In a July 6 research note, analyst Timothy Lee reported that Red Cloud Securities has initiated coverage on Phenom Resources Corp. (PHNM:TSX.V; PHNMF:OTCQX; 1PY:FSE), a gold-vanadium explorer, with a Buy rating and a CA$1 per share target price. The stock's current share price is about CA$0.74.

"Essentially, investors are getting a two-for-one special: a vanadium developer plus a gold explorer," Lee wrote, noting that the market has accounted for only the vanadium, not the gold and not Phenom's non-core assets.

Although Phenom has properties in Nevada (Carlin and AVP) and Arizona (West Jerome copper project), it is currently concentrating on advancing its Carlin project in Nevada's Carlin Trend, which is surrounded by deposits and mines, Lee indicated. Phenom's Carlin property boasts unique geography in the world-class, mining friendly jurisdiction of Nevada, both advantages to the company.

According to Lee, Phenom's land package hosts "two very different metals, one compelling project." The property contains the largest and highest-grade primary vanadium resource in North America, 378 million pounds at 0.59% V2O5, Indicated and Inferred. The deposit is approximately 35 meters (35m) thick, 1,800m long and 600m wide. Because it sits within 60m of the surface, open pit mining is viable.

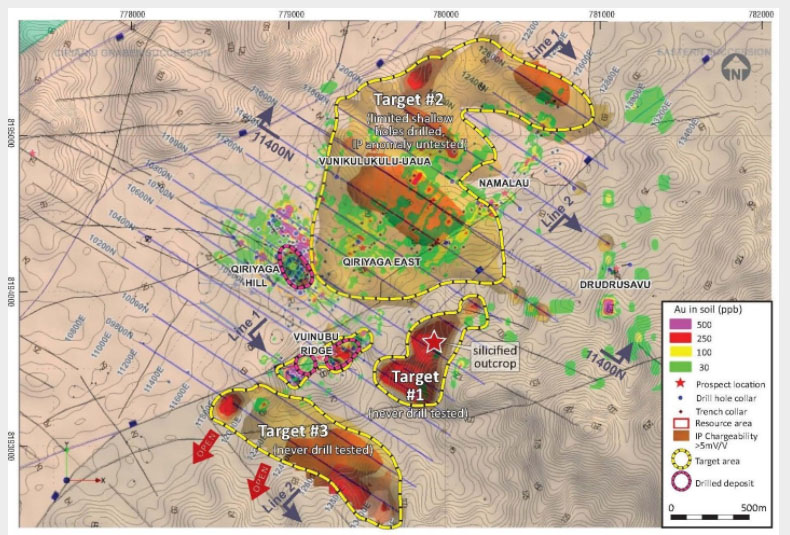

Additionally, below the vanadium resource is gold with characteristics found with Carlin-type mineralization; initial drilling showed brecciation, alteration and trace elements associated with Carlin-type deposits. Phenom is now focused on drill-testing the highly prospective gold target identified on an induced polarization survey and outside the scope of initial drilling. Lee relayed that management believes the anomaly could represent a root system that is 1.2 kilometers (1.2km) long, up to 750m wide and more than 500m deep, and remains open to the north and south.

"With exposure to two completely different metals, we believe Phenom Resources is uniquely positioned to attract investors longing to ride the wave of a growing vanadium market, along with those seeking a potential new gold discovery," Lee wrote.

Lee showed how an increase in the vanadium price would impact the Carlin project. The base case outlined in the 2020 preliminary economic assessment, which used a V2O5 price of US$10.65 per pound, showed an after-tax net present value discounted at 6% (NPV6%) of US$29 million and an after-tax internal rate of return of 7%. A 30% increase in the V2O5, to US$13.85 per pound, boosted the after-tax NPV6% to US$316 million and the after-tax IRR to 15.85%.

"Because Carlin's vanadium resource backstops Phenom's valuation, we expect its share price to somewhat resemble that of a call option," Lee wrote.

Also in Phenom's favor is the company's "top-notch team with a proven track record for discovery," Lee wrote. Renowned geologist and Carlin Trend expert Dave Mathewson is heading Phenom's exploration work. He has discovered about 5 million-plus ounces of gold within 10km of Phenom's Carlin project. Phenom's CEO, Paul Crowley, is also an experienced geologist who has worked in the industry for 41 years.

Catalysts on the horizon for Phenom encompass all three of its projects, Lee noted. For one, additional geophysical survey results are imminent. Also expected before year-end are results of Carlin gold target drilling, AVP drilling and West Jerome gravity surveying.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Phenom Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Phenom Resources, a company mentioned in this article.

Disclosures from Red Cloud Securities, Phenom Resources Corp., Initiating Coverage, July 6, 2021

Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Company Specific Disclosure Details

3. In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services and has been retained under a service or advisory agreement by the issuer.

4. In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or the analyst involved in the preparation of the research report has received compensation for investment banking services from the issuer.

Analyst Certification

The Red Cloud Securities Inc. Analyst named on the report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the company and securities that are the subject of this report; or any companies mentioned in the report that are also covered by the named analyst. In addition, no part of the research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.