Now that Alianza Minerals Ltd. (ANZ:TSX.V; TARSF:OTCQB) successfully completed the 2021 drilling campaign at its flagship Haldane silver project in the historic Keno Hill Mining District, it has more time on its hands to branch out into other projects. Under the Southwest U.S. Copper Alliance, Alianza and partner Cloudbreak Discovery acquired the Stateline Copper project, located in Colorado and Utah, and announced it on Nov. 29, 2021. A few days later, both companies completed a surface sampling program at their recently acquired Klondike Project, also located in Colorado, including chip samples up to 4.6m @ 1.56% Cu. Although both partners were excited and defined a high priority drill target, the Klondike Project was optioned out soon after this to Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB), on Dec. 7, 2021.

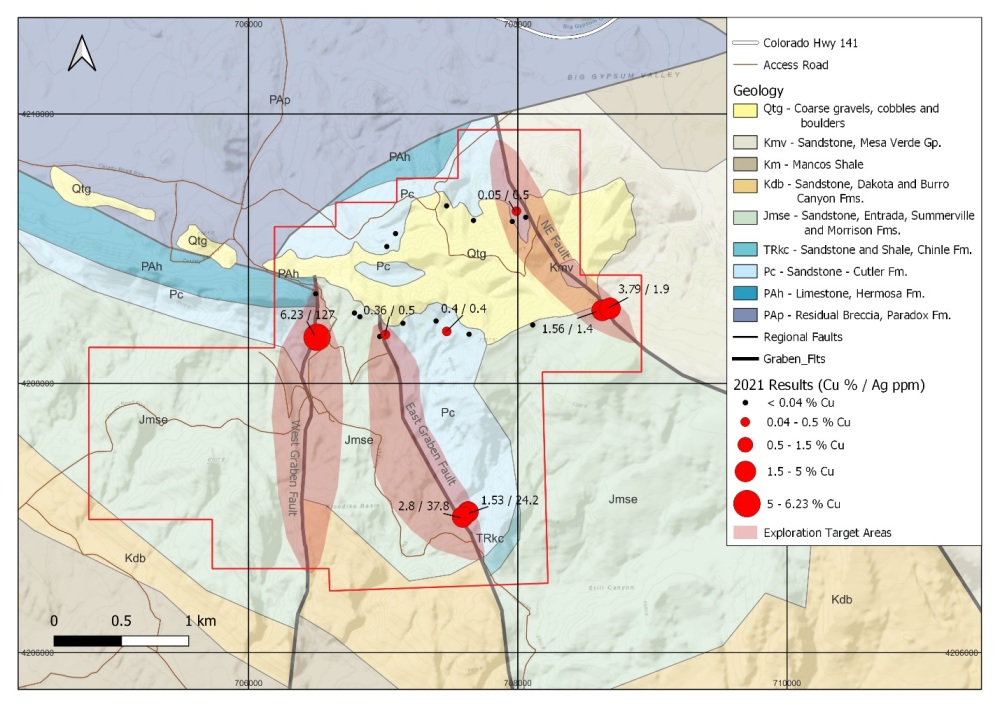

The Klondike deal seems pretty profitable, as according to CEO Jason Weber Alianza and Cloudbreak paid only CA$20,000 and an additional $40,000 in cash/share payments for the property. Besides this, the Alliance spent CA$52,000 for a reconnaissance program consisting of mapping, stream sediment sampling, and rock sampling. This program further defined existing drill targets at the West Graben Fault and East Graben Fault targets, and rock sampling and mapping successfully expanded the footprint of both targets and identified a new target named the Northeast Fault. Sampling at the Northeast Fault returned 1.56% Cu and 1.4 g/t Ag over a 4.6m chip sample of altered Jurassic sandstones of the Saltwash member of the Morrison Formation:

As can be seen, the scale of the zones of interest are of significant size. All costs combined for the Alliance were CA$105,000. I wondered why Allied Copper was so interested, as some samples are indeed very high grade for copper samples, but usually you see entire grids of sampling results before drilling is undertaken. Alianza Chief Executive Officer Jason Weber had this to say about this: “One of the prime targets at Klondike is the copper mineralization hosted in the fault structures. While the mineralization sampled on surface is interesting, we want to jointly test these structures and prospective sandstones at depth for their potential to host high grade copper. Allied is focussed on copper in the U.S. and not afraid to test earlier stage targets so the concept at Klondike was appealing to them. Strong copper mineralization at surface suggests a compelling subsurface target. ”

Allied Copper obviously agreed with Weber, and optioned the property on generous terms:

- Allied will incur an aggregate of CA$4.75M in exploration expenditures on the property, with at least CA$500K to be spent prior to the first anniversary of the closing date.

- Allied will issue 7 million common shares and make an aggregate of CA$400,000 in cash payments to the Alliance over a three-year period.

- Upon completion of these option agreement obligations, the Alliance will transfer 100% interest in the Klondike Property to Allied. Allied will also issue 3 million warrants exercisable for a three-year term at a price equal to the 10-day VWAP of Allied’s common shares at the time of the issuance.

- The Alliance will retain a 2% net smelter royalty which is subject to a buy down provision where Allied may, at its discretion, repurchase half of the royalty for CA$1.5 million within 30 days of commercial production.

Allied Copper traded Dec. 8, 2021 at CA$0.24 per share, so 7 million shares would be CA$1.68 million of payments in equity at the same share price over three years, which is pretty impressive considering the buying price. On top of that there are also 3 million warrants, of which the 10d VWAP is very close to the aforementioned CA$0.24. If Allied files on SEDAR an NI 43-101 technical report establishing the existence of a resource on any portion of the Klondike Property of at least 50Mt of either copper or copper equivalent at a minimum cut-off grade of 0.50% copper or copper equivalent and categorized as a combination of inferred resources, indicated resources and measured resources, then Allied will also issue a further 3 million warrants exercisable for a three-year term at a price equal to the 10-day VWAP of Allied’s common shares at the time of the issuance.

Looking at the total price Allied has to pay over three years (closing in on CA$3M excluding the royalty), it seems Alianza has found a new way of much more aggressively adding value to properties. I wondered what the chances are for Allied to fulfill all obligations, and if this short trajectory from acquiring properties to completing quick exploration programs to optioning out/selling is a new model for Alianza. CEO Weber answered: “We are always looking at new ways to structure agreements to give potential partners greater flexibility and we try to push the exploration timeline when it comes to structuring exploration expenditures. Allied wants to be aggressive testing projects so the accelerated timeline in the agreement suits their objectives very well.”

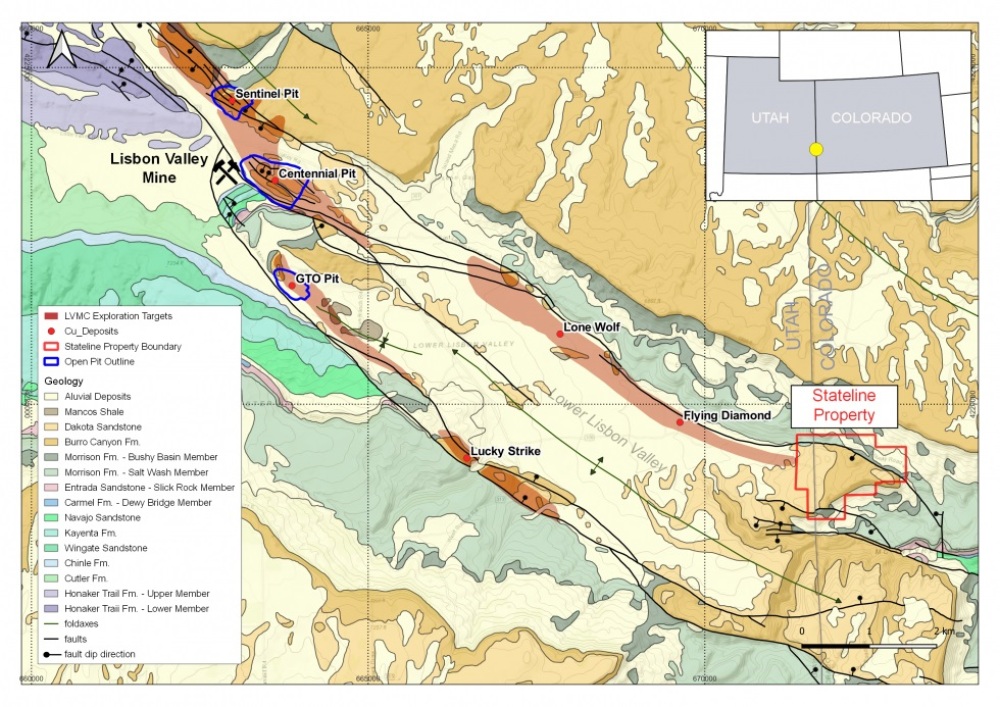

So far for the Klondike transaction. The Stateline project was purchased from the underlying vendors for a very small US$20,000 cash payment and a further US$40,000 payment in the form of cash and/or shares. The project is road-accessible year-round, via a network of roads through the valley, including those supporting access to the Lisbon Valley Mining Complex (LVMC). The project is comprised of 22 mining claims on federal mineral rights managed by the BLM. Ground covered by the current claims was at one time part of the LVMC claim package.

The highlights of the Stateline Copper project are:

- 148 hectare property covering Paradox Basin sedimentary package in San Miguel County, Colorado and San Juan County, Utah

- Favorable stratigraphy known to host sediment-hosted copper deposits in the Paradox Copper Belt including the producing Lisbon Valley Mining Complex (LVMC), 8 km to the northwest

- Exposed copper oxide mineralization at surface within host sandstone units bearing strong similarities to copper deposits along trend at the LVMC

- Mineralized outcrops have yielded assay results up to 1.6% copper and 1.7 grams per tonne (g/t) silver and 0.45% copper and 2.1 g/t silver.

The Stateline project is located approximately 40 kilometres southwest of Naturita, Colorado, covering the state boundary between Utah and Colorado at the southeast end of the Lisbon Valley. This property lies within the Paradox Copper Belt, which includes the producing LVMC. There are numerous historical copper occurrences that have been identified throughout the belt, however, many of these have not been explored using modern exploration techniques.

At Stateline, historical exploration was conducted as part of the regional programs associated with the LVMC. Previous explorers reported copper mineralization highlighted by results of 1.6% copper and 1.7 g/t silver in outcrop. Mineralization visible in outcrop occurs as disseminated malachite, which may be amenable to modern open pit mining with Solvent Extraction Electro Winning (SXEW) processing similar to the LVMC. The mineralization noted to date is interpreted to be the southeast extension of the Flying Diamond mineralization, which is a current target of interest associated with the Lisbon Valley Mining Complex. I wondered what his goals are with Stateline, and if it wasn’t possible to also option/acquire claims located more on the brownish marked zones on the map, and/or closer to the LVMC. He stated: “The alliance is working to bring in a partner on Stateline to test the potential extension of the Flying Diamond target LVMC has defined. LVMC has claims right up to the Stateline claim block and they are actively exploring in the valley between the mine and Stateline, so little or no ground is available for acquisition.”

Besides all these copper related ventures, the flagship project remains the Haldane Silver project. CEO Weber expects to drill further stepouts around Q2, 2022, as targeting of those holes is on its way now with an in depth evaluation of the results, and relating them to geological observations in drilling. Weber expects they will have a better idea of the size and scope of the next program around in the new year.

Despite the solid drill results at Haldane this year, the share price appears to be sideranging since March of this year and even breaking down further since November, creating the typical tax loss selling lows right before the Christmas holidays:

Share price 1 year timeframe (Source tmxmoney.com)

It was clear the solid follow up drill results at Haldane didn’t receive much enthusiasm, as investors probably liked to see multiple/ongoing intercepts of 4 digits for grade. Exploration isn’t that way unfortunately, and more patience seems to be required. Since this is reality at the moment, I like Alianza venturing into copper projects more actively these days as copper stories get more traction since the copper price performs much better than silver. Alianza isn’t a one project one metal play, so I’m not too worried about company changing flavor of the day strategies here. The current cash position stands at C$250,000, and CEO Weber is looking to raise money in the new year.

As the exploration plans at Haldane revolved around growing the West Fault target, and revisiting Middlecoff and their new Bighorn target, to follow up on the new vein targets discovered in 2019 drilling, I’m curious what the current status of these plans is, and when they will be announced. CEO Weber answered: “As mentioned earlier, the planning is ongoing. Once some of the logistical plans have been settled, we can layout the drill program and the prioritized collar locations. That will help determine which holes we drill and at which targets, however, West Fault will remain the primary target for the 2022 program. We will announce the program once the preparations have been completed in early 2022.”

Besides Haldane, the company is working at Twin Canyon in Colorado, and Tim Silver in the Yukon. They are working on a drill permit for Twin Canyon, which is expected around January. Regarding the Tim project, Coeur Mining, the operator of the JV, has completed a reconaissance exploration program, which included a SkyTEM airborne geophysical survey that was followed up by mapping, trenching and soil geochemical surveys. According to CEO Weber, results of this program are not complete yet, but Coeur has indicated its desire to conduct additional trenching and followed by diamond drilling in 2022. Alianza will likely get the results of the 2021 program in the New Year.

Regarding the Yanac Copper project in Peru, despite new president Pedro Castillo being vehemently anti-mining, management is actively talking to potential partners in order to drill test the copper porphyry target here, discussions are still ongoing.

As a reminder, the strategy of the alliance is to acquire and explore copper deposits in the United States, more precisely in Arizona, Colorado, New Mexico and Utah. Under the terms, either company can introduce projects to the Strategic Alliance. Projects accepted will be held 50/50 but funding of the initial acquisition and any preliminary work programs will be funded 40% by the introducing partner and 60% by the other party. I wondered if the Alliance has other transactions coming up soon, and CEO Weber stated: “The Alliance is looking at new targets as well as finding a partner for Stateline and it is possible that there is more news in January.”

Conclusion

After Haldane drilling completed and all drill results being published, Alianza management isn’t sitting on their hands, and seems to be venturing into copper based transactions at the moment, with Alliance partner Cloudbreak Discovery. The terms on the Klondike deal are impressive, and imply a remarkable improvement on acquisition costs for the Alliance. Although Haldane is the flagship project, it might be an interesting addition for Alianza to add a copper flagship project to the story as well, since copper trades close to multi-year highs and generates more interest from investors due to the electrification paradigm shift, meaning high copper demand is here to stay.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Mt Haldane

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.