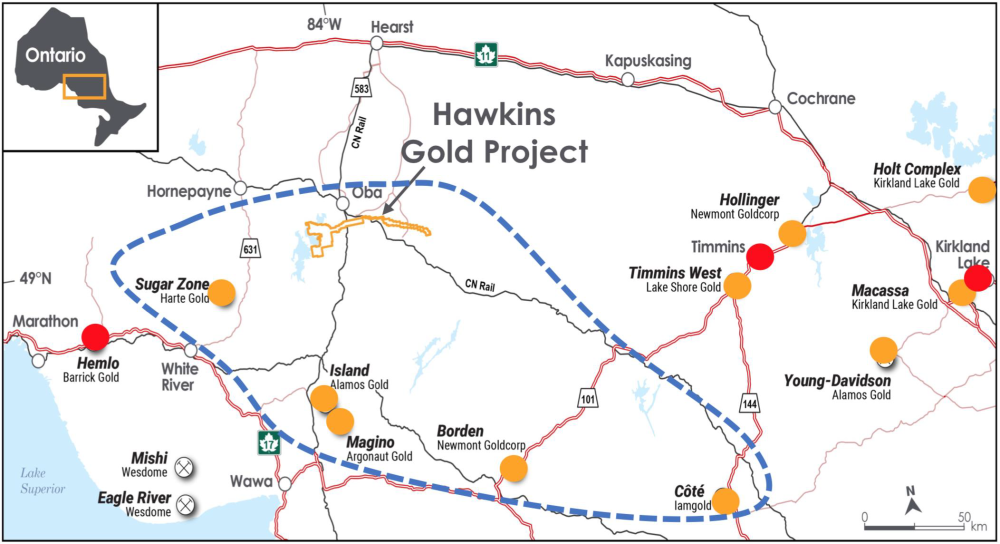

Crescat's Geologic and Technical Director Dr. Quinton Hennigh began his slide presentation by talking about E2Gold Inc. (ETU:TSX.V), a mining company that began trading earlier this year. E2's Hawkins gold project is on an intriguing property in Ontario, Canada. There, the company is pursuing the McKinnon target, which is showing signs it could be a Hemlo, a 24,000,000 ounce (24 Moz) gold deposit discovered in 1980 and located roughly 150 kilometers from Hawkins, in the same terrane. The McKinnon resource stands at about 6,200,000 tonnes of 1.65 grams per tonne (1.65 g/t) gold for 328,800 ounces of gold.

E2 has drilled 17 holes in McKinnon and hit gold. Results are back for all of the holes, and they showed small intercepts with pops of higher-grade material. The company plans to drill along strike to the west and to the east.

Whereas Hemlo's geological system has been debated for decades, Hennigh considers it a syndepositional deposit associated with seafloor volcanism. He said the geology he's seen so far at McKinnon is similar to that of Hemlo. To find out if there in fact is a Hemlo at McKinnon, the company needs to drill a line of holes about 500 meters (500m) below the surface, Hennigh said.

If those holes return intercepts of, say, 20m of 10 grams, or 2, 3 or 4m of 30 grams, Hennigh said, the deposit would start to look like Hemlo; Hemlo's average grade was about 0.5 ounce per ton.

An absolute winner of an intercept would be 80m of 20 grams.

Despite E2Gold's progress this year, the stock price has not responded well, Hennigh noted. The company's market cap is about CA$10 million.

"The fact that stock price is fairly depressed here says nothing but opportunity," he added. "If [E2] finds the kind of prize they’re hunting for, it could be very, very impactful."

Next, Hennigh provided updates on various other exploration companies.

Grande Portage Resources Ltd. (GPG:TSX.V; GPTRF:OTCQB; GPB:FSE)

Grande Portage added a second drill at its Herbert gold project, in Southeast Alaska, and thus is drilling more aggressively. With that second rig, the company might even be able to drill more meters than it initially planned.

Eskay Mining Corp. (ESK:TSX.V)

Eskay released a prefeasibility study for the Eskay Creek gold-silver project. It outlines a net present value of CA$1.4 billion and an internal rate of return of about 56%. The company plans to flow and sell high-quality concentrate; gold and silver recoveries were shown to be well into the 80s.

Labrador Gold Corp. (LAB:TSX; NKOSF:OTCQX)

Labrador is continuing its methodical exploration and just released more drill results. One hole returned 0.5m of 276.6 grams. This 147 gram-meter hole is the best drilled to date at the target.

Ethos Gold Corp. (ECC:TSX.V; ETHOF:OTCQX)

Ethos' first round of prospecting on its Toogood project, in Newfoundland, returned "amazing" grades in outcropping, of about 0.5 kilograms per ton. The company is greatly undervalued and thus presents a buying opportunity.

"This is an exciting, early-stage discovery," Hennigh said.

White Rock Minerals Ltd (WRM:ASX; WRMCF:OTCQF)

White Rock has been working on a field program, following up on stream sediment anomalies. In doing so, it found outcropping sulfide that appears high grade. Both samples contain sphalerite and galena and one contains chalcopyrite, all indicative of a high-grade zinc, lead and copper system along with the known gold and silver. The company is going to drill test right away.

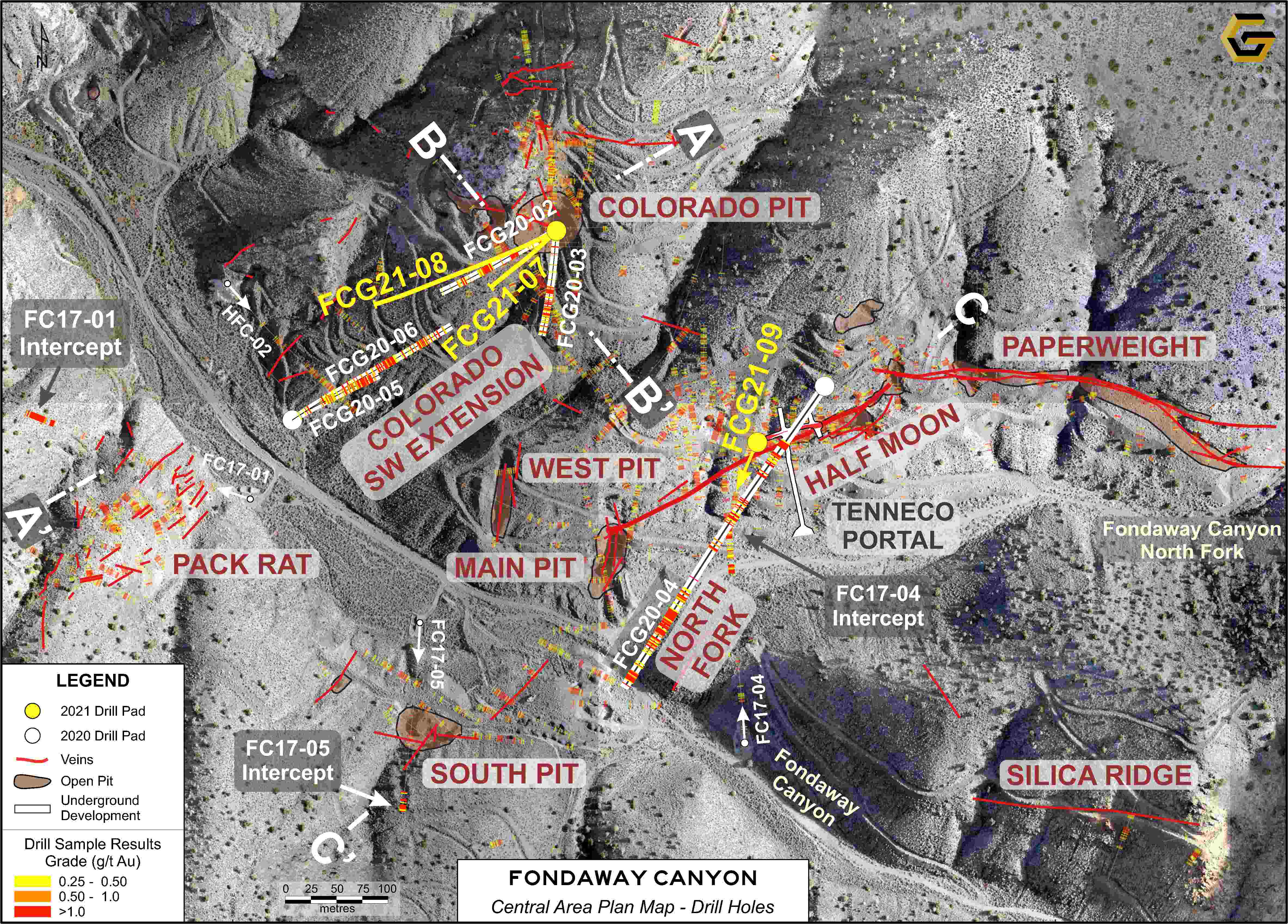

Goliath Resources Ltd. (GOT:TSX.V; GOTRF:OTCQB; B4IF;FSE)

Goliath finished drilling a second hole on its Golddigger property. (On the slide, red arrows show the planned progression of drilling.)

GBM Resources Limited (GBZ:ASX)

GBM's flagship property, in Queensland, Australia, hosts a number of epithermal vein systems. The company just added the Twin Hills project, which has a resource of about 1 Moz. The total resource on the property, inclusive of Yandan, Mount Coolon and Twin Hills, is about 1.5 Moz, and the company has not even done any significant exploration. Hennigh said he expects GBM to explore.

Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB)

In preparation for its upcoming drill program, Tectonic is now conducting a Titan survey of its property. The procedure, which looks at the electrical properties of the rock in subsurface, will likely generate drill targets.

"We want to see a robust drill program this year," Hennigh concluded.

Important Disclosures

Performance data represents past performance, and past performance does not guarantee future results. An individual investor's results may vary due to the timing of capital transactions. Performance for all strategies is expressed in U.S. dollars. Cash returns are included in the total account and are not detailed separately. Investment results shown are for taxable and tax-exempt clients and include the reinvestment of dividends, interest, capital gains, and other earnings. Any possible tax liabilities incurred by the taxable accounts have not been reflected in the net performance. Performance is compared to an index, however, the volatility of an index varies greatly and investments cannot be made directly in an index. Market conditions vary from year to year and can result in a decline in market value due to material market or economic conditions. There should be no expectation that any strategy will be profitable or provide a specified return. Case studies are included for informational purposes only and are provided as a general overview of our general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of our strategies or of the entirety of our investments, and we reserve the right to use or modify some or all of the methodologies mentioned herein.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in Crescat's Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominatly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a Crescat hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. Crescat's hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to Crescat's hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any Crescat hedge fund with the SEC. Limited partner interests in the Crescat hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in Crescat's hedge funds are not subject to the protections of the Investment Company Act of 1940. Performance data is subject to revision following each monthly reconciliation and annual audit. Current performance may be lower or higher than the performance data presented. The performance of Crescat's hedge funds may not be directly comparable to the performance of other private or registered funds. Hedge funds may involve complex tax strategies and there may be delays in distribution tax information to investors.

Investors may obtain the most current performance data, private offering memoranda for a Crescat's hedge funds, and information on Crescat's SMA strategies, including Form ADV Part II, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to [email protected]. See the private offering memorandum for each Crescat hedge fund for complete information and risk factors.

[NLINSERT]

Streetwise Reports Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) Dr. Quinton Hennigh is Crescat Capital’s full-time Geologic and Technical Director. You should assume that as of the publication date, Dr. Quinton Hennigh has a position in the securities discussed and therefore stands to realize significant gains in the event the price of security moves.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Cabral Gold. Click here for important disclosures about sponsor fees.

4) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

5) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Nulegacy Gold Corp. and Cabral Gold, companies mentioned in this article.

Important Crescat Disclosures Provided by Crescat Capital

Please read Crescat’s important disclosures.

Nothing herein should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies are included for informational purposes only and are provided as a general overview of Crescat’s general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of Crescat’s strategies or of the entirety of its investments.

Crescat has compiled its research in good faith and while it uses reasonable efforts to include accurate and up-to-date information, it is provided on an “as is” basis with no warranties of any kind. Crescat does not warrant that the information on this site is accurate, reliable, up to date or correct. In no event will Crescat be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of its data.

You should assume that as of the publication date, Crescat has a position in any securities discussed and therefore stands to realize significant gains in the event the price of security moves. Following the publication date, Crescat intends to continue transacting in the securities, and may be long, short, or neutral at any time.