Maurice Jackson: Joining us for our conversation is Jordan Trimble, the CEO of Skyharbour Resources Ltd. (SYH:TSX.V; SA:NYSE.MKT).

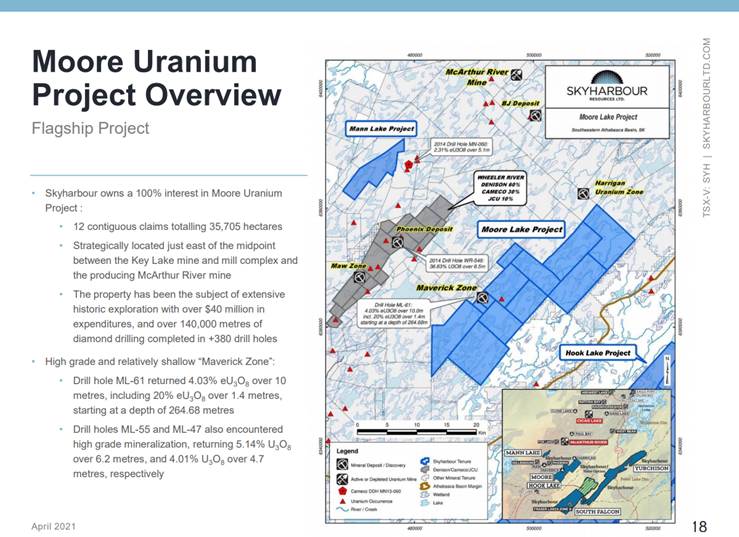

Always a pleasure to speak with you, sir. For readers new to Skyharbour Resources, the company is a preeminent uranium explorer with a project portfolio strategically located in the Athabasca Basin of Canada, which is elephant country for uranium as the basin hosts the highest-grade uranium deposits in the world.

Before we begin, I do want to note that Skyharbour Resources has generously rewarded shareholders in the last year, with a share price increase from CA$0.08 all the way up to CA$0 .60. And by the way, a lot of that movement occurred since our interview five weeks ago, when the stock was trading at CA$0.33. Let's find out what has the market optimistic about Skyharbour Resources. Jordan, take us to the flagship Moore Project and get us up to speed on the latest developments there.

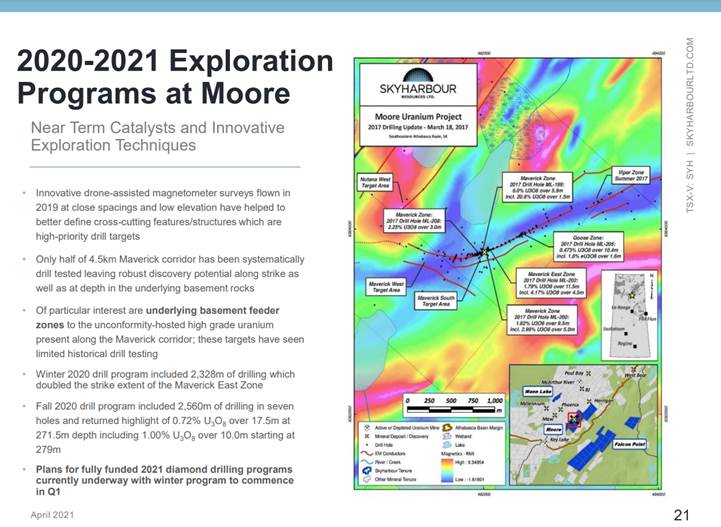

Jordan Trimble: Back in March, Skyharbour Resources announced that we were mobilizing crews for upcoming exploration programs. We've started off with some geo-physical programs at the project in particular, in a new area called Grid 19. Most of your audience will be familiar with our main target area, which is called the Maverick corridor. That's really been the focus for us over the last several years with the drill programs and the upcoming drilling, most of it will be focused on continuing to delineate and expand high-grade zones of uranium mineralization with a focus on the basement rocks, but we do have several other regional targets that we are keen to go and test in. Interestingly, we conducted an EM Survey on one of our targets called the Grid 19. We will be drilling here shortly and we have plans for a fairly aggressive drill and exploration program for the remainder of the year.

Noteworthy of mention, Skyharbour Resources just closed a $3 million financing. The company is now fully funded with over S8.5 million in cash and stocks, which fully funds us into next year. Plus, we may have an opportunity to expand on the initial plans, in terms of meterage on our drill programs. So keep an eye out for news flow from our main project, being the Moore lake project, both drilling at the Maverick corridor and at some of these regional targets as well, and that'll take us right in through the summer, into the fall with news flow.

Maurice Jackson: The Maverick corridor is a big feather in your cap and the project has had success here before and looks to replicate that success. You referenced high grade, tell us more.

Jordan Trimble: This project that has yielded some notable high-grade results since we acquired it from one of our larger shareholders, Denison Mines, a strategic partner of ours, back in 2016 and started working on it in 2017. We've had some notable results as high as 21% U3O8, over a meter and a half, 6% U3O8 over six meters.

And just more recently we've delineated and refined targets in the underlying basement rocks, looking for the feeder zones that have brought the uranium mineralization up from below. Back in December and January, we announced that we had our longest continuous zones of uranium mineralization, including one drill intercept that was 17.5 meters of 0.72% U3O8, and within that, 10 meters of 1%, that being hosted in the underlying basement rock.

We really believe we've just scratched the surface and with additional drilling, and we like our chances to generate more value with the project, by making additional discoveries, by expanding that high-grade zone in the underlying basement rocks. With an expanded budget we also have other targets that we can now test.

Maurice Jackson: If drill holes are the means, then the results are the ends. When do you think we can anticipate those results?

Jordan Trimble: The turnaround time is dependent on the labs, but looks like compared to last year when things were quite backed up, the turnaround will be a bit quicker. Usually it's a four to six week turnaround from when the drilling starts. So when we start getting numbers in, shareholders will see a steady flow of news over the coming months. And as I mentioned that we, because we have a healthy treasury we usually carry out several drill programs a year. We are fortunate of being in a position to be cashed up, which allows us expand on the 3,000-meter drill program that we had initially planned. Readers likely will see more meters drilled in this program here.

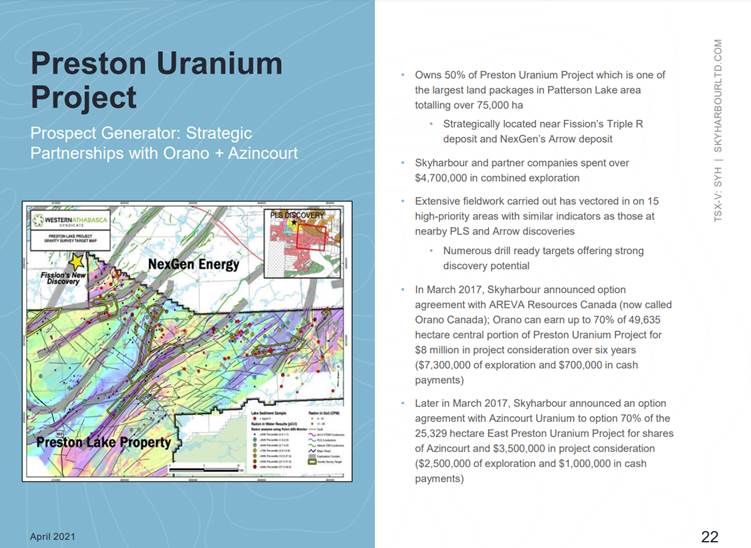

Maurice Jackson: Skyharbour Resources isn't just a one trick pony. The company employs a project generator business model that has three strategic partners; any updates for us on your partner programs?

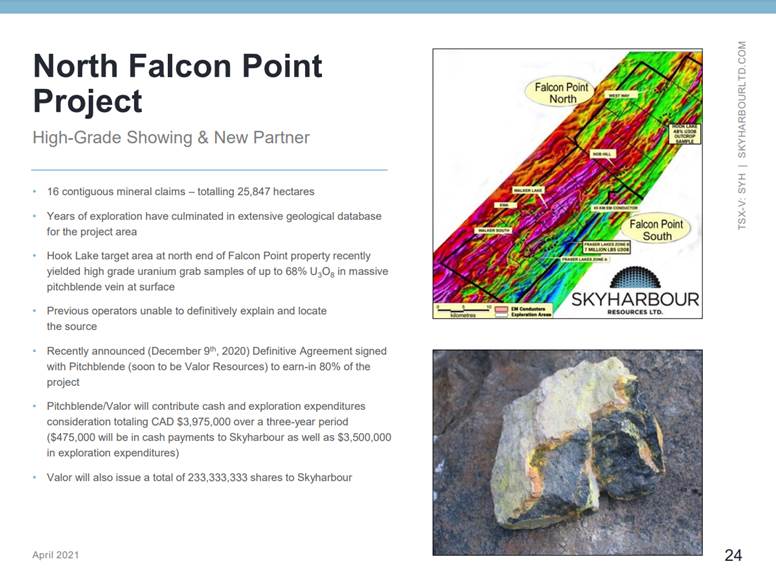

Jordan Trimble: We are proud to share that two of our three partners have now completed their respective earn-ins. Beginning at our Preston project, industry leader and strategic partner Orano Canada just completed a 51% earn-in. So we retain a minority interest going forward. Right beside that project, at our East Preston project, our other partner, Azincourt Energy, is now earned in 70% of that project. It wrapped up a drill program here recently, assay results are pending, so there'll be news flow from that. And then it does have plans to get back to work there in the summer, which is fully funded. And recently we signed a definitive agreement with ASX-listed Valor Resources, a new partner company based in Perth. And it is earning-in up to 80% at our North Falcon point, or Hook Lake project as we're now calling it.

And we just had news out on that about a week ago, announcing the completion of some electromagnetic geophysical programs that have been carried out as an initial first phase of work. And Valor is going to be following that up with some groundwork and then ultimately look to go and carry out a drill program. So again, this just adds to the news flow, adds to the potential catalyst and the discovery potential at the project base, as we get cash and stock from partner companies and they fund the bulk of the exploration that's being carried out on our partner funded projects.

We are in talks right now with other companies on some of our other 100% owned projects. We own 100% of South Falcon Point, as you may recall, which hosts an NI 43-101 compliant inferred resource. We also have 100% of the Mann Lake project strategically located southwest of the McArthur River Mine, and a few other properties as well. So keep an eye out for other deals and partner companies coming into the fold.

Maurice Jackson: Leaving the project portfolio. Mr. Trimble, you've been spot on with your analysis on the uranium market. What has your attention at the moment?

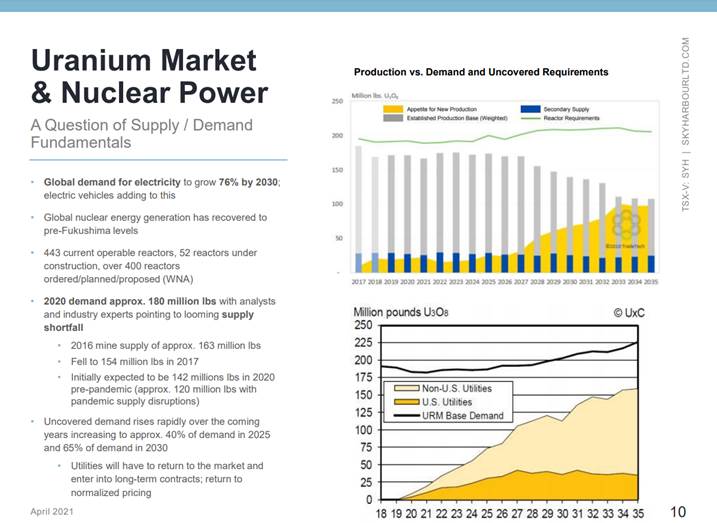

Jordan Trimble: While we've had quite the market over the last six or seven months, it's certainly been volatile, but you know, the net result has been a positive one. And since you pointed out earlier, we've seen equity prices, share prices, move higher on the back of renewed interest in this space. And I think that the key point here is we're finally seeing a positive sentiment around nuclear energy as really an integral part to solving the issue of climate change and global warming. And so as that sentiment continues to improve and as we see more interest, especially from ESG-mandated investors, I think you'll see this trend continue. I think it's still very early on in this bull market. We still have yet to see a major move in the uranium price. We're seeing a trade just below $30 a pound. We did see it about a year ago, jump off and it's kind of settled in back around $30 a pound, but there is still a major supply side response that's played out.

As we talked about in previous interviews, the global primary mine supply was hit hard last year with the pandemic, decreasing down to about 120 million pounds in the backdrop of over 180 million pounds of demand. But you're getting back to this global objective seemingly now around the world with countries planning to go carbon neutral in the next 20 to 30 years, people are waking up to a simple fact that you need nuclear energy as a part of that solution. And that's going to be a positive for uranium mining companies that provide the fuel for these nuclear reactors. And we're seeing it again across the world, some of the biggest countries and biggest economies in the world that are really pushing for this, including the U.S., including China, and in each of these countries, nuclear is going to play an integral role in achieving those emission reduction targets. So I think we'll see that continue; I think that'll bring more money into the space.

And as we've talked about before, there's very few ways to get investment exposure to uranium and to the sector. And there's very few active companies still, I think you'll see more pop up over the coming years, but the companies that have stuck it out for the last 5 to 10 years are going to be rewarded the most, and we've been building the company now for over eight years.

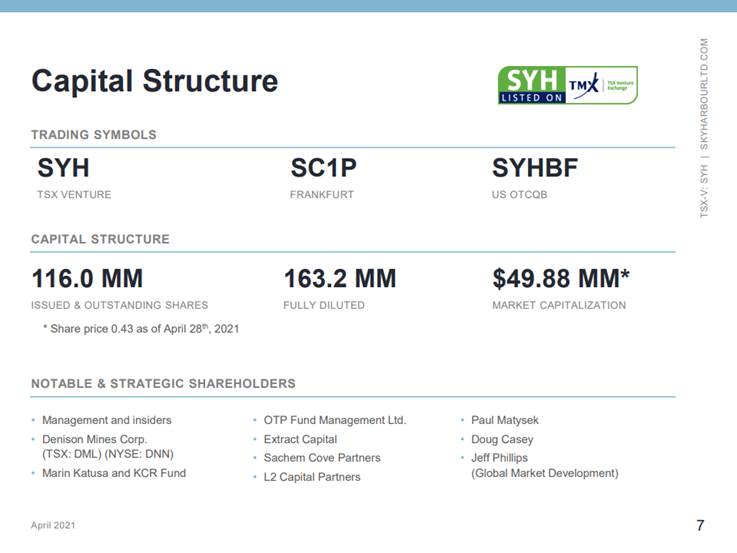

Maurice Jackson: Before we close, Mr. Trimble, please provide us with an update on the capital structure for Skyharbour Resources.

Jordan Trimble: Skyharbour Resources has about 115 million shares issued and outstanding, we're trading at about CA$0.45 for a CA$50 million market cap. We have a healthy treasury with over $8.5 million in cash and stock, and we are fully funded for all of the work that we have planned, as well as partners funding the bulk of the exploration programs that are on some of our other projects. Our market cap is still relatively low, and we are always endeavoring to position our shareholders with catalysts to increase the share price. If we look back to 2006–2007, uranium companies were trading at multiples of where they are today. I think there's still a lot of runway here. And again, as we see sentiment continue to improve, we see more investors pay attention to nuclear and to uranium mining companies.

Maurice Jackson: Sir, any final words for current and prospective shareholders?

Jordan Trimble: Keep an eye out for news flow over the coming months. We're at that point in the year where we've got spring and summer programs commencing shortly or currently underway. So there's going to be quite a bit of news flow, and readers always get more information at our website, which is www.skyharbourltd.com.

Maurice Jackson: Mr. Trimble, thank you for joining us today, wishing you and Skyharbour Resources the absolute best, sir.

And as a reminder, I am licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: [email protected]. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Skyharbour Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Skyharbour Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources and Azincourt Energy, companies mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.