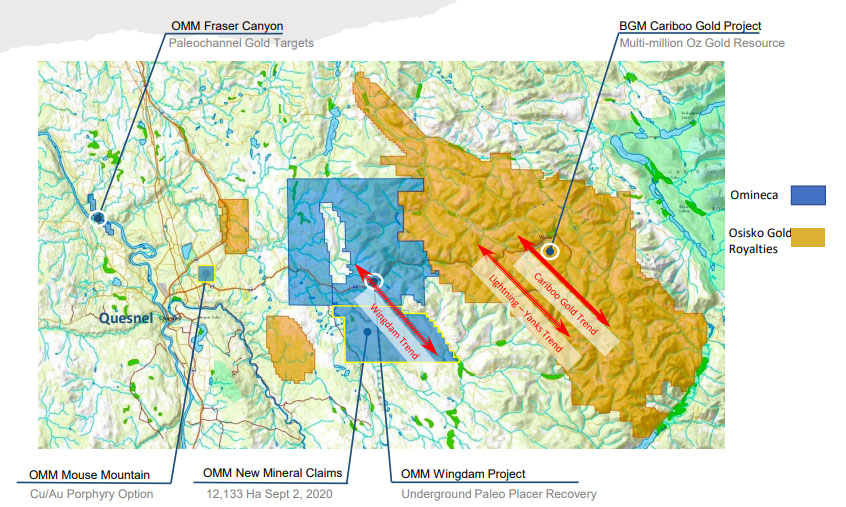

In a May 20 research note, Research Capital Corp. analyst Bill Newman reported the recent drill results from Omineca Mining and Metals Ltd.'s (OMM:TSX.V; OMMSF:OTCMKTS) Mouse Mountain and Wingdam projects.

At Mouse Mountain, Newman relayed, Omineca completed 2,000 meters (2,000m) of drilling. This is significant for two reasons. One, with this work, the resource company earned a 50% interest in the project. (CanAlaska Uranium owns the other half.)

Two, drill results are "encouraging," wrote Newman, and Omineca is now planning follow-up drilling there. Drilling showed mineralization about 1 kilometer (1 km) south of the Valentine zone and 2 km south of the Rainbow zone. The highlight intercepts are 12m of 0.156% copper followed by 28m of 0.104% copper as well as 3.2m of 0.428% copper.

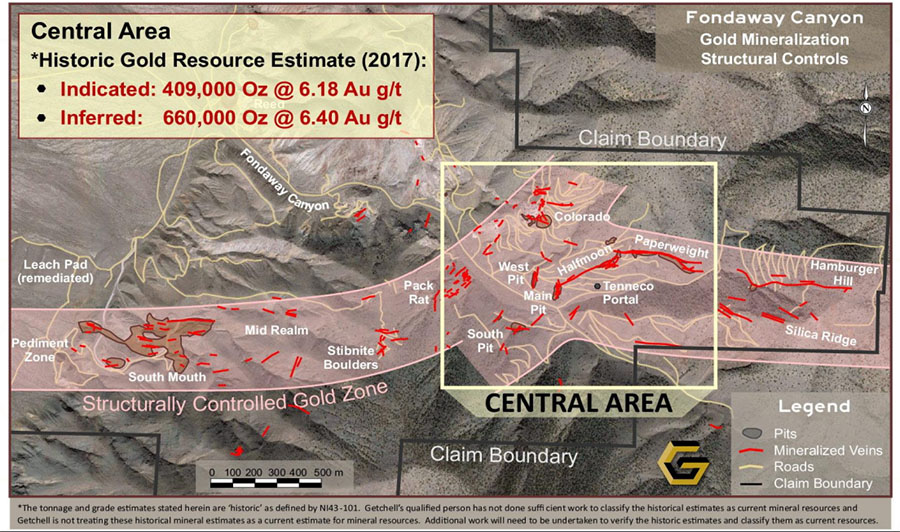

As for Wingdam, its flagship project, the explorer completed phase one of its drill program, placing 21 of the planned 27 holes, over 5,615m.

"Considerable indicator mineralization was confirmed as well as favorable lithology and structure needed to produce replacement-style mineralization," Newman wrote.

Omineca will drill the six outstanding holes during phase two, which it intends to commence next month, in June 2021. This event is one of two upcoming catalysts. The other is release of initial results of the bulk sampling of the Wingdam placer paleochannel.

Newman pointed out that Omineca's share price has experienced a recent pullback and posited it could be due to the company advancing its exploration programs at the two properties more slowly than expected.

Thus, regarding Omineca, "we view this as a buying opportunity as we see first Wingdam placer gold recovery as a potential near-term catalyst for the stock," Newman added.

Research Capital has a Speculative Buy and a CA$0.75 per share target price on Omineca. This target implies the stock has fourbagger potential given it is currently trading at about CA$0.17 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.