In real estate, it's all about "location, location, location." The same can be said for the mining sector.

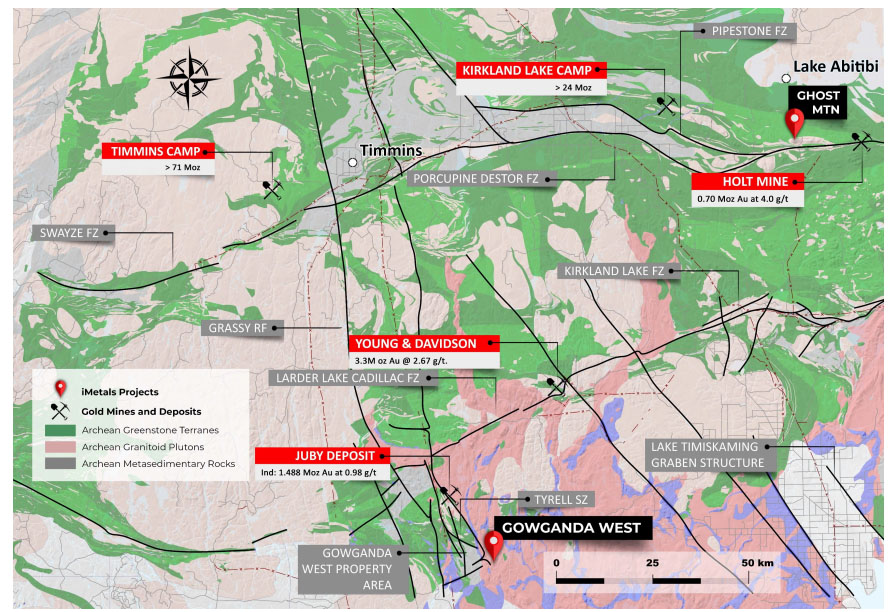

This key factor is what brought Streetwise Reports to speak with Saf Dhillon, president and CEO of iMetal Resources Inc. (IMR:TSX.V; ADTFF:OTCBB), who explained that the junior mining company's resource properties, located in northeast Ontario, are surrounded by world-renowned gold producers that have consistently delivered strong results over many decades.

Developing several properties in this impressive gold-mining slice of Canada "gives iMetal a great opportunity. We're surrounded by some of the most well-known and successful mining companies in the world," Dhillon said.

iMetal is focused on developing its Gowganda West Project, an advanced exploration-stage gold project located within the Shining Tree area in the southern part of the Abitibi greenstone belt about 100 km south-southeast of the Timmins gold camp. Gowganda West shares a border with Aris Gold Corp.'s (ARIS:TSX) multi-million-ounce Juby Deposit, as well with Orefinders Resources Inc. (ORX:TSX.V) and Kirkland Lake Gold Ltd.'s (KL:TSX) Knight Property.

With 20 years of experience developing companies primarily listed on the TSX Venture Exchange, Dhillon has laid out a laser-focused plan to achieve iMetal's goals for 2021 and beyond. In February, for example, the company began a strategic relationship with Riverside Resources Inc. (RRI:TSX.V), a prospect generator known for its "in-house technical knowledge," Dhillon said. Riverside's mineral location database—described by the company as "a vast treasury of field knowledge spanning decades of research to uncover opportunities that might otherwise be overlooked" is a key tool that Dhillon said iMetal is already leveraging and benefiting from.

"With the guidance of Riverside's technical team, we've been able to greatly enhance the probability of a successful drilling phase for our two main projects under development." Dhillon said.

He is mightily impressed with Riverside's extensive technical expertise and strong management team, which is led by CEO John-Mark Staude. Staude holds a Ph.D. in economic geology and has over 20 years of diverse mining and exploration experience in precious and base metals. Rob Scott, Riverside's CFO, has over 20 years of experience in corporate finance, accounting and merchant banking. Scott has also spent years developing a number of successful junior companies on his own as well as with other established exploration groups. Until recently Scott was the CFO of one of Canada's most recent success stories, Great Bear Resources Ltd. (GBR:TSX.V).

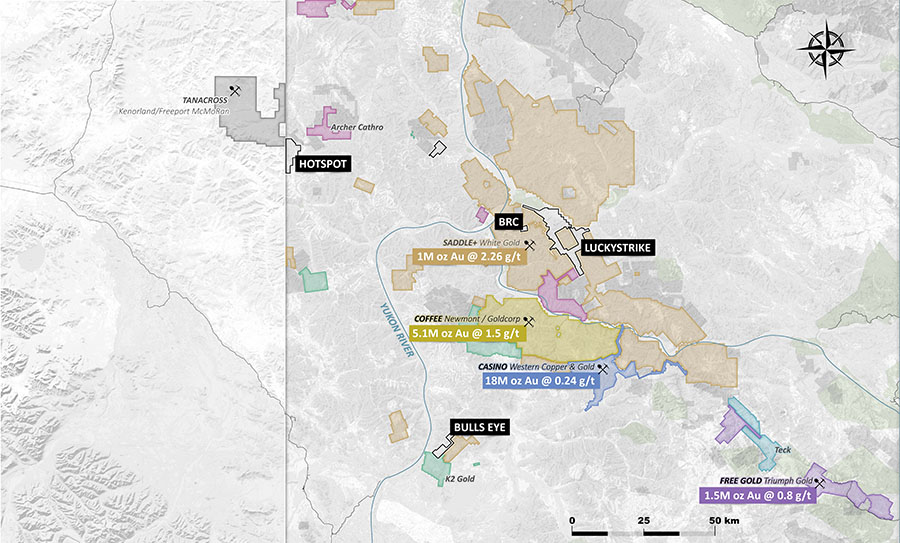

Dhillon said that iMetal is also focused on the Oakes Gold Project, which is one of three projects it is acquiring from Riverside. The other two properties are Pichette and Longrose.

The Oakes Gold Project is located in Oakes Township and is part of the Beardmore-Geraldton Greenstone Belt region, located northeast of Thunder Bay, Ontario. The region has a long and rich mining history that has produced 4.1 million ounces of gold over the past 100 years, including the combined MacLeod-Cockshutt Mine, which produced 1.5 million ounces of gold. More recently, the Hardrock Project, held 50% by Equinox Gold Corp. (EQX:TSX), has brought attention to the area by announcing its intention to mine its gold resource near Geraldton, Ontario.

The Oakes Project is 8,000 hectares and host to several gold-bearing shear zones. Channel sampling by Riverside (2019) of Trench 1 in the HG shear zone returned values of 31.9 grams per tonne (g/t) gold, 19.7 g/t gold and 6.9 g/t gold over 0.5 to 1.0 meter (m) intervals.

The Pichette Project is 1,650 hectares and hosts gold in banded iron formation. Historical drill intersections of 4.78 g/t gold over 0.65m and historical surface grab sample highlights of 24.55 g/t gold, 21.42 g/t gold and 16.01 g/t gold were reported. (Source (PME) 1990 42E12NE0168.)

The Longrose Project is 360 hectares and adjacent to the historical Leitch and Sand River mines and hosts gold quartz veins. Drill highlights include 30.8 g/t gold over 0.15m and 10.28 g/t gold over 0.45m from quartz veins (Longrose Gold Mines, 1947).

Despite iMetal's properties being cheek by jowl next to the "big boys" and having a diminutive market cap of approximately C$4.5 million, Dhillon is unfazed—in fact, he's excited about iMetals' prospects—literally and figuratively. "We're a less than $5 million market cap company with several projects that shares a border with or is on the same block as some of the most successful miners in the industry."

Gowganda West shares a border with Aris Gold Corp., whose team's vision is to build the next globally relevant gold producer, after success creating several leading mining companies, including Wheaton River Minerals, Goldcorp (now Newmont), Yamana Gold, Endeavour Mining and Leagold Mining (now Equinox Gold). Aris' new management team is led by CEO Neil Woodyer, who is supported by an independent board of directors led by Chairman Ian Telfer. Frank Giustra is a strategic advisor to the board.

Gowganda West also shares a border with Orefinders Resources Inc., which earlier this year had entered into a strategic partnership with Kirkland Lake Gold. Kirkland Lake Gold is a C$15 billion senior gold producer operating in Canada and Australia and has produced over 1.3 million ounces in 2020.

Ghost Mountain is another one of iMetal's 100%-owned properties that is in the early stages of exploration and development and is within close proximity to Kirkland Lake Gold's Holt mine property. In August 2020, Kirkland entered into a strategic alliance with Newmont Corp. (NEM:NYSE) with respect to exploration and development opportunities around the company's Holt Complex and Newmont's properties in Timmins, Ontario.

"Having some of the biggest titans in the industry as our neighbors gives us additional confidence that we're in the right place and it looks like at the right time," Dhillon said.

Dhillon is no stranger in taking a relatively small venture and shaping it into something quite impressive.

He was part of the management team at U.S. Geothermal Inc. (NYSE Market) at its inception in the mid-2000s. "It was a US$2 million start-up," and over the course of his 12 years there the company grew to a profitable US$300 million market cap independent power producer and it brought along Goldman Sachs (GS :NYSE) as a minority partner in one of the power plants. In 2018, geothermal industry leader Ormat Technolgies Inc. (ORA:NYSE) purchased U.S. Geothermal. Ormat is currently worth in excess of US$5 billion.

In early June, iMetal announced that it had closed "an initial tranche of its previously announced non-brokered private placement" and issued 7.7 million units at an issue price of $0.10 per unit and 577,000 flow-through (FT) shares at an issue price of $0.13 per FT share for $845,000. Net proceeds will go toward exploration activities in preparation for initial drill programs later on this year, as well as for general working capital.

iMetal has 50.4 million shares outstanding, plus 3.2 million options and 26.5 million warrants. Management owns 28%.

It's worth noting that many gold analysts, economists and sector observers see the price of gold rising. A market comment from Desjardins Securities in early June stated: "In precious metals land, gold is paring earlier losses and is trading back above the $1,900 level...Bullion is consolidating after posting its biggest monthly gain in 10 months in May, aided by signs of accelerating inflation and the threat of an uneven economic recovery."

"There are very exciting times ahead for iMetal!" Dhillon concluded.

[NLINSERT]

Disclosure:

1) Deborah Thompson compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She and/or members of her household own securities of the following companies mentioned in the article: None. She and/or members of her household are paid by the following companies mentioned in this article: None. Her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with iMetal Resources. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of iMetal Resources, a company mentioned in this article.