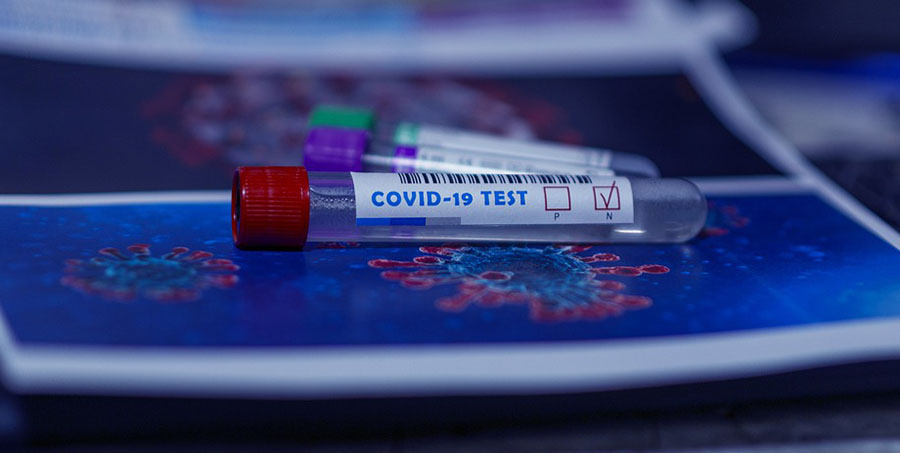

In a June 10 research note, ROTH Capital Partners analyst Jonathan Aschoff reported that Novan Inc.'s (NOVN:NASDAQ) preclinical study of the antiviral SB019 in SARS-CoV-2-infected hamsters showed positive results.

"Novan will likely explore a further development program with U.S. Food and Drug Administration (FDA) buy-in for SB019 as a potential intranasal treatment option for COVID-19," Aschoff wrote.

Also noteworthy, this biotech's stock offers investors nearly threebagger return potential. It is trading now at about $8.86 per share, and ROTH's target price on it is $26 per share.

Aschoff described the design and presented the results of the in vivo SB019 study. Uninfected golden Syrian hamsters were exposed to ones infected with SARS-CoV-2. All of the animals were administered, once daily, one of several low doses of SB019, the active compound of which is berdazimer sodium. The study objective was to reduce viral burden and/or deter virus spread. The results were compared to those of placebo controls.

As for SB019's safety, the hamsters tolerated it well; no adverse events were observed.

"We note the consistency of highly favorable safety with berdazimer sodium across all of Novan's development programs," Aschoff wrote.

Regarding efficacy, the study showed that SB019 reduced viral burden in the hamsters to a statistically significant (p<0.0001) degree of greater than 99.99%. Further, following total treatment, more than half of the initially uninfected hamsters lacked any detectable pulmonary virus. Two independent studies demonstrated that SB019 prevented the viral infection from moving into the lungs after transmission.

Based on these new results, Aschoff indicated, Novan is conducting dose ranging studies to determine an ideal sSB019 tarting dose and treatment regimen for humans. Looking forward, Novan may advance the antiviral itself or with a partner. The company likely will move forward with development of SB019 as a potential COVID-19 treatment, in the form of an intranasal rinse (like that achieved with a Neti pot). To do so, the company will have to complete toxicology studies and either obtain financing or secure a partner.

"The positive results should allow Novan to file an investigational new drug application and potentially begin clinical trials in H2/21," Aschoff wrote.

Finally, Aschoff noted that the most significant catalyst to date for Novan's stock is on the horizon, and that is release of data from the Phase 3 study of SB206, a topical antiviral gel, for the skin infection molluscum contagiosum.

ROTH rates Novan Buy.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.