Quebec Precious Metals has been successful to monetize its non-core assets as a source of funding for exploration and drilling programs for gold in the James Bay region of Quebec. Can you describe this monetization process and the results obtained to date?

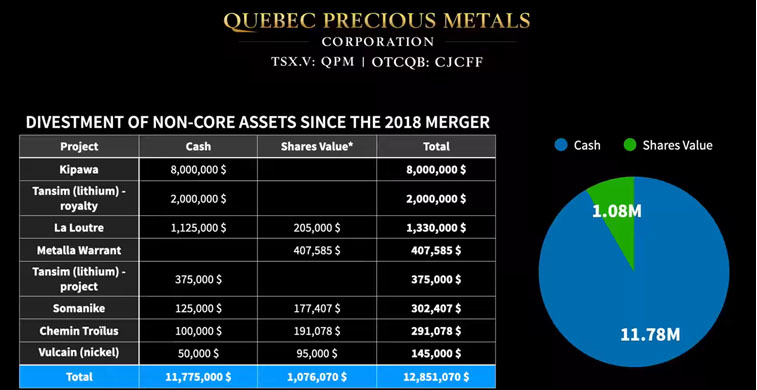

Quebec Precious Metals Corp. (QPM:TSX.V; CJCFF:OTCQB; YXEP:FSE) was created in 2018 through the merger of two existing companies in order to have a 100% interest in its flagship Sakami project and find the next gold mine in the James Bay region of Quebec. As part of this creation process, our company inherited seven non-core assets. These assets were either not gold or not located in the James Bay region. We clearly indicated that these assets were going to be monetized.

We contacted companies that could be potentially interested to acquire such assets. We were patient and have been able to generate to date close C$13 million in cash and shares as a result to this monetization process.

What have been the key success factors in this monetization process?

There were three key success factors: 1) the quality of the asset and the work previously done on it; 2) market conditions for certain commodities, for example, recently we have seen a very good market for lithium assets and we were able to monetize not only the asset but also the royalty that was created when we disposed of the asset; and 3) the appetite for acquirers for assets in Quebec. Quebec is considered as a good mining jurisdiction and many acquirers are looking for assets in Quebec.

Normally exploration companies, such as QPM, issue shares to fund drilling, which can lead to significant dilution of the shareholder base. Please explain how share dilution has been avoided by receiving proceeds from the divestment of non-core assets?

With a monetization process yielding C$13 million and assuming and all in drilling cost of $300 per meter, you can drill more than 40,000 meters. This a lot of meters and can be sufficient to identify a significant mineral resource. At our current share price, we would have to issue 52 million shares to fund that much drilling. This would represent a very significant shareholder dilution. We are trying to avoid that.

The cash received from the sale of non-core assets is "hard" cash as opposed to the traditional cash received from the issuance of flow-through shares. What is the advantage to receive ‘hard’ cash in particular for exploring in the province of Quebec?

In the James Bay region of Quebec where we operate, for every "hard dollar" that you spend, the company receives a 37.5% tax credit from the government tax agency following the submission of the documentation showing that the funds have been spent. This is like having a 37.5% discount on your drilling cost. Your exploration dollar goes a long way to discover more resources and the next gold mine.

Disclosure:

1) Normand Champigny: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Quebec Precious Metals. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: Quebec Precious Metals.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Quebec Precious Metals. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quebec Precious Metals, a company mentioned in this article.