Gold Explorer's Grab Sampling Extends Mineralized Corridor at Quebec Project From 60 Meters to 4.2 Kilometers

Source: Streetwise Reports (09/08/2021)

"At Quebec Precious Metals' Lloyd discovery area, results received from 2021 summer surface sampling program highlight several gold discoveries."

"At Quebec Precious Metals' Lloyd discovery area, results received from 2021 summer surface sampling program highlight several gold discoveries."

read more >

Explorer Generates $600K From First Tranche of Private Placement

Source: Streetwise Reports (09/08/2021)

Cortus Metals plans to use the funds to continue exploring its Nevada properties.

Cortus Metals plans to use the funds to continue exploring its Nevada properties.

read more >

Explorer Plans More Drilling For 2021: Epithermal Gold Targets in Lineup

Source: Streetwise Reports (09/07/2021)

Various targets "continue to emerge in the southwestern portion of Aurania Resources' Lost Cities–Cutucu project," a Noble Capital Markets report noted.

Various targets "continue to emerge in the southwestern portion of Aurania Resources' Lost Cities–Cutucu project," a Noble Capital Markets report noted.

read more >

Group Ten Metals: Heritage Mining Acquisition Is a 'Great Deal for Both Parties'

Source: Maurice Jackson for Streetwise Reports (09/03/2021)

Maurice Jackson spoke with Michael Rowley, CEO of Group Ten Metals, about Heritage Mining Ltd.'s deal to acquire up to a 90% interest in Group Ten's Black Lake-Drayton gold project in Ontario, Canada. According to the details, Heritage is poised to make payments of 7.2 million shares and CA$320,000 to Group Ten Metals, complete the exploration & development work, and grant Group Ten a 10% carried interest in the project through completion of a feasibility study.

Maurice Jackson spoke with Michael Rowley, CEO of Group Ten Metals, about Heritage Mining Ltd.'s deal to acquire up to a 90% interest in Group Ten's Black Lake-Drayton gold project in Ontario, Canada. According to the details, Heritage is poised to make payments of 7.2 million shares and CA$320,000 to Group Ten Metals, complete the exploration & development work, and grant Group Ten a 10% carried interest in the project through completion of a feasibility study.

read more >

Analyst Says No End in Sight to Gold Discovery Potential at Idaho Black Pine Property

Source: Streetwise Reports (09/02/2021)

Haywood Capital Markets commented in a research report that the newly announced discoveries at Liberty Gold Corp.'s Black Pine Project highlight the unbounded nature of the underlying gold system. Haywood rates Liberty Gold as a "Buy" and recommends accumulating shares at current price levels.

Haywood Capital Markets commented in a research report that the newly announced discoveries at Liberty Gold Corp.'s Black Pine Project highlight the unbounded nature of the underlying gold system. Haywood rates Liberty Gold as a "Buy" and recommends accumulating shares at current price levels.

read more >

Gold Producer Maintains Full-Year Guidance Despite Challenging H1/21

Source: Streetwise Reports (09/01/2021)

Even though to meet this guidance, Kopy Goldfields must achieve significantly higher production in this year's second half, "we believe H2/21 will show such growth," an Edison Investment Research report noted.

Even though to meet this guidance, Kopy Goldfields must achieve significantly higher production in this year's second half, "we believe H2/21 will show such growth," an Edison Investment Research report noted.

read more >

Junior Miner Has Drills Turning and a New Company Spinning Off

Source: Streetwise Reports (09/01/2021)

Fabled Silver Gold continues successful exploration in Mexico while preparing to spin off its copper project in Canada.

Fabled Silver Gold continues successful exploration in Mexico while preparing to spin off its copper project in Canada.

read more >

Gold Is Hot, Cryptocurrency's Not, According to These Two Experts

Source: Streetwise Reports (08/31/2021)

With inflation on the rise and gold at $1,700 an ounce, now is a good time to invest in gold, billionaire hedge fund manager John Paulson proclaimed — and Mark Mobius, founder of Mobius Capital Partners, strongly agrees.

With inflation on the rise and gold at $1,700 an ounce, now is a good time to invest in gold, billionaire hedge fund manager John Paulson proclaimed — and Mark Mobius, founder of Mobius Capital Partners, strongly agrees.

read more >

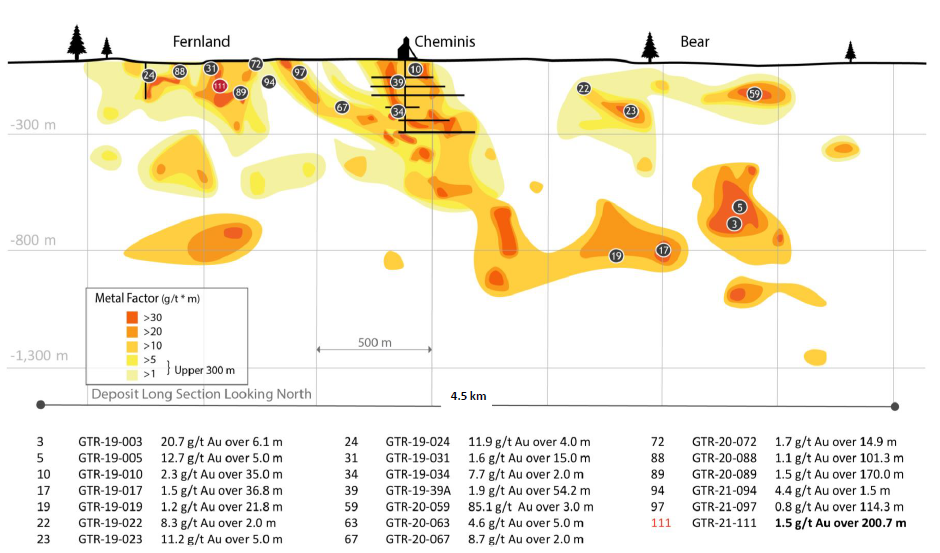

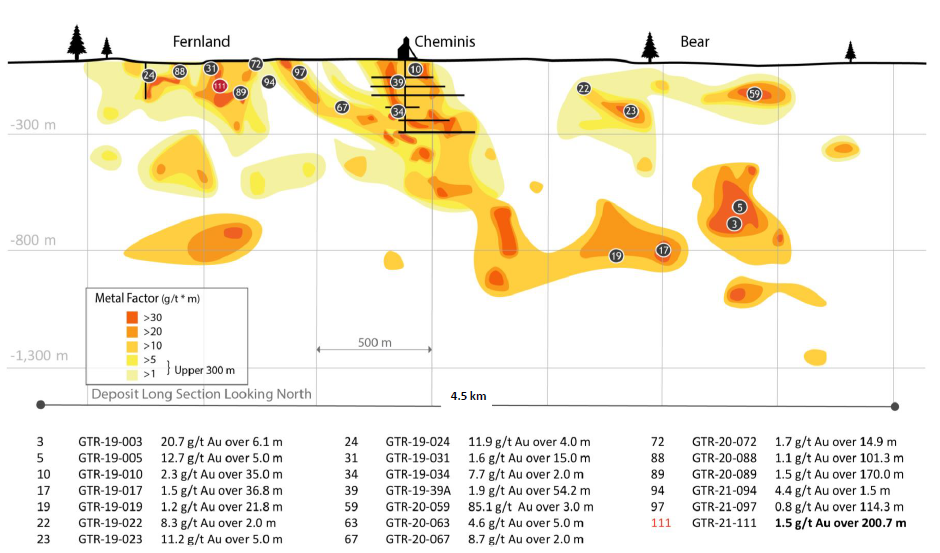

This Canadian Gold Company Is Transforming Three Deposits Into One Mineralized System

Source: Streetwise Reports (08/31/2021)

Gatling Exploration’s CEO, Jason Billan, answers the big questions about the company’s high-grade gold deposit in Ontario.

Gatling Exploration’s CEO, Jason Billan, answers the big questions about the company’s high-grade gold deposit in Ontario.

read more >

'Drilling Update Reminds of Resource Upside at Juanicipio,' Analyst Says

Source: Streetwise Reports (08/31/2021)

Results of MAG Silver's 2020 drill program at its Mexico joint venture project Juanicipio are interpreted in a National Bank of Canada report.

Results of MAG Silver's 2020 drill program at its Mexico joint venture project Juanicipio are interpreted in a National Bank of Canada report.

read more >