close to the value of the SSR shares and cash, which is very rare for explorers, and assigning almost no value to the various projects.

Conclusion

As copper is performing very well and likely will do so for an extended period of time, it is good to see Golden Arrow paying more attention to its copper project Rosales in Chile, top country for copper mining. By optioning out Caballos, management gets a free opportunity to own 30% of potential copper-gold findings. The company is aiming at drilling at not only Rosales, but also its gold projects Tierra Dorada and Flecha de Oro before year-end, with lots of other exploration news in between, so it seems the company is in an ideal situation to profit from renewed enthusiasm for copper and precious metals, and mining in general. If management is successful in their upcoming drill programs, the summer of 2021 could prove to be a real game-changer for Golden Arrow.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.