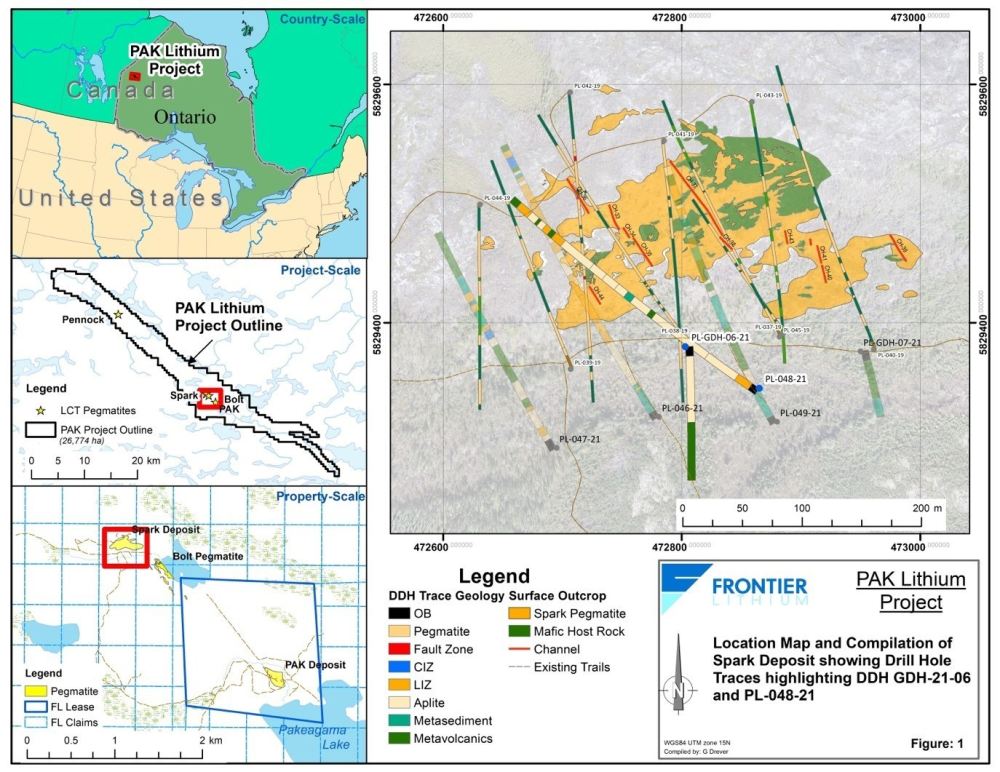

Frontier Lithium Inc. (FL:TSX.V; LITOF:OTCQX; HL2:FRA) is developing its 100%-owned 26,774-hectare PAK Lithium asset in Ontario, Canada.

The massive PAK Lithium Project is situated at the south end of Ontario's Electric Avenue, hosting premium lithium-bearing pegmatites.

“The Project covers 65 km of the avenue length and remains largely unexplored,” states Frontier Lithium, “However, since 2013 the company has delineated two premium spodumene-bearing lithium deposits (Pak and Spark) located 2.3 km from each other.”

“Frontier’s exploration target was to identify a minimum 20-million-tonne, high-grade, low-impurity resource base on the project to enable future participation in the battery material supply-chain,” Frontier Lithium CEO Trevor Walker told Streetwise Reports. “We have accomplished that target by delineating a 30-million-tonne resource and now are focused in-fill drilling as a requirement of future feasibility to convert from resource to reserve and have the critical mass required to build a vertically-integrated supply of lithium chemicals.”

With North American EV car makers and battery-manufacturers searching for local supply chains, Frontier Lithium's objective is to become a strategic domestic supplier of battery-grade lithium hydroxide and other chemicals to the growing electric vehicle and energy storage markets in North America.

“You look at the cost of the electric vehicles, about 30% is the battery itself,” explained Walker. “When you look at the cost of the battery, approximately half of it is the required minerals.”

“We are fortunate because we have the critical minerals as well as a strong manufacturing presence in Canada, two key factors to build upon. In addition, we also have a strong consumer base here in North America, a key market that auto OEMS are betting on with their planned investments and future vehicle rollouts,” added Walker.

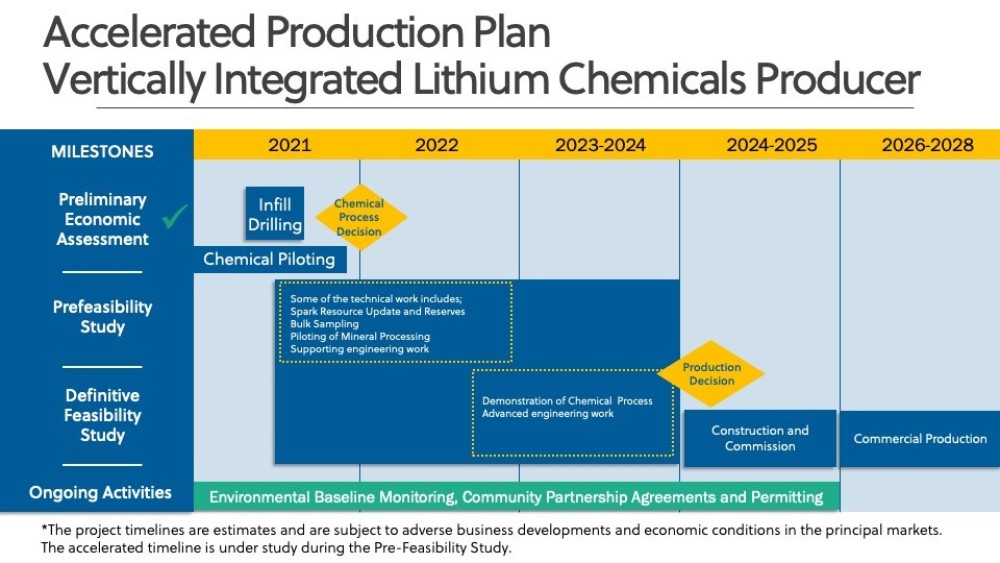

In February, 2021, Frontier released results from a Preliminary Economic Assessment (PEA) which reported a pre-tax Internal Rate of Return (IRR) of 27%.

The IRR is a metric used in financial analysis to estimate the profitability of investments. The metric is ideal for analyzing capital budgeting projects to understand and compare potential rates of annual return over time.

A PEA answers the question, "How best can this deposit be developed and operated to maximize profits for investors?"

“Currently, we are addressing recommendations listed in the PEA for the mine and mill and downstream chemical plant by advancing our work to a PFS level and expect to have that accomplished by mid-2022,” stated Walker. “The PEA results were solid, but we see room for improvement that is only achieved by further investment on the ground and in the labs.”

The PEA anticipates a mine-to-lithium hydroxide chemical/hydromet plant facility in the Great Lakes Region of North America, assuming a hydromet plant that would convert spodumene concentrate feedstock sourced from open-pit mining and a milling facility at the PAK Lithium Project.

Highlights of the PEA (in $USD unless otherwise stated) include:

- Life of project revenue of $8.52 billion over 26-year total project life

- Total initial capital expenditure estimate of $685 million with a contingency of 22.5% included

- Sustaining capital of $117 million

- Post-tax NPV8 of $974.6 million and IRR of 21%

- Annual average EBITDA (steady-state) of $225 million

- Chemical plant producing 23,174 tonnes of battery-quality lithium hydroxide monohydrate (LiOH-H2O) per year with an average selling price of $13,500 per tonne

- A total of 556,200 tonnes of LiOH has been contemplated being produced from open pit mining only at the PAK and Spark deposits

- PAK and Spark deposits are open in all directions and could provide potential resource expansion for a newly commenced Preliminary Feasibility Study

- All-in operating cash costs of $4,083 per tonne of LiOH

- After-tax pay back of capital expenditures is 4.5 years after the start of commercial operations

- Life of project revenue of over 26-years total project life

- Sustaining capital of pre-tax NPV at an 8% base case discount rate of .62 billion and Internal Rate of Return (IRR) of 27%

- Post-tax net "undiscounted" cash flow (before initial capital expenditures) of post-tax NPV and IRR of 21%

The baseline numbers and projections in the PEA are notably conservative, and we asked Walker about that.

“We can't put the cart before the horse,” responded Walker. “If you rush to market without essential test work and engineering and tell a fairytale story that the market is looking to hear, you're unnecessarily risking what is a world-class lithium resource, and that never ends well for current shareholders.”

"With this type of operation, based on the PAK resource size and unparalleled quality, we have a projected 26-year-mine-life year, just in those two open pits, and it drives some really compelling economic potential," added Walker.

Frontier aims to complete metallurgical test work and definitive feasibility in 2023 to be ready and permitted to construct and mine, mill, and downstream chemical plant to produce lithium chemicals as early as 2026.

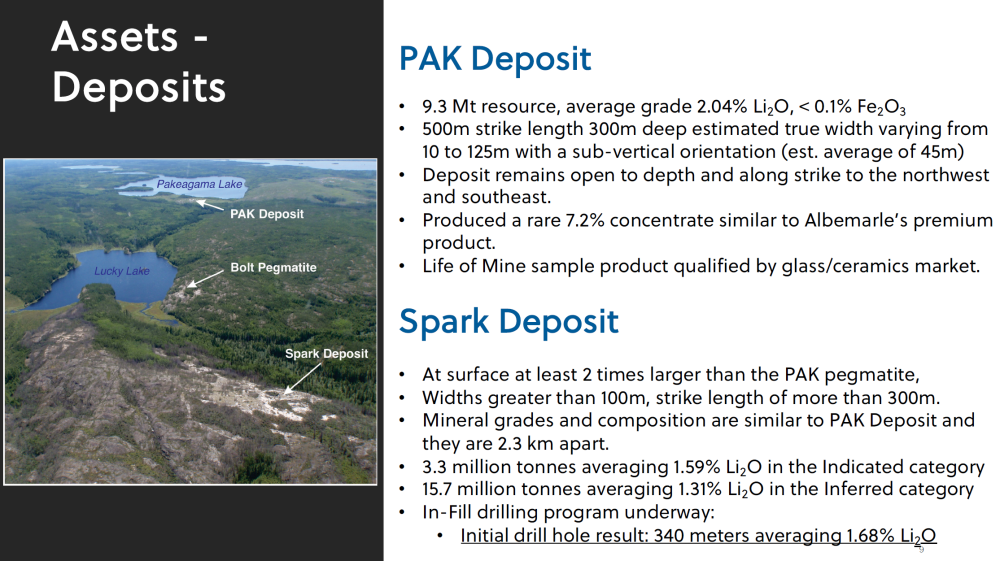

The PAK deposit contains a pit constrained mineral resource in the Measured and Indicated categories of 5.4 million tonnes averaging 1.99% Li2O and an Inferred mineral resource of 0.60 million tonnes averaging 1.97% Li2O, hosts a rare technical/ceramic grade spodumene with very low iron content.

The Spark deposit is located only 2km northwest of the PAK deposit and contains a pit constrained mineral resource estimate of 3.3 million tonnes averaging 1.59% Li2O in the Indicated category and a mineral resource of 15.7 million tonnes averaging 1.31% Li2O in the Inferred category.

“The capex of $685 million isn’t small,” admitted Walker. “It's a significant project. In the PEA, what we evaluated a phased approach. The potential to break ground is 2024.”

“By 2025, we anticipate constructing a commercial mill at the mine site, and operate that for two years, selling concentrates,” added Walker. “Meanwhile we build the downstream chemical plant, ideally to be located at a port on the Great Lakes.”

This scenario allows Frontier to produce lithium chemicals in 2028.

We asked Walker about the payback period.

“The payback is 4.5 years from that point of first commercialization with the mill,” confirmed Walker. “If we take the phased approach, it's relatively quick. The numbers are conservative. We are satisfied with the post-tax NPV and IRR and payback. This is a serious project with huge opportunity and upside.”

“We are working through the science,” added Walker. “With every step we take, our confidence is increasing.”

On June 1, Frontier Lithium announced the results of two of six drill holes drilled during February and March 2021 on the Spark pegmatite.

The analytical results were delayed by the COVID-19 pandemic, with remaining results expected in the near future.

Let's take a look at some of the highlights:

- Diamond Drill Hole ("DDH") PL-048-21 collared in pegmatite and intersected 340.7m of pegmatite averaging 1.68% Li2O

- Geomechanical DDH PL-GDH-06-21 intersected 82.2m averaging 1.25% Li2O with an 11.2 m zone at the top of the hole averaged 2.22% Li2O

- The western extent of the deposit is open and appears to be trending to the southwest

“We been performing in-fill drilling to raise the level of confidence in the resource as well as some geotechnical drilling to identify any problems with the future pit walls, and hydro geological drilling to get a better sense for potential water inflows for the PFS,” explained Walker.

“We're working towards commercial production of lithium hydroxide, a key chemical required for the most advanced lithium batteries required for highest range electric vehicles,” added Walker. “We are at various stages of testing various lithium chemical processes with initial hydroxide product samples expected by late summer. Final process selection is expected to take place in the coming months so that demonstration can take place in 2022 to support the advancing PFS”.

"A key strength of the PAK Lithium Project’s resource is the strong homogeneity of the new Spark deposit's spodumene and corresponding lithium grades in the pegmatite as well as the resource’s openness and strong potential to grow," stated Garth Drever, V.P. Exploration.

"In the 2021 summer-fall field season we will be on site at the project preparing samples for future metallurgical test work programs as well as in-fill drilling on the Spark deposit,” added Drever. “Our objectives will be to complete the geo-mechanical drilling and to upgrade the bulk of Inferred resource to Measured and Indicated as required for the Company's advancing PFS."

“We are creating a pathway to deliver a high-quality chemical with low-risk for North America to ensure the greatest amount of reward for project stakeholders and a lithium supply-chain looking to be in deficit for years to come.”

Frontier Lithium has 195 million shares outstanding. Management and directors own approximately 25% and are aligned with shareholders.

[NLINSERT]

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee. He/she or members of his/her household own securities of the following companies mentioned in the article: None. He/she or members of his/her household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Frontier Lithium Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Frontier Lithium Inc., a company mentioned in this article.