FenixOro Gold Corp. (FENX:CSE) is delivering on exploration promises, yet its share price is down 62% since September. Granted, the gold price had just peaked at ~$2,070/oz a month earlier. And granted, more than half of the roughly 700 Canadian/U.S.-listed precious metal juniors I'm tracking are down >40% from last year's highs.

Still, I believe that FenixOro remains particularly undervalued. Its enterprise value [EV] {market cap + debt – cash} of C$18 million ignores several very important attributes. The company's flagship Abriaqui gold project sits just 15 km west of the world-class, low-cost, high-grade Buriticá gold mine, just four km from Colombia's Pan-American highway, and near local labor pools.

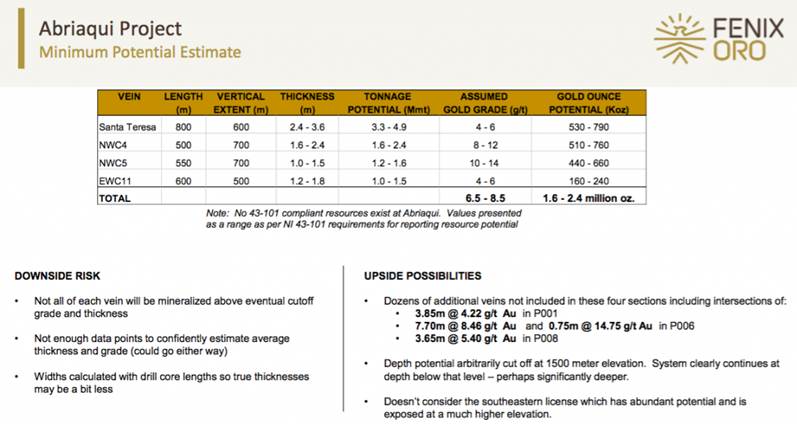

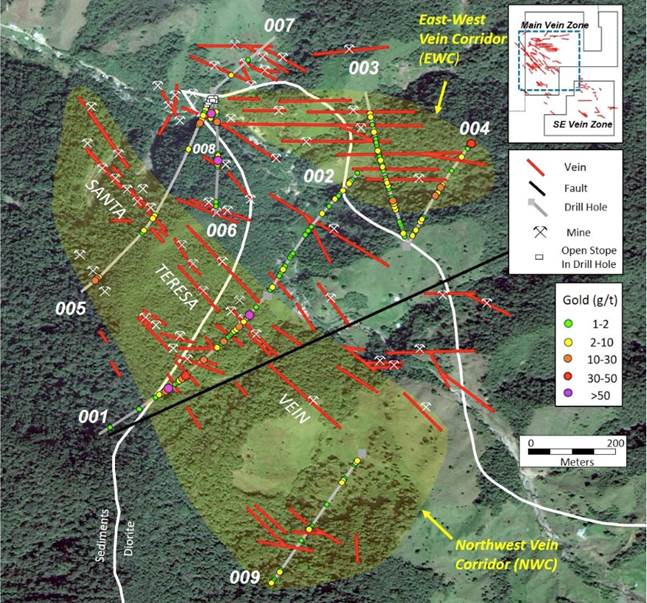

Abriaqui is being explored/developed by an expert team that has mapped over 100 gold-bearing veins at surface [grades up to 146 g/t Au]. Management has delineated gold mineralization over a vertical extent of 1,200+ meters (m) (open at depth) and has established an exploration target of 1.6–2.4 million ounce (Moz) gold from four of the better grading/better understood vein structures.

The exploration target summarized above was derived from a preliminary analysis of phase 1 drilling (9 holes, [100-750 m deep]/total of 4,029 m). All holes intersected multiple veins, 45 intercepts returned >2 g/t gold, the widest interval that's also hosted high-grade was 7.7 m of 8.5 g/t gold.

New structural data gained from mine mapping, sampling and oriented drill core data is being used in a second round of vein structure correlations. As of last week, 12 additional vein structures are being modeled.

This does not mean millions of ounces will soon be added to the exploration target. However, it certainly bodes well for the potential of Abriaqui hosting a significant deposit. The 16 longitudinal vein structures are found on <20% of FenixOro's land package.

If management can book even 1 Moz at moderate-to-high-grade—that would demonstrate a technical team with a good understanding of Abriaqui's geology, structure & continuity—giving investors line of sight to a multi-million ounce resource.

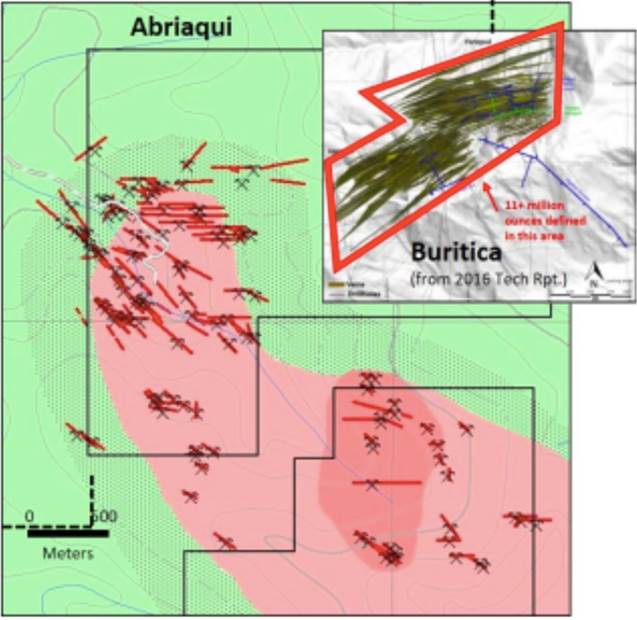

Compare FenixOro's valuation to the nearby Buriticá mine. Readers may recall that Continental Gold was a year from production in late 2019 when it was acquired by Zijin Mining. It had a 12.1 Moz, high-grade (9.96 g/t Au Measured + Indicated + Inferred) resource. In reviewing economic sensitivity tables in Buriticá's Feasibility Study; at the current gold price and C$/US$ exchange rate that mine is valued at ~C$2.1 billion.

Without overstating the favorable comparison of Buriticá to Abriaqui, I will convey the observed facts (without speculation). Both deposits have 100+ closely-spaced, high-grade veins developed in corridors that are hundreds of meters wide, mixed with numerous areas of lower-grade mineralization.

Both enjoy gold mineralization over substantial vertical extents (1,200+ meters), open at depth. They share several geological features as both are near the northern end of the 200 km Middle Cauca geologic trend, where >80 million ounces of gold have been discovered since 2007.

Very high-grade, closely spaced veins, potentially mineable for over a km vertically, (>1,600 m at Buriticá) is what makes that mine a monster on a very small footprint.

The following image shows Buriticá (in upper right corner) compared on the same scale to Abriaqui. Notice that 12+ million ounces is hosted on a footprint about one-third the size of FenixOro's property. To be clear, the overall land package is over 70,000 hectares, but the gold being mined is contained on a tiny fraction of the overall property.

Buriticá is one of the largest and most important gold mines in Colombia. It was discovered and developed by geologists and engineers at Continental Gold. One of the foremost experts at Continental was Stuart Moller, who's now a director and VP Exploration at FenixOro. Over a 4-year period (2007–11) he was actively involved in both the discovery and early development of the mine—planning and executing on drill programs covering the initial 270 holes.

Although pre-resource, FenixOro's Abriaqui project is years ahead of companies looking to commence green field exploration in Colombia, such as a major staking new ground. Time is money, a mid-tier or major should be willing to pay a lot more than C$18 million for a multiyear head start on defining a (potential) world-class resource.

With the help of a strong partner, drilling could be expanded, enabling a preliminary economic assessment (PEA) to be delivered a year or more faster than might otherwise be the case. Readers should note, with Chinese and Russian miners and investment groups increasingly being shut out from acquiring assets in the U.S. and Canada, strong projects in safe parts of South America are becoming more valuable and attractive.

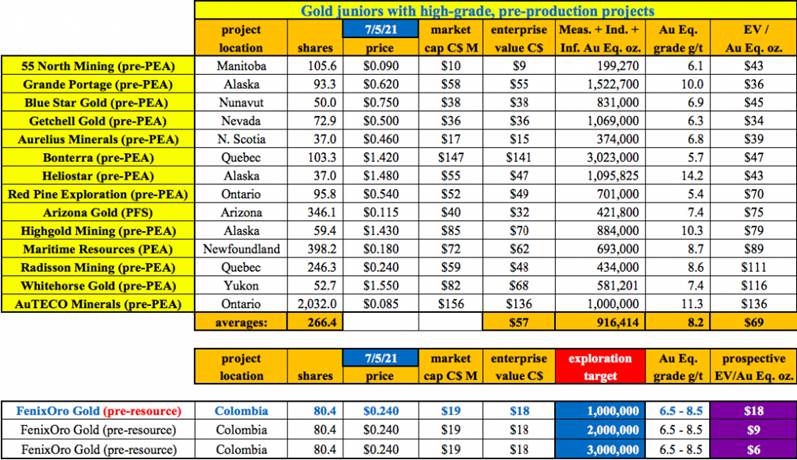

If management were to book 1 million ounces, the company would be trading at an EV/oz in the ground ratio of C$18/oz. That's very cheap vs. other early-stage high-grade gold juniors, such as the ones in the chart below—trading at an average of C$69/oz. At 2 million ounces, FenixOro would be trading at C$9/oz.

Not many projects around the world have BOTH the potential to be >5 million ounces AND >5 g/t gold. There are hundreds of juniors with properties that will never grow above 2 million ounces, or grade above 2 g/t gold.

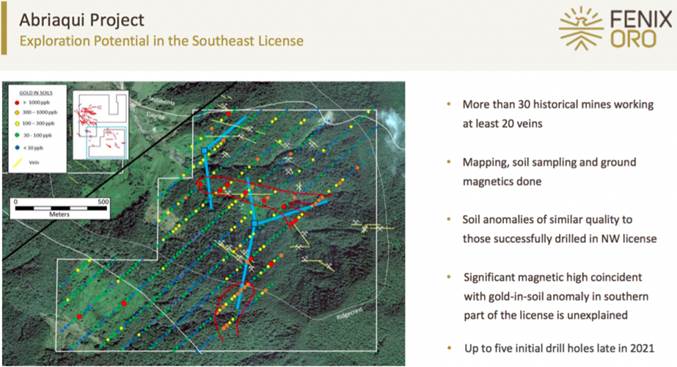

Management. completed a second round of soil sampling in the Southeastern Block (SEB) at Abriaqui. Historically that area returned very high-grade gold values from multiple vein systems. The un-drilled SEB contains >20 mapped at/near surface veins that have been exploited for decades by artisanal miners.

A significant 600-meter long anomaly defined by 1+ g/t gold-in-soils is open to the east. Readers are reminded that soil sampling has been an excellent indicator of non-outcropping veins at Abriaqui. For instance, hole P003 intersected 24 veins in an area where only eight were mapped at surface.

CEO/Director John Carlesso commented,

"As we gather more data points, we see increasing evidence of vein structures that are 5m+ thick, within 1m+ intervals of very high-grade gold. This typifies the Buriticá-style mineralization that's well known in the area. Additional structures are being added to the model, so we expect that it will continue to grow. The recent discovery of the Baul 3 vein coming off of the NW corridor is a prime example of how Phase 2 is discovering 'new' mineralized structures early in the program."

The SEB has a similar mineralogical and geochemical signature to the main vein area, and veins have been traced vertically for 1,230 m from the highest topographic elevation at 2,770 m to the deepest drill intercept at 1,540 m elevation, with high-grade gold potential open at depth. Five holes totaling up to 2,500 m are planned for an expanded phase 2 program.

Phase 2 drilling is well underway. The first hole, P010, of the phase 2 infill/step-out program on the northwest-trending vein corridor (NWC) has been completed to a hole length of 540 m. P010 was drilled to further define the 1,400 by 350 m zone intersected in holes P001, P005 and P009. The core looks like core material from P001, which included intercepts of 4.1 m at 5.1 g/t, 2.6 m at 9.1 g/t and 1.3 m at 28.2 g/t gold.

Prior to the start of phase 2, a program of detailed mine mapping and sampling was completed in the area of the phase 1 drilling. The goals of the program were to generate structural information to aid in 3-D modeling of the mineralized veins, and expand the database of vein sampling. Veins exposed in 76 near-surface mines were mapped and 270 new channel samples of veins and wall rocks were taken.

Of the 270 samples, 10 returned values of >50 g/t, and three >100 g/t gold. The best new results are from inside old mines; including 5.1 m (true width) at 6.6 g/t gold, 0.8 m of 149 g/t and 0.7 m of 56.5 g/t gold—on the newly defined Baul 3 vein.

FenixOro Director and VP of Exploration Stuart Moller commented:

"The mine mapping and sampling exercise was done to aid in 3-D modeling of vein systems. A pleasant surprise was the discovery of the Baul 3 vein, demonstrating mineralization up to five meters wide. Additional crosscut sampling is being conducted on the vein. One of the Phase 2 drill holes is being modified to test this new structure at depth. These developments underscore that significant upside remains for new discoveries at Abriaqui, both in terms of the # of new vein structures & wider zones of mineralization."

With hole P010 done, hole P011 is being drilled at a steeper angle than earlier holes to test the economic potential of the mineralized system. P011 is projected to intersect the last vein at ~1,375 m of elevation, which would add a meaningful 165 m to the known 1,200+ m vertical extent of high-grade mineralization.

Given the recent share price action, readers are probably wondering what phase 1 results are telling us. In my opinion, it should not require immediate blockbuster grades and widths to paint a picture (there have been some strong grades, but not combined with multiple-meter widths). Sophisticated investors will be reading between the lines as exploration data continues to accumulate.

If the smart money figures out that a multi-million ounce deposit is more than likely, the share price could move quite rapidly. I'm not saying we've reached that point yet (shares are still depressed), but it could happen at any time. Management is very optimistic, however it might require more drill results to light a fire under this stock.

Great drill results are being handsomely rewarded. Look no further than the charts of New Found Gold and E79 Resources. With FenixOro's EV of just C$18 million, it's not as if the valuation is stretched, especially compared to the C$2 billion Buriticá mine next door. FenixOro is valued by the market at less than 1% of Buriticá.

If investors choose to wait for more evidence of a multi-million ounce deposit…. so be it, that's a reasonable strategy. However, by holding out for confirmation of something big, investors risk missing out on some of the (potential) upside. In my view, FenixOro Gold Corp. (CSE: FENX) / (OTCQB: FDVXF) offers a compelling high-risk/high-reward investment proposition.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures/disclaimers: The content of the above article is for information only. Readers fully understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD CORP., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand & agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed & agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was a former, but fairly recent advertiser on [ER] & Peter Epstein owned shares in the Company.

Readers understand & agree that they must conduct their own due diligence above & beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.