Several weeks after Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC; 8AM:FSE) announced the acquisition of four exploration properties in Finland, the company was happy to finally announce a significant drill result at the Sesmarias target, part of its flagship Alvalade project in Portugal.

Several weeks after Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC; 8AM:FSE) announced the acquisition of four exploration properties in Finland, the company was happy to finally announce a significant drill result at the Sesmarias target, part of its flagship Alvalade project in Portugal.

As they were looking for large mineralized intercepts for almost two years now, scanning the complex folded structure stepping out hole by hole, management was delighted to finally hit a mineralized intercept of no less than 113.8 meters in total. Although Avrupa has been targeting 1% copper grades together with JV partner Matsa Resources Limited (MAT:ASX) (in the process of being taken over by Sandfire Resources NL [SFR:ASX] for $1.87 billion), I’m sure Matsa isn’t too disappointed with the resulting copper equivalent grades. Such long intercepts are capable of building serious tonnage as well, and this is exactly what drives production-focused outfits like Matsa (and Sandfire).

The reported results were coming from one deep hole, SES21-044, but it was an impressive intercept. Starting at 417.2m depth, there were various mineralized zones for each metal:

- 103.0 meters @ 0.51 g/t Au

- 96.0 meters @ 29.2 g/t Ag

- 113.8 meters @ 0.35% Cu

- 96.0 meters @ 0.86% Pb

- 96.0 meters @ 1.98% Zn

This included a 60.4 meter wide zone with slightly higher grade mineralization, grading 0.40% Copper, 0.68 g/t Gold, 37.08 g/t Silver, 0.96% Lead, and 2.33% Zn. Although Chief Executive Officer Paul Kuhn never likes equivalent grades, I do believe in this case it is necessary as just the copper or zinc grades aren’t sufficient, and there are just too many polymetallic by-credits. Used metal prices for my equivalent calculations are $4.00/lb Cu, $1.50/lb Zn, $1.00/lb Pb, $1780/oz Au and $22/oz Ag. As a result, the 60.4 meter intercept comes in at 2.25% CuEq or 6.01 % ZnEq, and the 96.0 meter intercepts at 1.87 % CuEq or 5.00 % ZnEq, as these are the metals MATSA is targeting. Of course, the recoveries for especially the precious metals aren’t as high as the base metals, and therefore the effective overall recovery will likely come in at around 75%, but such a resulting copper or zinc grade of 1.6% CuEq or 4.5% ZnEq is still economic at $4.00/lb Cu or $1.5/lb Zn. These grades sound low, but remember the metal value of 1.6% copper would be $141/t ore, but opex for underground mines varies anywhere between $40/t to $80/t, so there is quite a bit of margin.

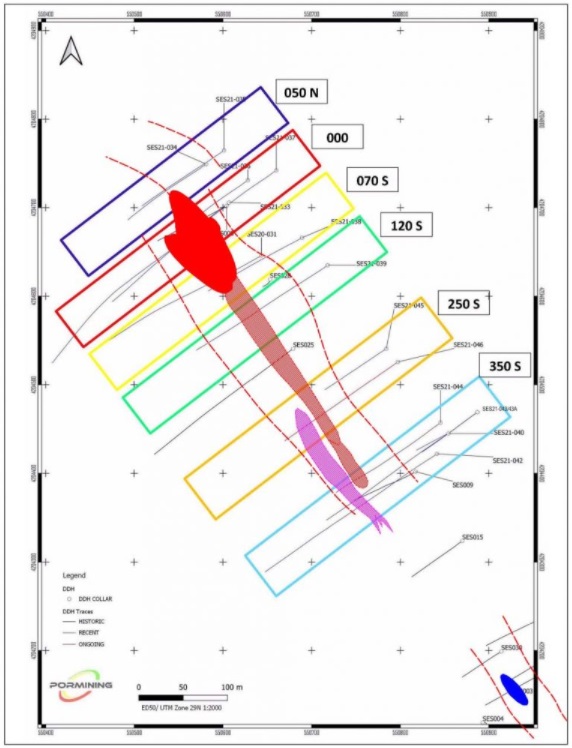

Avrupa Minerals has completed 16 drill holes now at Sesmarias North, totaling 8,150 meters, including three holes that were lost due to difficult downhole drilling conditions, and one scout hole. The company also drilled a 614 meter scout hole at the Caveira target, which will be reported later during Q1. As Avrupa is very methodologically exploring the Sesmarias target, because of its complex, folded structure, the reported hole SES21-044 was part of a fence, drilled at section 350S to the south, as can be seen here on this map:

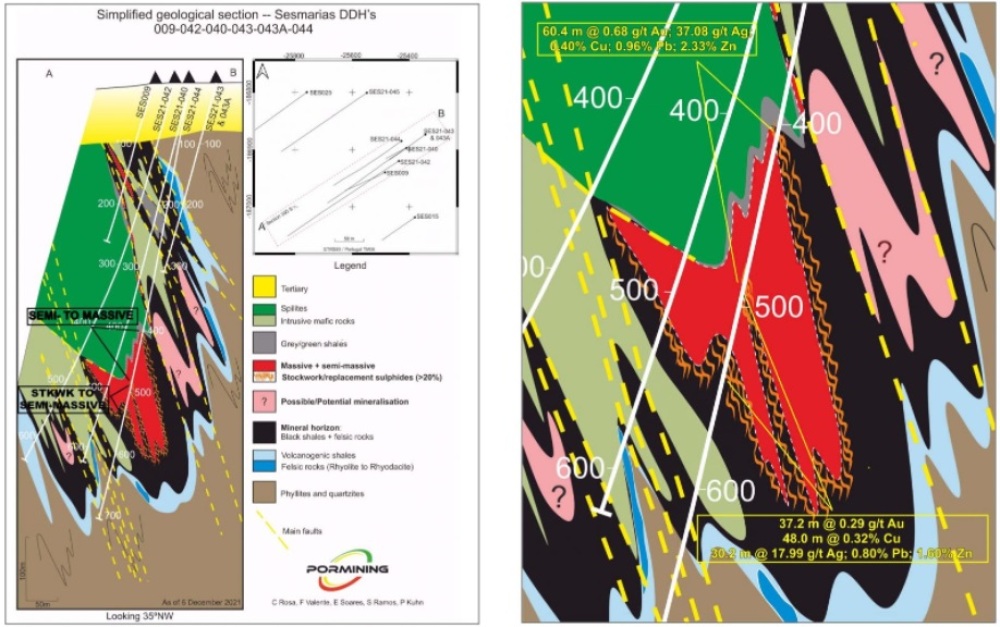

To get an impression about how complex the geology at depth really is, take a look at the following section 350S:

It truly is an amazing puzzle to solve, but it seems they are getting closer now, as there, in fact, are significant widths of mineralization. Management estimates this is an originally 30 meter to 40 meter wide zone, before folding, and there can be more folded mineralized zones as indicated in pink in the section above. Drill hole SES21-040 was already a nice indicator, as it returned 36.45 meters at 0.72% Cu, 0.36 g/t Au, 21 g/t Ag, and 0.82% Pb from 479.4 meters (or 36.45 meters at 1.29% CuEq), including 11.0 meters at 1.05% Cu, 0.51 g/t Au, 39.2 g/t Ag, and 1.64% Pb. Regarding holes SES21-041/042/43, these will be reported later on during Q1.

Mineralization occurs predominantly in the upper part of massive sulfide body, but also in semi-massive sulfides and underlying stockwork. Now Avrupa and MATSA have a good look on the folding, they are moving the drill rig to section 250S, in order to drill SES21-046.

As hole SES21-044 hit along section 350S, the most southern section, Avrupa aims at testing all other sections to the east as well. If successful with likewise intercepts along strike, they could prove up at least a 500 meter long zone, 100 meter high and 40 meter wide, resulting in 8Mt using a specific gravity of 4t/m3 for massive sulfides for Sesmarias North. Keep in mind it is still early days here of course. I guesstimated the tonnage for the Sesmarias 10 Lens at 19-20Mt, so slowly but surely the JV is approaching decent numbers here, although the goal is 50Mt. At the question if MATSA already saw enough to extend the earn-in, Kuhn answered:

“For now, everyone is happy about the ongoing direction. There is still a lot to do at Sesmarias to test the entire known strike length of mineralization, which is at least 1.7 kilometers. And there are untested targets all the way up to the Caveira Mine, 16 km north of Sesmarias. We will wait and see what the new owner Sandfire wants to do,” he said.

As usual, I always keep harassing Kuhn about the status of the extremely useful reconstruction of old Lousal data, as the acquisition of the data is now complete and will be entered into a 3-D modeling program during January/February.

“Work will continue with the modeling program in the coming months, as we acquired a large amount of new data around the Lousal workings,” Kuhn said. “We are already doing new field exploration based on some of the new data and also incorporating some of the information into ongoing targeting work at the Monte da Bela Vista area, located immediately adjacent to the north of the Lousal mine workings.”

Finally, now that Avrupa acquired the four Finnish properties, I wondered what the status is of the projects they are working on, in order to get the necessary exploration permits.

“The company is actively working on the data-in-hand for the Kolima reservation to fully identify lands wanted for the exploration license application,” he said. “We will provide information on that in the near future. The company plans to do further assessment investigations in order to properly identify the potential lands for exploration licenses in the other three reservations. These applications are not due until later in the year.”

On a closing note, but pretty important nonetheless, according to Chairman Mark Brown, some additional funds are necessary to pay for exploration expenditures, so he is looking to do a raise soon.

Conclusion

Slowly or not, Avrupa finally seems to have hit enough mineralization to indicate decent tonnage, and this is exactly what JV partner MATSA is after. Both companies have a better idea now where to look for mineralized folded structures at depth, and this is exactly the strategy they will deploy from now on. New drill results are expected to come back from the lab after the present drill hole is completed on the 250 S section. In the meantime, Avrupa is working diligently at their exploration permits in Finland and will soon provide information for the Kolima Reservation. Let’s see what this tiny junior can accomplish after an upcoming raise is completed, and exploration in Finland can commence.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to aztecminerals.com and read the company’s profile and official documents on www.avrupaminerals.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Avrupa Minerals Ltd., a company mentioned in this article.