Maurice Jackson: Joining us for our conversation is Dr. Roger Moss, the CEO of Labrador Gold Corp. (LAB:TSX; NKOSF:OTCQX).

It's a pleasure to speak with you as Labrador Gold has released yet another successful press release from the flagship Kingsway Gold Project. Before we begin, Dr. Moss, please introduce us to Labrador Gold and the opportunity the company presents to shareholders.

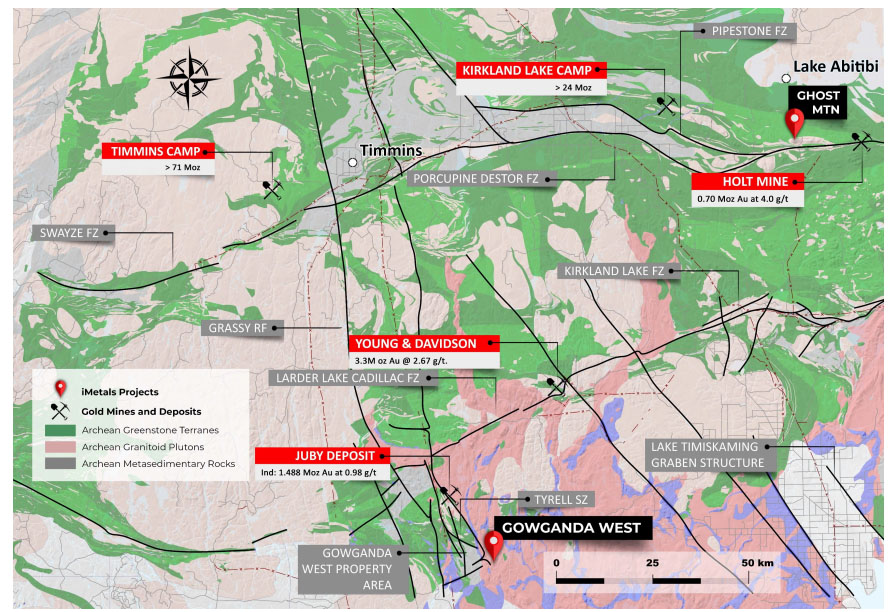

Roger Moss: As you mentioned, we've got our flagship Kingsway Project right now and it's great. It's right in the middle of Newfoundland where a lot of activity is going on. We also still have our other three projects, two in Labrador, one in Ontario, that we're still planning work on, but certainly the focus is here in Kingsway, which has attracted a lot of attention recently. So, yeah, results are good and we're working hard at it.

Maurice Jackson: Let's talk about that focus. When we last spoke in 2019, Labrador Gold was focused primarily in the Province of Labrador and you reference Ontario. But the property bank has expanded into Newfoundland and established a new flagship project, which has some of the most prominent names in mining financing your exploration expenditures. Dr. Moss, take us on-site to acquaint us with the Kingsway Gold Project.

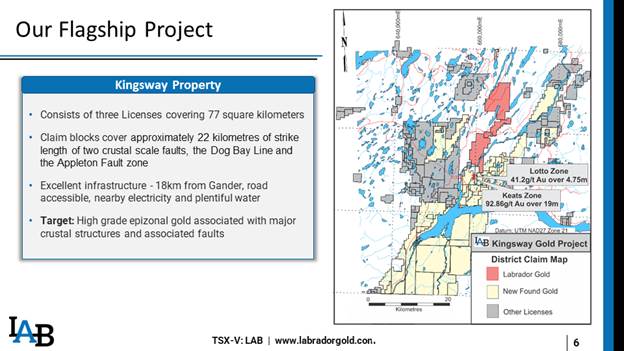

Roger Moss: This is a great time to be interviewed because I am on-site on the Kingsway. The project is about 15 kilometers west of Gander, which is a reasonable-size town here in Newfoundland. We have about 77 square kilometers and the license covers some really good geology and some exciting structures, which are, of course, often responsible for gold mineralization. I couldn't be happier with the location of the Kingsway Gold Project. I think it's in exactly the right spot.

Maurice Jackson: Speaking of location, how did Labrador Gold get involved in gold exploration in Newfoundland?

Roger Moss: Well, as you'll remember from our last conversation, we were working up in Labrador and we'd optioned some projects in Labrador with our technical advisor Shawn Ryan. And when New Found Gold announced their incredible intersection in January of last year, 2020, it took, I think, a lot of people by surprise including me, and after doing a bit of due diligence on it and figuring out, "Yeah, okay, this is the real deal," I called Shawn because I remember Shawn had mentioned he had claims in Newfoundland and I asked him, "Where are those claims?"

And he said, "Well, Roger, you're not going to believe it, but they're right next door to that new discovery (New Found Gold)." And I was like, "Wow, okay, that's great. What are you doing with them?" And he said, "Well, you're the fourth company that's called about them today, so we have to put together a package, send it to you guys, and you guys can make us an offer." So, that's the way it went. I'm happy to say that our proposal was accepted and we acquired the property in March of last year.

Maurice Jackson: In April, Labrador Gold commenced a 10,000-meter drill program and shortly thereafter—this is quite impressive—you completed two successful financings within 30 days, backed by Eric Sprott and New Found Gold for almost $25 million. And right after that the closing, Labrador Gold doubled its drill program to 20,000 meters, and today Labrador Gold has announced that there will now be a total of four drill rigs and expanded the drill campaign to 50,000 meters (press release), which leads me to ask, what has Eric Sprott and New Found Gold convinced that Labrador Gold and the Kingsway Gold Project as becoming the next major gold discovery?

Roger Moss: It's interesting because neither of the financings were solicited by us. We are were approached by Eric Sprott and New Found Gold. New Found Gold has a lot of knowledge about the entire district, and Denis Laviolette, who's the president of New Found Gold, is also the president of Goldspot, which is an AI company. I think that they probably have a very good idea of what we have at Kingsway. Maybe not quite as good as we do, but probably pretty close. I know that Eric and Denis are close and that Eric is a big shareholder of New Found Gold as well, and I think they saw an opportunity and decided that they wanted to get involved. Eric has been very active in financing all companies or most companies in Newfoundland and we were probably one of the biggest deals, I think, outside of New Found Gold itself. I think they just think that the potential here is really good. As I said, we're right along strike from New Found Gold, we're on the same fault system and I'm very happy with where we're at.

Maurice Jackson: Speaking of the center of attention here on the Kingsway Gold Project, we have the Big Vein. What exploration did you carry out leading up to the discovery of visible gold at the Big Vein?

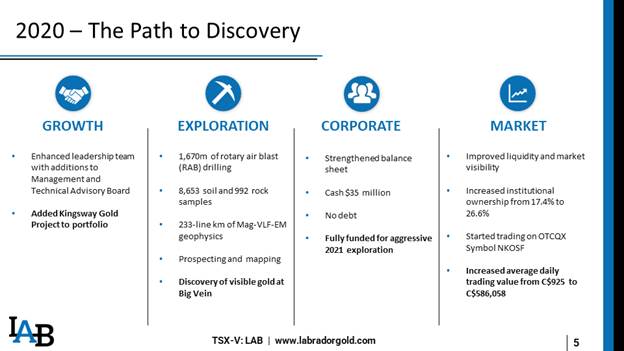

Roger Moss: Well, we got on the ground late last year because of the COVID pandemic and everybody was trying to figure out the different responses to that and the protocols around it. We didn't start work until I think it was late July, early August of last year. And we did an incredible amount of work in probably four months. And we did a lot of soil sampling, almost 9,000 soil samples, almost 1,000 rock samples. We did some RAB drilling. That's a rotary air blast, so we could very rapidly test any anomalies.

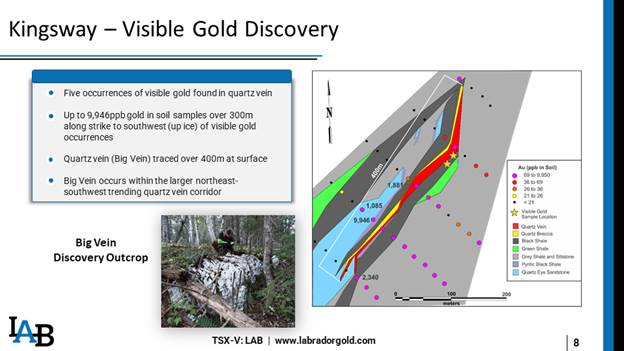

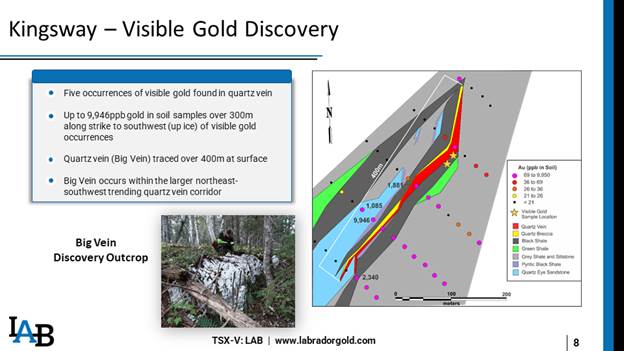

We did about 1,600 meters of that and we did ground geophysics. Probably, I think it was about 250 line kilometers of ground geophysics, so an awful lot of work was done with the crews out there last year. And that sort of made way or sort of precipitated the discovery of Big Vein and the visible gold that we found at the foot of Big Vein in a quartz vein border. A lot of work went into it, and, happily, we were able to find something significant before the snow covered the ground and we had to stop work for the winter.

Maurice Jackson: We've referenced the drill program. How far along are you and what is the strategy for the drilling?

Roger Moss: We are about 4,000 meters into the 50,000 planned. The strategy is exactly the same as New Found Gold has been carrying out at Queensland and specifically at the Keats Zone, very tight spacing, withdrawing multiple holes from the same setup. We're trying to figure out where the high-grade ore shoot is plunging. That's the key to what we're seeing here at Kingsway and what New Found Gold have been showing down at Queensway.

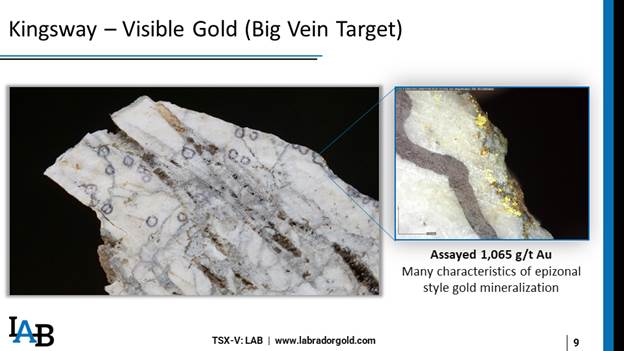

We know there are high-grade shoots within larger broad areas of lower grade gold and those are the shoots that we want to try and hit. And we have been successful in four holes. So far, we've found visible gold in the four holes—two holes we reported and two holes are still in the lab. I'm looking forward to getting the results of those.

Maurice Jackson: Speaking of success, let's talk about the proof of concept a little bit further. You just released a press release regarding gold intercepted at 20.6 grams per tonne (g/t) over 3.6 meters, and then 10.48 g/t over 2.4 meters, at the Big Vein. Tell us more, sir.

Roger Moss: Those were two of the holes that we had visible gold in. Both holes were really good. The Quartz Vein is looking good. Seeing visible gold in the drill core was a bonus. It's hard to target your holes when you don't have visible gold that you see, or when you have to wait a long time for assays to come back from the lab. We're kind of going around it a little bit by using a portable XRF in the core shack. And what that does is it allows us to get a qualitative reading of arsenic and antimony.

And generally, when we see higher arsenic and antimony in the core, it's well correlated with high gold grade. We are using that, but yeah, those are two intersections we were really happy to see the visible gold, to get the results back. Someone mentioned to me just after we put that out that that must've relieved a lot of pressure, and sure it did and it was good to see. We got that visible gold in the seventh drill hole. We went too far on when we found it. Now it's a matter of finding it on a more regular basis.

Maurice Jackson: Do you see more potential elsewhere on the property outside of the Big Vein area?

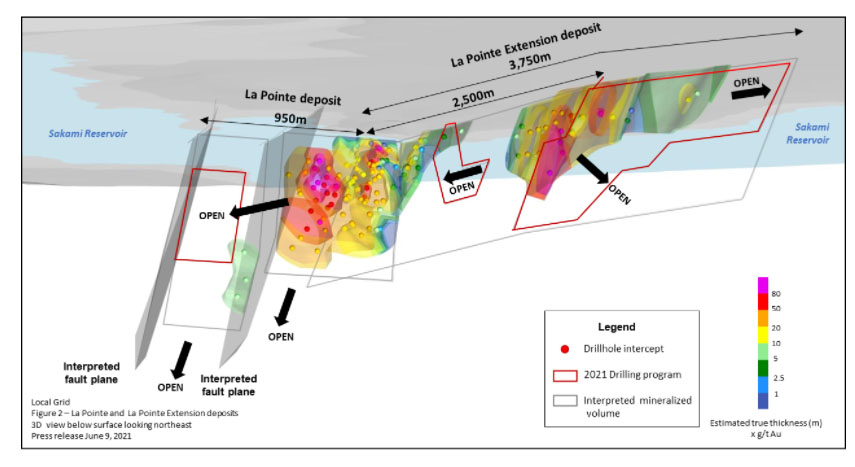

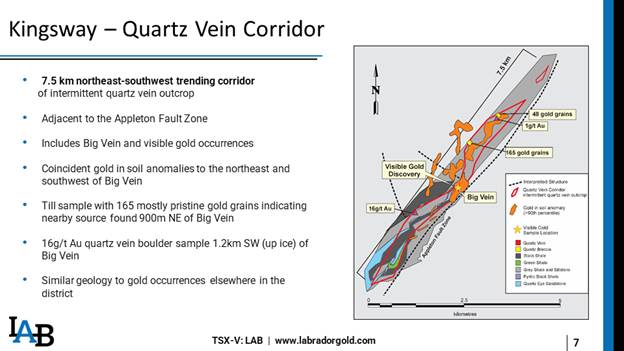

Roger Moss: Absolutely. I've talked about this before and I'm constantly encouraging our geos to get out there and look at different areas. There's a lot more potential. Big Vein is only 400 meters in strike length that we mapped out at surface, but it sits within what we call a Quartz Vein Corridor, which extends over 7.5 kilometers. And along that corridor, there's intermittent quartz painting and there's also a couple of areas that we've already outlined that may have the potential for more gold mineralization.

The Quartz Vein Corridor is extremely prospective and it also sets immediately adjacent to the Appleton Fault Zone, which is where the gold down at the Queensway property is hosted. It's associated with the Appleton Fault Zone and I think we have about 12 kilometers of that fault zone on our property. So, if you go from Big Vein, at 400 feet of strike length, it's within the Quartz Vein Corridor which is 7.5 kilometers. And then outside of that, you still have another corridor worthy about 5 kilometers of the Appleton Faults Zone. It's potentially a very large system.

Maurice Jackson: Speaking of drill results, when can shareholders expect to receive the next set of assay results?

Roger Moss: That's one of the questions I get most often and all I can say is that the labs are backed up. They're working hard to try and get through all the samples that are getting thrown at them. Samples go out from the core shack every few days and I'm anticipating that we'll have more results in, I would say probably next week.

Maurice Jackson: All right, sir, leaving the Kingsway Gold Project, let's discuss some important topics that are germane to the project. Are you fully permitted?

Roger Moss: We are permitted for the work that we're doing right now. There's ongoing permitting for further exploration, but for the work we're doing now, yeah, we're fully permitted.

Maurice Jackson: Does Labrador Gold own the Kingsway Gold Project as 100%?

Roger Moss: We have an option with Shawn Ryan to earn in 100%. That's on two of the three licenses and the third license we have an option with another geologist, also to 100%. We have the option to 100% on the entire property.

Maurice Jackson: We're going to get into some numbers later in this discussion, but from a capital expenditure standpoint, how is infrastructure on your project?

Roger Moss: Infrastructure is great. Like I mentioned, it's, well, 15 kilometers west of Gander. It's not too far from the Trans-Canada Highway, not too far from the coast. Access is great. It's the gravel roads, logging roads going right throughout the property, so we couldn't really ask for better infrastructure.

Maurice Jackson: What is your relationship with the First Nations?

Roger Moss: Well, here at Kingsway, we don't have any First Nations to deal with. Up in Labrador, we do, and we have a very good relationship with First Nations. Nunatsiavut Government, they're are self-governing First Nations group, and we have a very good relationship with them. The First Nations at the Ashuanipi Project asked us to stop work for a while there while we negotiate, so we're in negotiation or we're starting negotiations again, now, with them to get back to work at Ashuanipi. Like I said, here at Kingsway, there are no First Nations and so we're free and clear.

Maurice Jackson: Is the ultimate goal for Labrador Gold to build a mine or discovery and then sell the project?

Roger Moss: Oh, I think it's discovery and sell the project. None of the team here are mine builders. I'm an exploration geologist by trade. The goal is to make a discovery and sell it.

Maurice Jackson: All right. We've discussed the good, let's address the bad. What can go wrong and what are your action plans to mitigate that wrong?

Roger Moss: Well, obviously the worst thing would be not to find what we're looking for or not to find the sort of grades of gold that we would like to see. I think mitigating that is just constantly getting out, finding more targets, drilling where we know we have a chance to succeed, and just getting out in the field and doing the groundwork that finds us more targets along that Quartz Vein Corridor and the larger Appleton Fault Zone. I think that's going to be the best way to ensure that we're successful here.

Maurice Jackson: Switching gears, let's discuss the people responsible for increasing shareholder value that are behind the scenes. Dr. Moss, you've assembled an impressive team from your board of directors, management and exploration team. Please introduce us to your board of directors.

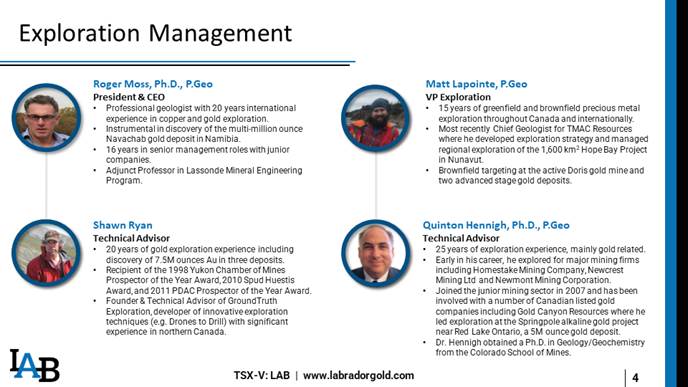

Roger Moss: Our board of directors is quite diversified. I'm the present CEO, I'm an exploration geologist with about 30 years of experience. Jim Borland is a long-time person who has been associated with the mining industry for a long time. He was the editor of The Northern Miner for a long time. He's done work with the PDAC in Toronto. Trevor Boyd is another exploration geologist who has a lot of experience in Canada in these kinds of orogenic gold systems. That's what we call the kind of gold that we're looking for. And then we have Leo Karabelas, who's got a lot of experience on the corporate development and investor relations side of things, and Kai Hoffmann, who was probably the last addition to the board a few years ago. He has a lot of interaction with the mining industry, through his Soar Financial Group and conferences that he arranges mostly in Germany for European investors.

Maurice Jackson: Who is on your management team and technical team?

Roger Moss: Well, the management team is really just myself and our CFO, Eric Myung. And he basically helps me out with all the budgeting and accounting and that kind of stuff. The technical teams, Shawn Ryan has been working with us as a technical advisor ever since we picked up his properties in Labrador and continues to do so. And late last year, we added Quinton Hennigh who is well known to many people who follow junior mining companies. Quinton I've known for some time. I worked with him from probably about 10 years ago now and that's when we were both technical advisors to another junior company. I've got a lot of respect for his opinion and, of course, he's also a director of New Found Gold and so he's advising us on how are we going to approach the property in a similar way to how New Found Gold has been managing their drawing.

Maurice Jackson: Let's get into some numbers. Sir, please provide the capital structure for Labrador Gold.

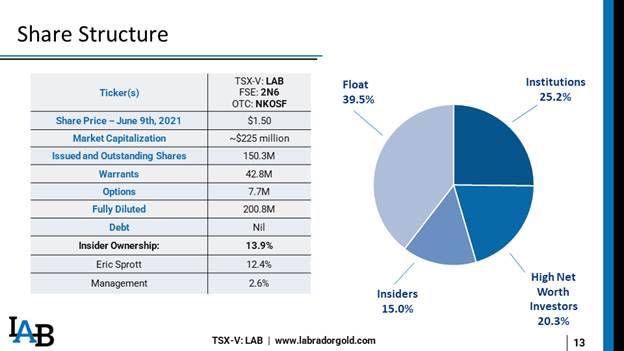

Roger Moss: We have about 150 million shares outstanding. On a fully diluted basis, we have approximately 200 million shares with probably about 43 million warrants, all of which are in the money right now, and about 7 million in options, which would also probably be all in the money right now. We have a float of about 40% and insiders 15%, Eric Sprott being the main one. After the two financings we did with him, he's up to about 12.5%. And then we have a couple of institutions that are involved. Palisades Goldcorp is probably around 8%. Crescat Capital probably around 8%, Plethora Precious Metals has some, I'm not sure where they're at now. And the other one, well, I'll put New Found Gold in there as well and they're probably at about 8%,

Maurice Jackson: How much cash and cash equivalents do you have?

Roger Moss: Right now, we're $35, $36 million. We do have warrants coming in, so I believe we're at about $36 million.

Maurice Jackson: How much debt do you have?

Roger Moss: None.

Maurice Jackson: That's a great position to be in. And what is the burn rate, sir?

Roger Moss: Well, in terms of our G and A, it's about $50,000 a month. If you add in the exploration, we're up to about $300,000 a month, so $250,000 for exploration and $50,000 for G and A.

Maurice Jackson: Well capitalized here. In closing, Dr. Moss, what keeps you up at night that we don't know about?

Roger Moss: Not much. I sleep really well and I try not to worry too much when I go to bed. But with some of the things that you might not know about, it's just shortages of people and equipment on the island. That's something that I'm always thinking about. Are we going to need more rigs? Are we going to need more equipment? Do we need more people? And it's really hard to get any of those things on the island. I drove a truck from Toronto because we needed a truck out here and we couldn't find one on the island. I've heard of the company shipping a truck from Vancouver, which is on the other coast, the west coast of Canada, all the way to Gander, which is pretty much on the east coast because you just can't get them here. So, things like that certainly can be challenges, but I think we're well-placed to meet that challenge.

Maurice Jackson: Last question. What did I forget to ask?

Roger Moss: I don't think you forgot to ask much there. We did talk about the technical team and the people in the field here, I always want to bring them up because they're doing an awesome job. They're the ones that are logging the core, sampling the core, getting it out into the lab, going out into the field every day, rain or shine, and doing the work that's going to bring success to the company. So, I just have a lot of admiration for their work ethic. A lot of them are younger geologists and they've proved to their value every day on-site and I couldn't be happier with the team we have.

Maurice Jackson: Dr. Moss, for readers that want to get more information about Labrador Gold, please share the contact details.

Roger Moss: Simply [email protected]. I'm happy to take any questions from shareholders or potential investors that are interested in hearing more about the story. Our website is www.labradorgold.com. One of the things that I would encourage people to do is to follow us on Twitter, which is @LabGoldCorp. We post a lot of things on Twitter. Most recently, we've had a few videos up there that show little clips of people working in the field, that team that I was talking about. That's the best place to look for things that are happening on a day-to-day basis. And we do try and highlight people working in the field on some of these videos, so check that out.

Maurice Jackson: Dr. Moss, it's been a pleasure speaking with you. Wishing you and Labrador Gold the absolute best, sir.

Roger Moss: Thank you very much, Maurice. That was great and I hope to be back here with some more interesting news in the not too distant future.

Maurice Jackson: Looking forward to it, sir.

Roger Moss: Thank you.

Maurice Jackson: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: [email protected]. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales; subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Labrador Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Labrador Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.