Maurice Jackson: Joining us for a conversation is Arturo Bonillas, the CEO of Magna Gold Corp. (MGR:TSX.V; MGLQF:OTCQB).

Sir, it's a pleasure to speak with you today to discuss the opportunity before us in Magna Gold. Before we delve into company specifics, Mr. Bonillas, please introduce us to Magna Gold and the opportunity the company presents to shareholders.

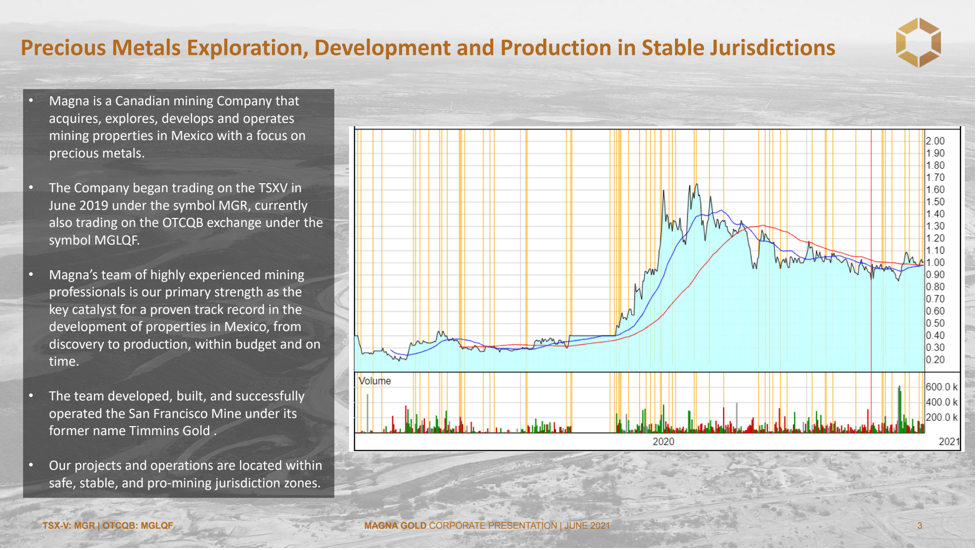

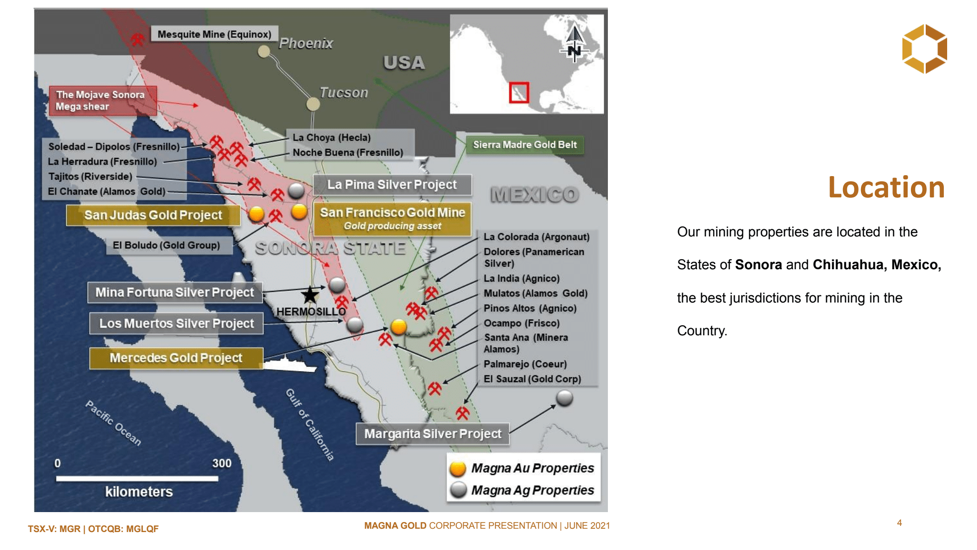

Arturo Bonillas: Magna Gold is the newest gold producer in Mexico. The company was created three years ago, and we've now become a gold producer, and explorer, and developer. We are in northern Mexico and we have a fantastic team.

Maurice Jackson: What a success. In just three years, that just demonstrates the business and geological acumen of your entire team. Let's go on site and find out more. Sir, take us to Sonora, Mexico, and get us acquainted with your property bank, beginning with the San Francisco gold mine.

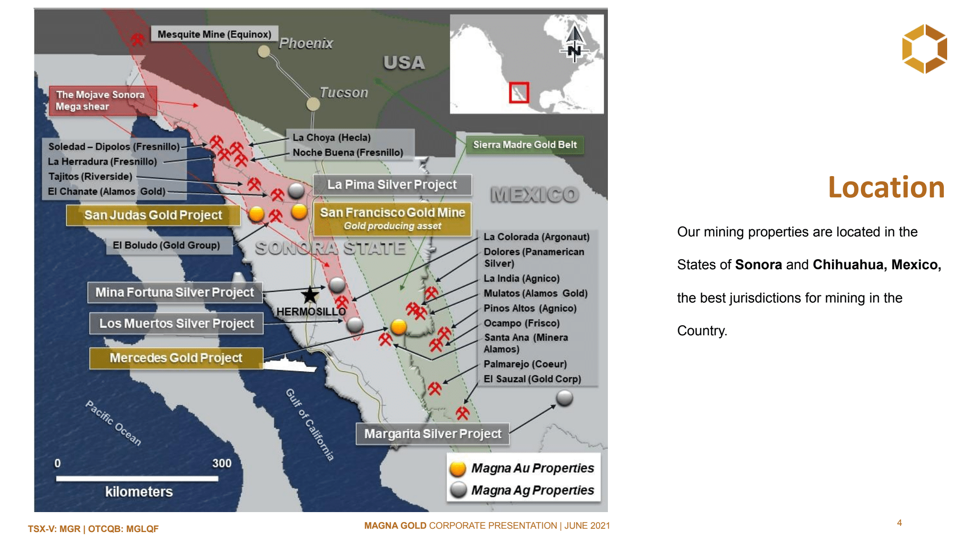

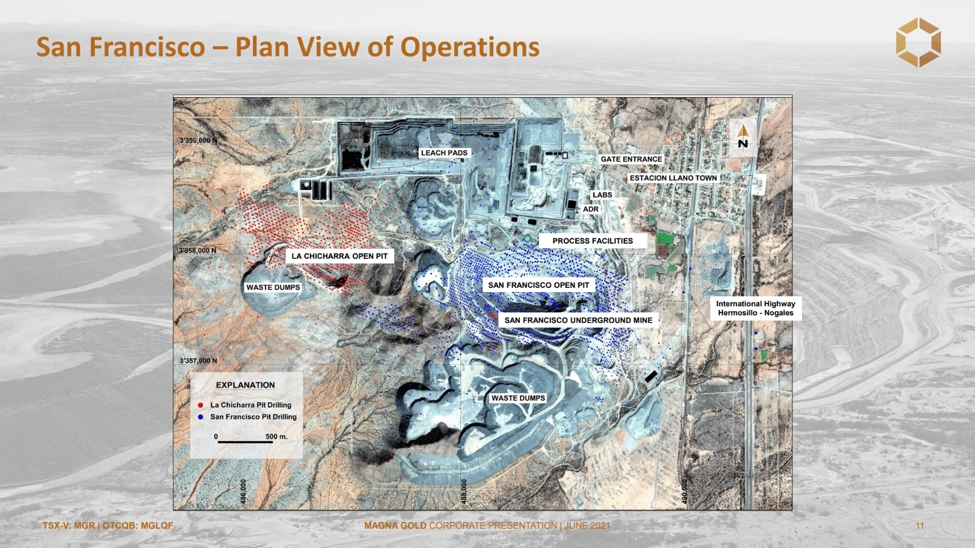

Arturo Bonillas: The San Francisco mine is a gold-producing mine that Magna Gold acquired a year ago. We've just gone through the milestone of putting the company back again into full-scale production. The mine is located in central Sonora and, along with the mine, we do have gold and silver exploration targets in the vicinity, some of them quite advanced that we are going to begin exploring in the near-term future.

Maurice Jackson: How was your team able to acquire the San Francisco gold mine?

Arturo Bonillas: Well, it was interesting. The mine is a geological deposit that was very well known by our team. When we acquired it, the company that had it was divesting its properties and our team was confident that we were the right ones to move it forward.

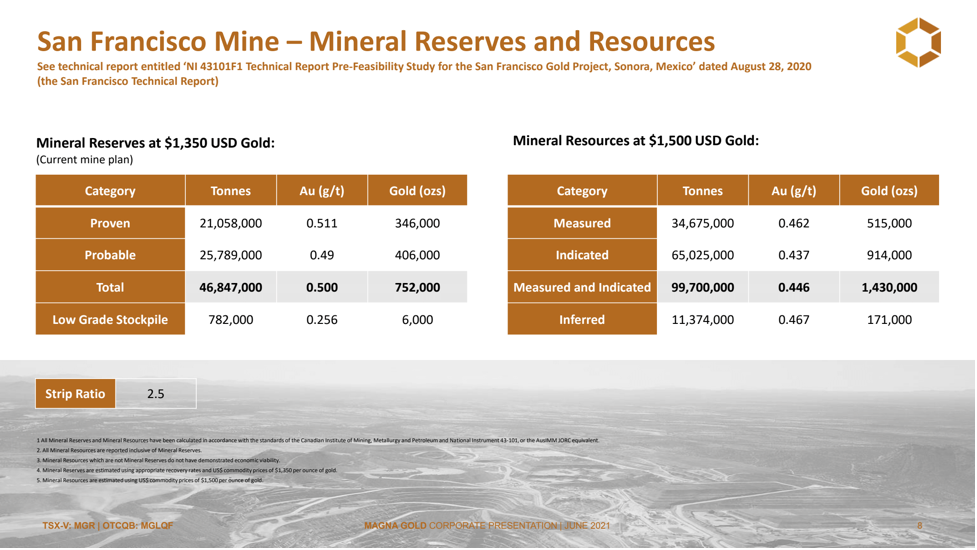

Maurice Jackson: Let's find out more about the grade and tonnage. Please walk us through the mineral reserves and resources on the San Francisco gold mine.

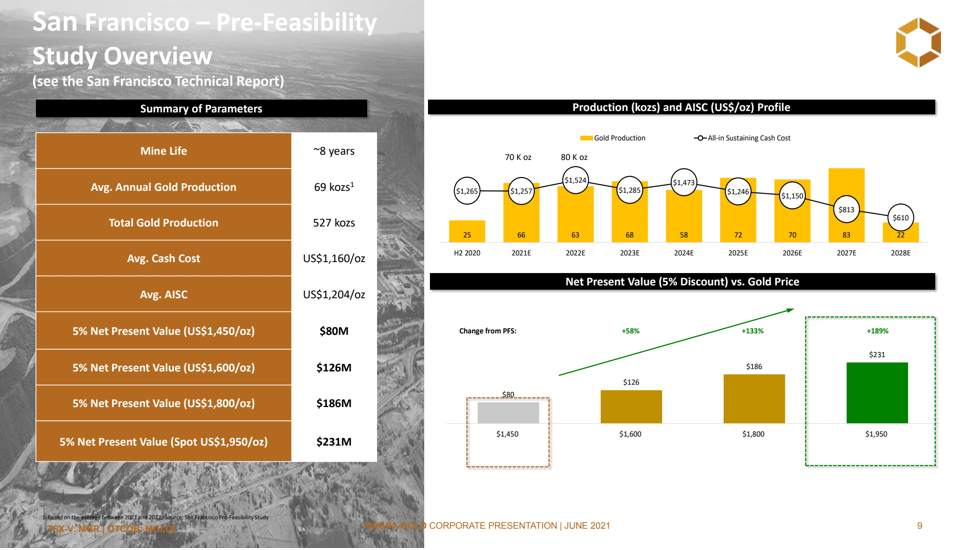

Arturo Bonillas: Of course. We bought according to a NI-43-101 report that we commissioned last year. We acquired 1.43 million ounces of gold in the resource category Measured and Indicated. Those resources were calculated at $1,500/ounce gold. Out of that, we produced a mine plan that extracts 750,000 ounces of gold, with a strip ratio of 2.5. It's important to note we used a conservative $1,350 gold for its guideline.

Maurice Jackson: Now, discussing those economics, how do those numbers change with today's gold price?

Arturo Bonillas: Well, they should look different. Of course, we can run them at $1,800 gold, but for the moment, we are maintaining the projections at the same prices, being conservative. Another reason is that we are adding ounces as we go with additional drilling, so the numbers should look much better when we finalize both our drilling and see how the price situation looks for the next three years. If there's a higher price, we'll have a higher net present value (NPV).

Maurice Jackson: The San Francisco mine is now in full-scale production. Tell us more about the economics, sir.

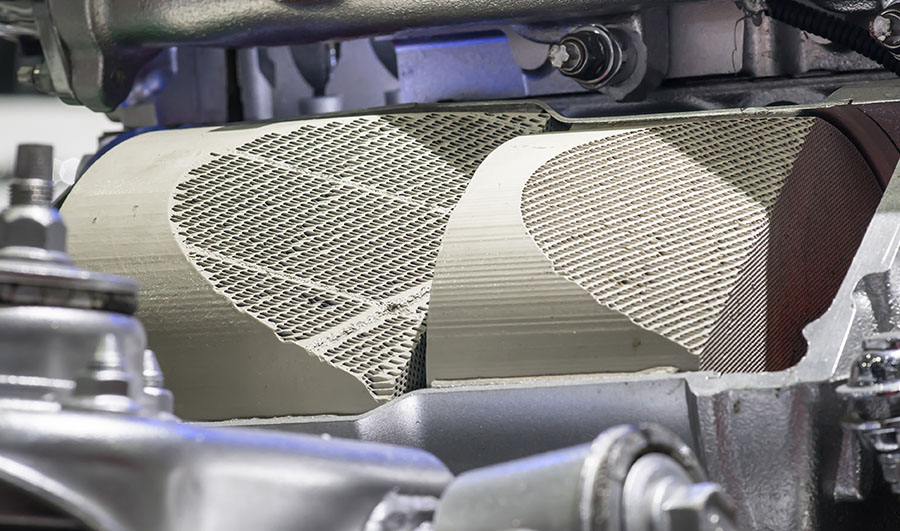

Arturo Bonillas: We took over the mine in May of last year. As of June 1, this month, we're back at full-scale production. The mine is now generating sufficient ore for a processing facility that is processing between 18,000 and 20,000 tons of ore per day, which is the rated capacity. We built a new leach pad and so we're back to normal. The company is now generating cash, which is quite fantastic.

Maurice Jackson: Please walk us through the economics of the preliminary feasibility study (PFS) and how the ramp-up will impact the all-in sustaining costs over the life of the mine.

Arturo Bonillas: I'll give you a couple of numbers here. During the ramp-up period, we had a strip-ratio of 8:1. The life-of-mine strip ratio is 2.5:1. Just imagine what we had to remove the first year to get us where we are at now? Economics change dramatically and generally, the first year is generally known as getting to full-scale commercial production.

Generally, all of that is capitalized. The mine looks very, very good, in terms of a rate of return and the money we put in, because we were certain we made sure that we didn't over-dilute to the company by getting there. We were in front of a mine that has an NPV, current prices of US$200 million, and it's increasing.

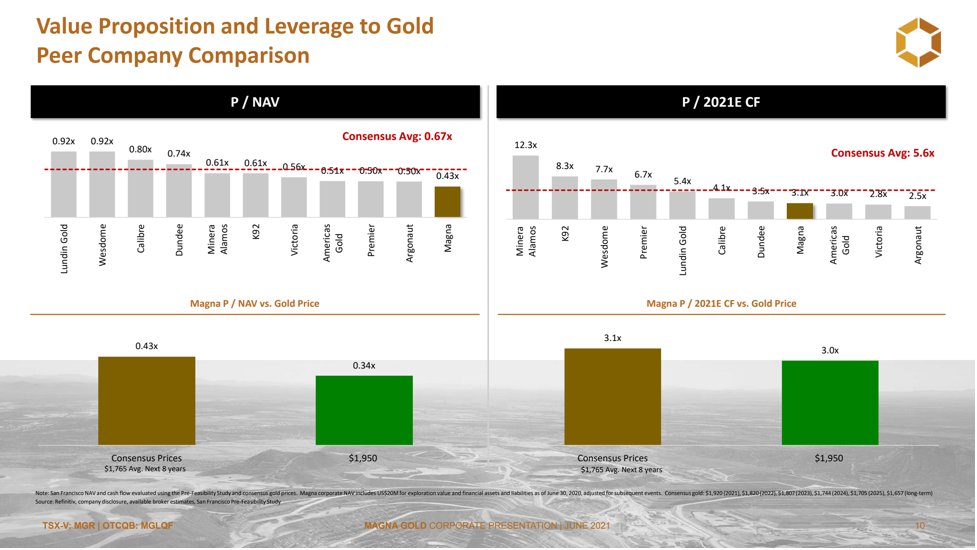

Maurice Jackson: Let's do some comparisons among your peers. What is the value proposition in leverage to gold that shareholders have in Magna Gold?

Arturo Bonillas: Well, I'll give you some comparisons. As I said, currently, the NPV of the mine production plan is, say, US$200 million at current prices. We are trading our market cap today is about CA$90 million, which is way underweight just on NPV values. When we get to and show that we've completed the full quarter of full production, we are expecting an important rerating on our stock price and the same with gold. We use generally, for long-term projections, $1,760/ounce gold. With the leverage to gold, it's very important here. Look, our price, or net asset value (NAV) is at $0.34. We believe we are undervalued.

Maurice Jackson: Speaking of that undervaluation, I have a Rolodex of names and they are all under the same opinion that Magna Gold's share price and market cap, I should say, is completely undervalued. That's exactly why we're honored to have you here on the program today. Does the San Francisco gold mine have room for expansion?

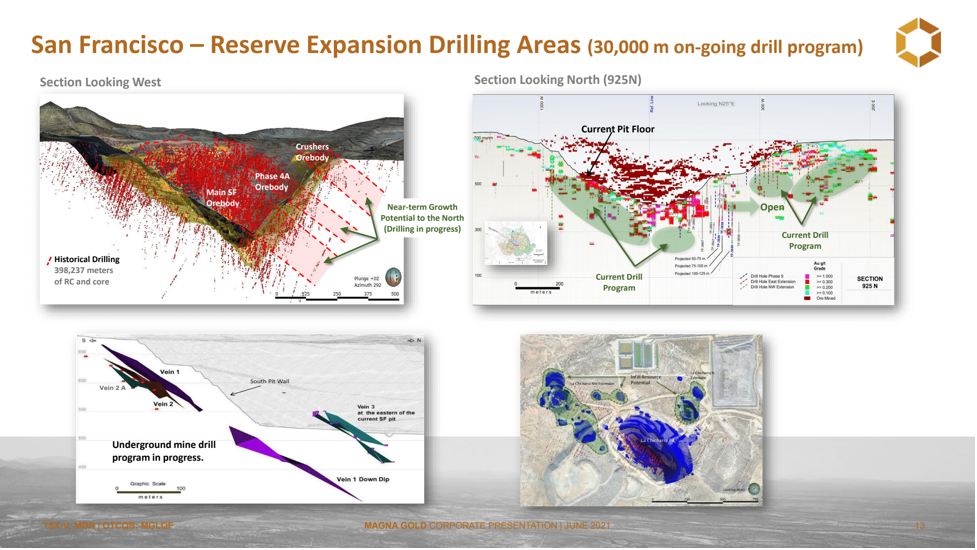

Arturo Bonillas: Oh, completely, plenty. That's one of the reasons we wanted to acquire the mine. It was not because of what it had already, which we certified, but the potential to grow. We were there many years ago as Timmins Gold Corp. and we were able to drill some of these areas, the new areas. I can't talk about fundamental growth in resources in the next few years, a couple of years. We have not even touched the surface on this property.

Maurice Jackson: Sounds exciting. Magna Gold was busy in 2020 with the acquisition of additional projects that balance out the property bank with some compelling gold and silver projects that will serve as a catalyst for shareholders moving forward. Can you introduce us to the remaining property bank and the highlights of each respectively, beginning with the Mercedes?

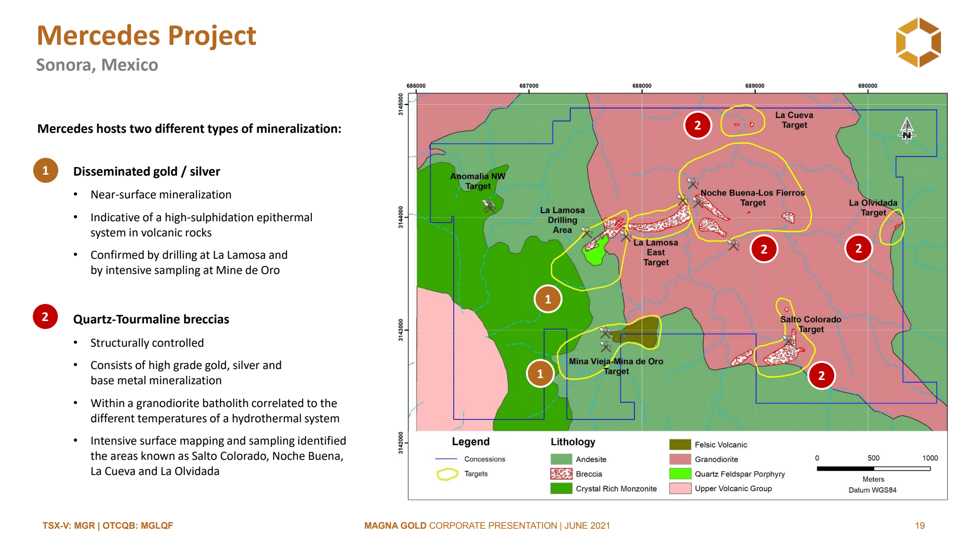

Arturo Bonillas: The Mercedes was our first acquisition. That's how we began as a company. We drilled it off, put a few holes at the beginning, because it was according to our budget and most important, all of our holes hit it. We're now talking about putting together a starter leach pad there, or a starter pit, which we are assessing. Also, Mercedes is a system within the Sierra Madre, where we found multiple underground mine works, centuries-ago old.

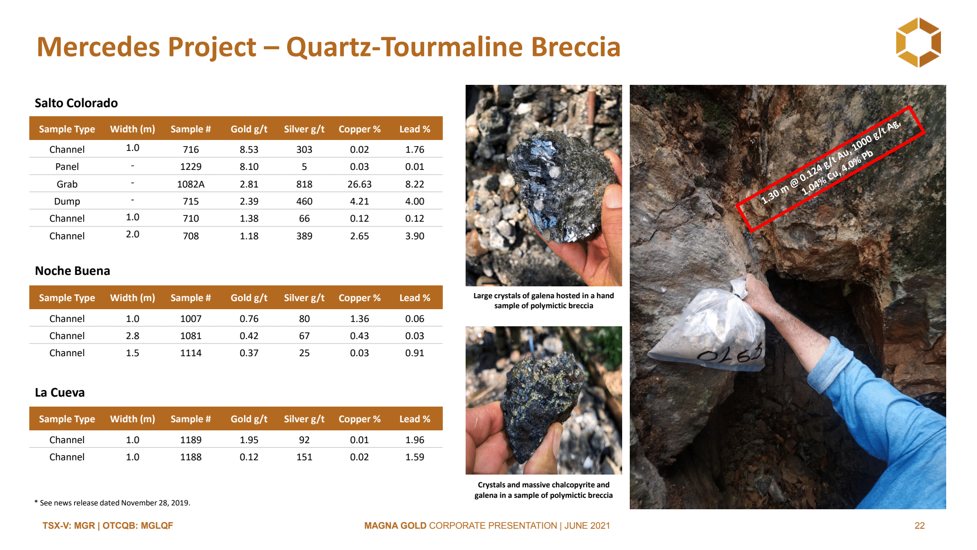

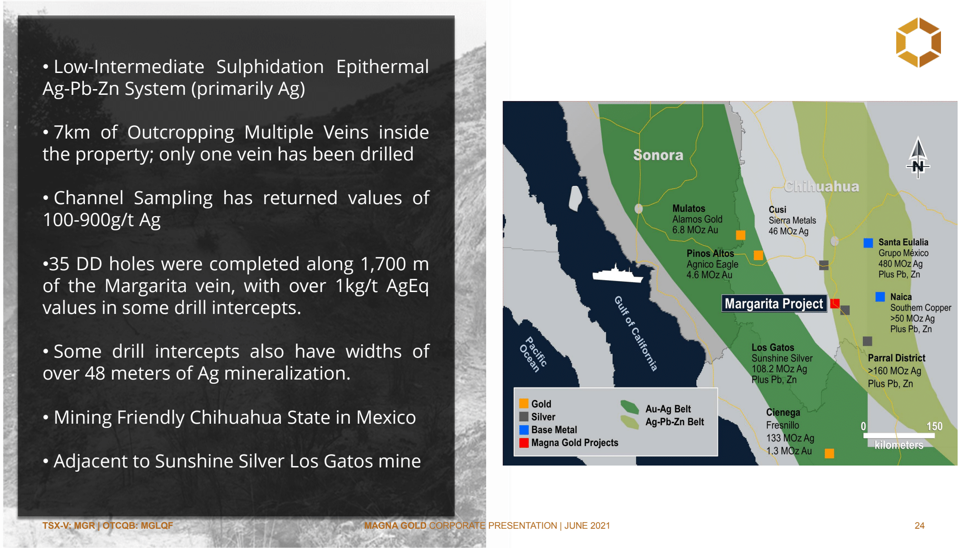

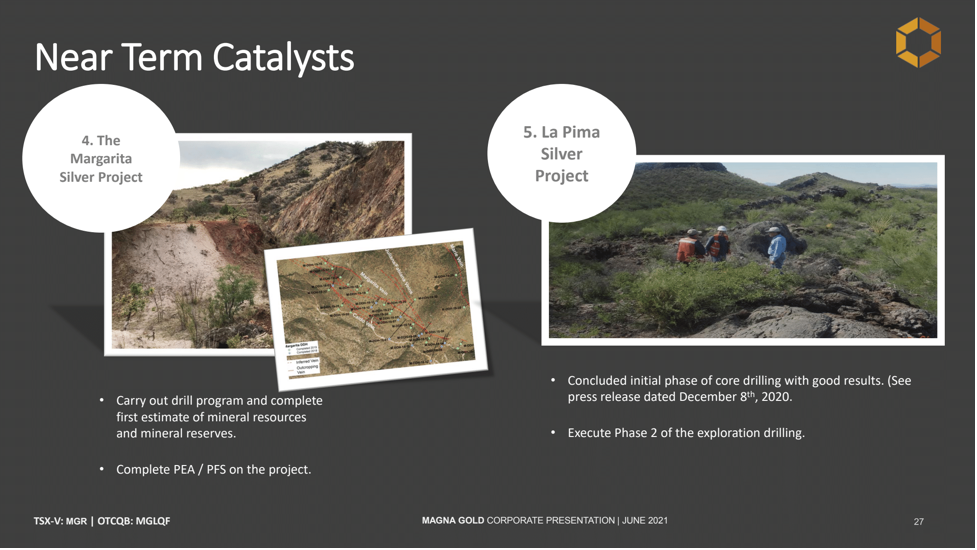

We obtained extremely high grades of copper, very, very high grades of silver on those other areas, and gold. So, we barely, again, touched the surface on the Mercedes property. That's what made Magna and that is, as I said, that was our initial transaction. Then we bought the San Francisco mine, which has within the package of properties that we acquired, more than 40,000 hectares altogether in the state. We have six targets within it. Outside of the area in Chihuahua, we acquired the Margarita Silver Project and we're very excited about it.

That's a high-grade silver mine. We have many areas to grow and we are very disciplined in our approach. We have prioritize our targets, and we will start grilling first the properties that will bring more value to the company in the shortest period. That is Margarita, to begin with, where we expect to complete a preliminary economic assessment (PEA) in Q1 of next year. That, I think, would be an underground, very high-grade, silver mine located in a very interesting area in Chihuahua.

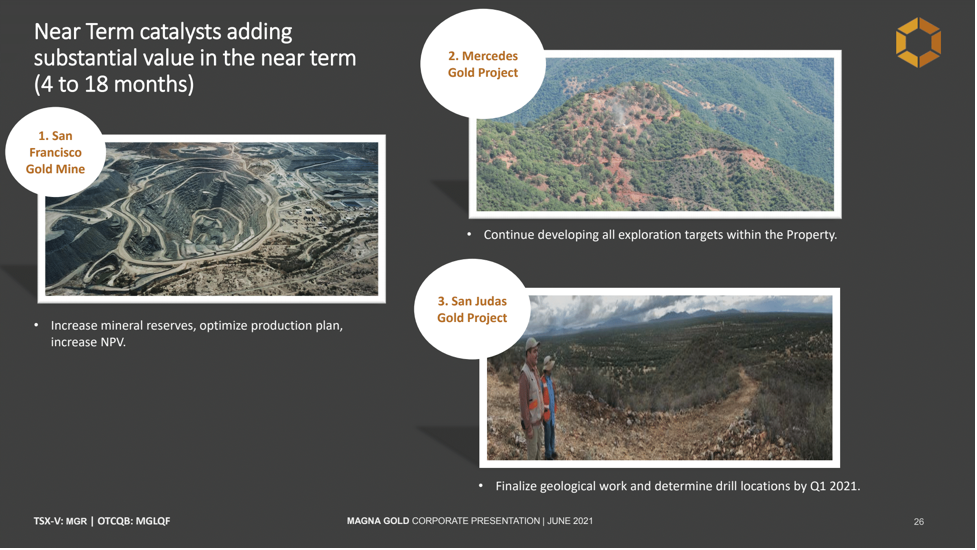

Then we have our other priorities that are outside of the San Francisco pit. The other priority is a potential satellite pit, 4 kilometers north of the San Francisco pit. We have all of these catalysts to start bringing forward. The San Francisco mine itself, as I said, has tremendous potential. We have drill plans, and so our approach is systematic. We are following the maximization of the NPV for the company, which that guides us. We keep looking at things. We've been looking at potential mergers and acquisitions (M&A) because we have the team, we have the team to do something. I believe that M&A is important, very important for Magna Gold.

Maurice Jackson: You've already demonstrated a great use of optionality here with the San Francisco mine, and it looks like the success is going to continue. Before we leave the property bank, multilayered question: What is the next unanswered question for Magna Gold? When can we expect a response, and what will determine success?

Arturo Bonillas: First, [we intend to] increase in resources and reserves at the San Francisco pit and surrounding areas. We have another pit, La Chicharra, and we plan to have a response by the end of the year, when we add more ounces. We will have a response sooner than that because we have already increased mineral reserves in 2021 and 2022. They are not published yet.

The other is the Margarita Silver Project. We expect to give you a response, a good response in the form of a PEA, a preliminary economic analysis, early next year, for which we believe we will have a very nice surprise. Then we have the other pipeline of projects within our land package. The next one is a potential satellite pit, an open-pit deposit, not far from the mine. Then we have a gold property called San Judas. It's an amazing property, and that we should be expecting to give you results by Q1/Q2 next year.

And our silver portfolio: We have a silver mine. We have a silver property called La Pima, which we drilled last year. We're trying to figure out how to put together all of these are very interesting land packaging targets that we have. We hope to give you a response as soon as possible.

Maurice Jackson: Sounds like a busy 2021. And again, it just underscores the value proposition before us here in Magna Gold. Let's discuss some important topics germane to the projects. Are your projects 100% owned?

Arturo Bonillas: Yes. The principal projects are ours. The San Francisco mine, and all the surrounding targets, are ours. The Margarita silver mine is completely ours. The other properties that we have options are on very, very, very good terms for the company. We will eventually exercise the option if the properties go well, but those are more early-stage exploration. And as I said, we have four to five-year option agreements to give us time to explore.

Maurice Jackson: We're going to get into some numbers later in this discussion, but from a capital expenditure standpoint, how is infrastructure on your projects?

Arturo Bonillas: It's amazing. Well, you see the San Francisco mine is just next to a four-lane highway, as well as the 40,000 hectares there. We're connected to the United States in an hour-and-a-half drive. To the north, is a two-hour drive from where I am now giving this interview, which is home for me. The Mercedes property [is] about 500 meters from the highway, also next to a power line, in a good area in the Sierra Madre mineralized gold belt.

We have good neighbors there. We have Minera Alamos Inc. (MAI:TSX.V; MAIFF:OTCQB), Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Alamos Gold Inc. (AGI:TSX; AGI:NYSE) and others. The Margarita Silver Project is also next to a mine called Los Gatos Mining Inc. It used to be called Sunshine Silver Mines. You can see the power lines going from the property. We feel very fortunate to be so close to infrastructure on all our properties.

Maurice Jackson: Speaking of neighbors, what is your relationship with the indigenous people?

Arturo Bonillas: Oh, great. We don't call them indigenous here. We call them our neighbors, the local townships. And we have an amazing relationship with the people from the San Francisco mine. They were next to a town and we've been neighbors for many years. We were very active on ESG (environmental, social and corporate governance) with the community, and that I think they like us. The other properties, they don't have important cities or towns nearby so we make sure that we deal with the surface property owners in a good manner, which we haven't had any problems until yet.

And we bring a mine like Margarita, we'll bring a lot of employment in the area. I feel very, very comfortable with our relationships with the local communities.

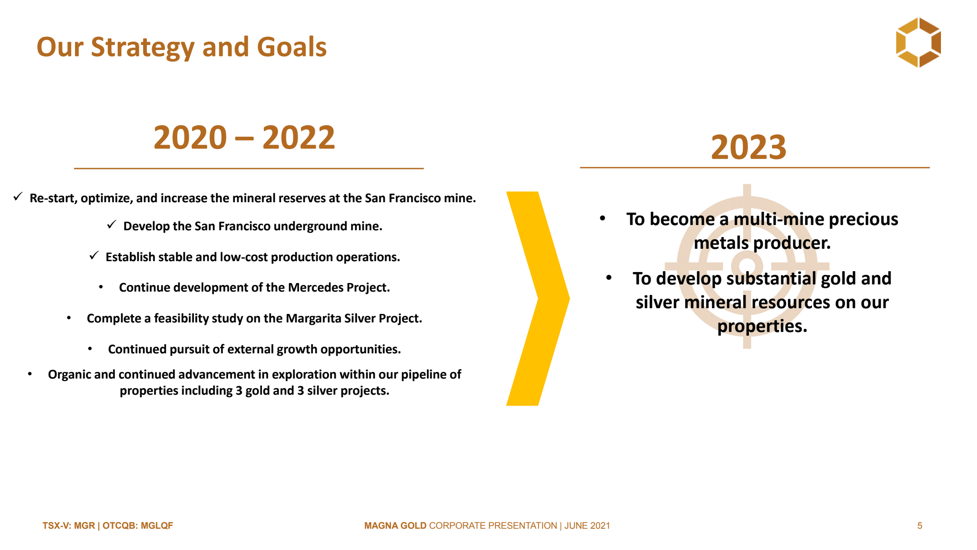

Maurice Jackson: Magna Gold is accelerating at an exceptional pace from exploration to production. What are the company's goals and strategy that the company will use to accomplish its stated goals for 2023?

Arturo Bonillas: Well, when we began, we founded the company, we said that we were going to be an intermediate precious metals producer. I stated that by 2023, we should be producing 200,000 ounces of gold equivalent ounces per year. By that same year, we should have 5 million ounces of gold resources, or gold equivalent resources, in the ground. We are one-third of the way there, and when we finish this year, we should be more than 50% of the way to those targets.

And we are an agile company. We do things disciplined, fast, and we have the contacts, the ability to do it. We're on our way there, we're on our way.

Maurice Jackson: We've discussed the good; let's address the bad. What can go wrong and what are your action plans to mitigate that wrong?

Arturo Bonillas: Well, that's a question that I always get asked and I always respond to with some specific problem. But really, the San Francisco mine, the way we turned that around—there's a feeling that the team is sort of invincible. So nothing. No, I sleep well at night. I know that, and everybody knows that, mining is not an easy industry, but I feel good because we have a very resourceful team. That is a guarantee that anything that happens we'll solve it. Look, the price of gold, if our cash costs at the San Francisco mine, we have $1,050 per ounce projected over the next seven years.

But we are working on making Magna a sub-$800 gold producer with all its properties, with the silver properties added, and the expansion of the San Francisco, and the other areas. We can do that because of economies of scale. I didn't mention that we opened up an underground mine in the San Francisco pit on one of the walls, and that's giving us gold. All of those activities will help us to be a sub-$800 per ounce gold. That would be the only thing if the gold price reduced significantly, but I don't think we'll see that in the interim.

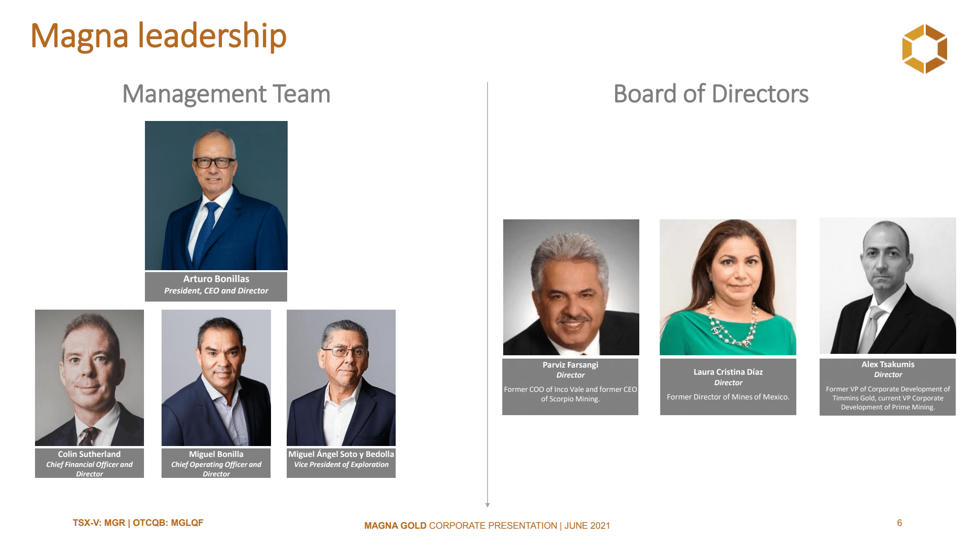

Maurice Jackson: Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Bonillas, please introduce us to your board of directors and management teams, and what skill sets do they bring to Magna Gold?

Arturo Bonillas: Of course. We have six board members on our board of directors. I'll start with Parviz Farsangi. Parviz is an amazing engineer with a PhD in mining engineering. Parviz was the COO of Inco Valley in charge of all its operations. He also has experience in Mexico. He was CEO of Scorpio Mining, and is very seasoned; he's a real help.

We have Laura Diaz. Laura is the former director of mines from Mexico. I've known her for years, and Laura is very well connected, besides knowing the mining law and its regulations, so it's a fantastic help.

Alex Tsakmis: Alex was our VP corporate development years ago at Timmins Gold. He's right now very seasoned in that area of corporate development, investor relations. Alex is a great counsel for me. He's been great.

And then we have Colin Sutherland. He was the president of McEwen Mining Inc. (MUX:TSX; MUX:NYSE). Before that, I met him years ago and then he joined Timmins Gold as our CFO, very seasoned, and he's our CFO and director. We need to find another independent director.

Then the board is also Miguel Bonilla. I met Miguel about 14 years ago. He came to work with the group and the team, and he's evolved to a point where he's fundamental to the company. He deals with everything else besides production but everything else—permitting taxes, treasury union.

Miguel Angel Soto, our VP exploration: Miguel and I've been working together for probably more than 30 years in different companies, and Miguel is also very seasoned. He's well known in the country, and he's an important asset to Magna Gold and is part of the team for years.

Maurice Jackson: I see there's a prominent name that you omitted there. Who is Arturo Bonillas and what makes him qualified for the task at hand?

Arturo Bonillas: Well, thank you. I was born in a mining town called Cananea. At the time, that mine was the largest mine in Mexico. It's a copper mine that was sold by Anaconda Mining Inc. (ANX:TSX), which is no longer there. I went to school at the University of Arizona; I'm an industrial engineer. As soon as I got out of school, I began working at that mine, as I was in charge of the software development for cash-flow development, and a programmer, Fortran programmer. Then I got involved at the time, the software was being developed for optimization of bit designs.

I started getting involved in all the areas of mining. I ended up being the head of purchasing for the company. Then I moved on as vice president of exploration in new projects of a company that was a joint venture between Frisco and Placer Dome. We developed the Mulatos Project from basically zero to a million ounces. Mulatos is now what's called Alamos Gold Inc. (AGI:TSX; AGI:NYSE). We developed the San Felipe mine in northern Baja. I also became a producer. And then in 1993, I went out on my own and have been a promoter, operator and explorer since then. The latest was Timmins Gold and Silvermex Resources Inc. before Magna Gold. I am a Mexican citizen and I love what I do.

Maurice Jackson: Well said. How about boots on the ground? Who do you have on your technical team, sir?

Arturo Bonillas: Well, there's me. I live here but our technical team, we have our mine operators. We have Raul Elizalde; he's a young man that also we hired when we built the mine for the first time. He's now the director of production of the San Francisco mine. He's the one responsible to turn things around in the field. And we have Miguel Soto on exploration. Those are fundamentally our guys on the ground.

As I said, I live here, and we've just begun to put together a very nice team in Canada. We were slow in putting together the team because we were a capital pool corporation initially. Now we have a full board with all of its committees. We don't have an office yet. Everybody works from home, but besides our CFO, we have a VP of Finance in Canada, Gregory Barbier. And we also have now—he just joined us—our VP corporate development. His name is Amandip Singh and he just joined us. He was actually at the mine last week. And I don't want to forget Leslie Kapisianyk, our in-house lawyer for corporate matters. I hope I didn't forget anyone, but they're the main team.

Maurice Jackson: Well, I have to applaud you, just in three years, on all your commercial success and how you've rewarded your shareholders. It's not common to see the success that you've had in such a short tenure. I know you're being very modest, but I have to pat you on the back, sir. It's a big, big feather in your cap and you're doing a phenomenal job as a CEO.

Let's get into some numbers. Magna Gold released its Q1 results. Can you walk us through some of those numbers?

Arturo Bonillas: The Q1 results were when we were in ramp-up, so they're not quite representative. I have them here but I'll give you some trends. Q1, we were producing about 90 ounces per day, and gradually increasing them from 90 to 100. As of June, we are going to average 180 ounces per day. July will be over 200 ounces per day. The numbers that you see in Q1 show a loss. They show a cash cost of $1,800, but if you deduct the strip ratio, which was eight to one, and you redo the numbers and bring them down to 2.5, which is a mine life, that cost is exactly $1,050 per ounce.

So, our focus now is to increase our free cash. We have payables that we have to cover—important payables, big payables that were negotiated with the main contractors, who have been great to us. The rest of the year will be to reduce payables, and generate more cash, and get to the parameters that we have on our mine plan, which is the one that is published—70,000 ounces per year on average, which I know will be more. And the $1,100 per ounce of cash costs and $1,250 all in—that's what I can say about the Q1 results. We are good.

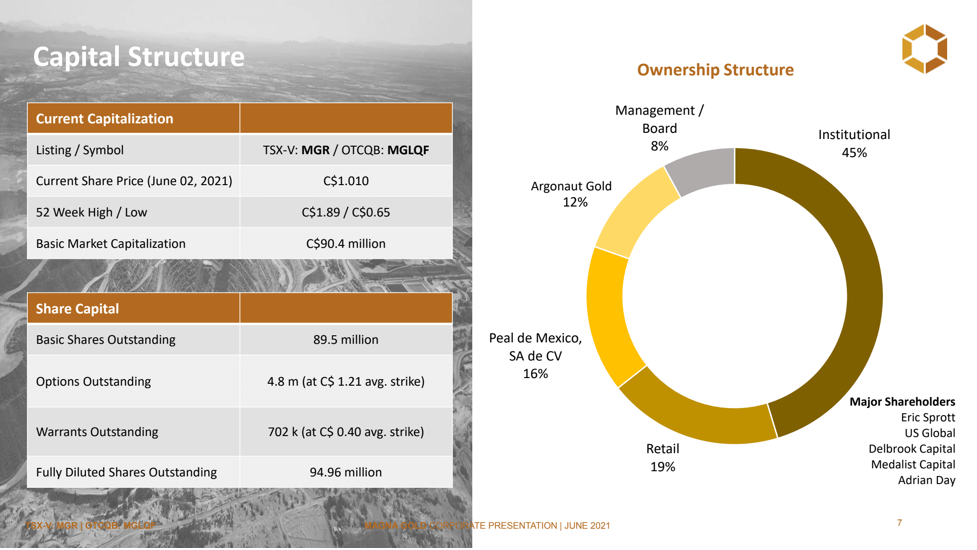

Maurice Jackson: Sir, please provide us the capital structure for Magna Gold.

Arturo Bonillas: We have 89 million shares outstanding, and 95 million shares fully diluted. I'll begin with our institutional shareholders, which have been with us since day one, which own about 42% of our shares. [These] include prominent names such as Mr. Eric Sprott, Delbrook Capital, U.S. Global, Medalist Capital, and Mr. Adrian Day. And I'd like to give a special mention to Medalist Capital, who are the ones who put Magna Gold together for our team.

We have two more important shareholders, I call them strategic shareholders. One of them is Argonaut Gold Inc. (AR:TSX), and they hold a 12% position. They inherited approximately 10 million shares as compensation for the mine acquisition. We paid them to Alio Gold, then Argonaut Gold acquired Alio. They're good shareholders; they're always calling, they're always checking on how can they help.

They're very supportive. Then we have another group called Peal de Mexico, which is the mining contractor, and they have been instrumental to us. They were fundamental in our acquisition of the mine and they are long-term players. When you have a mining contractor as part of your main shareholders, you get many things guaranteed, such as no strikes and/or they will do their best to negotiate. At times, we have to renegotiate the price with them to adapt to different circumstances, so they're fantastic.

Then, the management is about 8%, mostly options that we've given out. And my position, I did write an important check when we created the company. And our float is around 19%.

Maurice Jackson: How much cash and cash equivalents do you have?

Arturo Bonillas: By the end of this month, we should have between US$12–$13 million in the bank. It'll remain there for the next two, three months, because we'll be reducing the payables.

Maurice Jackson: How much debt do you have?

Arturo Bonillas: We don't have any debt. We just announced the convertible debenture for US$8 million. That will be our debt, which is the venture two years, with a strike price of $125 with Delbrook, which is very good to the company. And then we have forward sales with Argonaut, but we finished paying them in December, so I don't consider that a debt per se because we paid them with gold, and that's about it.

We have an NSR (net smelter return). The accounts payable are the ones who are the largest. We'll be taking care of them over the next four months.

Maurice Jackson: Sir, what is your burn rate?

Arturo Bonillas: We have a budget of $8 million dollars that we were just raising. Then we're going to spend over probably the next two years, as I said. We will prioritize and we will keep increasing. And our G and A in Mexico, which is basically where most of the people are, it's about $200,000 a month in Canada and another $150,000. I think we're in a very good burn rate position. It may increase, I think it will increase as we grow the company.

Maurice Jackson: Are there any redundant assets on the books that we should know about?

Arturo Bonillas: No.

Maurice Jackson: All right, sir. Last question for you here. Is management charging any consultant fees for any services?

Arturo Bonillas: No. We are all salaried. Everyone in management is an employee.

Maurice Jackson: In closing, sir, what keeps you up at night that we don't know about?

Arturo Bonillas: The price of gold, at one time, but not now. As I said, things kept me up at night last year because we were turning around this mine that was in big trouble. So I feel more and more confident now. We are there, we reached the Promised Land, as I said, where the gold is—a sustainable supply of ore for production. We have good properties to explore and that we want to diversify. Our goals are clear and we have the right team.

Maurice Jackson: Last question, what did I forget to ask?

Arturo Bonillas: Although we touched on it in the beginning, I want to remind the reader: Who is Magna Gold and what defines us? We are experienced operators, developers and mine builders in Mexico. I believe that we have a culture that is agile, resourceful, and are very passionate about what we do, and we are always looking to increase shareholder value.

Maurice Jackson: Mr. Bonillas, for someone listening that wants to get more information on Magna Gold, please share the website address.

Arturo Bonillas: www.magnagoldcorp.com.

Maurice Jackson: Mr. Bonillas, it's been a pleasure speaking with you today. Wishing you and Magna Gold the absolute best, sir.

Arturo Bonillas: You're very kind. Thank you very, very much.

Maurice Jackson: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: [email protected]. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales; subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Magna Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Magna Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Magna Gold. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Magna Gold, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.