December Comex Gold Chart:

Gold is like a coiled spring in a wedge formation, ready to break out. The On Balance Volume (OBV) shows strong accumulation since January 2020. It did dip some with the correction in the March lows, but was still positive. Since then, OBV has been steadily rising again. The odds are high that the break out from the wedge will be to the upside.

This next chart of the TSX Venture index, a good barometer of junior miners, is very important. Often the juniors would bottom in August, the summer doldrums and then start a rally into year-end. Since 2015, the bottoms have come between August and November, but rallies have not been significant until November/December and go into January to March the next year. Of course 2020 was an exception with a March bottom.

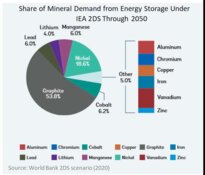

The chart I am showing is a 2 year chart and you can see this pattern quite easily. Even in 2019 the rally began around November time frame but uncertainty about emerging Covid-19 kept the market in check until it finally plunged in March and then bounced back up. In 2020, a strong rally started in November. This year we have the first bounce already in October with the best rally in the Venture index since the correction. The down trend channel has been broken. I don't think gold has to rally for the Venture Index to have a strong rally as many metals have been strong, like all the base metals, uranium and the battery metals. Platinum and palladium have corrected with gold, but it is mostly a case of automotive plants being shut down with chip shortages and lower demand for these metals as exhaust catalysts.

Inomin Mines Inc. (MINE:TSX.V; IMC:FRA) is a greatly undervalued hidden gem with four advanced gold and nickel projects. With only 28.5 million shares out and at 8 cents, the $2.3 million valuation is way to cheap and one of the best buys one could find on the TSX Venture market.

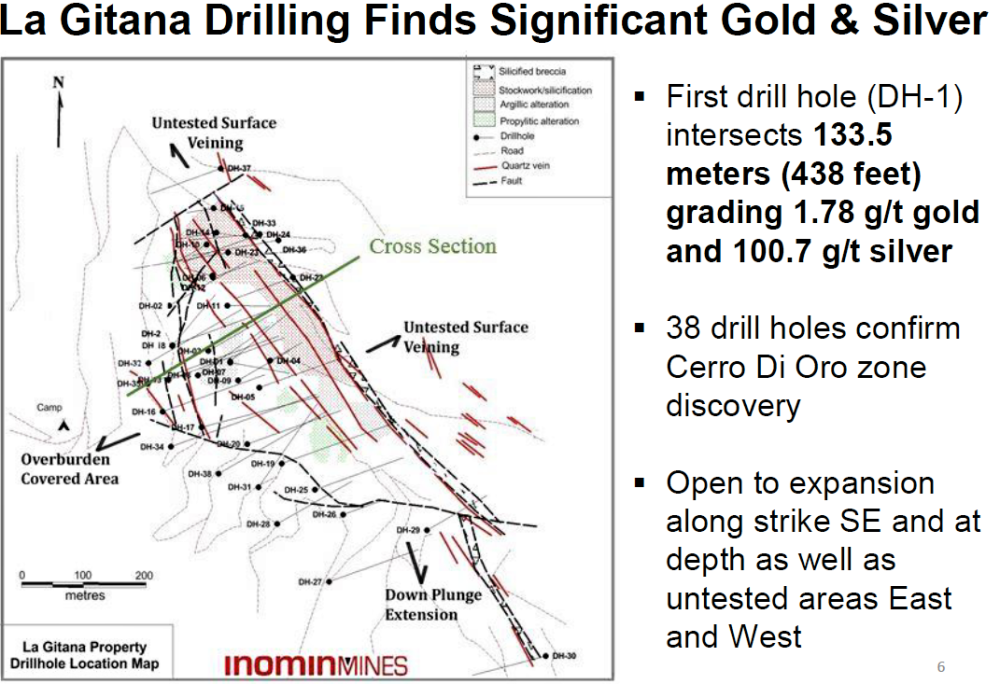

What spiked my interest in Inomin was in 2020 when the company announced the acquisition of the La Gitana and Pena Blanca gold-silver properties in Mexico. Many of you will remember Chesapeake Gold, one we did very well with back in the 1990s. During 2004-2006, Chesapeake Gold conducted exploration at La Gitana including surface mapping, sampling, IP-resistivity geophysics, as well as core drilling. Drilling of 38 holes defined a gold-silver mineralized zone measuring 500 meters long, 300 meters wide and 50 to 300 meters deep. The discovery hole at La Gitana ran 133.5 meters of 1.78 g/t gold and 100.7 g/t silver. Pena Blanca was also a Chesapeake project but not advanced as far.

So Inomin has an advanced stage project that will most likely be a discovery and mine and the stock price is giving pretty much no value. There is a lot more to this company as well once you read on. The acquisition was just finalized in March of this year. They have also started drilling their nickel project in British Columbia.

Inomin Mines TSXV:MINE Recent Price - $0.08 52 week trading range $0.06 to $0.23

Shares outstanding 28.5 million

Highlights

-

Highly experienced management team with seniors/juniors along with numerous discoveries;

-

Tight share structure with low number of shares outstanding;

-

Strong exploration potential for nickel and gold;

-

Drill results from their Beaver nickel project in BC is a near term catalyst;

-

La Gitana, Mexico, a significant gold -silver discovery, wide open to expansion;

-

Massive outcrop at Pena Blanca, Mexico points to possible large discovery;

-

Inomin has strong potential to prove up three separate deposits;

-

Very low valuation at C$2.3 million;

-

And now you can buy at the bottom of the stock chart.

Management

John Gomez, President and CEO, is an entrepreneur that has founded and managed private enterprises in mining, technology, and sports. Prior to being a founder of Inomin, Mr. Gomez founded and was president of a private gold exploration company in Colombia. Under his leadership, the company acquired strategic land and mining interests in some of the country’s top gold districts. Mr. Gomez also founded and was president of U3O8 Media Inc. a leading news provider for investors on the uranium market. The U3O8.biz model was used to establish the Investing News Network. His consulting company, Oro Grande Capital Inc., provides marketing, corporate development and funding services to select public and private companies. Mr. Gomez has a Bachelor of Arts degree from the University of Victoria.

John Peters Director, P.Geo, has over 30 years of experience in the mining industry. He is currently a geological consultant for junior mining companies including Westhaven Ventures Inc, Commander Resources Ltd, and Fjordland Exploration Inc. Following four years as mine geologist for Homestake Canada, he spent 25 years as exploration manager for over 10 junior companies with projects located across Canada, West Africa, South America, United States, and Greenland. Notable discoveries in British Columbia, Canada Mr. Peters has been involved with include the Woodjam porphyry copper-gold deposit, the Shovelnose gold discovery, and the Beaver-Lynx nickel discoveries.

Bill Yeomans, Director, P.Geo, is a gold exploration professional with over 36 years experience in all stages of gold exploration throughout the Americas. He gained extensive exploration management experience across the entire Guiana Shield of South America with BHP, along with several junior mining companies. He has generated projects which resulted in significant NI 43-101 compliant gold resources on three different projects including the Duquense-Ottoman gold project in Quebec. Mr. Yeomans has worked as a consultant to IAMGOLD and Dundee Precious Metals, evaluating advanced gold projects across Canada, western USA and Alaska.

Victor Jaramillo, Advisor, M.Sc., P.Geo, is an international geological consultant with over 30 years of experience in the mining industry. Mr. Jaramillo has worked for major and junior mining companies as senior project geologist, technical director, chief mine geologist and exploration and mine manager. Most of his experience in the last 25 years has been focused on precious metal deposits. Mr. Jaramillo was directly responsible for the discovery of the Langosta porphyry copper-gold deposit in Mexico, and the discovery of the Las Lomas porphyry copper-gold deposit in Peru.

Bruce Winfield, Advisor, M.Sc., P.Geo, has more than 40 years of experience in the minerals industry as a geologist, corporate executive and consultant. Following 14 years with major mining companies Texasgulf Inc. and Boliden Inc., he held the position of VP Exploration for Greenstone Resources and Eldorado Gold Corporation leading to the exploration and development of five gold deposits.

Ari M. Shack, Corporate Secretary and Director, BsC and Bachelor of Law Degree. Mr. Shack has practiced throughout his career as a commercial solicitor advising both public and private companies. Mr. Shack has extensive experience advising clients in relation to day-to- day commercial transactions and operations. In addition, Mr. Shack has experience advising private and public companies on corporate finance matters, including securities issuance and secured lending.

Properties

I really like MINE's Mexican assets and they are currently negotiating exploration agreements with locals. There BC nickel project is no slump either and since they currently have a drill program underway, I will start there. Base metal prices are lighting up and nickel just broke above the 2014 highs, making a test of the $13 area the likely next target.

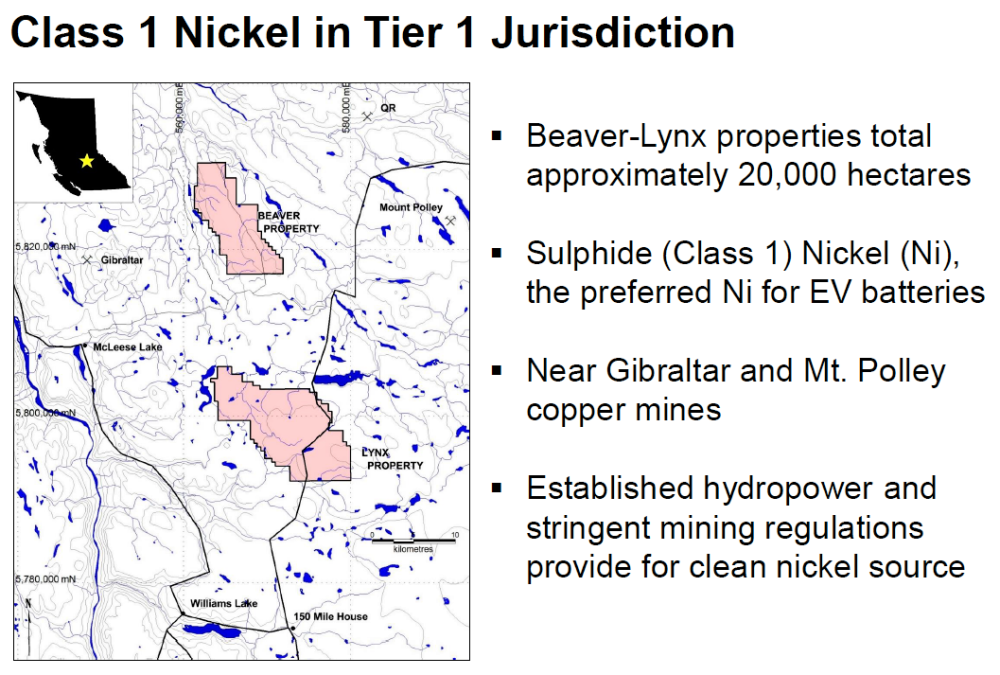

Beaver nickel-cobalt property, BC, 7,528 hectares, 100% owned

This graphic showing location also has MINE's 12,662 hectare Lynx nickel property just 11 km to the south of Beaver. MINE recently staked more claims between Beaver and Lynx to join the two properties into one.

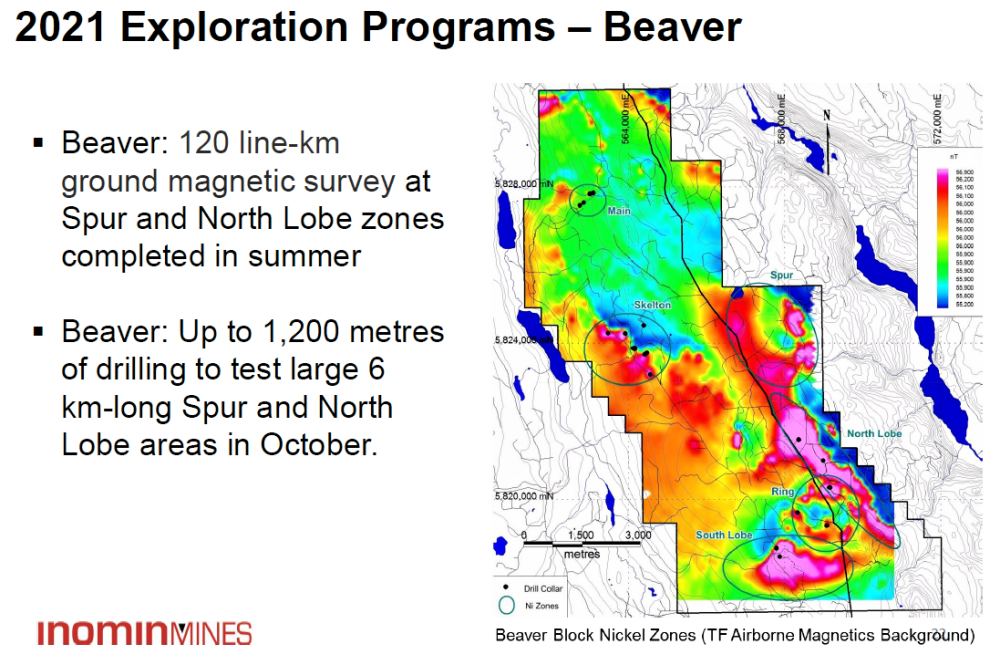

The Beaver property was initially targeted for gold exploration and gold was found in some areas. What stood out was nickel and cobalt was discovered in all areas. The ultramafic rock that hosts the nickel has been delineated over a large 4km by 8km area with the drilling and magnetic surveys. The graphic below shows the target, magnetic survey highlighted in pink and red.

Drilling started October 5 with approximately 1,200 meters of diamond drilling planned to test for nickel mineralization within a five-to-six-kilometer-long area covering the Spur and North Lobe zones. This large exploration area has been defined by Inomin's summer 2021 ground magnetic survey and limited previous drilling.

Most BC copper porphyry mines grade 0.30–0.40% copper. For example, Gibraltar just 15 km away has a 0.27% copper equivalent grade. Beaver at 0.20% nickel equivalent (nickel + cobalt has a similar value to 0.40%–0.50% copper, based on current nickel and copper prices.

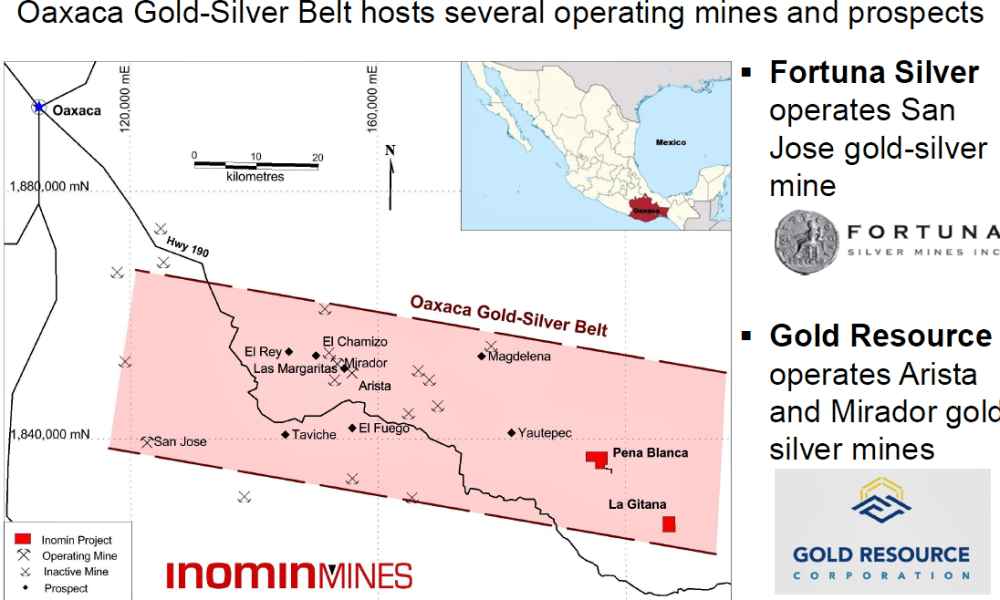

Gold and Silver in Mexico's Oaxaco Gold-Silver Belt

La Gitana, 494.2 hectares, Mexico, 100% interest.

As mentioned above, La Gitana is already advanced with a discovery made by Chesapeake Gold in 2004–2006. Initial drilling of 38 holes has defined a strong zone of gold and silver mineralization up to 500 meters long, 300 meters wide and 300 meters deep. Drill results include 133.5 meters (438 feet) of 1.78 g/t gold and 100.7 g/t silver. The zone is open along strike and at depth, as well as laterally.

In total, 8,230 meters of diamond drilling has been completed at La Gitana. The Cerro Di Oro gold-silver zone is open along strike and at depth. Mineralization also appears open laterally: to the east surface veins have not been drilled; to the west is an untested overburden covered area.

The drill map next page plots the previous drill holes and shows the directions where the zone can be expanded.

MINE's future exploration will include airborne magnetics and ground sampling, followed by diamond drilling in prospective areas. Drilling would focus on areas along strike and at depth to the southeast of known gold mineralization, as well as laterally to test for parallel gold and silver bearing structures. Following this phase of drilling, a preliminary resource calculation should be completed.

Pena Blanc Gold-Silver, Mexico, 100% interest

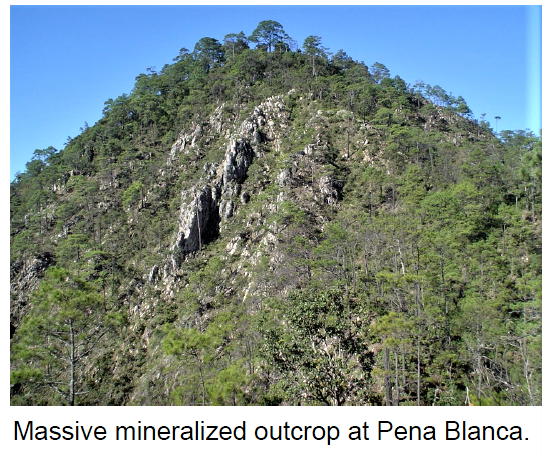

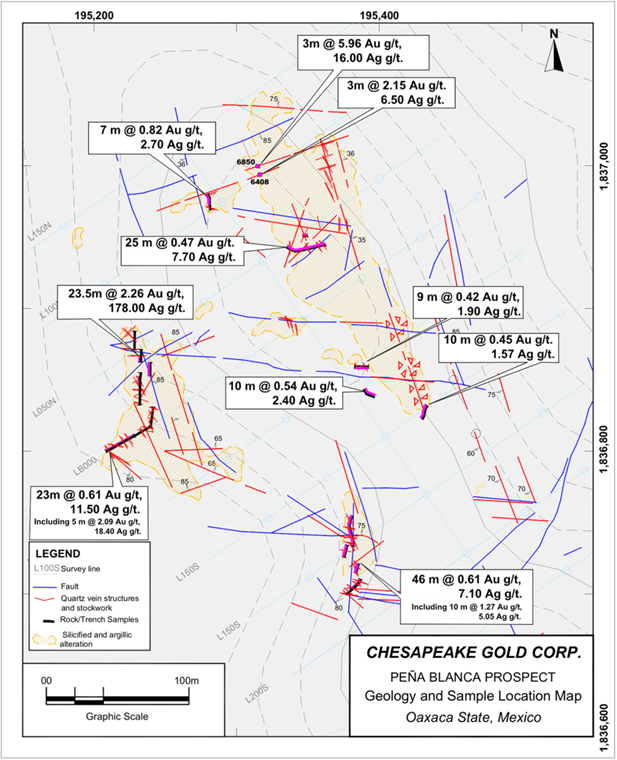

Similar to the La Gitana gold-silver property just 15 km away, Pena Blanca hosts an epithermal mineral system with a substantial footprint. Initial exploration has identified gold-bearing, hydrothermal alteration over approximately 9 square kilometers, of which less than 1 square kilometer has been systematically mapped and sampled. The style of the alteration and mineralization, as well as the size and orientation of structures, suggests Pena Blanca has potential to host a large, gold-silver mineral system.

With such a large outcrop sticking out of the ground, it makes for very high odds that a deposit can be identified. As reported by Chesapeake, sediment anomalies ranging between 276 ppb to 2,200 ppb gold have been discovered from a 2.5 kilometer by 3.5 kilometer area surrounding Pena Blanca ridge.

Chesapeake collected channel rock samples from outcrops and hand-dug trenches excavated in a 200 meter by 300 meter area located at the northwest end of the soil sample grid. The sample cuts were taken across several different zones 50 meters to 100 meters apart. Although this project is not advanced with drilling, some very good channel samples were cut and collected on surface. Proper channel and trench sampling is very indicative of what drill results would be across the surface. The map below shows the numerous channel/trench samples with length and grade.

Inomin hired Carlos Torres and Eduardo Ortiz to lead the company's community relations and project evaluation activities in Mexico.

A resident of Oaxaca, Mr. Torres will represent the company with local communities, government officials and other stakeholders. Mr. Torres is a civil engineer who worked as a mine manager and field engineer at Gold Resource's El Aguila gold-silver mine in Oaxaca. At El Aguila, he was involved in developing infrastructure for the project including road access, mining camp, open-pit and underground mine development, and tailings dam. Mr. Torres also worked as habitat program supervisor in Oaxaca with Sedesol, a Mexican federal government ministry of social development agency in charge of urban development to improve living standards in rural communities.

Mr. Ortiz has been appointed senior exploration geologist to evaluate the company's gold-silver properties in Oaxaca and new acquisition opportunities in Mexico. Mr. Ortiz, who started his career as a geologist in Oaxaca, has worked throughout Mexico. His immediate previous position was senior exploration geologist for a Mexican subsidiary of First Majestic Silver Corp. Prior to this position, he worked as senior geologist at Endeavour Silver Corp. He also was chief geologist at Goldgroup Mining Corp.'s Cerro Colorado mine in Sonora.

MINE is planning to start exploration on one or both of these projects in 2022.

Financial

Last financial statements show approx. $320,000 cash and no debt. Since then, MINE has closed its second and final tranche of its non-brokered private placement. Under the second tranche, the company issued 724,000 non-flow-through units for gross proceeds of $72,400.

On Aug. 25, 2021, the company closed the first tranche of the offering, pursuant to which the company issued 2,862,000 flow-through units for gross proceeds of $357,750 and 446,000 NFT units for gross proceeds of $44,600, for total gross proceeds of $402,350. Each FT unit comprises one flow-through common share and one-half of one warrant, with each whole warrant entitling the holder thereof to purchase one non-flow-through common share for a period of two years from the date of issuance at an exercise price of 15 cents.

In total, they recently raised $474,750 that easily funds their drill program at Beaver. They would have some funds to start exploration in Mexico but would have to do another raise for drilling in Mexico.

Summary

MINE has an excellent management team and top notch properties in Canada and Mexico. They have strong potential to advance two projects in Mexico to mines and the nickel project in BC to a mine. They also have the Fleetwood zinc-copper-gold-silver volcanogenic massive sulphide project in southwest BC and 100% of the King's Point gold-copper-zinc project in Newfoundland under option to Maritime Resources Corp. I did not go into detail on Fleetwood and King's Point where more can be found on their website.

What I find as most attractive besides the quality projects is the low valuation. The stock should be higher value just based on one of their three projects I went into detail on. I doubt you could find another junior explorer on the Canadian junior stock exchanges with a lower valuation that has properties of this caliber. Inomin belongs in everyone's junior exploration portfolio.

Furthermore, it is an excellent time and price to buy on the chart. The stock first woke up in the beginning of August 2020 when the company first announced the acquisition of La Gitana and Pena Blanca in Mexico. This is the cheapest you could ever by the stock since then and it sits at a bottom on the chart. It is all upside from here with little downside. About 7 cents is long term and strong support. There would be a bit of resistance around 10 cents and this could allow accumulation up to this range. Regardless, the key resistance is around lucky 13 cents and even at this price, MINE has a very low valuation of C$3.7 million.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Read what other experts are saying about:

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Inomin. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Inomin is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Inomin. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Inomin, a company mentioned in this article.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.