News Flash, Jan. 27: Forward Water Technologies Corp. on Thursday announced it had signed a non-binding letter of intent to form a joint venture with Membracon Ltd. for delivery of Forward Water's technology within the United Kingdom and Ireland.

Forward Water will provide laboratory, engineering, and system support while Membracon will develop client opportunities.

Forward Water's forward osmosis process can recover clean water from industrial wastewater.

Click here for more information.

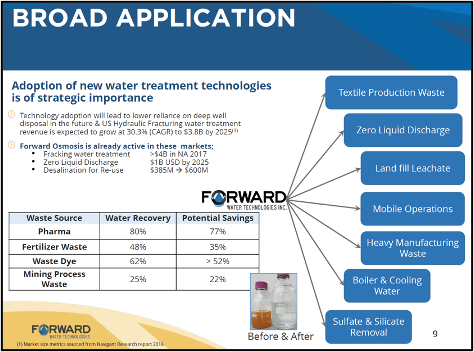

Forward Water Technologies Corp.’s (FWTC:TSX.V) primary business objective is to significantly reduce water usage in many industrial use applications.

The technology is being tested across multiple industries with positive results, reducing water consumption by as much as 90%.

Specifically, Forward Water is evaluating how its technology can add value in the brine mining sector. The company has recently signed two NDAs with major lithium extraction companies having access to large lithium rich aquifer-based brine deposits.

The lithium extraction industry is searching for a solution to excessive water consumption.

“A method dating from the 1950s, Lithium Extraction from Brine has encountered more and more scrutiny because it affects surrounding water reserves and could affect the climate,” reports E&T Engineering.

“A method dating from the 1950s, Lithium Extraction from Brine has encountered more and more scrutiny because it affects surrounding water reserves and could affect the climate,” reports E&T Engineering.

Lithium is “water-mined” by pumping saline groundwater up from the subsurface.

“The problem with this comparatively cheap method is that up to 95% of the extracted brine water is lost to evaporation and not recovered,” continued E&T.

The brines often have very low levels of the target minerals and require significant concentration to be economically retrieved.

Today, this is usually done using solar or forced thermal evaporation, both of which have high energy costs, long processing times, and negative environment effects.

FWT's low energy forward osmosis process can concentrate the valuable materials from these brines with much greater efficiency and at a lower cost.

Extracted clean water can be also reused, sent to replenish the aquifer source, or discharged to the surface for agricultural purposes.

FWT Labs testing indicates that osmosis process can be readily achieved in the lithium sector. In many of the test cases conducted by FWT, over 90% of the water has been removed from the brines.

“The reduction of water in the brines has led to more than a 10 times increase in lithium concentration,” reported Forward Water, “FWT's test cases suggest that the forward osmosis process may enable easier and lower cost downstream processing of these key materials.”

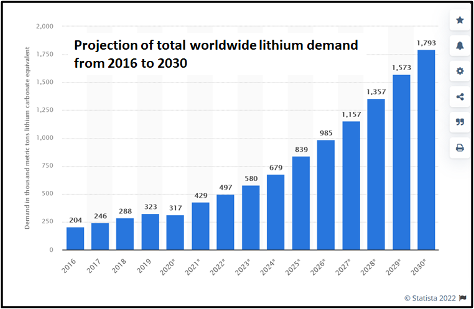

Global demand for lithium is surging.

“While mining companies scramble to increase production from existing facilities and develop new sources of supply, benchmark prices of lithium carbonate ended 2021 at records,” reported Nikkei Asia. “In China, the biggest battery-producing country, the price was 261,500 yuan (just over $41,060) a ton, more than five times higher than last January.”

Streetwise Reports recently spoke with board members Andrew Pasternak, Wayne Maddever, and John Koehle about Forward Water’s technology and business objectives.

Through each of the board members' respective entities, they hold 65.8% of the company's shares.

Pasternak is executive director of GreenCenter Canada, a not-for-profit chemistry Development Center located in Kingston, Ontario. GreenCentre originally licensed the technology from Queen’s University (Kingston, Canada) and was heavily involved in further technology development. GreenCentre remains a 15.4% shareholder of FWTC and Pasternak serves as a board member.

Maddever is a portfolio manager for Bio Industrial Innovation Canada’s investment fund, the Sustainable Chemistry Alliance (SCA), an accelerator located in Sarnia, Ontario. Bio SCA is a 25.2% shareholder of Forward Water. Maddever is a board member and advisor to Forward Water.

Koehle is principal and managing director of FirstLine Venture Partners, a family run venture capital firm. FirstLine is a 25.2% shareholder of Forward Water, and Koehle is a board member.

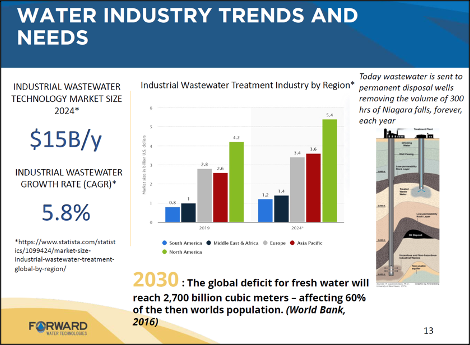

“The technology with Forward Water treats heavily compromised wastewater that can't be dealt with in any other way than burying, burning or boiling,” Maddever said. “We're not talking about municipal wastewater. These are industrial waste streams, found anywhere from heavy industry to the oil and gas industry. They can't be disposed of by normal methods.”

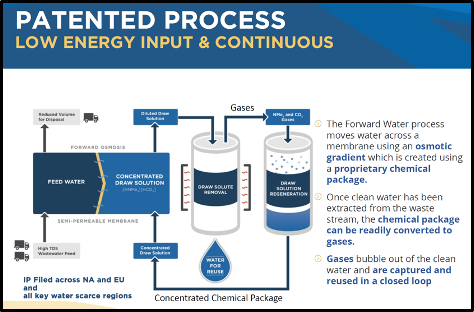

“The Forward Water patented process involves a novel method based on what's called forward osmosis,” Pasternak said. “In most water purification processes, you jam it across a membrane. That is standard reverse osmosis. You have a high pump or a piston, and you push it across the membrane, and only pure water goes through the membrane.

“The Forward Water patented process involves a novel method based on what's called forward osmosis,” Pasternak said. “In most water purification processes, you jam it across a membrane. That is standard reverse osmosis. You have a high pump or a piston, and you push it across the membrane, and only pure water goes through the membrane.

“The problem with that is it can take a lot of energy and money to do that,” continued Pasternak. “Forward osmosis relies on a different process, a more natural process. Water naturally diffuses from a low salt to a high salt gradient. The problem with the traditional forward osmosis method is that you've got to get rid of the salt. What Forward Water patented technology has done is create a forward osmosis method that uses a switchable additive instead of traditional salt. The additive can readily to be converted into a gas and easily recovered and leaving only pure water as the output. This allows you to tackle waste streams that simply would not be possible using traditional forward or reverse osmosis technology.”

We asked Koehle if the company was eligible to receive government funding.

We asked Koehle if the company was eligible to receive government funding.

“Forward Water already received non-dilutive financing from the Canadian government to build a pilot project out in Alberta, to demonstrate the technology in a commercial scale,” said Koehle.

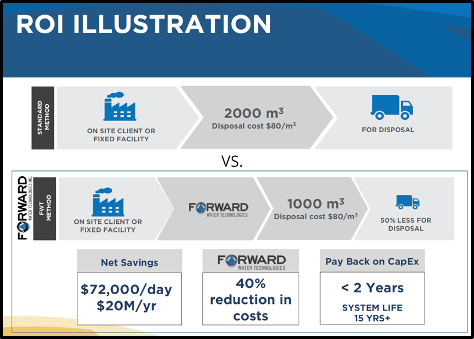

“The business model is basically a build-own-operate model,” Koehle said. “We're providing a service to the company. The unit will be located at a company's facility. They pay for the for the operation on a per cubic meter basis. So Forward water will have a continuous income stream. Every time you install another unit, you've created a cumulative repetitive income stream. The business model is much superior to selling capital goods.”

Streetwise asked about the capital cost of each building unit.

Streetwise asked about the capital cost of each building unit.

“Probably around $1 million,” Koehle said. “Depending how much customization is required, pre-treatment, post treatment, things like that. But ballpark we're targeting around $1 million. The first one will be a little bit more expensive, because of initial engineering. But once you've done that, the cost will go down.”

On Dec. 16, 2021, Forward Water announced a corporate update on the studies being conducted in the FWT labs of its patented forward osmosis technology solution.

Key Operational FWTC Highlights:

- Completed second tranche of its brokered private placement of $1.3 million, in addition to funding from its first tranche of $5.2 million early in the year.

- Completed the reverse takeover of HWCC, which was HWCC's qualifying transaction.

- Resumed trading on the TSX Venture Exchange under the symbol “FWTC.”

- Announced ongoing trials pending in Europe and the United Kingdom and continued collaboration with its partner in India, Goldfinch Engineering.

- Announced that Grant Thornley joined as vice president of Engineering Sales, bringing 20 years of experience in green-focused companies.

“Forward Water Technologies has been seeing rapidly growing interest in various wastewater sectors by saving water from being permanently destroyed, and realizing large reductions in their operating expenses associated with legacy water solutions,” stated CEO Howie Honeyman.

“Forward Water Technologies' proven trial runs, plus initial funds raised concurrently with its go-public transaction, (allow) the Company to pursue its aggressive growth strategy and execute on its business plan,” added Honeyman.

“One of the ideas we are exploring is deploying this technology in the food industry,” Koehle said. “There are a lot of applications that boil off water.”

“One of the ideas we are exploring is deploying this technology in the food industry,” Koehle said. “There are a lot of applications that boil off water.”

“We're working on a technique that would allow the company to run it through a forward osmosis filter and get the water out without changing the taste of the food,” added Koehle. “We see this as potentially profitable.”

Forward Water has 105,600,099 shares outstanding. It is trading at $0.11 with a market cap of $11.6 million.

Disclosure:

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Forward Water Technologies Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Forward Water Technologies Corp., a company mentioned in this article.