Some of the most interesting juniors are the ones that already have sufficient, solid drill results to delineate a very decent NI43-101 resource, but can grow them even larger, and have flown under the radar for a long time while quietly completing their drill programs.

Often a change in management and/or changing metal sentiment are all it takes to achieve significant re-ratings. Aztec Minerals Inc. (AZT:TSX.V; AZZTF:OTCQB) seems to be just that type of junior mining company, focusing on gold/copper projects, with the additional benefit of a high-profile founder (Bradford Cooke, Executive Chairman and founder of Endeavour Silver), and interestingly lots of exploration potential at depth for both their JV projects, Cervantes (Mexico) and Tombstone (Arizona, U.S.). With about CA$2 million in the treasury, drill results for Cervantes coming in the second half of February, and another drill program planned for Tombstone, it looks to become a busy and interesting year for Aztec Minerals.

About Aztec Minerals

Aztec Minerals is a mineral exploration company focused on the discovery of large polymetallic mineral deposits in the Americas. The current flagship project is the Tombstone project in Arizona, containing historic mines which produced 32 Moz silver and 240 koz gold from 1878 to 1939. The former flagship Cervantes project is a porphyry gold-copper property in mining-friendly Sonora, Mexico. Both projects have seen sufficient drilling to indicate significant oxide heap leach resource potential, and both have large scale exploration (porphyry and CRD type mineralization) potential at depth.

Aztec Minerals was listed in 2017, with Cervantes as their qualifying asset at the time. Despite strong drill results generating impressive gold-copper intercepts in 2018, often starting almost from surface, negative mining sentiment didn’t help the story, and the company didn’t follow up with drilling at depth at Cervantes at the time. During 2017, the Tombstone property was optioned, but didn’t see any drilling. Both properties have seen further geophysical surveys and target definition, and after the COVID-19 crash of March 2020, Aztec management made the most of a complete market turnaround, initiated by the huge $2 trillion stimulus package.

The newly incoming Chief Executive Officer Simon Dyakowski enjoyed a recovered share price and a CA$3 million raise in the summer of 2020, and drilling at Tombstone resulted in strong oxide intercepts. Unfortunately, the newly enjoyed positive mining sentiment didn’t follow the continuing general stock market recovery, which went on to new all-time highs until very recently when the Fed decided to utilize a more hawkish stance on rising interest rates, and Aztec was no exception:

Share price 5-year timeframe (Source: tmxmoney.com)

Despite macro economic antics, it looks like the share price is bottoming now. With the current high inflation environment, the negative real rates, being the main (at least for me) sentiment driver for gold, seem stronger than ever. So it looks like the gold price seems set for a move higher soon.

When looking at management and the Board of Directors, the most recognizable name is of course founder and Chairman Bradford Cooke (MSc Geology), who is also the founder and Chairman of Endeavour Silver (CA$883 million market cap, over CA$1.5 billion in May 2021) and Canagold Resources. At the helm is President and Chief Executive Officer Simon Dyakowski (CFA, MBA), who has extensive experience in corporate development and capital markets (RBC, Bank of Tokyo, Salman Partners, and various junior mining companies). He is assisted by Vice President of Exploration Allen Heyl (BSc, P.Geo), who has over 38 years of experience, mostly in the Americas. Allen was important to the discovery and evaluation of over 30 Moz gold and 25 Mt copper, including Marmato-Enchidia (Aris Gold), Motherlode (Corvus/Anglogold Ashanti), Rio Blanco (Zijin Mining), and Tres Cruces and Nueva Condor/Huampar (Oroperu). Management is assisted by a Board of Directors with lots of experience in all relevant fields, and supported by an advisory board with another 70 years of relevant experience.

Some basic information on share structure: Aztec Minerals has a tight 64.96 million shares outstanding, and trades at an average daily volume of 63,000 shares. There are 13.2 million warrants (bulk of it priced at CA$0.40, expiring in August 2022) and 4.845 million options (weighted average price of 25 cents with an average remaining life of 2.1 years), meaning the fully diluted number of shares stands at 83 million shares now. Management and the Board of Directors hold 10%, other insiders 3%, and a few funds and high net worths hold 20%.

The cash position is estimated at CA$2 million, with no debt, and management is looking to raise more depending on drill results. For the last nine months ended Sept. 30, 2021, G&A was CA$1.06 million, which was substantial as exploration expenditures for the same period came in at just CA$1.03 million. Dyakowski had this to say about it: “G&A was higher due to legal fees to negotiate the Cervantes JV. We also had to support the exercise of warrants that expired in July 2021 and October 2020.”

The current share price is CA$0.23, resulting in a current, tiny market cap of CA$14.94 million, and this is one of the reasons I believe this little junior could become a genuine multi-bagger in a year or two. Let’s have a look at their projects to see why I believe this kind of potential could be there.

The Tombstone and Cervantes Projects

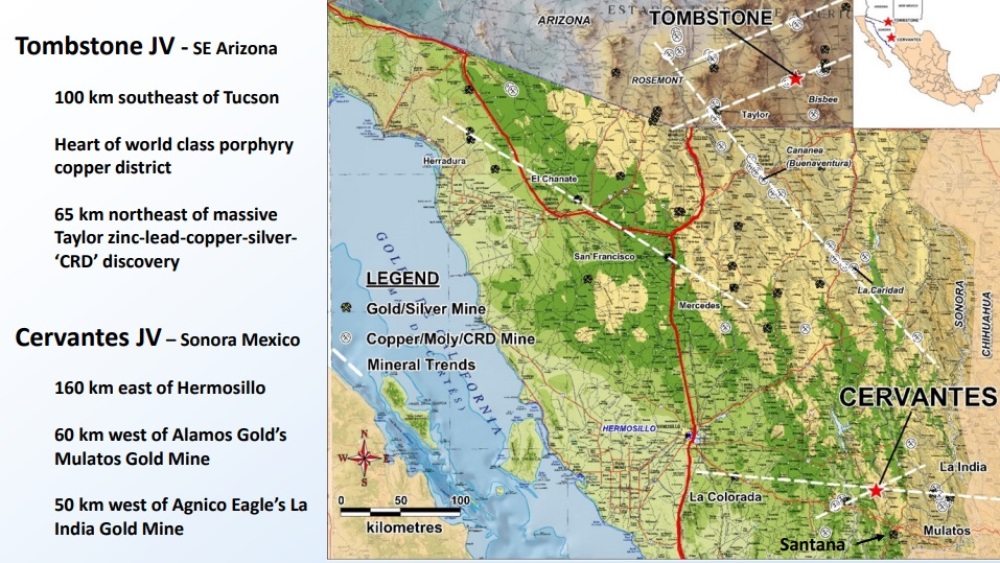

Aztec Minerals has two core assets in its portfolio, which are Cervantes and Tombstone. Both projects are part of a JV, where Aztec Minerals is the operator and majority owner in both JVs, and both projects are located in mining friendly and prolific areas, as can be seen here:

The current flagship project of Aztec Minerals is the 434 hectare Tombstone project in Arizona. The company is the operator of a 75/25 JV with private Tombstone Partners. Tombstone hosts a historical mine from the old days, called the Contention Mine, producing 32 Moz of silver and 240 koz of gold, mostly from CRD deposits and oxide ores between 1878 and 1939. Historic mining was terminated because of lack of technology to counter the water table related inflows at the time.

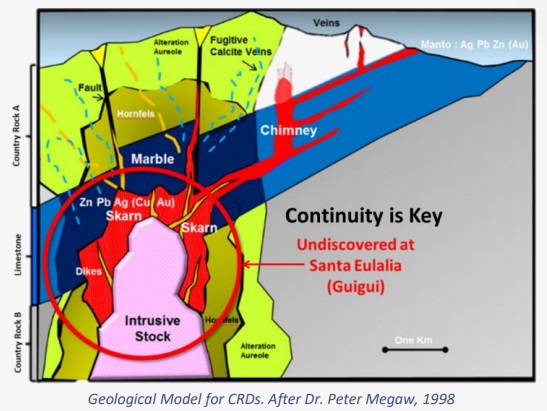

In a nutshell, CRD stands for Carbonate Replacement Deposits, where the orebody is formed by replacement of sedimentary, usually carbonate rock by metal-bearing solutions in the vicinity of igneous intrusions. Igneous intrusions form when magma was forced into older rocks at depth, then cools and solidifies before it reaches the surface. Three common types of intrusion are sills, dykes, and batholiths. In many cases, CRD deposits are close to skarn/porphyry deposits, and often have the shape of vertical chimneys or more horizontal blankets (called mantos). A well-known and nearby example is the large Taylor deposit, discovered by Arizona Mining (taken over by South32 recently for CA$1.8 billion). A schematic section of a geological model for CRDs, developed by Dr. Peter Megaw, who was the first to describe them in his doctoral thesis, can be seen here:

The intrusive stock drawn in the model above usually stands for Cu-Au or Moly porphyry mineralization. Usually in these geological models, the zonation for metals begins with copper/gold/moly at depth, then there is a zinc/lead/silver zone, and more close to surface one can find silver/gold. Quite often, a CRD or porphyry has an oxide gold/silver cap at surface, which is heap leachable, and this is exactly the case at Tombstone (CRD) and Cervantes (porphyry).

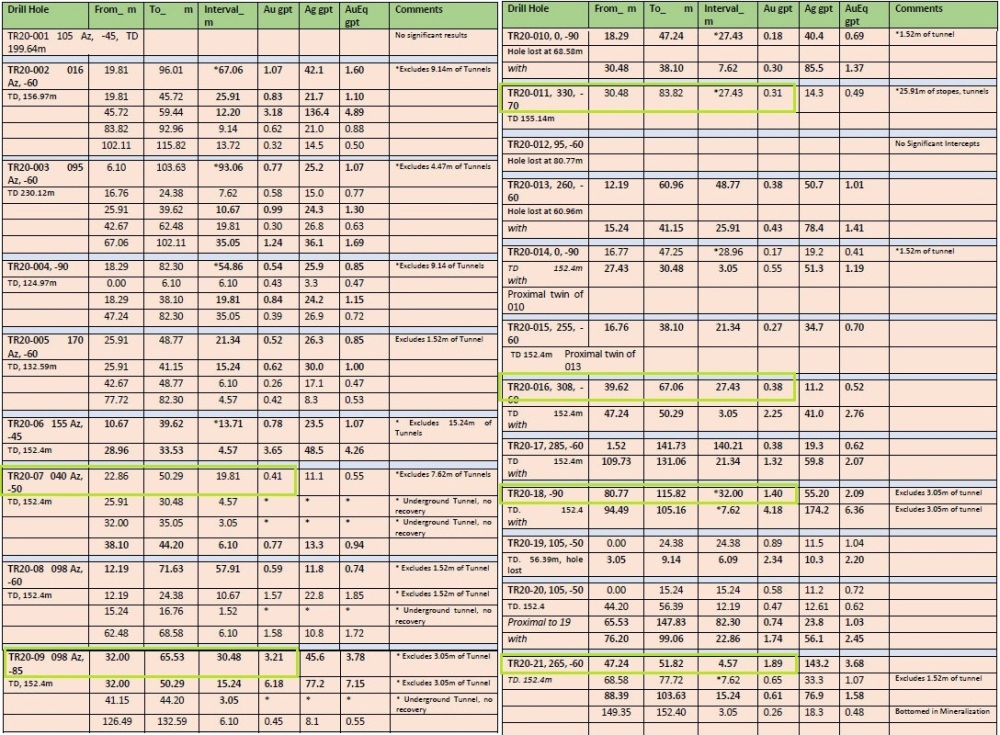

RC drill programs completed in 2020 and 2021 at the Contention pit indicated substantial mineralization, as all but one of the 44 drill holes intercepted gold and silver. Intercepts were often long, and also predominantly longer than the thickness of overburden at each hole, indicating a potentially favorable stripping ratio which could bode extremely well for future economics. For example, the drill results of 2020 are shown in the table below, with only 6 of 21 holes starting at a depth deeper than the length of intercept itself (probably handy to zoom in with your browser):

Highlights are TR20-002: 67m @ 1.07g/t Au (1.6g/t AuEq) from 19.8m, TR20-003: 93m @ 0.77g/t Au (1.07g/t AuEq) from 6.1m, TR20-009: 30.48m @ 3.31g/t Au (3.78g/t AuEq) from 32m, TR20-017: 140.21m @ 0.38g/t Au (0.62g/t AuEq) from 1.5m, and TR20-018: 32m @ 1.4g/t Au (2.09g/t AuEq) from 80.8m. Please note several holes were drilled under significant angles like hole TR20-017 and TR20-018, reducing true width to sometimes even 30% of apparent length. Notwithstanding this, these are amazing results, for sure when taking into account that almost all holes bottomed in mineralization, and that the encountered mineralization was oxidized and heap-leachable. Interesting to see are the intersected historic underground workings, being developments, or (very) high grade veins being mined below the historic open pit.

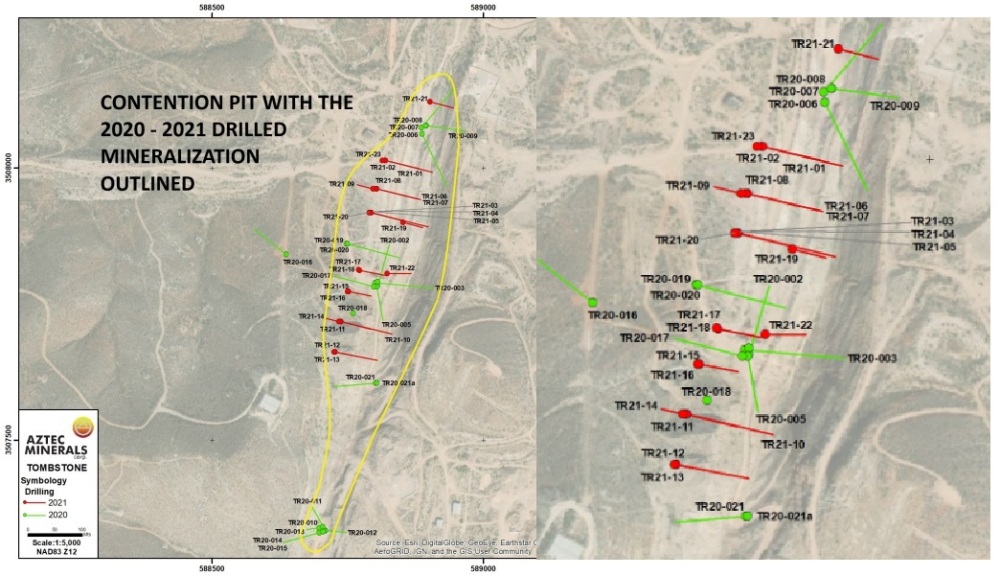

The 2021 program was designed to step out from the 2020 holes, spaced 50 meters apart along fence patterns trending north-northeast, dipping from near vertical to -45 degrees east. The 2020 drill collars are indicated in green, the 2021 collars in red:

The news release from Dec. 7, 2021 provided a complete list of all drill results, and these didn’t exactly disappoint either. Highlights are TR21-03: 32m @5.7g/t Au (6.3g/t AuEq) from 80.7m, TR21-06: 74.7m @ 0.22g/t Au (0.47g/t AuEq) from 83.3m, TR21-10: 96m @1.39g/t (2.2g/t AuEq) from 25.9m, TR21-11: 24.4m @ 1.2g/t Au (2.22g/t AuEq) from 82.3m, TR21-16: 64m @0.8g/t Au (1.03g/t AuEq) from 48.8m, TR21-017: 64m @ 1.73g/t Au (2.53g/t AuEq) from 27.4m, and highlight among the highlights hole TR21-22: 65.5m @ 2.44g/t Au (3.4g/t AuEq) from 21.3m. This last hole was a twin hole from a historic hole, and the result was even exceeding expectations. Please note true width sometimes varies considerably from apparent widths as well in this drill program, as mineralized zones tend to dip from 20 to 80 degrees. Although the most southern-located holes TR20-10 to 15 returned decent intercepts of lower-grade mineralization, these are still economic. Therefore, it seemed reasonable to follow up by “infill-stepout” holes more to the north, but this didn’t happen yet. According to Dyakowski, this was due to more competent rock in that area, so they decided to drill this part later on with diamond drilling, and also to drill deeper which requires diamond drilling to hit targets at depth.

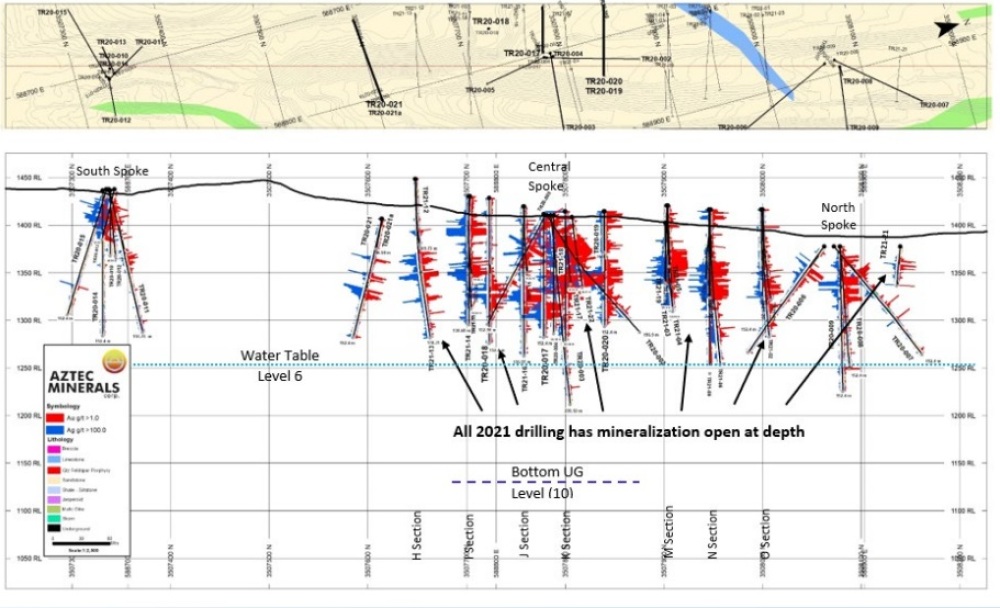

In the following section, it can be observed how consistent the gold mineralization is, and more importantly, is open at depth:

The water table is located at about -150 meters depth, but poses no problem whatsoever with current dewatering equipment. Standard open pit depths are about -200 meters, so there is more exploration potential at depth, but also laterally. The total drilled area now measures 900 meters long by 230 meters wide, and to maximum depths of 200 meters. When doing a back-of-the-envelope guesstimate, this could result in a 900 meters by 150 meters by 50 meters by 2.75 t/m3 = 18.5 Mt mineralized envelope, at an average grade of 1g/t AuEq this could already result in an estimated 600 koz AuEq resource. As the area is open laterally and at depth, I’m curious how far Aztec management can take this.

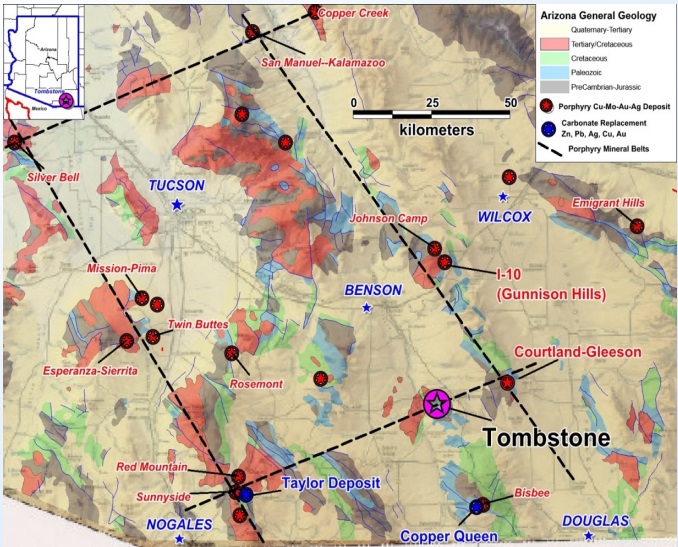

Besides this open pit potential, management firmly believes there could be large CRD type mineralized potential at depth (150 meter to 1,000 meter depth), based on several meaningful deeper drill results which already had results like 7.16m @ 6.5%Pb and 2.6%Zn, indicating high grade CRD mantos, the presence of nearby manganese-silver rich mines, and other polymetallic mines located in the same type of host rock, in this case Paleozoic limestone. Besides this, Tombstone is on the same trend and just 60 kilometers away from the Taylor deposit (Arizona Mining/South 32):

Whereas results and interpretation of Phase 2 RC drilling program tested shallow epithermal gold-silver mineralization, the upcoming Phase 3 drill program is designed to target deeper epithermal gold-silver mineralization below the Contention pit, and the coveted deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments. This program will be scheduled after Cervantes drilling has been wrapped up, and more money is raised according to management.

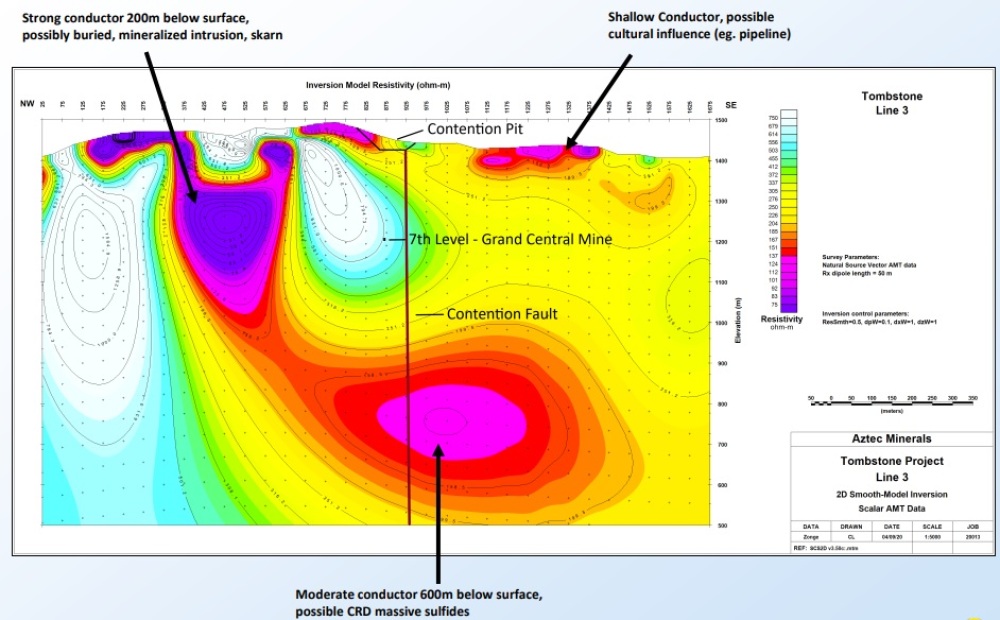

A geophysical survey involving resistivity already outlined a significant target at depth, which can be seen below:

This will be the focus of the deep drilling from the Phase 3 program at Tombstone. For clarity: The vertical brown line is an interpretation of the Contention Fault which runs from north to south along the Contention Pit.

The second project of Aztec Minerals is the former flagship 3,650 hectare Cervantes project, which is a porphyry gold-copper property in mining-friendly Sonora, Mexico, and Aztec Minerals is the operator of a 65/35 JV with listed Kootenay Silver).

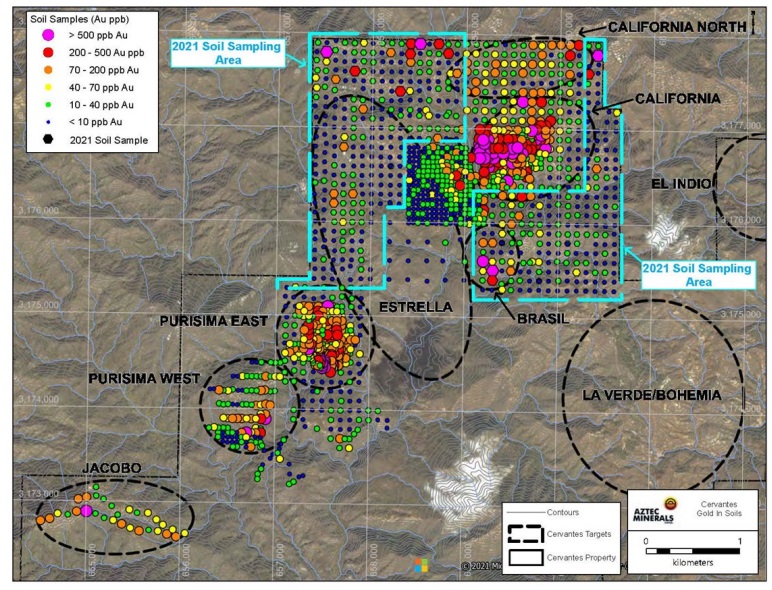

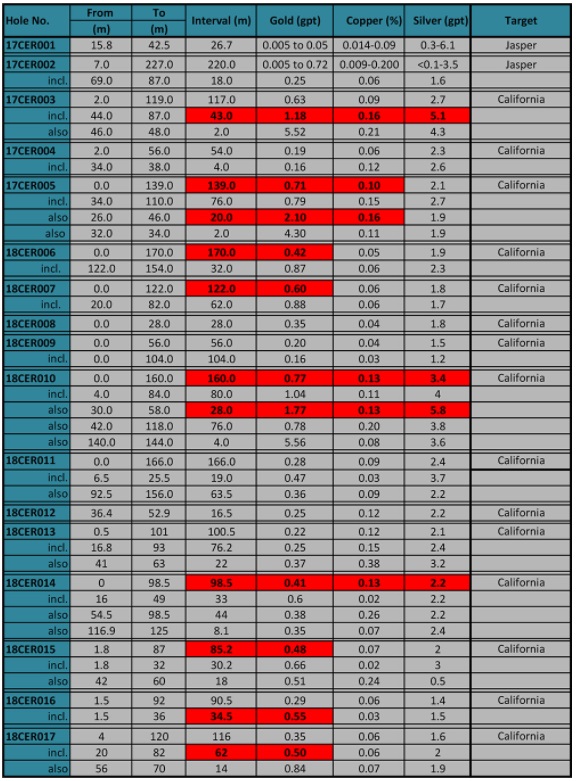

The Cervantes project has already seen a lot of reconnaissance exploration, such as IP surveys, airborne magnetics and radiometrics, but also soil sampling which can be seen on the map below. But only the California target has seen drilling so far, with strong results, as Phase 1 highlights show:

- 160 meters of 0.77gpt Au, 0.13% Cu and 3.4gpt Ag

- 139 meters of 0.70gpt Au, 0.10% Cu and 2.1gpt Ag

- 43 meters of 1.18gpt Au, 0.16% Cu and 5.1gpt Ag

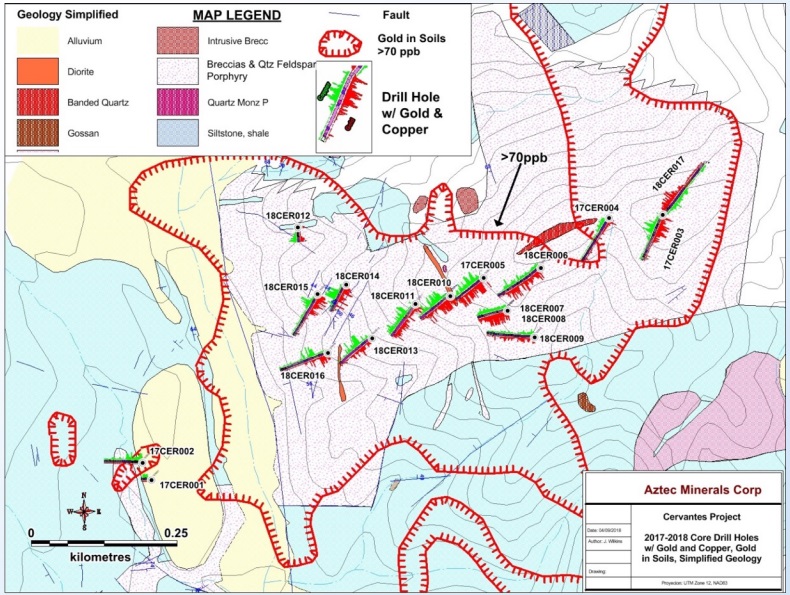

A map with the 2018 drill collars from a 17-hole 2,675 meter Phase 1 program, testing a 900 meters by 600 meters gold in soils anomaly can be found below. All holes intersected gold-copper-silver mineralization:

To get a good grasp on results at California, have a look at the table with the full results from the 2018 program, with the best holes highlighted in red:

It was interesting to read about preliminary metallurgical test work on oxidized drill core, as recoveries were achieved up to 88% for gold, and 78% on mixed oxide-sulphide material. This is extremely good for oxide recoveries and transitional ore recoveries, more standard are 70% to 75% for oxides and 50% to 60% for transitional ore.

Aztec Minerals estimates a drilled area of 800 meters length by 200 meters width to a depth of about 150 meters. As can be seen on the section below, all drill holes were drilled under an angle, but as the surface and thus the mineralization itself are dipping under a gentle angle as well, it can be assumed that true width in the case of Cervantes is 60% to 70% of apparent width. This in turn made me guessing about a 800 meter by 200 meter by 70 meter by 2.75 t/m3 = 30.8Mt mineralized envelope, assuming an average grade of 0.6 g/t Au this would result in an estimated 600 koz Au, excluding copper and silver credits, so slightly more than Tombstone. Not bad at all for an oxide deposit if management can prove this up and hopefully expand these numbers further. But this is not all, as you are probably already aware of potential at depth by now.

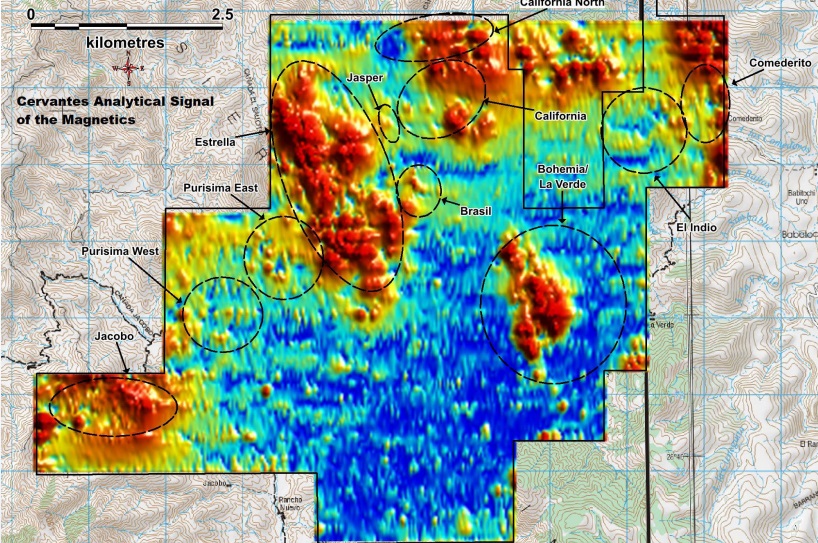

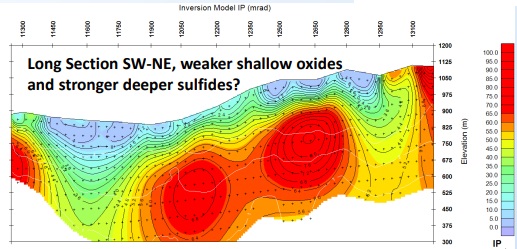

A 12.8 km pole-dipole IP survey was completed in 2016 over 220 hectares covering portions of the California soil anomaly and the Jasper prospect. Strong chargeability anomalies starting from the surface to depths of at least 600 meters were outlined. Such broad, strong chargeability anomalies are often associated with large zones of disseminated sulfide mineralization typical of porphyry copper deposits.

A three-dimensional IP survey covering 520 hectares was conducted in 2019, extending the coverage from the 2016 survey towards the west and southwest covering three additional targets: Estrella, Purisima East, and Purisima West. Impressive and extensive IP anomalies were detected from near surface to depths of 500 meters on all three targets.

Aztec Minerals started a substantial Phase 2 5,000 meter RC drill program on Dec. 14, 2021, and depending on drill results, is looking to delineate a resource estimate on the California, California Norte, Jasper, and Purisima East targets. According to a very recent Jan. 26, 2022, news release, the first 14 holes are completed now, totaling 2,810.6 meters, and results are anticipated in the next several weeks. Two holes of 500 meters depth are planned at California to test the IP chargeability anomaly as pictured above. The balance of the Phase 2 program will test an IP chargeability anomaly at California Norte, and an outcrop at the Jasper target. As Aztec Minerals also identified very large IP chargeability anomalies at depth, it is looking to find large porphyry sulfide gold-copper mineralization there, which will also be explored in the ongoing Phase 2 program, and could very well shape up to be a very interesting wild card for investors.

Wild cards aside for gamechanging opportunities at depth, personally I like the oxide resource potential of say 600 koz to 1 Moz Au for both projects the most, as only one economic oxide project of this size could easily already support a CA$50 million market cap, let alone two. And without any further discoveries at depth included.

Positioned For a Re-Rating

At a current market cap of just CA$15.9 million with about CA$2 million in the treasury, with two realistic chances on an economic oxide deposit AND two wildcard chances on deep, large scale mineralization, plus inflation running wild which could provide gold with a perfect setup for higher levels, Aztec Minerals seems to be positioned well for a re-rating this year. Drill results for Cervantes are due in the second half of February 2022, and a new drill program is planned for Tombstone. In addition, management indicated it is seeking opportunities in safe jurisdictions within the Americas for projects with high quality bulk tonnage gold/silver/copper potential, so an acquisition is not out of the question in 2022, which seems to be shaping up to be another busy year for Aztec Minerals.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.