Red Metal Resources Ltd. (RMES:OTCBB) is a copper explorer, working in the Coastal Cordillera of the III Region of Chile.

Streetwise Reports recently spoke with Red Metal President and CEO, Caitlin Jeffs, P.Geo. Jeffs is a veteran geologist, originally from Vancouver, who now lives in Thunder Bay.

"Geology takes you all over," recalled Jeffs. "You end up in strange places."

Jeffs worked for Placer Dome for three and a half years.

"It was a great experience," stated Jeffs. "Working for a major, you see things that you don't get to see if you're strictly exploration."

Jeffs and her husband started a geological consulting company. The team has stuck together and launched multiple public companies.

"If you have a group that works well together, you're going to have more success," stated Jeffs. "Most of the juniors, they have limited funds and therefore limited opportunity to build a stable team. They do work piecemeal, hiring consultants and geologists on the fly."

Jeffs' team is working on three different juniors. Jeffs runs Red Metal in Chile. Her husband, Michael Thompson, runs Kesselrun Resources, exploring gold in Ontario. The third partner, Neil Pettigrew, is VP of exploration and a director of Palladium One Mining that is developing projects in Ontario and Finland.

"We all know each other's strengths and weaknesses," stated Jeffs, "which is beneficial when you're running complex exploration projects in multiple jurisdictions."

Surging Demand Anticipated

Goldman Sachs believes the copper price is "poised for the next leg higher" as short-term headwinds fade and fundamentals point to a significant demand boost further out," reported Mining.com.

The copper concentrate market remains very tight, creating projections of a 430,000-tonne refined deficit in the second half of 2021.

Key Highlights of Chilean Copper:

- Chile's III Region was the mining center for copper, gold, and silver starting in the 16th century

- Chile is the world's leading copper producing country

- With the discovery of large porphyry deposits inland, mining halted on the Coastal Cordillera

- Mechanized mining methods and exploration techniques have improved over the last century, providing the region with new potential

- Present-day mining includes large iron mines and revived small-scale copper, gold, and silver mines as well as several large iron-oxide, copper-gold mines, such as Candelaria and Mantoverde

- Compared with jurisdictions such as Ontario, Canada, the Coastal Cordillera of Chile remains relatively unexplored

Chile's Escondida conventional open-pit mine is currently the world's top copper producer.

Located in the northern Atacama Desert 3,050 meters above sea level, it is a joint venture between BHP (57%), Rio Tinto (30%), a Japanese group (10%), and the International Finance Corporation (2.5%).

The Collahuasi copper mine, also in northern Chile, is the world's second biggest-producing copper mine. It is jointly owned by Anglo American (44%), Glencore (44%), and Japan Collahuasi Resources (12%).

These monster mines cannot meet surging global demand. According to commodities trader Trafigura Group, meeting demand would require building the equivalent of eight projects the size of BHP Group’s giant Escondida in Chile, the world’s largest copper mine.

"A deficit in the copper market is set to deepen over the next several years as supply of the widely used metal struggles to keep up with strong demand from the power and construction sectors, compounded by the proliferation of electric vehicles," reports S&P Global Market Intelligence.

The Chilean desert has provided the world with copper for a long time, but it's expensive for juniors to work at high elevations. Because of the cold winters, the work is seasonal and it's hard to recruit people to work at remote inhospitable locations.

"We are focused on the Coastal Cordillera area," stated Jeffs. "We're only 25 kilometers from the coast. Historically, there has always been copper mined in this region. They are generally smaller deposits, but they're higher grade. There are significant benefits, cost savings, because we can explore year-round."

In 2007, Jeffs was asked by an investment group to inspect some projects in Chile. She was surprised how little exploration had been done on the properties.

"In Chile there were relatively few drill holes," recalled Jeffs. "So, I wrote my report, and the investment group picked up initially 66 hectares. I joined the technical team and ended up becoming management."

Jeffs learned how difficult it is to acquire ground in Chile.

"It took us another decade to acquire a land package large enough for me to have confidence we could actually find a deposit," stated Jeffs. "Chile has a complicated land tenure system where you can own exploration claims, but somebody else might own the mining rights. I wanted to make sure all our claims had secure mining rights."

We asked Jeffs about the historical work that has been done on the Chilean property.

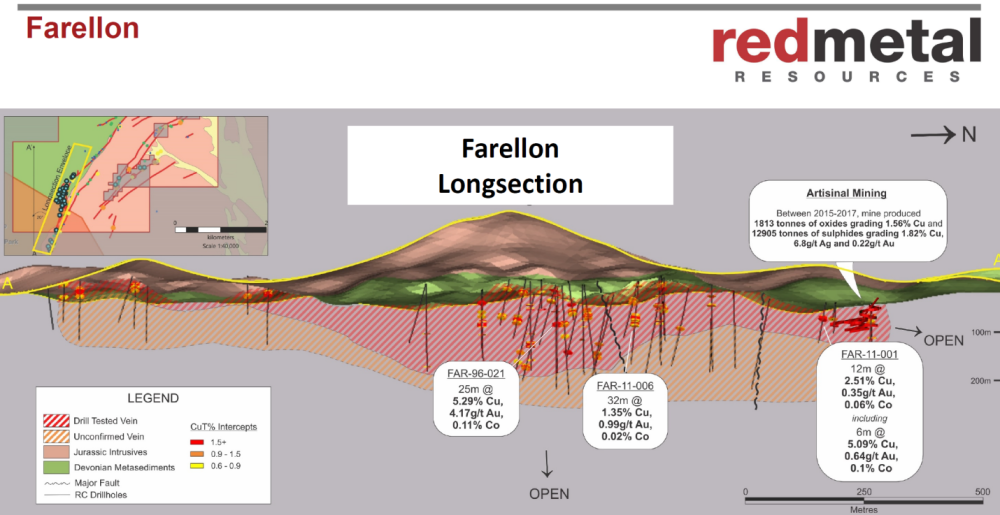

"The original 66 hectares had been drilled in 1996 and 1997 by an Australian company. It drilled approximately 4,000 meters, to about 150 meters vertical depth — outlining a 1.5-kilometer strike length of mineralized veins."

Knowing that the historical grades were economic, Jeffs and her team twinned five of the historical holes, to confirm the accuracy of the old assays. Then they raised some money and drilled another 3,000 meters.

"Having acquired the land package, and having confidence in the structure of the ore body, we're looking to raise enough money to develop a maiden resource and expand upon it as the full resource potential remains largely untapped" stated Jeffs.

Savvy resource investors always monitor local politics.

Chilean presidential primaries in mid-July, 2021, propelled leftist former student leader Gabriel Boric and center-right Sebastian Sichel as the front runners in November's general election.

"On the left, underdog Boric, 35, a lawmaker with more moderate views who hails from the Patagonia region of far-southern Chile, garnered 60% of the vote in the primary, soundly defeating Communist party contender and Santiago-region Mayor Daniel Jadue," reported Reuters.

"On the right, independent Sichel, 43, a former Cabinet minister and president of Chile's Banco del Estado who sports a tattoo of a trout on his forearm and began the race as an underdog, bested conservative mayor and two-time presidential candidate Joaquin Lavin, taking 49% of the vote in a four-way primary," added Reuters.

These two young sophisticated politicians are vying to succeed right-leaning President Sebastian Pinera, who is serving his second non-consecutive term.

"One of our board members is a Canadian who is part owner of a law firm in Chile," stated Jeffs. "He caters specifically to foreign companies seeking a balance between the Chilean legal system and their home country's legal system. He benefits from having all bilingual lawyers. We get expert political insights from him."

Chile's politicians get elected to three-year terms, and cannot run in successive terms.

"Three years is pretty limiting in terms of consolidating political power," clarified Jeffs. "The country can't lurch too far to the left or the right. Chile tends to bounce around in the middle ground."

Jeffs predicts that royalty structure in Chile will change, echoing what is happening over the world.

"Big companies will have to cough up more," confirmed Jeffs. "But Chile understands that, over the years, mining has been extremely beneficial to the economy. I don't think that relationship will be fundamentally damaged."

On July 21, 2021, Red Metal announced that it has filed a preliminary nonoffering prospectus with the British Columbia Securities Commission.

Red Metal has applied to list its common shares on the Canadian Securities Exchange (CSE).

In the past year, Red Metal added a VP of corporate finance and completed a subscription receipt financing, which is conditional on listing on the CSE or another recognized stock exchange in Canada.

"Our goal is to find a high-grade mine that can be developed quicker, for a lower price than the larger porphyry deposits," stated Jeffs. "We think there's a market for that if copper demand continues to skyrocket, due to electric vehicles, and the electrification of everything."

Smaller deposits are predicted to make up an increasingly large percentage of the copper supply. A lot of this supply will come from Chile.

Red Metal has only 47 million shares outstanding of which about 30% is owned by insiders and management. A number of key investors also own large chunks of the company, with about 4 million shares in the public float.

[NLINSERT]

Disclosure:

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Red Metal Resources Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Red Metal Resources, a company mentioned in this article.