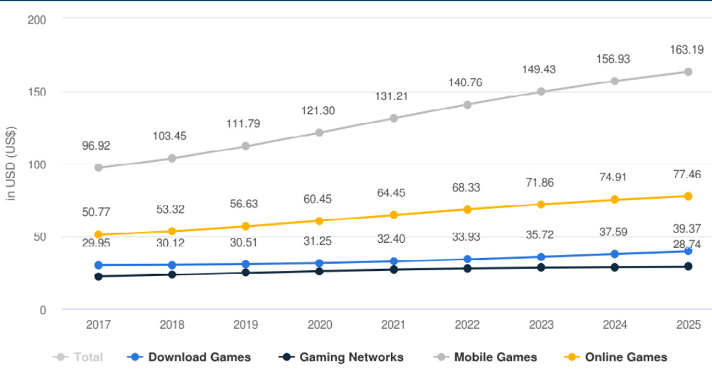

The gaming market is huge! In 2019, it was an estimated $192 billion market, forecasted to grow at an 11% CAGR to almost $400 billion by 2026. Compare this to the music industry, which had $20.2 billion of revenue in 2020, or the movie industry which had a $42.5 billion global box office in 2019. Gaming is starting to catch up to the global sports market, which is expected to grow from $388 billion in 2020 about $600 billion by 2025.

Sophic Capital has published research (Report 1, Report 2, other gaming industry research) about the gaming industry/market and catalysts accelerating its growth. As we previously wrote, lockdowns during the COVID-19 pandemic accelerated gaming interest as many people looked for new forms of entertainment in the absence of sporting events, concerts and cinema outings.

Not only did the gaming industry benefit but so did the streaming of video games – Twitch, Facebook Gaming, and DLive all saw year-over-year growth of content watched in 2020. In fact, esports audiences could grow to 474 million viewers in 2021.

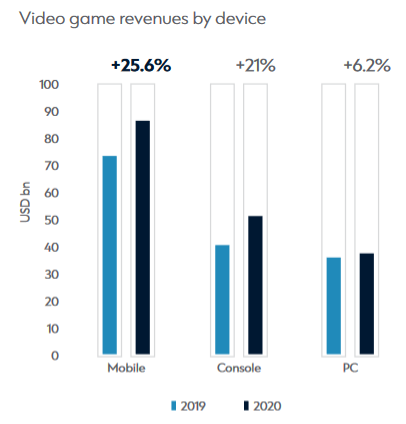

Mobile gaming is set to benefit from increased interest in gaming. In 2020, mobile gaming was a $71.9 billion industry posed to grow to $153.5 billion by 2027 (NewZoo and Standard Chartered estimated over $80 billion). Prior to implementing restrictions on play time, China was set to account for $48 billion of this 2027 market. Virtually all game sales for mobile gamers happen online, driven by Gen-Z (those born between 1996 and 2012), the world’s largest demographic and the demographic that spends the most time on their mobile phones. Gaming is Gen-Z’s favorite entertainment activity (Exhibit 1) – in fact, it is a lifestyle, a way to meet friends and socialize. And as telecommunications companies (telcos) across the world upgrade to 5G infrastructure, Gen-Z’s mobile gaming experiences are about to be enhanced as is Gen-Z’s ability to build communities with like-minded peers.

Exhibit 1: Playing Video Games Is Gen-Z’s Favorite Activity (Source: Deloitte Insights, Digital Media Trends, 15th Edition)

Telcos Need to Become Business Platform Service Providers

Before entertainment companies adopted Over-the-Top (OTT) models, telcos were the dominant technology companies. Music offerings were never a telco strength, and OTT music services (services that are streamed over the Internet, bypassing network operators and potentially competing against similar operator services) like Spotify, removed any potential for telcos to gain market share. Video packages (cable) continue to lose market share as people "cut the cable." Telcos have even lost their dominant position in teleconferencing due to OTT video conferencing services like Facebook Messenger, WhatsApp and Zoom. In effect, OTT services have relegated telcos to the suppliers of data pipes – in other words a utility – providing the data highways for OTT services to extract revenues from telco subscribers. Worse yet, when OTT services falter, subscribers don’t complain to Netflix or Amazon Video – they complain to telcos, and telcos are left to spend on opex and capex while OTTs pay nothing.

To counter the lost revenue opportunities, network operators attempted to bundle services (telco, broadband, SMS) to extract higher Average Revenue Per Customer (ARPU). ARPU did increase, but telcos are still the same, low-growth utilities. What telcos need to do is transform into business platform service providers.

Telcos Need to Target Gen-Z, the Largest Demographic

Here is a summary of the evolution of telco networks:

- First generation (1G) networks were analog-based and only offered voice communications;

- 2G transitioned to digital communications from analog, and SMS messaging introduced;

- 3G offered video and mobile data;

- 4G and 4G+ brought high-speed access and mobile internet;

- 5G downloading will be 10 times faster than 4G.

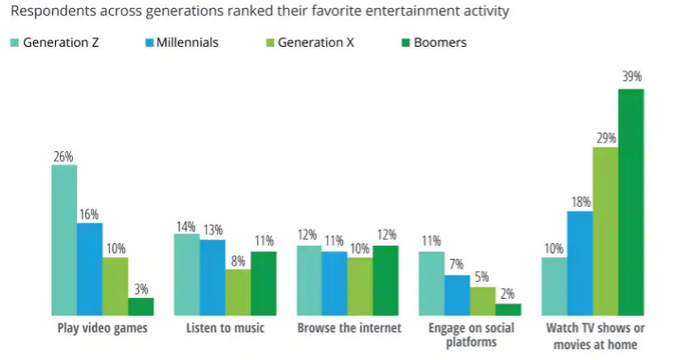

Gen-Z is the next generation for telcos to monetize. Most of Gen-Z’s first exposure to mobile communications has been via 4G networks. Even in emerging markets, 4G networks covered 46% of the population 2015 which grew to 82% by 2019 (Exhibit 2) and have driven much of Gen-Z’s mobile communications adoption. Beyond the cost of mobile data, Gen-Z doesn’t care who provides their mobile data – they only want reliable access to their favourite OTT services. Given this, it’s incumbent on telcos to not only give Gen-Z reliable access to keep them as subscribers but also add extra value to increase Gen-Z ARPU. Reliability will come from 5G networks; reliability will come from the “killer app” for 5G – gaming.

Exhibit 2: Growth of 3G and 4G Coverage (Source: GSM Association, The State of Mobile Internet Connectivity Report 2020)

Community is What Most Brands Miss When Targeting Gen-Z

Community is a crucial foundation for Gen-Z’s digital lives. Gen-Z is a demographic that is radically inclusive, and their mobile presence makes people and causes important to them accessible. According to a McKinsey & Company survey, 66% of Gen-Z believe communities are created from common causes and interests and not education or economic background. In Sophic Capital’s Getting into the Game report we revealed that gaming is Gen-Z’s number one entertainment interest.

Gen-Z doesn’t like to be a customer – they like being part of a community. They are not loyal to companies – they are loyal to communities. Brands can work to build trust to be part of a community, but if brands break that trust, Gen-Z will banish them.

Telcos are a touchpoint for Gen-Z to access their favourite online communities and gaming (their favorite entertainment activity). However, telcos are only monetizing these touchpoints through data plans.

Swarmio Media (SWRM:CSE) offers telecom operators the ability to finally build communities and trust with Gen-Z through gaming, potentially adding new Gen-Z subscribers, reducing churn and increasing ARPU.

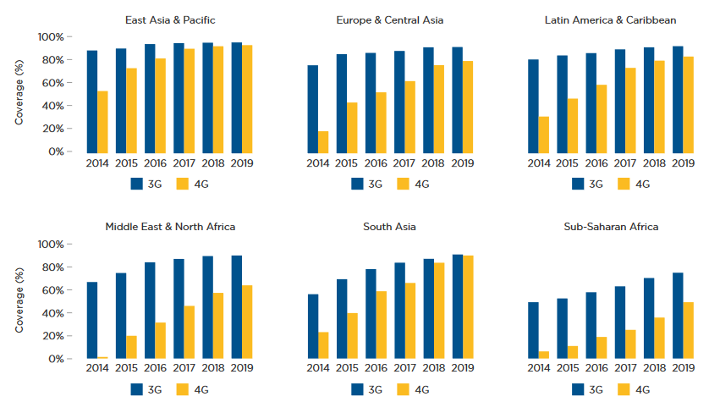

Telcos Absent From Gaming

To meet growing demand for wireless bandwidth, telcos are upgrading their communications networks. Although 4G networks dominate global coverage, network operators are investing in 5G infrastructure. Customers will benefit from these upgrades; so will OTT service providers, and telcos do not want to repeat the missed opportunity of failing to investing in services subscribers demand (like music streaming in the past). Telcos are looking for new services that will generate new subscribers, reduce churn and extract more ARPU from existing customers, and (mobile) gaming is a growing opportunity (Exhibit 3).

Exhibit 3: Gaming ARPU by Channel (Source: DOCOMO Digital)

Cloud and edge gaming could provide new revenue streams for telco operators. Gaming does exist over 4G networks, but 5G networks will provide faster download speeds and lower latencies (the time it takes data to travel across a network to its destination).

Cloud Gaming

Cloud gaming streams games from a server to the gaming device. It centralizes processing and pushes content to the gamer’s device, making the gaming experience largely dependent on the network coverage, capability, stability and distance from cloud server locations. There are no storage requirements for the phone and reduced processing requirements. Every player input from the gaming device is sent to the cloud engine, graphic changes computed and encoded as video, and then streamed back to the gaming device. Gamers can access cloud games whenever they have network coverage and do not have to download or install games. Although cloud gaming simplifies access and hardware requirements for games, game providers need to invest in data centers and manage processing to ensure gamers have seamless access and error-free experiences.

Cloud gaming provides the opportunity for telcos to host game processing. For example, rather than process and pull game data from a centralized Facebook data server that then has to connect the Internet to deliver the data to the end user, a telco could provide the service. The advantage of shifting the data processing to the telco is a reduced data path (from thousands of kilometers to tens or hundreds) thereby reducing latency. As well, the telco generates new revenue through this service.

Edge Gaming

Edge gaming pushes processing closer to the user’s device (the edge of the network) rather than to a centralized server. Processing

at the edge removes the need to upload data to a server and then wait for the server to process the data and return video. The “edge” device can be a cell tower, a data cen

ter, or even the user’s phone. Pushing the processing to the edge minimizes the amount of data that needs to be processed at a centralized server, thus reducing network bandwidth requirements.

Telcos Could Game the Gaming Consoles

Cloud and edge gaming could disrupt traditional gaming business models. Major gaming publishers distribute their titles via consoles like PlayStation and XBOX. By partnering with telco operator and leveraging their networks, game publishers can remove their dependency upon consoles. This is no different from video publishers bypassing cable networks or cinema chains by offering an OTT service (Disney+, Amazon Prime, for example). Gaming OTT subscription models seem to be the next entertainment disruption, providing telcos opportunities to attract new subscribers, increase ARPU with existing customers, and build customer stickiness. It’s even possible that telcos themselves could start producing gaming content.

Telcos Need to Own the Edge

To attract new subscribers and in increase ARPU from existing customers, we’ve made the case that telcos need to:

- Evolve from being utilities to business platform service providers;

- Target Gen-Z, the largest demographic, and;

- Offer gaming services to attract and keep Gen-Z subscribers.

We’ve also established the case that EDGE gaming and 5G networks are the path to provide seamless gaming experiences. Thus, we conclude that telcos need to own the edge and offer edge computing. There are numerous edge computing use cases. For example, autonomous vehicles are edge devices that are suited to process data locally rather than by transferring data to a centralized server. Remote monitoring of assets such as off-grid power systems is another use case. Hospital monitoring of patients, where the hospital is the edge, not only reduces reliance on cloud processing but also reduce data privacy risks. But as it applies to attracting and maintaining Gen-Z subscribers, telcos need to offer edge computing gaming, especially on fast 5G networks. On top of this, they can add value-add gaming services that add value for Gen-Z. Sophic Capital will detail these gaming services in our next report.

Patented Edge Computing Technology

Founded by telecom veterans, Swarmio Media offers telecom operators a patented edge/cloud solution that reduces latency and offers a superior gaming experience for subscribers. Every gamer needs speed. If telcos fail to deliver speed, Gen-Z will find another telco that delivers. Recall that edge computing shifts processing closer to a subscriber’s device rather than host it at a server that is sometimes thousands of kilometers away. Also recall that 5G telecommunication networks offer the ability to upload data about 10 times faster than 4G networks (which have the most global coverage) and decrease latency (the time for data to reach its destination). The speed provided by the combination of edge computing along with 5G networks makes gaming the “killer app” – today!

Swarmio Matrix is the Company’s real-time, artificial intelligence (AI) latency-optimized edge computing (LEC) technology for game delivery. The biggest issue gamers face is lag, with 44% of UK gamers naming it the most infuriating part of gaming. Swarmio Matrix offers faster and more responsive processing closer to gamers to provide a better gaming experience on supported titles. With potentially thousands of edge devices connected to a gaming network, processing needs and node locations become factors in how to optimize latency for all gamers. Swarmio Matrix’s proprietary LEC provides a solution to this complicated issue, ensuring a seamless and fair gameplay experience for gamers in those environments.

Telco operators can utilize edge gaming through Swarmio Matrix, creating fantastic gaming experiences for players. Telcos also need to monetize this cutting-edge AI latency-optimization platform. Swarmio Hive fills this need.

Swarmio Hive: Attract Gen-Z Subscribers and Make Them Stick to Telcos

One way Swarmio builds telco subscriber stickiness is by building community through Swarmio Hive (Exhibit 1), the Company’s turnkey gaming and esports platform for telecom operators. Swarmio Hive helps telecom operators capture, engage and monetize gamers via community building and gaming engagement tools. This begins with the customized, branded Swarmio HIVE community hub, tailored to a telecom operator’s subscribers, that offers rewards, community, content and game play. One unique aspect of each custom Swarmio Hive deployment is the ability for members to challenge each other in matches and tournaments. Even influencers can issue challenges, giving players access to fan favorites. Rewards like virtual prizes, access to influencers, or points that gamers can exchange for other prizes, skins and in-game content can be issued during challenges. Creators can either stream their matches for public consumption or privately through dedicated servers.

Swarmio Hive fully manages gaming and esports operations for telco operators. Everything from event design and administration, influencer management, community management, to gamer-centric support, Swarmio Hive ensures not only stress-free operations for telcos but also a perfect gaming experience and community for telco subscribers.

Exhibit 4: Swarmio Hive is an Application for Telcos to Monetize and Retain Gen-Z Gamers (Source: Company reports)

Access to Tournaments Inside the Swarmio Hive Community

Swarmio Hive is a community and gamification platform offering members the ability to organize tournaments. Propagating a shared gaming interest solidifies Gen-Z communities, and this is what gaming tournaments accomplish. Tournaments also offer participants the opportunities to win points, which can be redeemed in the platform for things like gaming skins (virtual assets). With multiple tournaments available on Swarmio Hive daily, this rewarding gameplay builds loyalty and engagement, helping telcos to reduce churn and continue to increase ARPU.

Access to Influencers Inside the Swarmio Hive Community

Brands are still trying to understand how to build Gen-Z loyalty. Throwing money and splashing logos is not enough. As we discussed, loyalty and community are pivotal for Gen-Z. Loyalty is based upon trust, and one way to build trust is through words, actions, and influencer content.

An “influencer” is a social media celebrity who has a reputation for expertise in a certain field. A gaming influencer could be a professional esports gamer, someone who has extensive knowledge to comment on gaming, or someone who can play call a gaming tournament while keeping viewers engaged.

Some influencers may not have millions of followers but have a strong local presence. Telcos that license Swarmio Hive have the opportunity to attract these local influencers and help them grow their presence. This can be something like allowing 10 fans the chance to compete against a local esports pro or redeeming points to conference with a gaming expert. Influencer access grows trust and loyalty to Swarmio Hive and builds community, increasing subscriber stickiness for telcos.

Paid Tier Potential Offer Telcos Additional Revenue Opportunities

Swarmio Hive allows telcos to not only attract and maintain gaming customers but also offer different paid membership tiers. For example, lower tiers could offer limited prizes and higher tiers could add private game servers or allow a subscriber to run their own event. Telcos could also bundle tiers with data caps. These tiers can be bundled for new subscribers or existing and increase ARPU for the telco.

Easy Integration For the Telco

Swarmio provides a turnkey solution for telcos and fully manages all gaming and esports operations. As seasoned veterans in the telecom space, Swarmio delivers the gaming solution for telcos and their subscribers, combined with support based upon industry IT service management methodologies.

After a telecom operator licenses Swarmio’s platform, the Company’s gaming and esports team collaborates with the customer to design, implement and manage the end-to-end operations of the platform. This frees resources for telcos since their involvement in implementation, management, and maintenance is Swarmio’s responsibility. From event design and administration, influencer management, community management and gamer-centric support, Swarmio ensures that operations run smoothly for telcos while consistently delivering a perfect gaming experience and community for a telco’s gaming subscribers.

Telco Investing in Marketing for Profit Share

When telcos sign up with Swarmio they agree to a revenue share in the monthly ARPU and revenue from the platform for all the services. The telco agrees to a significant marketing investment to introduce the platform to its subscribers and integrates Swarmio into its payment processing for easy billing. This is important in the regions that Swarmio is targeting as customers generally have payment set up with the telco, making it easy to bill in regions where billing electronically can be challenging.

Summing the Play Action

In summary, Swarmio is the right solution, for the right industry, for the right people. Video games are the primary source of entertainment for Gen-Z, the largest demographic globally. Online video games face challenges with lag, making the experience unpleasant for gamers – especially for gamers who live far from game hosted servers. If a gaming experience is consistently "laggy," Gen-Z will abandon it. Telcos can’t afford to lose that attention. Telcos need new revenue streams to support their constant network enhancements as consumers will always demand more speed and lower latency. Telcos also need to increase APRU. Fortunately, Swarmio addresses these issues by providing turnkey, telecom-grade edge computing that can minimize lag, thus, enhancing gaming experiences for gamers on Swarmio Hive. Swarmio’s solution also allows several ways for Gen-Z to build community (very important to this demographic) though custom gaming events, challenges, tournaments and engagements, meaning telcos can reduce churn, potentially add subscribers, and increase ARPU. Investors seeking an opportunity to invest in the multi hundred-billion-dollar gaming industry, Gen-Z (the largest global demographic) and telecommunications should consider Sophic Capital client Swarmio Media.

Disclosures for Sophic Capital Inc.

Swarmio Media has contracted Sophic Capital Inc. for capital markets advisory and investor relations services and owns shares in the Company.

Disclaimers: The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.

Streetwise Reports Disclosures:

1) Sophic Capital Inc.'s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Swarmio Media. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) 5) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Legible Inc., a company mentioned in this article.