Editorial note: Oatly opened on May 20 at $22.12, 30.1% the IPO price.

Plant-based alternatives to meat and dairy products have taken off, embraced by consumers searching for more sustainable or dairy-free options. Beyond Meat now boasts a market cap of $6.5 billion, and the start-up Impossible Foods was valued at $4 billion at its last funding round.

Looking to join and potentially dwarf them is Sweden-based Oatly Group AB (OTLY:NASDAQ), which markets oat-based beverages, ice-cream-like desserts and yogurt, and will begin listing its American depositary shares (ADS) on the NASDAQ Global Select Market under the ticker symbol OTLY on Thursday, May 20.

Oatly's focus is on sustainability. According to its website, Oatly "exists in order to help as many people as possible make the switch from an animal-based diet to plant-based, which scientists say is one of the most effective actions an individual can take right now to save our planet."

Oatly dates back to the 1990s when, using research from Lund University, it developed a patented technology to turn oats into beverages, and basically took the cow out of the equation to make "milk," in this case a vegan product. Oatly initially focused on Sweden and Europe, but has expanded into the United States and China in recent years and plans to continue to expand.

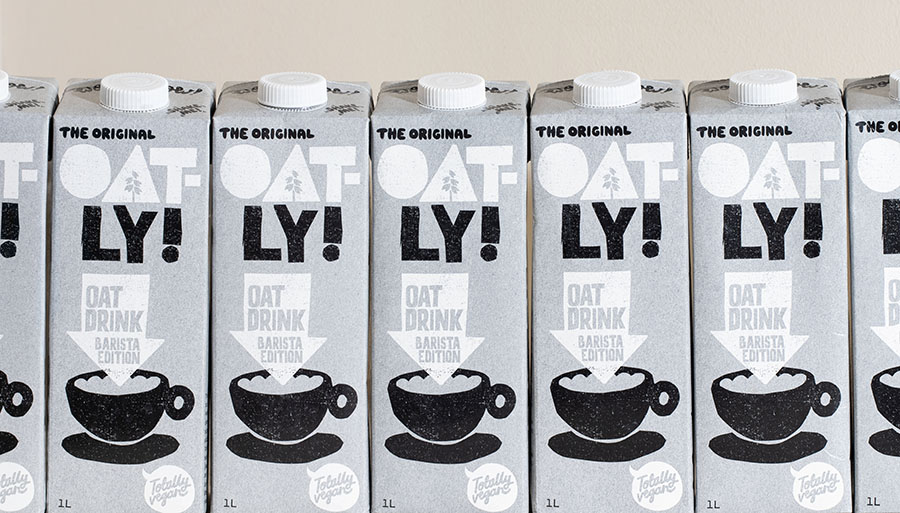

In additional to retail, where it is available in 60,000 outlets, Oatly has trained its eye on the coffee shop market, and its products are now available in 32,200 coffee shops. Oatly has inked deals with major chains, such as Starbucks and Jamba. Its Oat Drink Barista Edition is popular with coffee shops and cafes because it is fully foamable.

According to Oatly, the initial public offering will be for 84.376 million American depositary shares, each representing one ordinary share of Oatly. The company expects the IPO price to be between $15 and $17 per share.

The offering has a top-tier list of underwriters, with Morgan Stanley, J.P. Morgan and Credit Suisse serving as lead book-running managers and Barclays, Jefferies, BNP PARIBAS, BofA Securities, Piper Sandler and RBC Capital Markets as book-running managers.

Analysts predict the offering will value the company as high as $10 billion, and could raise as much as $1.6 billion.

The company has been the focus of celebrity attention, with Oprah Winfrey, Jay-Z and Natalie Portman among its investors.

Oatly is riding the plant-based beverage trend. A recent survey by Morning Consult found that nearly one in three consumers use non-dairy milk beverages at least once a week.

Sales of plant-based beverages are growing rapidly; the plant-based milk market in 2020 totaled $2.5 billion in dollar sales—a 20% increase from the prior year—accounting for 35% of the plant-based food market, according to the Plant Based Foods Association. Plant-based milk now accounts for around 15% of the milk category. Global plant-based dairy sales are estimated to be $18 billion by Euromonitor.

Oat milk, especially, has taken off in popularity. Nielsen estimates that year-over-year sales of oat milk products grew 203% in the United States from 2019 to 2020. One reason for its wild popularity is oat milk uses less water to produce than other dairy-alternative milks.

[NLINSERT]

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.