By advancing the potential of its precious metal projects in the Northwest Territories, Rover Metals Corp. (ROVR:TSX.V; ROVMF:OTCQB; 4X0:FRA) said it is helping assert Canada’s Arctic borders and safeguard the nation’s northern sovereignty at the 60th parallel.

Within the Arctic region’s 21 million square kilometers, eight countries — Canada, the United States, Russia, Denmark, Sweden, Finland, Norway, and Iceland — have exclusive economic rights to resources up to 200 nautical miles from their shorelines.

But as rising ocean temperatures disrupt shorelines and shipping routes, heavy hitters like China are eying assets and deep seaports along the Northwest Passage.

Potential at the 60th Parallel

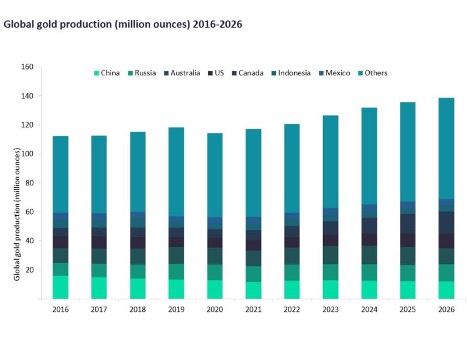

Global gold production is expected to grow at a compound annual rate of more than 3% through 2026, with Canada being the largest contributor to the increase. Over the forecast period 2022-2026, Canadian gold mine production is expected to grow at a compound annual growth rate (CAGR) of 18.7% to reach 15.5 Moz.

Global gold production is expected to grow at a compound annual rate of more than 3% through 2026, with Canada being the largest contributor to the increase. Over the forecast period 2022-2026, Canadian gold mine production is expected to grow at a compound annual growth rate (CAGR) of 18.7% to reach 15.5 Moz.

But action is needed to capitalize on these trends. “If there are no new mines coming online in the Northwest Territories, the population, taxes, and government needed to assert Canada's northern border dwindles and those northern borders are up for grabs," said Rover Metals Chief Executive Officer and Director Judson Culter.

With its strategic proximity to the key city of Yellowknife, Rover’s 100%-owned Up Town Gold and Cabin Gold assets could be the catalysts that build a critical mass of population, infrastructure, employment and income, he said.

Up Town Gold

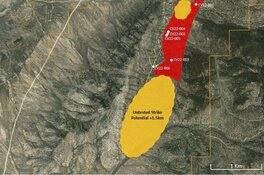

Located on the outskirts of city limits of the city of Yellowknife, this Archean lode-gold prospect adjoins the historic 7.2 Moz Giant Mine gold deposit and Gold Terra Resource Corp.'s (YGT:TSX.V; YGTFF:OTC; TXO:FRANKFURT) 2.2 Moz Yellowknife City Gold Project.

“We believe the Up Town Gold project has the potential for a million-plus ounces,” Culter said.

Up Town has a high chance of resale within the next two years, potentially to Newmont, which optioned part of the Yellowknife City Gold project to Gold Terra.

In addition, Culter said, “A new producing gold mine pushes the demand for new exploration and discoveries in the northern territories, paving the way for shipping and airborne logistics, new jobs, and the potential for new highways and hydro infrastructure. For every new head hired into a junior mining company, there’s a multiplier of two and a half new jobs hired into the supply chain that supports that company.”

Cabin Gold

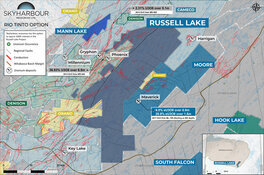

Cabin Gold is located 110 km northwest of the city of Yellowknife, close to hydro lines and to the Tlicho All Season Road (TASR), the newest corridor of mining infrastructure in the Northwest Territories. Two new gold mines along the TASR are scheduled to come online in the next five years: Fortune Minerals Ltd.'s (FT:TSX) NICO Project and Nighthawk Gold Corp.'s (NHK:TSX.V) Indin Lake project.

Supported by a grant from the Government of the Northwest Territories’ Mining Incentive Program under a mandate to ensure that mineral resource exploration and development continues to flourish in the north, Rover commenced Phase 2 exploration in Cabin Gold in June 2021.

“The project will be a success even if we prove-up only 500,000 ounces of gold because we can do a milling offtake agreement with either Nighthawk or Fortune,” Culter said.

New drilling results are expected sometime this summer, but for now, Culter considers Sabina Gold & Silver Corp. (SBB:TSX; RXC:FSE; SGSVF:OTCPK) to be “the closest geological analogue in terms of how we're going to follow on our discoveries. Plus, we’re in the same neighborhood and with relatively the same type of rocks.”

A Golden Investment Opportunity

Rover just closed its $0.05 unit financing, raising gross proceeds of $1,991,260 under non-brokered private placement financing.

With assets in all the right places, Rover Metals is relatively under-appreciated and undervalued, Culter said.

“We’re at the very bottom of the discovery curve, moving up the market cap valuation,” he said. “We need another $4 million or $5 million in drilling, but over the next two years, there's critical ounces and value in our project.”

The company has raised close to $2 million dollars at a time when others have struggled to raise anything.

“Here’s a company with high-grade gold resources in the right neighborhood. We’re fully financed, with drill results coming, so we’re pretty, pretty, confident,” Culter said. “I think investors should be taking note.”

Newsletter writer Clive Maund agreed, writing in March when the share price was $0.04 that Rover Metals was an immediate speculative buy. The price hovered at $0.04 on Monday.

“This therefore looks like a good low price to pick it up and this is said in the knowledge that it could temporarily break even lower,” he wrote. “As it is only at 4 cents now, it can’t drop much lower.”

Rover Metals has a market cap of $5.51 million and 157.44 million shares outstanding. It trades in a range of $0.12 and $0.03 over 52 weeks.

| Do you want the latest investment ideas delivered to your inbox? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Wendy Hubbert and Steve Sobek compiled this article for Streetwise Reports LLC and provide services to Streetwise Reports as an independent contractor/employee, respectively. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Rover Metals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Rover Metals and Gold Terra Resource, a company mentioned in this article.