Agricultural commodity prices have steadily risen this year as a slew of supply side disruptions continue to hamper the production of several key cash crops. Climate related headwinds including droughts, fires, and floods have caused futures contracts of everything from corn to cotton to steadily rise throughout most of this year.

Recently, the cost of fertilizer has seen an enormous uptick, coinciding with a spike in natural gas prices that threatens to send crop prices even higher. A shortage of natural gas – feedstock for nitrogen fertilizers – has caused several companies across the European continent to announce production curtailments.

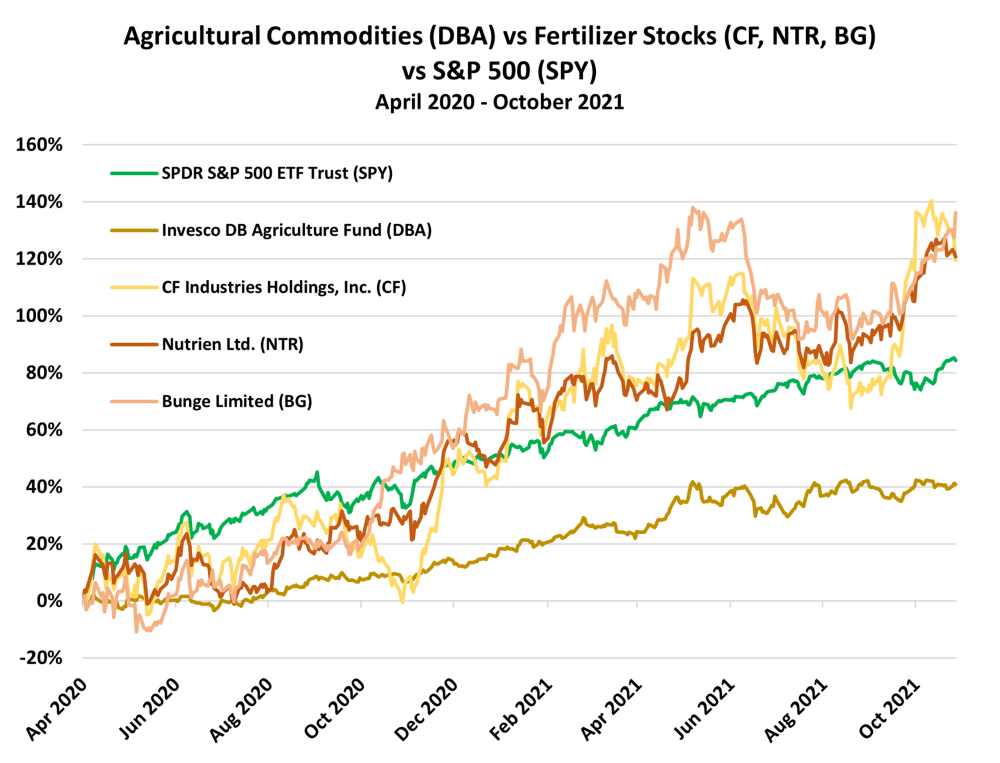

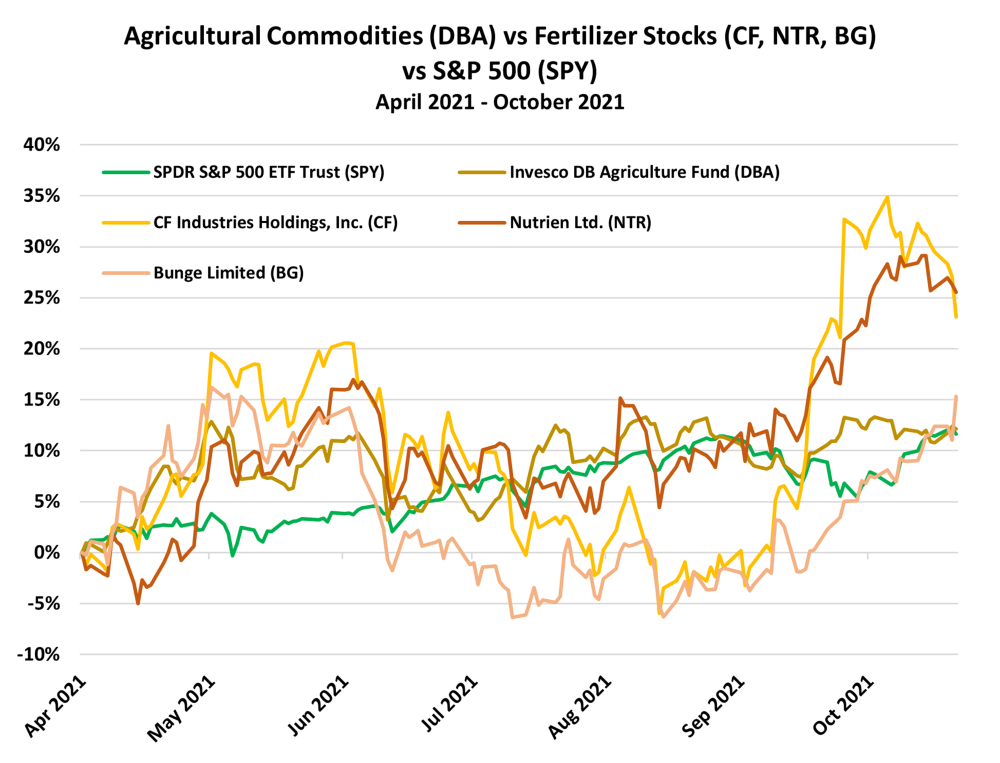

Related ETF & Stocks: Invesco DB Agriculture Fund (DBA), CF Industries Holdings, Inc. (CF), Nutrien Ltd. (NTR), Bunge Limited (BG)

Agricultural Commodities Battle Lingering Disruptions

Farmers across the US West have battled severe drought conditions throughout the year, and the dry weather is not expected to subside any time soon.

Last weekend, heavy rainfall across parts of California, Utah and Arizona helped alleviate some short-term drought impacts, yet major reservoirs and basins remain at historically low levels. According to the US Drought Monitor, even with the increased precipitation, long-term drought conditions will persist.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on October 28.

MRP has previously highlighted both droughts and frost that depleted Brazil’s coffee harvests, noting that weather abnormalities are likely to become more common across different parts of the world, sending crop futures contracts higher.

According to The Wall Street Journal, climate related disruptions across South America have continued to hinder crop production. Drought going on its third year is unlikely to abate, as climate scientists say recent weather patterns heading into rainy season signal further drought in the region next year.

Reduced rainfall and the subsequent weather events that follow in South America have resulted in as much as a 60% fall in the yield per acre of corn, wheat and soybeans. While those numbers can vary across the continent, yields have certainly fallen, on average, in recent years.

Further, the United States Department of Agriculture (USDA) put out their October World Agricultural Supply and Demand Estimates (WASDE) report, painting a bullish picture for some key agricultural commodity futures.

Cotton is trading at its highest level in a decade, driven partly by a post-pandemic surge in demand for consumer goods. The USDA’s most recent outlook noted that supply and demand estimates for US cotton markets show lower production, lower stocks, and higher prices month over month.

The Wall Street Journal notes that China’s appetite for cotton has also contributed to higher costs, as the pace of US sales of cotton to China is 83% greater than the same time last year.

The most recent WASDE report also predicts higher wheat costs as ending stocks for US wheat in the 2021/2022 period are expected to fall to the lowest level since 2007/2008.

While climate related disruptions have become standard in the agricultural industry, a new catalyst has recently emerged that could keep futures contracts climbing next year.

Fertilizer Costs Cause Fear in Ag Markets

Fertilizer, a crucial component in crop production, has been in short supply recently as the industry is the latest to be hit by skyrocketing natural gas prices. Natural gas is used as feedstock for nitrogen fertilizers and typically accounts for 80% of production costs.

Bloomberg reports that in Europe, fertilizer plants have had to temporarily shut down due to soaring natural gas prices, which are nearly six times as expensive as they were a year prior. Fertilizer output has dropped as much as 40% in the region, per The Wall Street Journal.

If natural gas markets fail to figure out how to handle runaway prices, fertilizer plants will not only curtail production further, but permanently close or relocate outside of the region.

In early October, fertilizer futures were above pre-financial crisis 2008 levels. Ammonia, the foundation of nitrogen fertilizers, has hit a thirteen-year high in Western Europe. Progressive Farmer writes that all but one of the eight major fertilizers experienced a price increase of 10% or more month over month, with urea leading the way with a 26% rise.

According to Hoard’s Dairyman, nitrogen-based fertilizer prices are nearly double what they were a year ago, partly due to a curb on exports from China. This has sent the crop planning process into overdrive for the 2022 season, as farmers are looking to lock in a lower price while fertilizer costs jump every week.

To make matters worse, elevated fertilizer prices come at a time when European farmers are at the heart of planting season. Bloomberg notes that the unprecedented costs are already supporting next season’s crop prices, as higher input costs for farmers are expected to be passed onto consumers.

In the US, the Texas Farm Bureau reports that fertilizer prices have jumped anywhere from 50-90%, and if supply chain disruptions persist, corn and soybean seed costs could rise 5-15% in 2022.

Corn appears to be the crop most affected by fertilizer prices. The Wall Street Journal notes that if fertilizer remains this expensive, more farmers are likely to opt next year for planting soybeans, as they require less fertilizer. Estimates from S&P Global Platts show that roughly three million acres of US corn could switch to soybeans next season.

Wheat, oats and barley are some of the other crops sensitive to price swings, according to the USDA.

Theme Alert

Skyrocketing natural gas prices have created a new catalyst for agricultural commodities to move higher. As fertilizer companies continue to curtail production, the cost of fertilizer is likely to remain significantly elevated and hamper crop production.

Worse, climate related disruptions are projected to occur more frequently and increase in severity in the years to come, likely contributing to reduced harvests and higher prices.

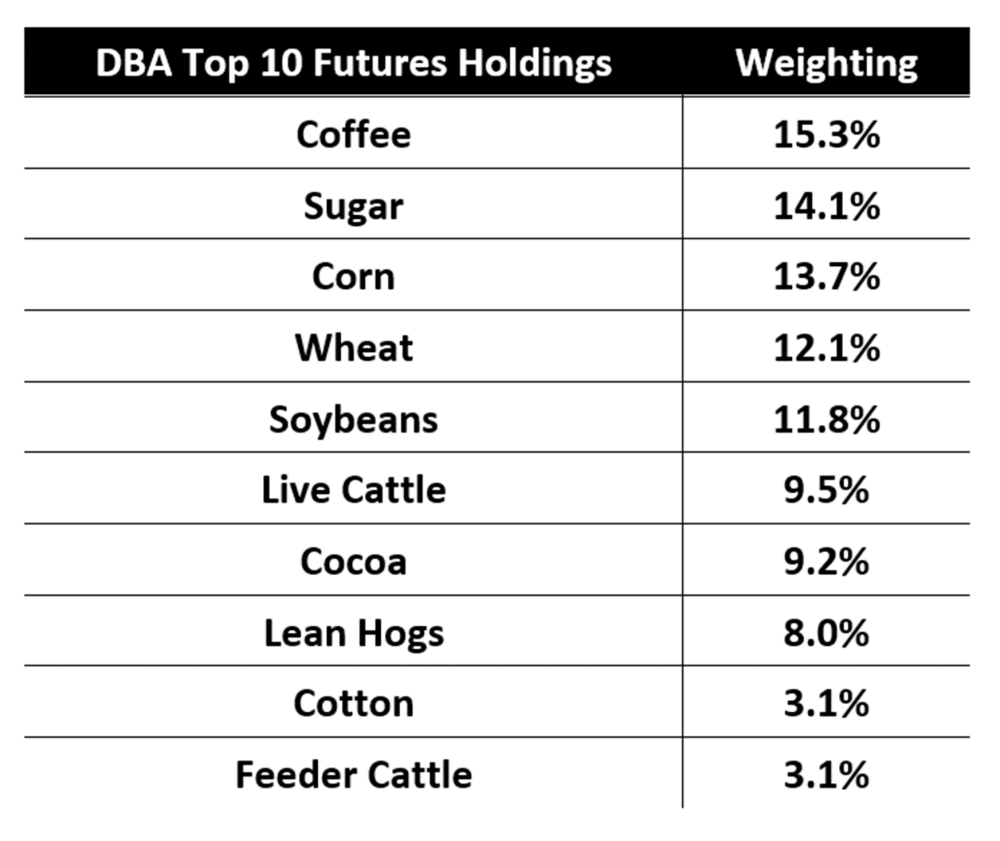

MRP uses the Invesco DB Agriculture Fund to track our LONG Agricultural Commodities theme, which contains the futures contracts of major crops including, but not limited to, corn, wheat, soybeans, coffee and cotton.

MRP added LONG Agricultural Commodities to our list of themes on April 7, 2021. Since then, the Invesco DB Agriculture Fund has returned 12%, slightly outperforming the S&P 500’s return of 11% over that same period.

Originally published October 28, 2021

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Disclosures:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.