Mineworx Technologies Ltd. (MWX:TSX.V; MWXRD:OTCQB; YRS:FSE) is focusing its proprietary and environmentally friendly precious metals extraction technologies on a small but essential piece of equipment that has a big impact on the air we breathe—diesel catalytic converters.

Americans own roughly 287 million cars and trucks. Since 1977, vehicles sold in the U.S. must have a catalytic converter, a device that reduces toxic gases and pollutants in exhaust. That includes hybrids, which now account for approximately 5.5 million vehicles. This growing market sector, valued at $255 billion in 2020, is forecast by Mordor Intelligence to reach $1166.65 billion by 2026.

Those millions of diesel catalytic converters represent a potentially valuable resource. In the big picture, the converters combined with electric batteries are what enable hybrid cars to be less polluting. Because they are more fuel efficient, hybrids emit just under 52 pounds of carbon dioxide every 100 miles, 20 pounds less than a conventional car.

The converters also have intrinsic value, as anyone who has had a catalytic converter stolen from their vehicle will tell you. Each converter contains between three to seven grams of platinum and two to seven grams of palladium. The spot prices for these precious metals have recently ranged around $38/gram and $92/gram, respectively (approximately $1,081/oz and $2,614/oz). The difficulty has been separating the metals from the housing.

Historically, smelters have been the only game in town for recycling diesel catalytic converters. But smelters contribute their own share of air pollution and they run significant risk of explosion if materials are not handled appropriately. In addition, there is a glut of diesel catalytic converters that have reached the end of their 12-year life cycle. Many smelters have reached maximum capacity and are no longer accepting converters.

This "low-hanging fruit" is what CEO Greg Pendura has in mind as the company prepares to open North America's largest diesel catalytic converter recycling facility in Tennessee later this year.

According to Pendura, the firm's process has both short- and long-term advantages. "Our cleantech approach is far better for the environment than smelting. It produces far fewer emissions and is much less volatile," he says. "Second, if you can recover these precious metals, you don't need to mine as much of them. This reduces the monetary, environmental and social costs of mining. Third, recycling allows us to offer a product at a more predictable cost, with far less supply chain uncertainty."

Additionally, to meet more stringent emission regulations the newest generation of diesel catalytic converters are built using higher percentages of platinum, palladium and rhodium. This raises the stakes for finding an economic, efficient and environmentally aware way to recycle those precious metals.

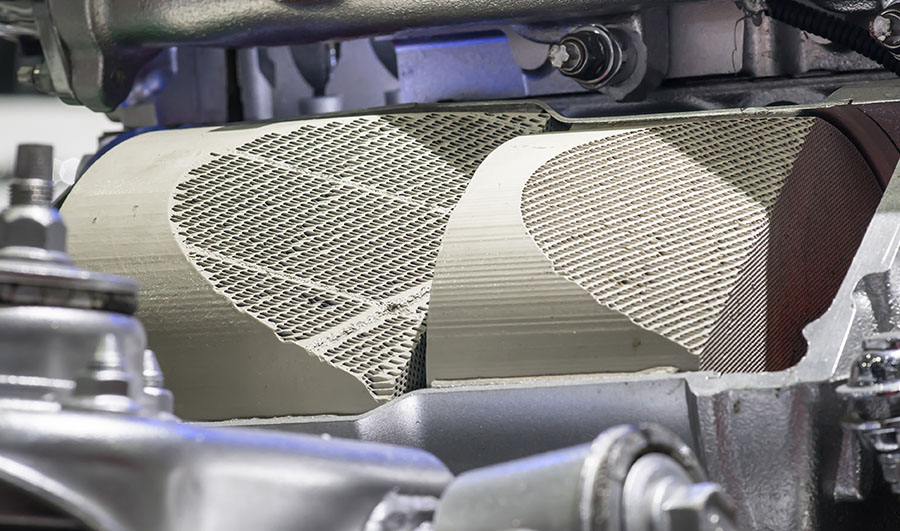

Mineworx's proprietary processing technology starts with grinding catalytic converter components to a fine powder. The palladium and platinum ores are then extracted using Mineworx's proprietary chemical process and recovered as concentrate. The concentrate is refined, poured into ingots and sold.

As of June 2020, Mineworx's pilot of the process is going well. "We set up a mini-facility in Vancouver, Canada," Pendura said. "We're running 100-liter tanks and the lab tests are showing very good results."

When the company is satisfied with the pilot results, the equipment will be transported to a new facility run by Davis Recycling, Inc. Founded in 1988, Davis recycles base and precious metals, collecting product from customers in 13 states for processing at its 12-acre facility in Johnson City, Tenn. "Our joint venture with Davis Recycling puts us in a primetime distribution location for the entire United States," Pendura said. "Plus, we are working with a trusted partner who shares our values and innovative spirit."

When the Tennessee plant is fully operational, it will be capable of processing 10 tonnes/day, up to 3,120/tonnes annually. The recycle rates per tonne are expected to reach 1,500 grams of platinum and 170 grams of palladium a day. At scale, the company expects to generate up to $100 million in annual revenue, at a 20% margin.

On June 24, Mineworx announced that it signed a joint venture operating agreement with Davis Recycling, forming a new company called PGM Renewal LLC. Mineworx will have a 55% equity position and Davis 45%.

"We are pleased to formalize the partnership we have with the team from Davis that has been developed over the last year of research and testing," Pendura said. "This partnership combines the Davis supply chain and logistical expertise with the technology developed by Mineworx for a truly world class operation."

"The extraction of platinum and palladium from diesel catalytic converters has been top of mind for a very long time and we believe that Mineworx's environmentally friendly solution is a perfect fit for us," Ben Davis, CEO of Davis Recycling commented.

Iron Ore Mine Adds Depth

Founded in 1986, Mineworx started out as a mining play, and it retains a strong presence in that sector in Spain. Its 100%-owned Cehegín Iron Ore project in southeastern Spain was previously exploited by Altos Hornos de Vizcaya (AHV), a Spanish ironworks company. AHV mined and processed more than 4 million tons of high grade ore and completed approximately 38,000 meters of drilling.

Today, the project has several upcoming catalysts, according to Pendura. The company anticipates an upcoming NI 43-101 research report to substantiate the historical mining data which shows a 25- to 30-million-ton mineralization.

The Spanish government classified Cehegín as a "strategic initiative" which will "fast-track access to government funding and may allow us to build a small demonstration plant. It also cuts the regulatory terms by half," Pendura said. "We also will benefit from special tax reductions that could exempt up to 30% of net profits from tax for as long as 10 years."

Pendura expects the demonstration plant to refine 60 tons of iron ore annually, increasing to 1 million tons a year, with 65% purity at full production rates. "The E.U. is the second largest import market for iron ore. There is obvious demand for a more local product. With the spot price of Tier 1 iron ore hovering around $200/ton, the Cehegín demonstration plant has the potential to produce a $5 million annual profit," Pendura concluded.

Mineworx noted that it is aware of a press release issued on June 23 by Enviroleach in which "Enviroleach states that it has commenced a civil action against Mineworx in the Supreme Court of British Columbia (the "Civil Claim") in relation to Mineworx allegedly using certain Enviroleach intellectual property without permission. Mineworx denies any and all allegations made by Enviroleach and is of the view that the allegations are frivolous and without merit. Accordingly, Mineworx intends to vigorously defend the Civil Claim and to take all steps available at law to protect its interest and position going forward."

Mineworx has 354 million shares fully diluted (shares/options/warrants) and is approximately 10% owned by insiders. In early June, the current cash on hand is close to $5 million, with CA$60,000 in debt.

Read what other experts are saying about:

[NLINSERT]

Disclosure:

1) Diane Fraser compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She and/or members of her household own securities of the following companies mentioned in the article: None. She and/or members of her household are paid by the following companies mentioned in this article: None. Her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Mineworx. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Mineworx, a company mentioned in this article.