Rising inflation, as well as disappointing job growth data, continue to weigh on the US Dollar (USD). While the Biden administration and Federal Reserve are prepared to spend even more to kick the economy into a higher gear, it will come at the cost of ever more monetary debasement.

Overseas, Russia's ongoing de-Dollarization efforts and China's relative economic strength are putting even more downward pressure on the USD. Often running inverse to the Dollar, gold and precious metals continue to be the primary beneficiaries of surging prices around the globe. This has prompted central banks to continue buying up swathes of gold reserves.

Related ETFs: Invesco DB US Dollar Index Bullish Fund (UUP), Invesco DB US Dollar Index Bearish Fund (UDN), SPDR Gold Shares (GLD), iShares Silver Trust (SLV)

Over the last two months, the US Dollar index (DXY), an index of the value of the USD relative to a basket of foreign currencies, has given up all of the gains it made in a Q1 rally. During Monday trading, the DXY fell back below 90 where it started the year.

That move came in the aftermath of Treasury Secretary Janet Yellen's suggestion that President Biden should move forward with a $4 trillion spending plan for infrastructure, jobs and family care, even though she expects inflation will now remain elevated at 3% YoY until about the end of 2021.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on June 8.

Yellen also urged other nations to continue forging ahead with more spending, noting at a G7 press conference that "Most countries have fiscal space, and have the ability to put in place, fiscal policies that will continue promoting recovery…"

As the Secretary has suggested, the US is still knee deep in an ongoing recovery and, looking at last week's job numbers, employment remains a key sticking point. The US economy added only 559,000 jobs in May, well below the consensus estimate of 650,000. That came after an even worse undershoot of 266,000 jobs added in April, versus a forecast of 978,000. The labor force participation rate in the US <href="#:~:text=Labor%20Force%20Participation%20Rate%20in%20the%20United%20States%20is%20expected,62.70%20in%2012%20months%20time."target="_blank">edged down to 61.6% in May, 1.7% below pre-pandemic levels in February 2020.

With the Fed looking down the barrel of more monetary debasement and breakout inflation, which threatens to push US real rates even more deeply into negative territory, the Dollar continues to face significant downward pressure. Internationally, even more risks are mounting.

Russia Ramps up De-Dollarization

Late last week, Russia made the decision to fully remove US Dollar assets from its $186 billion National Wealth Fund over the next month. To replace the $40 billion of USD assets, Russia will expand its holdings in Euro (EUR), Chinese Yuan (CNY) and gold assets. In order to reach the targeted FX structure, the Ministry of Finance will exchange their Dollars for $23 billion equivalent of gold, $18 billion equivalent of CNY and $5 billion equivalent of EUR. This move continues a broader trend of Russian de-Dollarization tactics that MRP has been following since 2017.

As ING notes, the removal of the Dollar from the NWF won't necessarily trigger a full de-Dollarization of Central Bank of Russia (CBR) reserves, and it may have little implication for the market on its own. However, it could be just the first sign of more efforts to divest from the Dollar.

Earlier this month, Russian Deputy Prime Minister Alexander Novak said the oil and gas rich country may soon move away from US Dollar-denominated crude contracts if President Biden's administration continues to impose targeted economic sanctions. In 2019, Russia's state-owned oil giant Rosneft moved all its oil export contracts into EUR.

Though Russia isn't outright prohibiting the country's companies from using the Dollar, a very difficult task for a nation still reliant on Dollar-priced commodities like steel, Bloomberg notes the government will indeed utilize economic incentives to encourage the use of the EUR over USD going forward.

Gold's Rise Guides More Central Bank Buying

Russia's expansion of gold holdings is nothing new. Gold made up 23% of the CBR's international reserves as of June 2020, surpassing the share of Dollar holdings, which dropped to 22%, for the first time ever. As Bloomberg writes, Russia spent more than $40 billion building a war chest of gold over the past five years, making it the world's biggest buyer.

With an estimated output of 331 tons in 2020, Russia was the second-largest gold producer in 2020, tripling its output over the previous two decades. Per S&P Global, Russia is expected to become the largest producer of the metal within this decade, reaching output levels of 427-482 tons per year by 2030. Production in China, the world's current leading producer, was 368 tons for the year.

New data shows gold is becoming increasingly popular among many other nations as well. Gold stored at the Bank of England, for instance, has been selling for unusually high premiums recently, signaling that central banks may be back in the market buying. Per Bloomberg, the Bank for International Settlements, which regularly trades the metal on behalf of the world's central banks, bought as much as 1 million ounces of BOE metal from various commercial banks at a premium of 30 to 40 cents recently – compared to the usual range of 0 to 20 cents.

Renewed interest in the yellow metal comes as global inflation is at its highest level since 2008. Gold's spot price has risen to nearly $1,900/oz, about 40% higher than June 2019 levels. In the World Gold Council's '2021 Central Bank Gold Reserves' survey, the council found that 21% of central banks intended to increase their gold reserves over the next 12 months.

China Drowns in Dollars, Yuan Strengthens

Another headwind for the Dollar is China's increasingly large trade surplus with the US. Over the 16 months to April, Dollar deposits in the country rose by $242.2 billion, People's Bank of China (PBOC) data shows. Per The Wall Street Journal, Chinese depositors now hold more than $1 trillion in Dollars, often the proceeds from booming exports and other capital inflows.

In May, China's trade surplus with the US rose to $31.78 billion, up from $28.11 billion in April. May inflows into Chinese equities reached $11.3 billion, according to the International Institute of Finance. Foreign investors increased their holdings of Chinese bonds by $11.45 billion in April.

Meanwhile, the USD/CNY rate has shifted from north of 7.0 in June 2020 to below 6.4 in recent days. Though strategists at UBS and HSBC each told Reuters that a drop to 6.25 is possible, they suspect a recovery may soon follow, giving a little bit of relief to the greenback.

As part of the phase one trade deal signed with the US last year, the PBOC has largely backed off from manipulating the Yuan, allowing market forces to walk down the USD/CNY rate. The stronger CNY exchange rate relative to USD has been favorable for China in some ways, helping to stymie domestic inflation, but the PBOC is expected to begin stepping up their actions to tamp down on Yuan strength.

For Investors

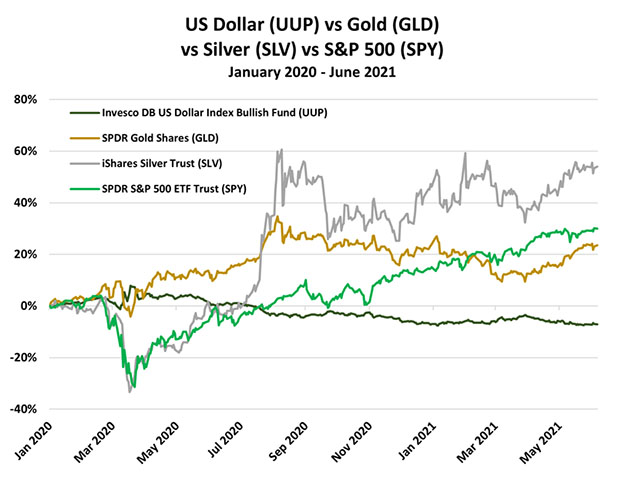

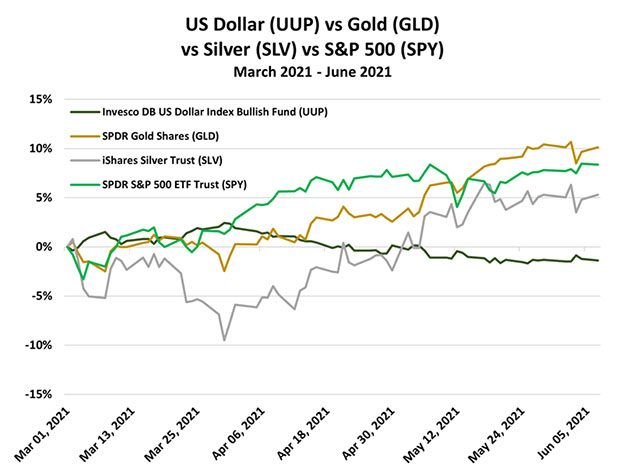

As the US economy grapples with a slowing recovery, expansionary fiscal and monetary policies seem likely to remain entrenched in the near-term. With the Dollar facing pressure from ever-more negative real rates, as well as international variables in Russia, China, and the gold market, a significant greenback rally looks unlikely for now.

The case for inflation-resistant safe havens like gold and other precious metals, meanwhile, seems as strong as ever. MRP currently maintains an active LONG theme on Silver & Silver Miners, initiated in July 2019.

Originally published June 8, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

[NLINSERT]

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.