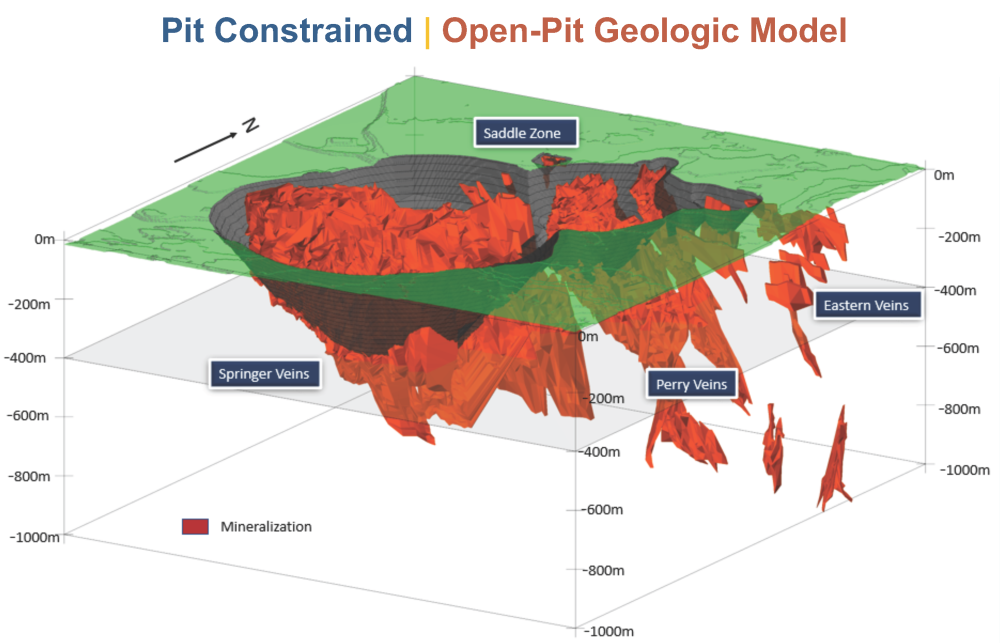

QC Copper and Gold Inc.'s (QCCU:TSX.V; QCCUF:OTCQB) Opemiska Deposit in Quebec consists of 81.7 million tonnes @ 0.88% copper equivalent (CuEq) of pit-constrained Measured and Indicated mineral resources and 21.3 million tonnes @ 0.73% CuEq of Inferred mineral resources. The resource is pit constrained and contains more than 532,000 tonnes (or 1.17 billion pounds of copper and 816,000 ounces of gold) in the Measured & Indicated (M&I) classification and an additional 109,000 tonnes (or 240.3 million pounds of copper and 209,000 ounces of gold) in the Inferred classification.

Over 82% of the total mineral resource reports to the M&I classification. Within the larger resource, the company has identified a high-grade potential starter pit of 10.6 million tonnes of M&I Resources grading 1.26% CuEq. The mineral resources are using pit optimization algorithms and a 0.2% CuEq cut-off, inclusive of US$3.50/lb copper and US$1,650/oz gold prices.

Regarding this accomplishment CEO Stephen Stewart commented to Mining Stock Education that it was a “major milestone and something that we've been working on for years.… to be able to get over that global envelope of 104 million tonnes at 0.85% copper equivalent, which equates to nearly two billion pounds of copper in the ground”…“So, we're over the moon. That's over $8 billion of gross metal value in the ground in the best mining jurisdiction in the world.”

Regarding this accomplishment CEO Stephen Stewart commented to Mining Stock Education that it was a “major milestone and something that we've been working on for years.… to be able to get over that global envelope of 104 million tonnes at 0.85% copper equivalent, which equates to nearly two billion pounds of copper in the ground”…“So, we're over the moon. That's over $8 billion of gross metal value in the ground in the best mining jurisdiction in the world.”

Potential to Double the Resource

Stephen Stewart said QC Copper and Gold will aim to double the size of its approximately 2 billion CuEq pounds deposit. The company has outlined multiple targets for expansion and discovery drilling this coming winter. These targets include extensional drilling to expand the existing mineral resource envelope, proximal former mines including the adjacent Cooke & Robitaille deposits, and other prospective targets along the Gwillim and Beaver Lake fault zones.

Stewart stated, “This is going to get bigger. There is no question about it.…Our shareholders and followers can expect us through the balance of this year and obviously 2022 to get out there and expand in and around this super-pit.”

Opemiska Catching the Eye of Producers

Opemiska is receiving interest from producers and potential strategic partners, Stewart shared. However, he is not willing to give away too much of Opemiska’s value too early:

In terms of getting interest from producers, we've had, over the past year or so, a lot of interest. Smart money, smart investors have taken notice, but also strategics. So we have shown them our database. Prior to this resource, we have had some very interesting phone calls when the resource came out. We certainly entertain interest from strategic partners, but it would have to be on the right terms. To be honest with you, all else equal, there's ample capital available to us today from institutional and retail investors. I think that's the best course for us not to get married immediately. So that's probably the route we'll take. And when the time is right, when we build the value, when we are, multiple nine figure valuation, that's when we could consider getting a dance partner, if you will.

Potential CAD$500M Valuation says Stewart

Before the release of the Opemiska resource last week, QC Copper and Gold was valued at less than a CAD$30 million. Stewart believed the company was deeply undervalued then, especially because QC Copper and Gold also owns about CAD$14 million worth of Baselode Energy (TSXV:FIND) shares. But even after a nice share price rise since the resource announcement, Stewart argues his company is still grossly undervalued and is best compared to Marathon Gold with its Valentine Gold project:

To me, the best comparable is Marathon Gold. So Marathon's got six to seven million ounces. They're bigger than us right now. They're a touch higher grade, but in the seven to eight-hundred-million-dollar market cap range. That's a bold statement from a company that's got about a CAD$30 million market cap. But when you look at the assets, we're not that far off. And so we're day one, we got a ways to go. We're going to grow this resource, but to me, that's the target. I think this thing has a $500 million valuation on it, all else equal. Well, that's the direction I'm going to take this company.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

[NLINSERT]

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: QC Copper and Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: QC Copper and Gold is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.