There is a huge push towards green energy to resolve climate change, especially under the new U.S. Democratic government and the worldwide climate change movement. It will not be easy to electrify the world with green energy, but one thing is for certain – copper is electricity's best friend. Electric vehicles require two to four times more copper than fossil fuel vehicles. Windmills don't use battery metals like lithium but a lot of copper in their generators. Solar farms don't use battery metals either but a lot of copper. Copper powers the data centers and cell phone towers and all the electronic gizmos we use. A lot is used in homes and buildings in the current boom. Is it any wonder copper it is said to have a PhD in economics?

On this Comex weekly price chart we can see a nice consolidation since the 100% run up from $2.40 to $4.80. There is rising upward pressure with a series of higher lows. Resistance is around $4.80 and I believe this could be overcome in a matter of weeks.

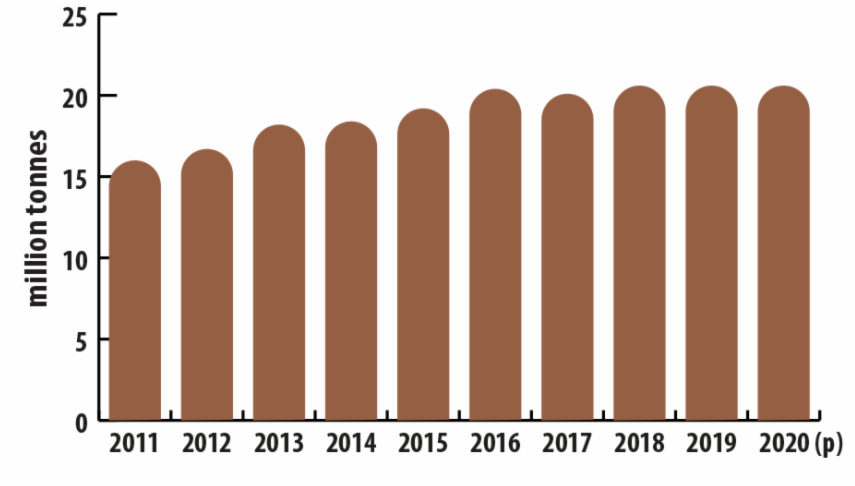

After decade or more of underinvestment in the mining sector it is no surprise to see that production growth has stalled, just as demand is seeing a considerable increase.

Copper Warehouse stock levels don't seem to get a chance to build up and with supply chain problems now, they are destined to run out. In that case copper could run to $10.

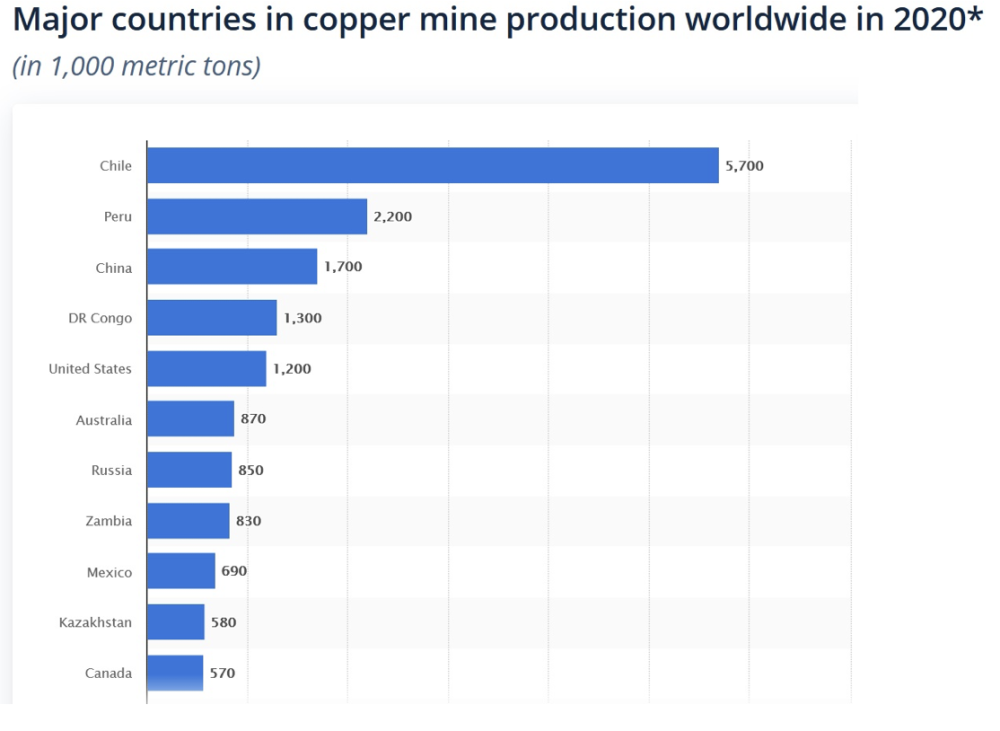

In December 2021, Gabriel Boric became Chile's youngest president-elect, at 35 years old. Boric is a left-wing progressive and ran his campaign talking tough on Chile's mining sector. Don't be surprised to see the government cause disruption and declines in Chile's copper production. The next biggest producer is Peru and I do not see too much political risk there or in Zambia, Mexico, U.S. and Canada.

Element 29 Resources Inc. (ECU:TSX.V; EMTRF:OTC). Recent Price - $0.65

Shares outstanding 79.8 million. Management/insiders own 21% and Funds 12%

ECU is a Canadian exploration company with two very large and growing copper projects in Peru: The Elida project (central) and Flor de Cobre (south).

Highlights:

-

Strong management and well cashed up with recent $6.9 million placement;

-

Based on the quality and size of the company’s two core projects, this is one of the most undervalued copper plays I have seen in a very long time, especially when you factor in the mid- to long-term outlook on copper;

-

This company is relatively unknown in the market but I don’t expect that situation to last much longer;

-

Both of the company’s core projects have world class potential (500 million to 1 billion+ ton) with active drill programs now running at both. Extremely high historical drill intercepts exist at both properties including: Elida: 384 meters @ 0.71 copper equivalent (CuEq) & Flor de Cobre: 272 meters @ 0.92 CuEq). If you have been following the copper market then you know that these are world-class intercepts;

-

Both projects are at relatively low elevation, have near surface mineralization, are near key infrastructure (power, labor, transportation) and most importantly are far removed from any farming regions.

Management

Previously management was running a private company called GlobeTrotters Resource Group and they would acquire, advance properties and then deal them to majors. To gain higher leverage on their expertise they decided to vend in some key properties in a junior called Element 29 (copper's atomic number).

Richard Osmond, P. Geo., Interim CEO and Chairman, has over 25 years of experience in the mining sector including experience with INCO (VBNC), Falconbridge and Anglo American. He was involved in exploration discoveries at Vale's Voisey's Bay deposit and Glencore's Raglan mine. He was later hired as a senior technical leader with Anglo American responsible for North America and Europe focused on Ni exploration in northern Canada, Alaska and Scandinavia as well as IOCG and porphyry Cu-Mo exploration in Mexico and Alaska. Mr. Osmond is currently the president of GlobeTrotters Resource Group Inc.

Paul Johnston, PhD., P.Geo., VP, Exploration, has worked in the exploration and mining industry for 30 years, devoting much of his career to exploration and development of porphyry copper and epithermal gold deposits. Most recently, he was chief geologist for Globetrotters Resource Group Inc. focused on generating and advancing copper and gold prospects in Peru. He began his career as a mine geologist at the Hemlo gold deposit with Noranda. In 1996, he joined the exploration group at Teck Resources and accumulated extensive international experience in early to advanced stage exploration through a variety of technical and management roles in Southeast Asia, Australia, North America, and South America, including regional chief geoscientist for South America.

Ricardo Labó Country Manager, Peru, is a mineral economist with over 20 years of industry experience in Peru, Latin America, and Africa. He has held several high-level positions in the Ministry of Energy and Mines of Peru including vice minister of mines, advisor to the Minister of Energy and Mines as well as director of mining promotion and development where he successfully promoted responsible mining exploration and development investment in the country. In the private sector, he held several senior positions at the Australia Peru Chamber of Commerce, Rio Tinto, Roche, Phelps Dodge and Grupo Apoyo, provided strategic advisory and consultancy services to several international mining companies and institutions, and was a board member of several private and state-owned mining and energy companies.

Michael Doggett, PhD, Director, is a mineral economist with 35 years of experience in project evaluation, taxation, royalties, and exploration, in addition to publishing and training. Mr. Doggett is the founder of El Olivar Imperial, a private Peruvian mineral processing company. He has served on numerous listed companies and non-profit boards. He served as director of the Mineral Exploration Program at Queen’s University, Canada, where he is currently an adjunct professor.

Properties

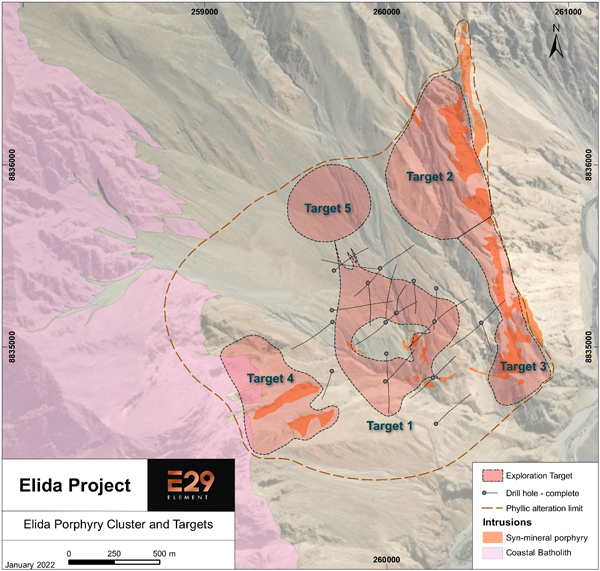

Elida, Peru, 19,210 hectares, 100% owned

The project is located in central Perú, approximately 85 kilometers inland from the Pacific coast at moderate elevations between 1,500 meters and 2,000 meters. It is close to transportation and power infrastructure, including a 45 mega-watt hydroelectric generation facility situated 15 kilometers from the project. Elida is a newly discovered porphyry copper-molybdenum exploration project within a property composed of 28 mining concessions. The property contains a large, 2 x 2 kilometer alteration system enclosing a cluster of porphyry centers that represent five distinct exploration targets.

In 2021, Element 29 completed seven drill holes in Target 1 totaling 4,481 meters that intersected multiple, long intervals of Cu-Mo-Ag mineralization and traced mineralization to a depth greater than 900 meters. Mineralization remains open at depth. The remaining four large targets are untested. Under the current drill permit, the company can elect to drill-test all identified targets.

Last 2021 drill holes reported January 19, 2022 - Elida Drilling Highlights

-

Drill hole ELID025 intersected 908.75 m of 0.39% copper (“Cu”), 0.035% molybdenum (“Mo”), and 2.9 g/t silver (“Ag”) for 0.55% copper equivalent, including 339.6 m of 0.50% Cu, 0.036% Mo and 4.3 g/t Ag for 0.67% CuEq starting from the bedrock surface at 38.45 m depth. The hole confirmed the vertical extent of mineralization to 933 m below surface and remains open at depth.

-

Drill hole ELID024 intersected 451.75 m of 0.38% Cu, 0.034% Mo, and 3.1 g/t Ag for 0.53% CuEq. The hole confirmed an apparent western limit of Target 1 mineralization and demonstrated good continuity of mineralization between holes ELID019, ELID020, and ELID025.

-

Drill hole ELID023 encountered a much wider than anticipated zone of mineralization on the south side of the low-grade central quartz monzonite porphyry stock and confirmed the westward continuity of mineralization south of the stock. The strongest of two mineralized intervals was 91.1 m of 0.41% Cu, 0.032% Mo, 4.1 g/t Ag (0.56% CuEq). The hole was stopped before reaching the southern limit of the Target 1 mineralized zone.

Flor de Cobre, Peru, 1,927 hectares, 100% owned

Flor de Cobre is a copper porphyry located in the Southern Peru Copper Belt, 45 km south of Arequipa. Some of the world's largest copper-molybdenum porphyry deposits and mines including Cerro Verde (Freeport), Cuajone, Toquepala (Southern Copper), and Quellaveco (Anglo/Mitsubishi) reside in the Southern Peru Copper Belt. It is located ~30 km southeast of the large copper mine at Cerro Verde and ~7 km northwest of the Chapi copper mine.

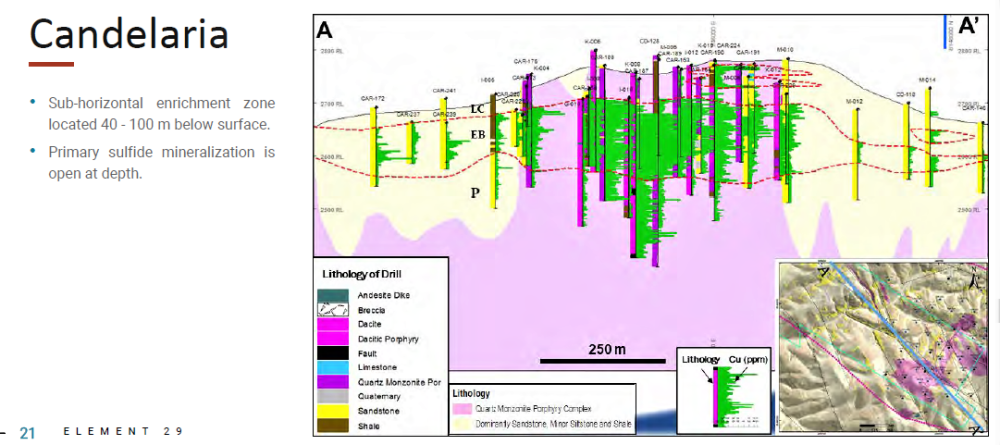

Rio Amarillo and Phelps Dodge explored the Candelaria area in the mid-1990s and reported an historical copper resource of 57.4 Mt at 0.67% Cu at a 0.2% Cu cut-off. A highlight of the drilling programs completed by Rio Amarillo and Phelps Dodge was hole K-008, which intersected 116 m at 1.4% Cu of supergene enrichment starting from a depth of 78m followed by 156 m of 0.58% Cu in hypogene sulfide mineralization. The hole ended at 350 m in Cu-Mo mineralization.

This is a good graphic that shows the enrichment zone that is not far below surface. It could provide very high returns to start mining with a low capex and as a starter pit to a future larger mine plan.

Financial

Last financial statements reveal $3.4 million in cash and a small loan of $40,000 interest free loan, as part of the Canada Emergency Business Account (the CEBA). If $30,000 is repaid on or before Dec., 31 2022, the remaining $10,000 is forgiven. Since then, on Dec., 14, 2021, Element 29 closed an oversubscribed, non-brokered private placement financing of 11,498,000 million units at a price of 60 cents per unit for aggregate gross proceeds of $6,898,800.

Summary

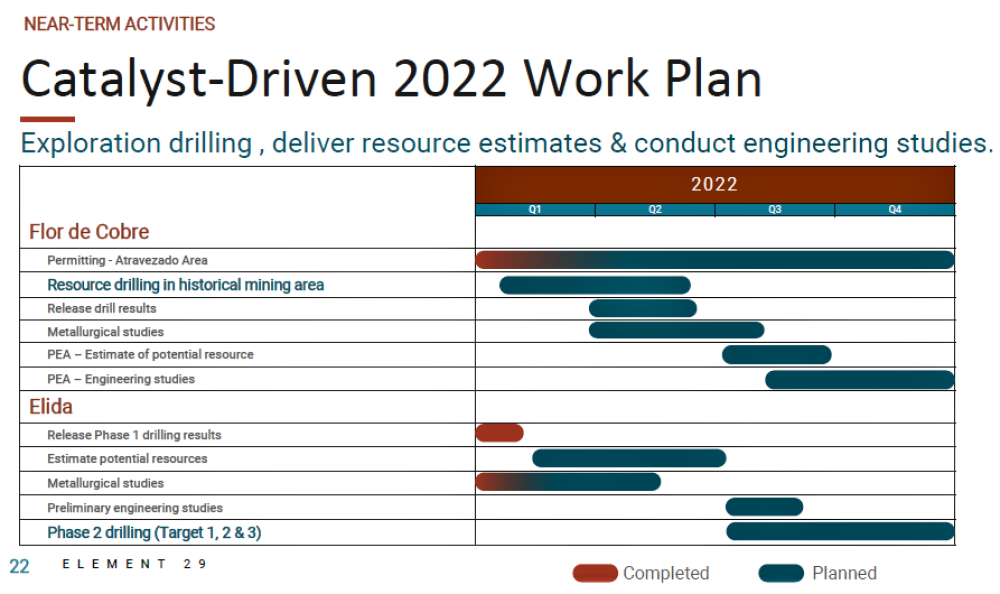

ECU has a market value of about $42 million after subtracting cash on hand. This is a low valuation for a junior that has two advanced stage copper projects with world class drill intercepts in Peru, the 2nd largest copper producer in the world. The graphic below shows its work plan for 2022 and obviously there will be no lack of news and it will be very good news. The stock has only been trading for a little more than a year and was in a nice uptrend until year end weakness. This has provided a nice consolidation before the next move higher. First resistance is a little over the $0.70 area.

Midnight Sun Mining Corp. (MMA:TSX.V; MDNGF:OTCQB). Recent Price $0.26

Shares outstanding: 113 million

I have followed this company for a few years and have known the CEO Al Fabbro a long time as well as director Rick Mazur. I have been a shareholder for a few years and participated in two private placements. I believe now is the time that stock could have a big move.

Al Fabbro – President, CEO, & Lead Director, has over 30 years’ experience in both the finance and mining industries. From 1984 to 1990, Mr. Fabbro headed the retail trading department of Yorkton Securities, followed by six years with Yorkton’s Natural Resources Group. After working for 10 years as an investment advisor with Canaccord Capital, specializing in the natural resource sector, Mr. Fabbro left to become lead director of Roxgold Inc., which was named the top company on the TSX Venture 50 and raised in excess of $60 million in equity financing during his tenure.

Rick Mazur – Director, P. Geo, MBA, is a geoscientist who has held positions in the international exploration and mining industry for over 30 years as a project geologist, financial analyst and senior executive on uranium, gold, base metals, coal and industrial minerals projects around the world. Mr. Mazur worked as an analyst for Canamax Resources Inc. from 1985 to 1991 during the development of three Canadian gold mines. Two of these mines – Bell Creek in Timmins, Ontario, and the Island Mine in Wawa, Ontario, are still in production.

VP Exploration – Rio Tinto. I did not go much into Midnight Sun's exploration people because Rio Tinto is managing exploration with an earn in. It has paid Midnight Sun US$1 million and have completed a US$3 million work program. Results of this will be reported very soon. In the next four years Rio Tinto must pay Midnight Sun US$1 million and complete US$16 million in work to earn 51%. In stage 3, Rio Tinto pays Midnight Sun another US$1 million and completes an additional $14 million in work to earn 65%. Finally another $US15 million in work over two years to earn 75%.

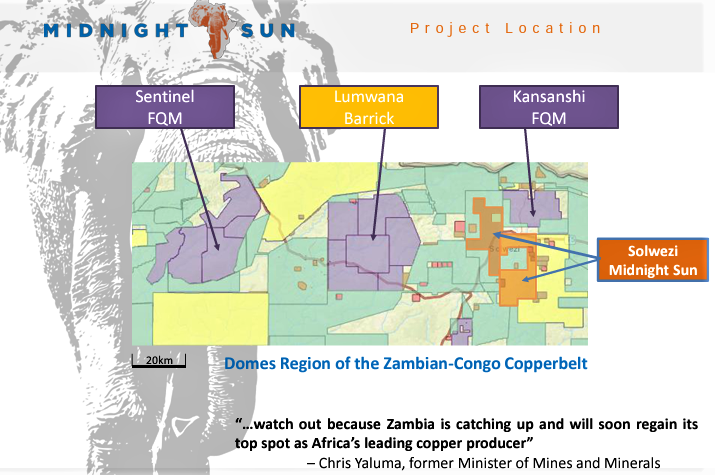

Project - Solwezi licences, NW Province of Zambai, South Africa, 506 sq. km.

Midnight Sun truly is among elephants, including being surrounded by major mining companies and it is adjacent to Africa's largest copper mine. The Kansanshi Mine, owned and operated by First Quantum Minerals Limited, is located roughly 15 km from the Solwezi Licenses. The Kansanshi Mine is one of the world’s largest copper mines and also an important gold producer. As of 2012, the Kansanshi Mine updated Resource was estimated at 744.3 Mt @ 0.86% Cu and 0.15 ppm Au Measured and Indicated and 365.2 Mt @ 0.71% Cu and 0.12ppm Au Inferred. You could say it is also location, location, location. There is paved road access to the property and a large network of unpaved roads through the property. Due to large human presence, large wildlife has left this area and there are no national parks or protected zones in the area

Rio Tinto started work in April 2021 with 3 drill rigs and detailed surface exploration. Exploration paused the end of June and resumed last September. The September 13, 2021, news release gives a good summary.

MIDNIGHT SUN ANNOUNCES RECOMMENCEMENT OF 2021 EXPLORATION PROGRAM

Exploration work to date has been focused on gaining a deeper geological understanding of the Solwezi licenses within the broader context of the various geological models hosting the significant copper mines in the area.

"Most of the mineralization on the Solwezi licenses occurs under a 40- to 50-metre thick layer of groundcover and there are very few occurrences of outcrop," stated Al Fabbro, president and CEO of Midnight Sun. "With this cover, along with the sheer size of the 506-square-kilometre land package, we share Rio Tinto's view that the regional component, while time consuming, is a very necessary step in the exploration process to define and delineate target areas for drilling and potential development."

Upon returning to the field, the exploration program is expected to include work at Dumbwa, Likoka and Mawemba.

Dumbwa

Dumbwa is a 20-kilometer copper-in-soil anomaly overlying basement rock where previous drilling encountered disseminated chalcopyrite and bornite with certain similarities to Barrick's Lumwana mine, which is approximately 60 kilometers west of the Solwezi licenses. The best hole to date at Dumbwa was drilled by a previous operator and intercepted 1.24% copper over 16 meters starting at a depth of 164 meters (SDRC-13). The planned program includes infill soils, air core drilling, reverse circulation drilling and diamond drilling to test possible mineralization in magnetic, radiometric, and induced polarization geophysical responses.

Mawemba

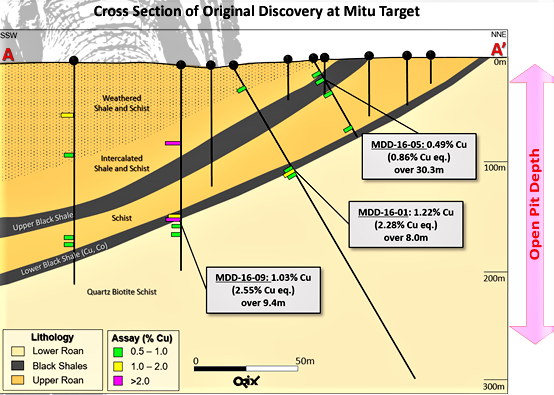

Mawemba is a geophysical anomaly along the Mitu trend which has returned positive geochemical and air core drill results similar to the original Mitu discovery area. Diamond drilling and an expanded soil survey are planned for the Mawemba target area.

Likoka

Diamond drill hole MDD-17-15 was initially drilled as a greater-than-3.7-kilometer stepout from the discovery at Mitu, in the area now called Likoka, and measured 4.23 per cent copper equivalent over 11.6 meters. The upcoming work will tighten geochemical spacing and increase air core drill coverage of the area in preparation for a diamond drill campaign.

This next graphic gives a good look at drill holes and locations with the original discovery.

Financial

Last financial statements show $2.5 million in cash and a small $40,000 interest free loan, as part of the Canada Emergency Business Account (the CEBA). If $30,000 is repaid on or before Dec., 31 2022, the remaining $10,000 is forgiven. The last financing was for $1.967 million at $0.35 per share. Rio Tinto is making all the exploration expenditures so Midnight Sun has a low burn rate.

Summary

Midnight Sun saw some excellent high-grade copper intersects in its initial discovery and drilling. It is in elephant country and has very good odds of making a multi-billion ton copper discovery. It has to be a very good project to entice Rio Tinto to spends US$51 million to gain a majority interest. The market value is still quite low at $30 million.

With large mining companys, they don't report incremental, timely exploration results like a junior, but they are due anytime now to report on their phase 1 exploration and if they will continue to the next phase of US$17 million. I expect they will and we could see some exceptional results that pop the stock.

This is quote was in last Septembers' news release: "I am very excited about Midnight Sun's immediate future, and believe that Rio Tinto's detailed, systematic approach to exploration at Solwezi is what will ultimately identify the full potential of the license area," said Mr. Fabbro. "The next few exploration programs will be the most important in the company's history and as our understanding of these licenses continues to grow, so do our chances of success."

On the stock chart you can see a steady uptrend since the Rio Tinto news and then some consolidation and weakness as the mining market came down in the last half of 2021. It provides us with a low entry point and just a little above major support on the stock.

For 27 years, Ron Struthers, founder and editor of Struthers' Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil & gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.

SWR Disclosures:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Element 29 and Midnight Sun. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Struthers Stock Report disclaimer: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.