Todos Medical and NLC Pharma announced positive results of Phase 2 clinical trial in the treatment of hospitalized COVID-19 patients: The oral antiviral drug, Tollovir, lowered time to clinical improvement, with a complete decline in COVID-19 deaths.

The landscape in oral antivirals may evolve very quickly in the coming weeks after Todos Medical (TOMDF:OTCQB) reported today that its interim data is scheduled for Thursday. The CEO said in a NewsMax interview over a week ago that they were “expecting some very strong data.”

Right now the dominant players in oral antivirals are Pfizer Inc. (PFE:NYSE) and Merck & Co. Inc. (MRK:NYSE) with EUA’s for mild to moderate COVID-19.

The leader is Pfizer with their 3CL protease inhibitor called Paxlovid™ (PF-07321332; ritonavir). It was found to reduce the risk of hospitalization or death by 89% versus molnupiravir’s 30% reduction compared to placebo in non-hospitalized high-risk adults with COVID-19.

The pundits have hailed this as a solution, but the reality is that it's no more than a stopgap measure for only “high-risk” adults and doesn’t address the needs of the majority of the population.

Antiviral Landscape

The oral antiviral landscape is broken into non-hospitalized and hospitalized treatments. The top contender in the non-hospitalized category is Adamis Pharmaceuticals Corp. (ADMP:OTCBB) and Todos Medical is virtually the only one left in the hospitalized category, where it will compete against Gilead Sciences Inc.'s (GILD:NASDAQ) remdesivir, which is given through an IV infusion.

Atea Pharmaceuticals Inc. (AVIR:NASDAQ) is marginally in the hospitalized race because it failed to meet their endpoints in an outpatient Phase 2 trial and their big pharma partner, Roche Holding AG (RHHBY:OTCQX), subsequently terminated their partnership.

Atea is now exploring their compound in combination with others, to better inhibit SARS-CoV-2 replication.

Non-Hospitalized Contenders

In moderate disease, Adamis Pharmaceuticals is expected to read out interim results when they reach 50-60 patients with its oral antiviral candidate Tempol. In preclinical studies, the drug demonstrated antiviral, anti-inflammatory, and antioxidant activity. Paxlovid set the bar high, but the safety issues clouding the EUA left a crack for the additional mechanisms of Tempol along with a better safety profile to gain a foothold.

ADMP adeptly filed for fast track approval to ameliorate this risk of a clinical trial that has to compete against Pfizer’s standard of care. The biggest issues are the lack of human data to determine optimal dosing and the challenge recruiting unvaccinated trial participants.

Hospitalized Contenders

The long-awaited clinical results for Todos Medical’s COVID-19 antiviral are drawing near and are expected this week. The 3CL protease inhibitor, called Tollovir, has been highly anticipated to carve out a niche in the $20 billion COVID-19 antiviral market as a highly efficacious alternative in the hospitalized setting. Pfizer is the name to beat because it beat expectations and smashed competitor Merck’s antiviral pill, with 89% efficacy versus 50% (later revised to 30%) efficacy in preventing hospitalizations for those who were recently infected and at risk of progressing to a severe state, needing hospitalization.

Pfizer’s Paxlovid and Todos' Tollovir are both 3CL protease inhibitors, but Tollovir also has an anti-cytokine in the formulation.

A simple analogy is that when Paxlovid and Tollovir enter the fighting arena, both are armed with the same sword, but Tollovir also has a shield and greater dexterity in that it can be used in the hospitalized or early stage of the disease. In the hospitalized setting, drugs that act on multiple mechanisms of action seem to do well.

The only other contender in the hospitalized space is CytoDyn Inc.'s (CYDY:OTCQB) monoclonal antibody leronlimab. Their drug is a CCR5 inhibitor that stops the trafficking of macrophages to the site of infection thereby restoring homeostasis to the immune system. This restored functionality allows the immune system to more efficiently clear the virus and allow the body to heal.

The company had excellent Phase 3 data that showed an 82% reduction in 14 day mortality and no safety signals. Despite their statistically significant mortality benefit, the FDA wanted more data so the company initiated trials in Brazil for severe and critical patients.

Its plan is to get regulatory approval in Brazil and also use some of the data as part of a meta analysis for its severe COVID-19 trial that took place in the United States.

Inpatient Versus Outpatient: A Focused, Less Crowded Market

Being a 3CL protease inhibitor, Tollovir would probably work well in the outpatient setting like Pfizer’s Paxlovid; however, the company’s drug has anti-inflammatory properties (unlike Paxlovid) in addition to its antiviral properties. Thus, it has an edge in the hospitalized setting and will primarily be competing against the intravenously infused remdesivir, aka Veklury, made by Gilead Sciences, which has no direct anti-inflammatory properties.

Remdesivir is the drug Tollovir will need to beat to become a potential standard of care antiviral in the hospitalized setting. For the hospitalized setting, the bar is not as high as preventing hospitalization by 89%.

There are two key reasons investors should be expecting positive results from the upcoming Tollovir readout:

- Tollovir observational study

- Robust mechanism of action of the antiviral

Observational Study Suggests Robust Efficacy

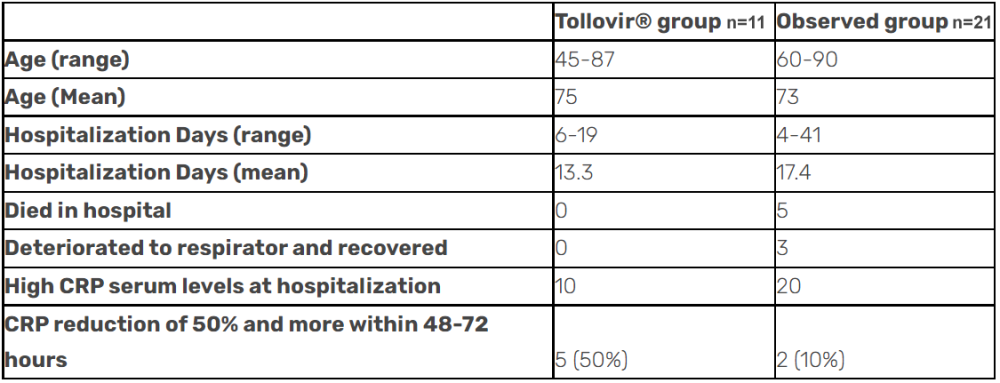

Tollovir drastically reduced death by 100% in an observational study released in October 2021. These results are waiting to be validated by the upcoming Phase 2 data. The study also showed that patients experienced a faster recovery with Tollovir (by four days on average), complete prevention of the need for ventilation/intubation, and a reduction in inflammatory marker, CRP. Many in the scientific community tend to discount observational studies due to a lack of a control arm and clinical observations that lack consistency.

This observational study shouldn’t be discounted at all because it had a control standard of care and had excellent biomarker data.

Todos Medical Press Release (October 4th, 2021)

These study results are very promising and any Phase 2 results similar to these would be considered a resounding success, since 100% mortality benefit is much greater that what remdesivir showed in its Phase 3 in hospitalized patients, about a 25% relative mortality benefit.

Biological Mechanism of Action: 3CL Protease Inhibitor

The other reason to expect positive Tollovir Phase 2 data is because it has the same mechanism of action as the highest performing COVID-19 antiviral developed to date, Pfizer’s Paxlovid.

There have been basically two main mechanisms for COVID-19 antivirals: RdRp inhibitors and 3CL protease inhibitors. RdRp inhibitors interfere with the complex that is assembled to duplicate COVID-19'S RNA, which is subsequently repackaged into new virions.

The 3CL protease inhibitors, on the other hand, work by blocking the key enzyme, the 3C-like protease, used by the virus to cut unusable polypeptides into smaller pieces which are functional and then are used further in the viral replication process. The 3CL protease is a key checkpoint in the replication process.

RdRp Inhibitor Track Record

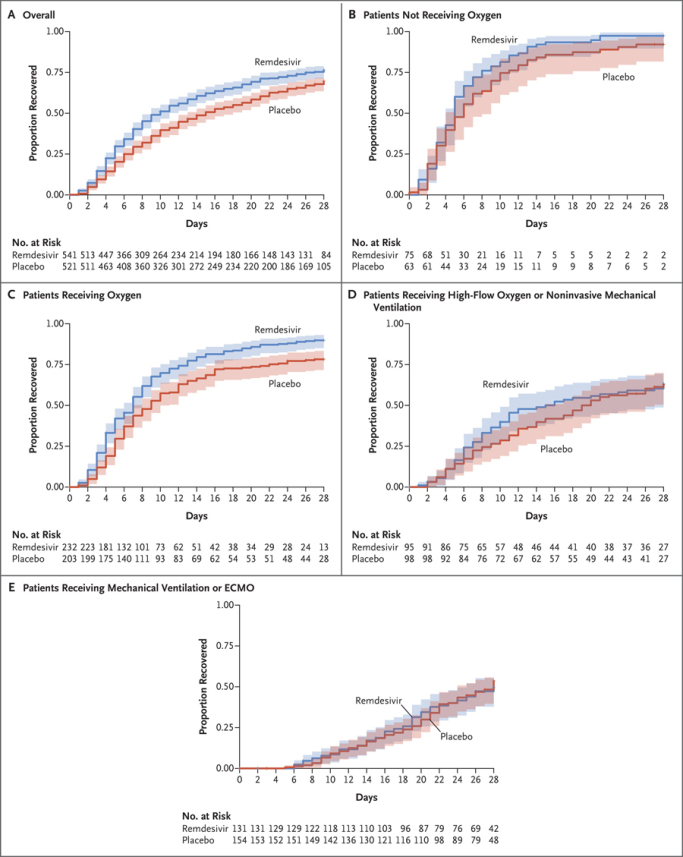

RdRp inhibitors have had a checkered past with varying efficacy. First, when Gilead was developing its antiviral, remdesivir, the FDA EUA approval relied on a pretty significant post hoc analysis that resulted in efficacy shown neither in early or late/severe hospitalized COVID-19 patients, but only in moderately sick patients. Most recently the FDA approved remdesivir use for outpatients (87% efficacy) at risk of being hospitalized, but this followed significant restrictions for months (not approved/labeled for patients with renal impairment, contraindicated in ventilated patients). Below one can see how the drug only worked on patients hospitalized with oxygen but without ventilation.

Remdesivir represents a moderate success in the antiviral space. On the other hand, Atea Pharmaceuticals was developing a next generation version of remdesivir, but the compound's Phase 2 results did not impress partner Roche enough for it to continue the collaboration.

Merck's molnupiravir is also an RdRp targeting drug which aims to insert many mutations in the RNA replication process, so much so that the virus can't replicate properly. The issue is that its mutagenicity profile is in question and couples that might get pregnant, kids, and people afraid of developing cancer don't know the long term safety profile of the drug. In terms of efficacy, the drug was found to be 50% effective in preventing hospitalization in the outpatient setting with those at risk of becoming hospitalized, but then in a later analysis this risk reduction was lowered from 50% to 30%, which is a number that is hard to get excited about given the drug's potential safety issues.

3CL Protease Inhibitors

3CL protease inhibitors, however, have a simple and very successful development history without any high-profile flops. Pfizer quickly brought Paxlovid through clinical development with resounding success, demonstrating an 89% reduction in the risk of hospitalization or death in at-risk outpatients. The only hiccup they ran into was that the drug was cleared from the body so fast that they had to dose it with a well known HIV drug, ritonavir, to slow the metabolism of the drug.

The aforementioned Tollovir observational study in the hospitalized setting was also a success with high implied efficacy, though the drug hasn't received any EUA or full approval yet.

So in the outpatient setting, there is 3CL protease inhibitor efficacy of 89% (oral 5 day course) versus RdRp inhibitor efficacies of 30% (oral 5 day course) and 87% (3 day IV infusion), and a discontinued partnership. In the hospitalized setting, there was an observed 100% reduction in death for the 3CL protease inhibitors versus a 25% reduction in deaths for the RdRp inhibitors despite both cases reducing hospitalization days by about the same number of days.

It is possible that the 3CL protease inhibitors are outperforming their RdRp-targeting counterparts because the 3CL protease also has detrimental effects on the host cell that it's made in, cleaving various host proteins including NEMO and galectin-8, which are both involved in the endogenous antiviral response. Either way, the evidence available suggests that the 3CL protease is likely the best antiviral target for COVID.

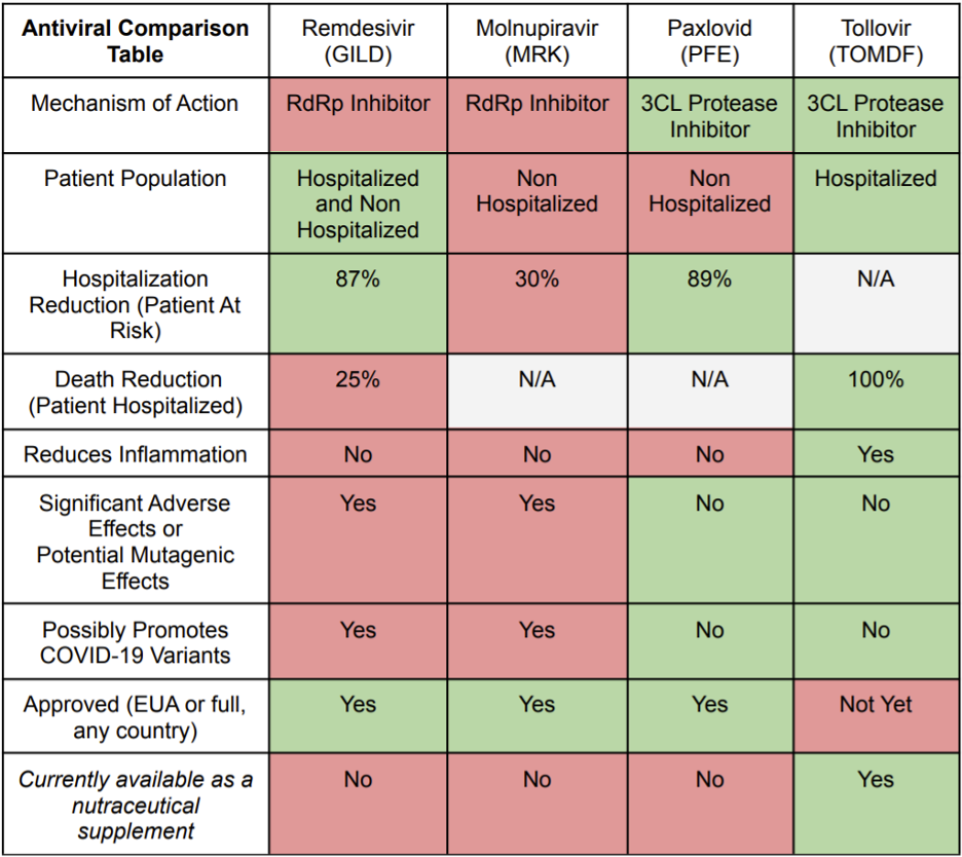

Antiviral Comparison

There are a range of antivirals available for different situations, but some are safer and more effective drugs than others. First and foremost, it is expected that Tollovir will significantly outperform the 25% mortality reduction benchmark shown in remdesivir’s Phase 3 study. And in the hospitalized setting, remdesivir is known to carry the risks of elevating liver enzymes (suggesting potential liver damage) and injection site reactions, as well as being a potential risk in patients with poor kidney function. Right now it is really the only antiviral option in the hospitalized setting but it could be dethroned quite easily given its modest effect. Tollovir looks set to beat it handily as it is a dual anti-inflammatory/antiviral drug with the better antiviral mechanism of action (MOA).

When looking at remdesivir in the outpatient setting, it was able to achieve efficacy similar to Paxlovid (87% versus 89%) in preventing hospitalization. At first glance, this is a great accomplishment for the drug and gives the RdRp class hope of competing with the 3CL protease class of antivirals. However, this efficacy was achieved by three-day intravenous infusion, which is a significant convenience and scalability issue. Still, there should be some market opportunity in this application for remdesivir.

The biggest wildcard and risk to Tollovir is CytoDyn's leronlimab, because it has completed trials in the United States with results suggesting significant efficacy. Tollovir is considerably behind in U.S. development because no IND is in place, but it is perhaps a leg up on safety because the same active ingredient in its nutraceutical Tollovid has the FDA certificate of free sale (though leronlimab has an impeccable safety profile as well). In a Proactive video, CytoDyn's CEO said that the FDA will be willing to accept meta-analysis for its Phase 3 trial in support of a BLA filing. Meta analysis allows the combination of two or more Phase 3 trials in data analysis, and this would help CytoDyn provide proof of efficacy as their prior trial did not randomize the trial arms properly when accounting for age, which convoluted results. The company indicated another 20 patients needed to be recruited in the currently enrolling Phase 3 trial. Since this leronlimab Phase 3 trial is being conducted in Brazil where infections have recently skyrocketed, the company might be able to quickly recruit the 20 patients out of 1.5 million current infections. If this recruitment is successful, then CytoDyn could beat Tollovir to the finish line in filing for a COVID-19 EUA in the hospitalized setting. The EUA would be in critical patients, potentially still leaving the door wide open for Tollovir to carve out a niche in the severe setting. It should also be noted that leronlimab is not an antiviral; it is an immune modulator. However, in competing for treating patients, this is still relevant.

Tollovir needs to generate more data, but the drug is shaping up to be an outperformer in the high-value hospitalized setting with 100% mortality benefit versus 25% mortality benefit with remdesivir. It is unlikely that Tollovir will continue to show a complete, 100%, mortality benefit because no drug can save every patient’s life when the sample sizes are increased in size, but it is expected that the benefit will remain very high, probably between 50% and 100%, which is much better than 25%. Further, there is a potential extension of Tollovir application to the outpatient setting, where it would be reasonable to expect efficacy similar to Paxlovid.

If and when Tollovir enters the outpatient setting, it may even have an edge over Paxlovid as Paxlovid has risk of interacting with very commonly used drugs such as statins, and this poses significant safety concerns. The chart below summarizes the competitive profiles of each of the four select COVID-19 antivirals.

Conclusion

Tollovir is the highest value, runner-up COVID-19 antiviral that has the potential to outperform the other top antivirals in the hospitalized and non-hospitalized playing field. Investors interested in the COVID-19 therapeutics space should watch closely as the company develops it. Todos Medical has a mere $45 million market capitalization compared to its closest peer CytoDyn with its $410 million market cap sitting at a close to identical stage of development if the upcoming trial results are good. It is well known that top COVID-19 antivirals bring billions in value to their companies with Gilead, Merck, and Pfizer’s market caps jumping up billions of dollars in value upon positive clinical results for their antivirals and with remdesivir bring in over $1 billion per quarter in revenue (with $1.9 billion in Q3 2021), and Paxlovid expected to sell $17 billion of the drug in 2022 alone. How a microcap company’s stock will perform upon releasing positive results in COVID-19 is anyone’s guess, but one thing is clear; the future appears very bright for TOMDF investors if Tollovir performs as expected.

Vision and Value is an investor, small business owner, and a mechanical engineer.

Disclosures:

1) Vision and Value: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Todos Medical CytoDyn Inc. My company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Todos Medical. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.