Drill holes are junior mining's lifeblood. They can drive investor interest, make companies and cement reputations.

There was a lot of movement in 2021, and Streetwise Reports is counting down the Top Five.

Newsletter writer John Kaiser, editor of soon-to-launch Kaiserresearch.com, has made a career of looking at drill results on behalf of retail investors to determine whether or not those results have merit.

Kaiser says some of the industry’s big discoveries were part of well-planned exploration programs, but some of the biggest were essentially flukes.

Kaiser says some of the industry’s big discoveries were part of well-planned exploration programs, but some of the biggest were essentially flukes.

“At Fruta del Norte when (Aurelian Resources) drilled that deep hole and intersected 200 meters of really high-grade (gold), that took the stock from 60 cents to two-and-a-half dollars,” Kaiser tells Streetwise. “It was blind hole, too. (Aurelian) had chewed through (about) $19 million and accomplished nothing and then went for this ‘Hail Mary’ hole and it was like catching a touchdown in the endzone to win the Super Bowl.”

The drill hole Kaiser referred to hit 189 metres averaging 24 grams gold per tonne (24 g/t gold) in 2006 at the Fruta del Norte gold project in Zamora Chinchipe province, Ecuador.

Aurelian went on to drill off a 13.7 Moz gold resource there before Kinross Gold Corp. (K:TSX; KGC:NYSE) launched a takeover bid worth about CA$1.2 billion in July 2008. After political tangles stalled development, Lundin Gold Inc. (LUG:TSX) bought Fruta del Norte in 2014 for about $240 million, made nice with the locals, and poured its first gold in 2020.

This year proved a banner year for drill results as gold prices flirted with US$1,900/oz for the better part of 12 months; silver spent much of 2021 well above US$22, almost double its 10-year low of US$12.47 in March 2020; and copper consistently tested US$4.80/lb, up from a five-year low of US$2.25/lb in April 2020.

For our purposes, the criteria were simple: these drill results had to contain significant gold, be published in 2021 and ultimately move the needle on the share price.

Here are the Top Five Drill Holes of 2021.

5. Satori Resources Inc. (BUD:TXS.V), Drill Hole TLMZ21-12

Commodity: Gold

Project: Tartan Lake

Intersection: TLMZ21-12 intersected 5.8 meters averaging 47.56 g/t gold, inside a broader interval of 12.6 meters averaging 23.76 g/t gold

Where: Flin Flon Greenstone Belt, northern Manitoba

Ownership: 100% Satori Gold

Overview: Satori was late to the party but made the cut after a news release on Dec. 6 reported that hole TLMZ21-12 intersected 5.8. meters averaging 47.56 g/t gold at the Tartan Lake Gold Project in Manitoba. It was part of a longer interval of 12.6 meters averaging 23.76 g/t gold.

The hit is thought to be a new zone of mineralization, sub-parallel to the main zone.

Holes TLMZ21-12 and TLMZ21-11 12 both targeted the down plunge continuation of the main zone mineralization. TLMZ21-11 intersected 5.3 meters running 2.25 g/t gold in the Hanging Wall (HW) zone followed by 2.1 meters of 8.87 g/t gold in the main zone.

TLMZ21-12 is the second highest grade interval ever reported at Tartan Lake, which operated from 1987 through 1989 and produced slightly less than 36,000 oz gold.

Kaiser lists Satori among his “Bottom Fish” picks.

“(Tartan Lake) is one of those orogenic high-grade (gold) systems in Manitoba. It was improperly developed and then abandoned and then sold,” Kaiser tells Streetwise. “(President and CEO) Jennifer Boyle and (director) Wes Hanson are now trying to revive it and demonstrate that these high-grade veins extend vertically. The trick is that the deeper you go in these sub-vertical systems the more expensive the holes become and the longer it takes. So they've been busy working to extend the down plunge potential of the (mineralized gold) system to show that there's enough gold bearing ‘meat’ present to justify redeveloping this system.”

Shares of Satori closed at $0.165 on Dec. 8., two days after news of TLMZ21-12 hit the market, a 37.5% bump from the $0.12 close on Dec. 1.

It seems like Boyle and her team have things moving in the right direction.

4. Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO:FSE), Drill hole DDH 21RDD024

Commodity: Gold

Commodity: Gold

Project: Frotêt

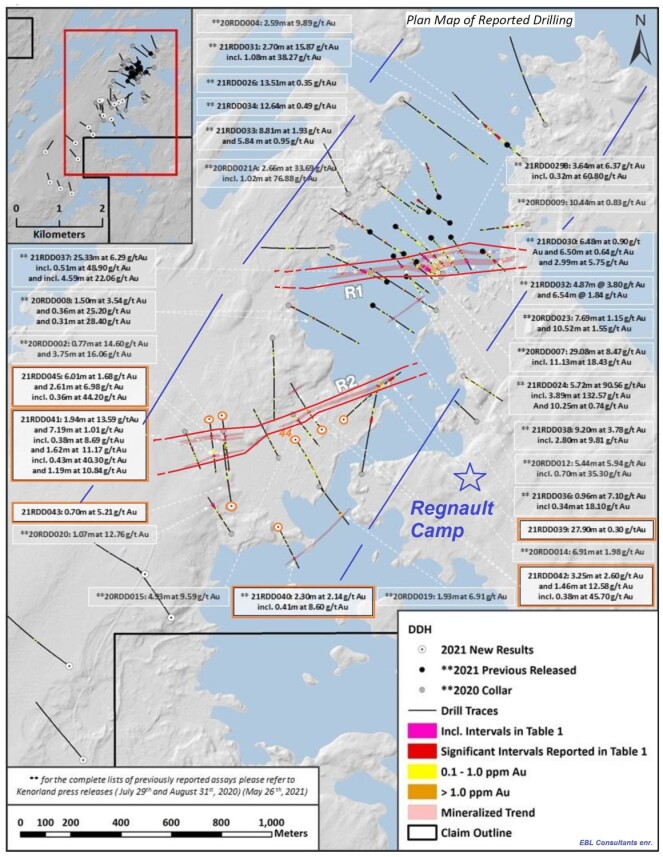

Intersection: 5.72 meters running 90.56 g/t gold, including an interval of 3.89 meters grading 132.57 g/t gold (DDH 21RDD024) on the Regnault (R1) deposit

Where: Frotêt-Evans Greenstone Belt, James Bay lowlands, northern Quebec

Ownership: Kenorland Minerals, 20%; Sumitomo Metal Mining Co. (SMMYY:OTC), 80%. Kenorland is the operator.

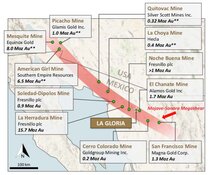

Overview: The remarkable DDH 21RDD024 was hit during follow-up drilling at its Frotêt gold project in northern Quebec. Kenorland was seeking greater understanding of the east-west orientation of the mineralized structures in the Regnault deposit. The junior discovered the Regnault gold system and the R1 structure early in 2020 when hole DDH 20RDD007 hit 29.08 meters grading 8.49 g/t gold.

"Regnault is emerging as a very interesting new discovery… (Kenorland) has secured a strategic partner (Sumitomo) that will have the funds for any (capital expenditures), which takes away some of the financing risk. KLD-V is one to watch," Mining Analyst Eric Lemieux told Streetwise in July.

In November, Sumitomo Metal Mining Canada bought 5.2 million common shares in Kenorland at $1 apiece. Sumitomo now owns 10.1% of Kenorland’s outstanding shares. About 80% of the money is earmarked for further exploration, while the rest will cover general expenses.

3. HighGold Mining Inc. (HIGH:TSX.V; HGGOF:OTCQX), Drill Hole JT21-125

Project: Johnson Tract

Project: Johnson Tract

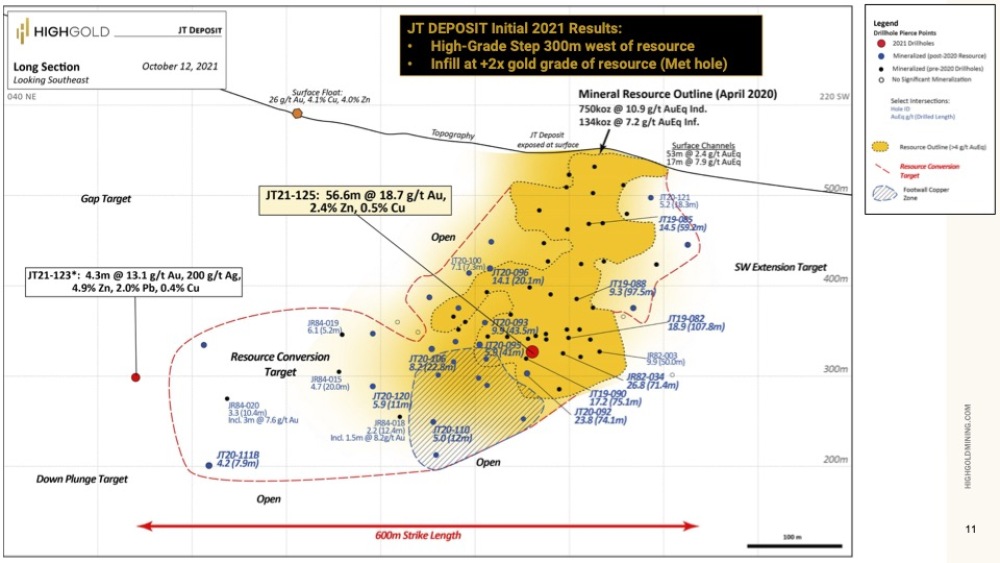

Intersection: 56.6 meters at 18.69 g/t gold, 3.9 g/t silver, 2.43% zinc, 0.47% copper, and 0.36% lead, including an eye-popping interval of 32.9 meters running 31.69 g/t gold, 5.1 g/t silver, 1.82% zinc, 0.58% copper, and 0.47% lead.

Where: Alaska

Ownership: 100% HighGold Mining (Cook Inlet Region, Inc. [CIRI], one of 12 land-based Alaska native regional corporations created by the Alaska Native Claims Act of 1971, has a back-in right for up to a 25% participating interest).

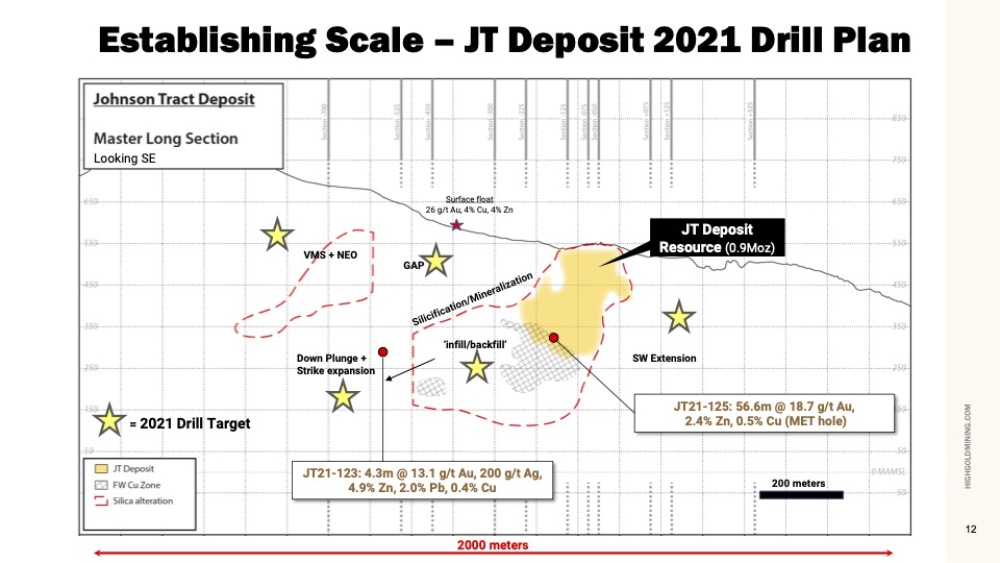

Overview: HighGold Mining has been steadily building the resource and de-risking the project since acquiring John Tract in 2019. And with mining financiers Eric Sprott and Robert McEwen aboard, it won’t have to worry about financing. It currently has about $26 million in the kitty.

An initial resource estimate published in June 2020 reported 2.7 million indicated tonnes grading 6.1 g/t gold, 6 g/t silver, 0.6% copper, 5.6% zinc and 0.8% lead, the equivalent of roughly 750,000 oz gold. Another 0.6 Mt inferred tonnes grading @ 2.1 g/t gold, 9 g/t silver, 0.5% copper, 6.7% zinc, and 0.3% lead works out to about 134,000 oz gold, and that was before hole JT21-125.

An updated resource estimate is expected in the first half of 2022.

Southeast of JT21-125, drill hole JT21-123 hit 4.3 meters grading 13.1 g/t gold, 200 g/t silver, 4.9% zinc, 2% lead and 0.40% copper, which basically confirms the down-plunge strike expansion of Johnson Tract.

“Joe Mazumdar and I think the Johnson Tract deposit is a hybrid VMS (volcanogenic massive sulphide), late intermediate sulphidation overprint. There are also epithermal showings, possibly related to a separate porphyry,” says geologist Brent Cook, former editor of the Exploration Insights newsletter. “Joe Mazumdar has worked up a rough resource estimate and thinks 750,000 to 1 million oz is a reasonable target for the main deposit. Good potential outside of this.”

HighGold closed at $1.75 on Oct. 6, the same day news of JT21-125 became public, up from $1.01 the day before – a one-day 73% spike in the share price.

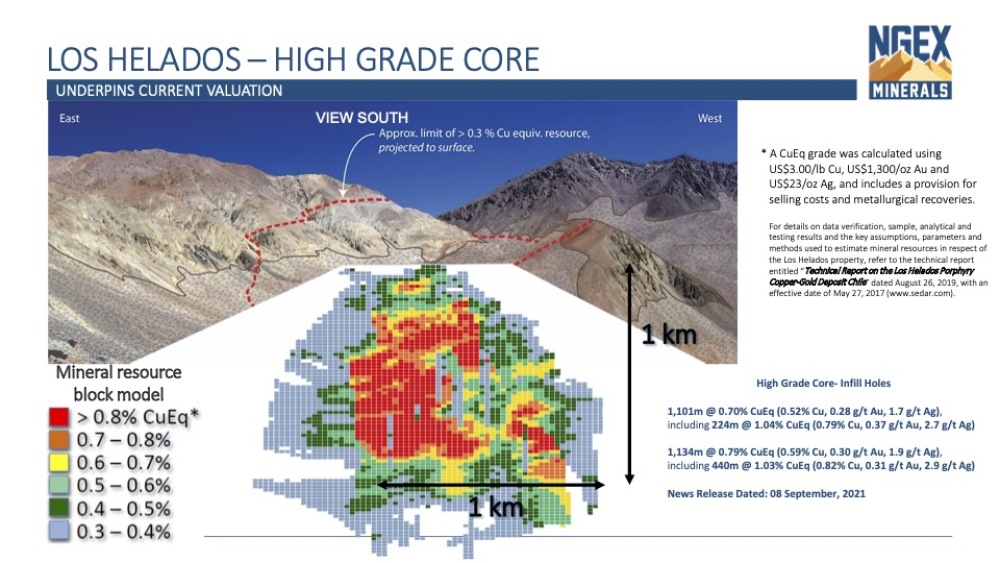

2. NGEx Minerals Ltd. (NGEX:TSX.V), Drill Hole LHDHG03

Commodity: Copper, Gold, Silver

Project: Los Helados

Intersection: LHDHG03 returned 1,134 meters grading 0.79% copper-equivalent (CuEq) (0.59% copper, 0.30 g/t gold, and 1.9 g/t silver), including a higher-grade interval of 440 meters running 1.03% CuEq (0.82% copper, 0.31 g/t gold, 2.9 g/t silver)

Where: Chile

Ownership: 64% NGEx; 36% Japanese company Nippon Caserones Resources

Overview: While LHDHG03 was published in 2021, it was actually drilled in 2015 as part of a program to collect whole-core geotechnical data. It wasn’t assayed until this year but was worth the wait.

LHDHG03 returned 1,134 meters grading 0.79% CuEq (0.59% copper, 0.30 g/t gold, and 1.9 g/t silver), including a higher-grade interval of 440 meters running 1.03% CuEq (0.82% copper, 0.31 g/t gold, 2.9 g/t silver). It’s part of a much larger copper-gold porphyry deposit and will be part of an upcoming revised resource estimate.

NGEx boasts that Los Helados is the fourth largest copper discovery in the last 10 years.

Using $3.00 copper and $1,300 gold, Los Helados contains a National Instrument compliant indicated resource of 17.6 billion pounds copper and 10.7 Moz gold, as well as an inferred resource of 5.8 billion pounds copper and 2.7 Moz gold.

NGEx was created in 2009 by the Lundin Group to honour patriarch Adolf Lundin (1932-2006). NGEx = No Guts (No Glory) Exploration.

The junior closed at $1.55 on Dec. 21 on volume of 118,000 shares, up from $0.72 when news of LHDGH03 was published Sept. 8.

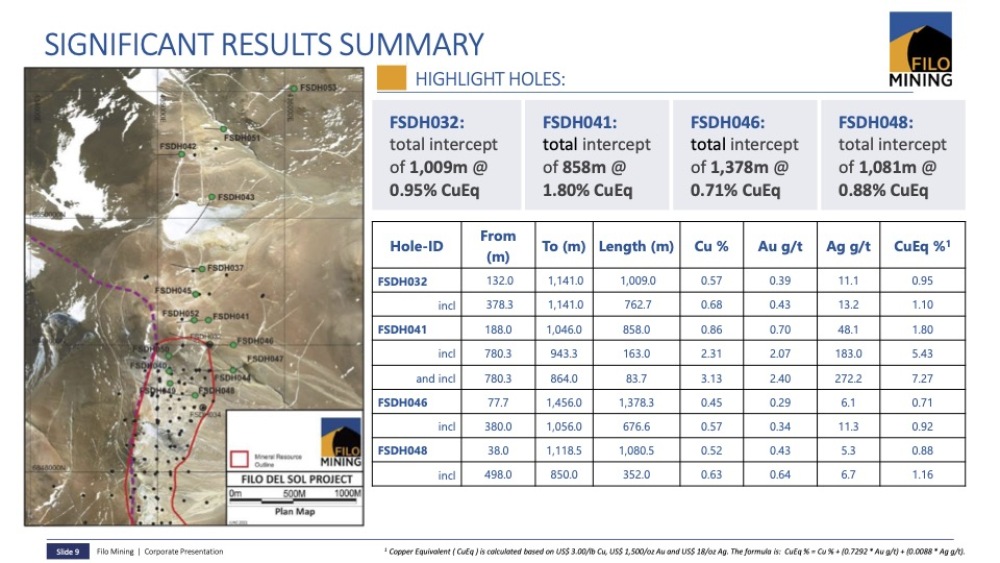

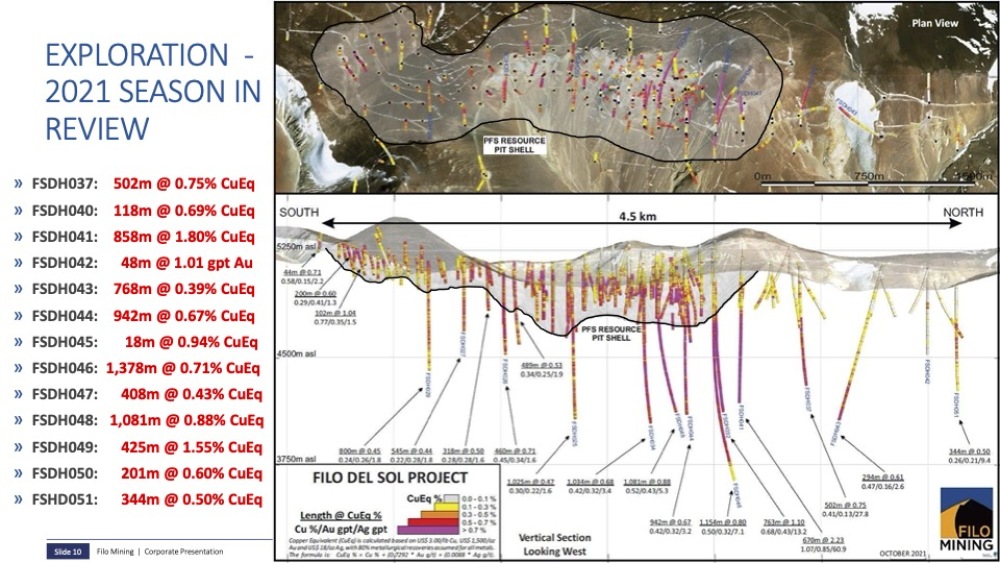

1. Filo Mining Corp. (FLMMF:OTCMKTS), Drill Hole FSDH041

Commodity: Copper, gold, silver

Commodity: Copper, gold, silver

Project: Filo del Sol

Intersection: 858 meters grading 1.8% CuEq (0.86% copper; 0.7 g/t gold, and 48.1 g/t silver) or from 188 meters below surface. The hole had an even sweeter interval of 163 meters running 2.31% copper, 2.07 g/t gold and 183 g/t silver or 5.43% CuEq.

Where: San Juan province, straddling the border between Argentina and Chile (it is subject to the Mining Integration and Complementation Treaty for cross-border projects between the twcountries).

Ownership: 100% owned by Filo Mining (about 34% of Filo is owned by the Lundin Family Trust, AKA the Lundin Group. Lukas Lundin is a director, while Adam Lundin is chairman)

Overview: This is the King Daddy Topper—Filo Mining’s FSDH041—the longest high-grade intersection yet in what is thought to be one of the feeder zones to the high-sulphidation epithermal mineralization at Filo del Sol.

The mind-blowing thing about this hole is that even after 858 mineralized meters, the hole ended in mineralization at a depth of 1,046 meters.

On May 12, Filo Mining closed at $4.13. A day later, when the news of FSDH041 reached the market, it spiked to an intraday high of $8.49 and closed at $7.69 – an 86% pop. It closed at $11.73 on Dec. 21.

Filo Mining acquired the project when it was spun out of NGEx in 2016.

FSDH041 is part of a cluster of stunning holes at Filo del Sol, which includes FSDH046, the deepest hole drilled at Filo Del Sol to date — and probably the second-best drill hole of 2021.

It returned 676 meters at 0.92% CuEq (0.57% copper, 0.34 g/t gold, and 11.3 g/t silver) from a depth of 380 meters within a longer interval of 1,378 meters running 0.71% CuEq (0.45% copper, 0.29 g/t gold, and 6.1 g/t silver) from a depth of 77.7 meters.

FSDH046 ended almost 1.6 km below surface – and it is not included in the current resource.

There are five drill rigs currently turning at Filo Del Sol. The company expects to add two more in 2022 to further define the sulphide resource and see how far out the mineralization extends.

After Filo published FSDH041in May, rogue mining analyst Mark Turner, editor of the controversial IKN blog, wrote: “It must be a thing to witness the core coming up (from the drill), as you know every length is adding millions of dollars to your company's market cap. Hole of the year, period.”

Disclosures:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) Joe Mazumdar: I own, or my family owns, shares of the following companies mentioned in this interview: HighGold Mining. I personally am, or my family is, paid by the following companies mentioned in this interview: None.

3) Brent Cook: I own, or my family owns, shares of the following companies mentioned in this interview: HighGold Mining. I personally am, or my family is, paid by the following companies mentioned in this interview: None.

4) Eric Lemieux: I own, or my family owns, shares of the following companies mentioned in this interview: Kenorland Minerals Ltd. I personally am, or my family is, paid by the following companies mentioned in this interview: None.

5) John Kaiser: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None.

6) The following companies mentioned are billboard sponsors of Streetwise Reports: Kenorland Minerals Ltd. Click here for important disclosures about sponsor fees.

7) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

8) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

9) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kenorland Minerals Ltd., a company mentioned in this article.