Crescat Capital's Tavi Costa, Portfolio Manager, and Kevin Smith, Chief Investment Officer, purported that China is heading for an economic collapse, and several metrics are signaling this.

"We're definitely hitting a point of where credit growth in China is hitting a limit."

For one, China's industrial production of crude steel has declined year over year. It's the largest drop since the global financial crisis and reset of China's credit environment, and the plunge is steeper than it was during the yuan devaluation. China's ore imports are declining, too.

"We're definitely hitting a point of where credit growth in China is hitting a limit," Costa said. "That's what's happening with Evergrande."

The Evergrande Group, the largest property developer in China with debt that is equivalent to $300 billion, just defaulted on a payment on a dollar bond. This is significant because it affects the broader Chinese population, Smith noted.

"This is China's Lehman," he added, referring to the U.S.' Lehman Bros. bankruptcy filing in 2008. "It's happening right in front of our faces right now."

Two, whereas Chinese equities and China's trading balance margins used to generally move in concert, today, they're moving in separate directions. Equities are declining, and trading balance margins are increasing. The last time this divergence happened, it led to a major devaluation of the yuan, Costa noted.

"The U.S. already is experiencing effects of what is happening in China."

Also showing an atypical divergence is the gold price and gold miners' stock, the former decreasing and the latter increasing. Costa noted that Chinese citizens are prohibited from freely buying gold or any other commodity to protect against capital erosion.

"China is having its reckoning moment," Smith said. "We believe it's going to translate into a massive People's Bank of China liquidity injection, money printing, currency devaluation and hyperinflation." All of this will impact the rest of the world.

The U.S. already is experiencing effects of what is happening in China, Smith and Costa noted.

Emerging market stocks are starting to fall apart, leading the way to possibly a major deceleration of growth in the U.S. The Federal Reserve wanting to taper compounds the situation. Brazilian stocks are "beginning to fall apart," Costa pointed out, and further decline is expected in the emerging markets as a whole.

The Dow Jones Transportation Index is bearishly diverging from the Standard & Poor's 500, which also happened during the tech bubble. Even though transportation is a small portion of the market, it tends to lead it.

"We're seeing parts of the markets starting to break down, and the S&P continues to be at, what, 3% from all-time highs," Costa said.

The U.S. can expect rising inflation, as evidenced by the housing data component of the Consumer Price Index and in major growth in wages and salaries.

"There's a major growth in wages and salaries, and I think that that's underpinning this issue with structurally inflationary forces moving higher here in the U.S.," Costa said.

Yields in China's corporate bond market are spiking. While similar yields in the U.S. are much lower, they tend to move in sync with China's, indicating the same upward trend is likely to occur in the States as well.

The U.S. stock market, with accounts for 200% of gross domestic product, is in a bubble, one of the country's biggest ever. Valuations are not sustainable.

"I think it's going to start melting down here," Smith added. "People are going to rotate out of overvalued stocks, and they're going to rotate into gold. It's still going to be getting the safe haven bid."

"We called it blood in the streets ... because they wanted to buy gold and silver stocks."

Such an event happened during the COVID-19 crash in March 2020 and also in 2008, when Lehman went under and took gold and silver down with it.

"We called it blood in the streets at that time not because we wanted to buy stocks at large but because they wanted to buy gold and silver stocks," Smith said. Whereas gold and silver are not down to the bottoms of March 2020, the same trend is happening.

The current global macroenvironment continues to validate Crescat Capital's three-pronged investment advice, Smith said, and following it is the way to prepare for a "China crash." The firm recommends being short the Chinese yuan, being short overvalued U.S. megacap growth stocks and the S&P 500 Index, and being long precious metals.

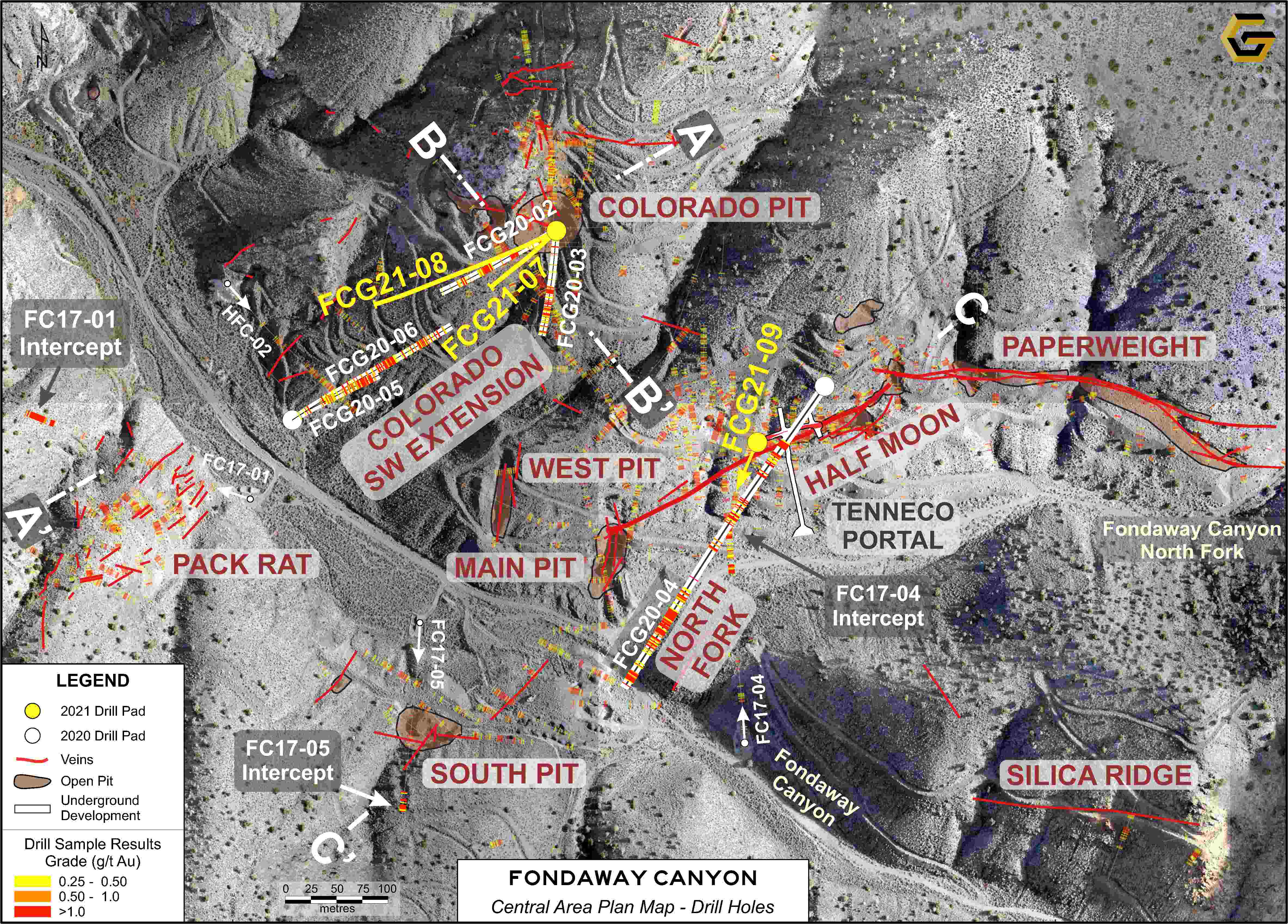

Crescat Capital follows its own advice. It is positioned in its Global Macro Fund for a major currency devaluation with its put options on the Chinese yuan and the Hong Kong dollar. The firm also is short U.S. equities. It is long tangible assets and precious metals, and has a sizable portfolio of gold and silver exploration companies, many of which Quinton Hennigh, Crescat's Geologic and Technical Director, provided updates on later in this broadcast.

"Why can we be confident buying gold and silver stocks here? Because we know that the Federal Reserve and, in China, the PBOC are going to come in with massive new amounts of quantitative easing and money printing to deal with these problems," Smith added.

Read part two of the Sept. 20 briefing, including Dr. Quinton Hennigh's recap of 14 companies with "fantastic results."

[NLINSERT]

Streetwise Reports Disclosures:

1) This is contributed content from Crescat Capital compiled by Doresa Banning for Streetwise Reports LLC. Doresa Banning provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None. Her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Important Crescat Disclosures Provided by Crescat Capital

Please read Crescat’s important disclosures.

Nothing herein should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies are included for informational purposes only and are provided as a general overview of Crescat’s general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of Crescat’s strategies or of the entirety of its investments.

Crescat has compiled its research in good faith and while it uses reasonable efforts to include accurate and up-to-date information, it is provided on an “as is” basis with no warranties of any kind. Crescat does not warrant that the information on this site is accurate, reliable, up to date or correct. In no event will Crescat be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of its data.

You should assume that as of the publication date, Crescat has a position in the securities discussed and therefore stands to realize significant gains in the event the price of security moves. Following the publication date, Crescat intends to continue transacting in the securities, and may be long, short, or neutral at any time.