Rokmaster Resources (RKR:TSX.V) was my top gold junior for 2021, but that was until I learned of Galway Metals Ltd. (GWM:TSX.V). Nothing against Rokmaster, as they will expand to a multi-million-ounce discovery; I just think Galway will be bigger.

Galway Metals

Current Price - $1.00/share

52-week trading range: $0.33 to $2.09/share

Shares outstanding: 178.6 million; management/insiders own 21%, institutions own 52%

Highlights

- Galway has 3 dozen institutional shareholders;

- Strong insider ownership at 21%;

- Two advanced-stage projects in Canada with drilled resources;

- Clarence Stream, New Brunswick first-mover status, 100% control of 65 kilometers (65 km) of strike in emerging gold belt;

- Clarence Stream, 2017, NI 43-101 of 390,000 (390k) gold ounces Measured and Indicated (M&I) with 277k gold ounces Inferred;

- Clarence Stream resources are in just two of six deposits and all six are open to expansion;

- >140,000 meters of historical/recent drilling and adjacent to Mount Pleasant Mill;

- Current 100,000-meter drill program with sevel rigs underway at Clarence Stream;

- Estrades polymetallic project, Quebec; a 10,000-meter drill program underway;

- High-grade gold/zinc resource, 540,000 Au equivalent Indicated resource, plus 520,000 Au equivalent Inferred resource (NI 43-101 report here);

- Strong expansion potential: Apr 19 drill hole 57 with 10.7 g/t gold, 423 g/t silver, 22.8% zinc, 2.8% copper and 2.6% lead over 2.7 meters;

- Strong financial position, CA$24 million cash and no debt.

Management (from company website)

Robert Hinchcliffe, President, CEO & Director, has over 25 years working in the mining industry and has been directly involved in capital raises and transactions in excess of $600 million. Mr. Hinchcliffe founded Galway Resources in 2005 and went on to raise over $100 million and successfully negotiate the sale to AUX for $340 million and establish two new, well-capitalized, spinout companies. Prior to that, he worked as Chief Financial Officer of Kirkland Lake Gold, wherein the company raised over $50 million in funds to re-commission the Kirkland Lake Gold Mine. Kirkland Lake currently has a market value of approximately CA$13 billion and produces approximately 1,400,000 ounces per year. He also worked for seven years on Wall Street as a Mining Analyst for Prudential Securities, SG Cowen, and Santander Investment, covering U.S., international, and Latin American mining companies, in addition to other sectors.

Robert Suttie, CFO, currently works with Marrelli Support Services as its senior manager of financial reporting and compliance, possessing more than sixteen years of experience, ten of which were in public accounting prior to his tenure with the company.

Michael Sutton, Chief Geologist and Director: his career spans over 30 years as an exploration geologist. Mr. Sutton has worked in some of the largest gold camps in the world, including Witwatersrand, Timmins, and Kirkland Lake, serving in various capacities related entirely to the exploration and mining of gold. Mr. Sutton was awarded the Prospector of the Year for Ontario (along with Stew Carmichael) for the discovery of the South Mine Complex while he was chief geologist and assistant manager at Kirkland Lake Gold Inc. He guided Vault Minerals as vice president of exploration to a takeover by Queenston Mining Inc. He has since worked as senior geologist (consultant) at Queenston, Osisko, and now Canadian Malartic. Previous to that, he worked for Kinross, Barrick, Lac Minerals and Corona.

Larry Strauss, VP of Corporate Development and Director, has over 30 years' working in the mining industry in different capacities. More specifically, Mr. Strauss has 18 years of experience as a mining and commodities analyst in both Canada and the United States, followed by 13 years as a director and advisor to resource exploration companies. He was most recently a director at Galway Resources from April 2009 until its acquisition in December 2012. Prior, Mr. Strauss was a director at GMP Securities, where he spent seven years as a mining analyst.

Joseph Cartafalsa, Director, is partner at the New York-based law firm of Putney, Twombly, Hall & Hirson LLP, one of the oldest law firms in New York. He has over 20 years' experience as a management-side labor and employment attorney, representing clients in a myriad of industries, including exploration and mining, finance, media and manufacturing.

Alfonso Gómez Rengifo, Director, has over 30 years working in the resource sector, holding various positions with prominent international mining companies in Colombia. Mr. Gómez was a director for Galway Resources and is currently the Colombia country manager and director for Galway Gold, in charge of the company's efforts in Colombia regarding financial, legal, permitting, environmental and community affairs, among other areas.

Rob White, Director, is cofounder of M&T Bank's M&A and Corporate Finance Group and currently comanages the practice. Mr. White's primary responsibilities involve advising on divestitures, acquisitions, and private capital raising activities for middle market clients. Mr. White has also performed strategic consulting services, including Fairness Opinions and shareholder value studies.

Galway has a top-notch management team with lots of experience and past discoveries. I have known many of the principals since their involvement with Galway Resources in Colombia. That project was sold off for $340 million and today's Galway Metals was spun out from that sale, along with Galway Gold.

Projects

Clarence Stream, 100% interest, 60,465 hectares

Clarence Stream is a new, emerging gold belt where Galway Metals controls the whole thing, some 65 km of strength length. The project is advanced, with the last NI 43-101 in 2017 revealing 390,000 ounces gold in the M&I category with another 277,000 ounces Inferred. This is in the North and South zones, which are both open along strike in both directions and at depth.

These resources are only in two of six deposits and all six are wide open for expansion.

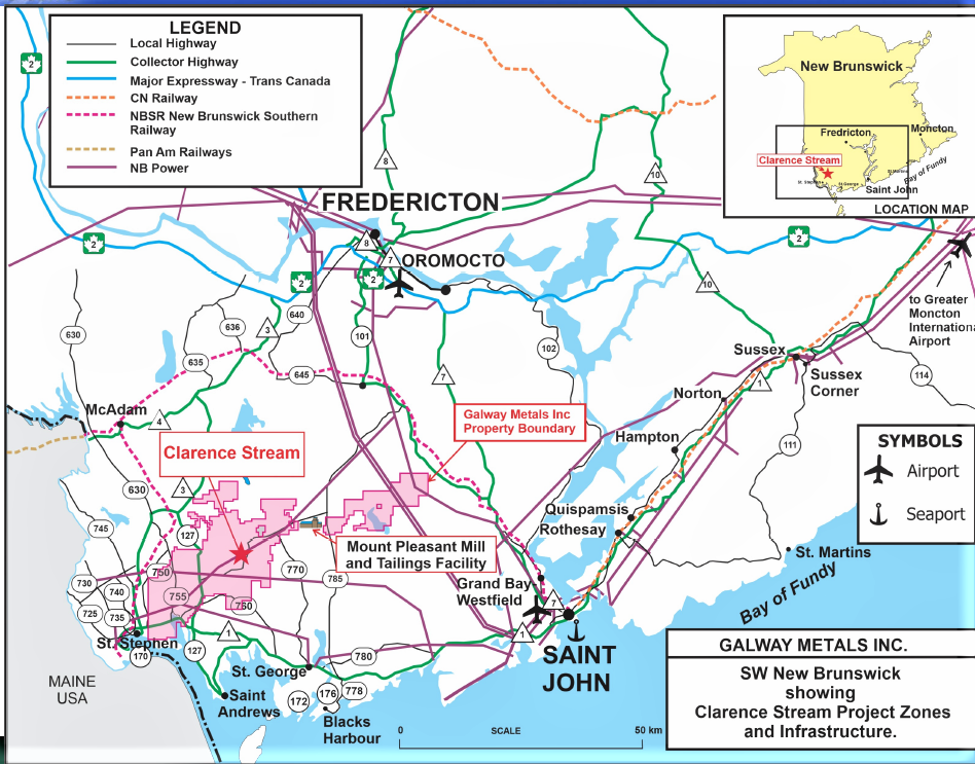

The location and infrastructure is excellent. New Brunswick is a mining-friendly jurisdiction, always rated highly by the Frazer Institute. You can see on the location map below that the project is very close to all major infrastructure. This will result in lower development costs.

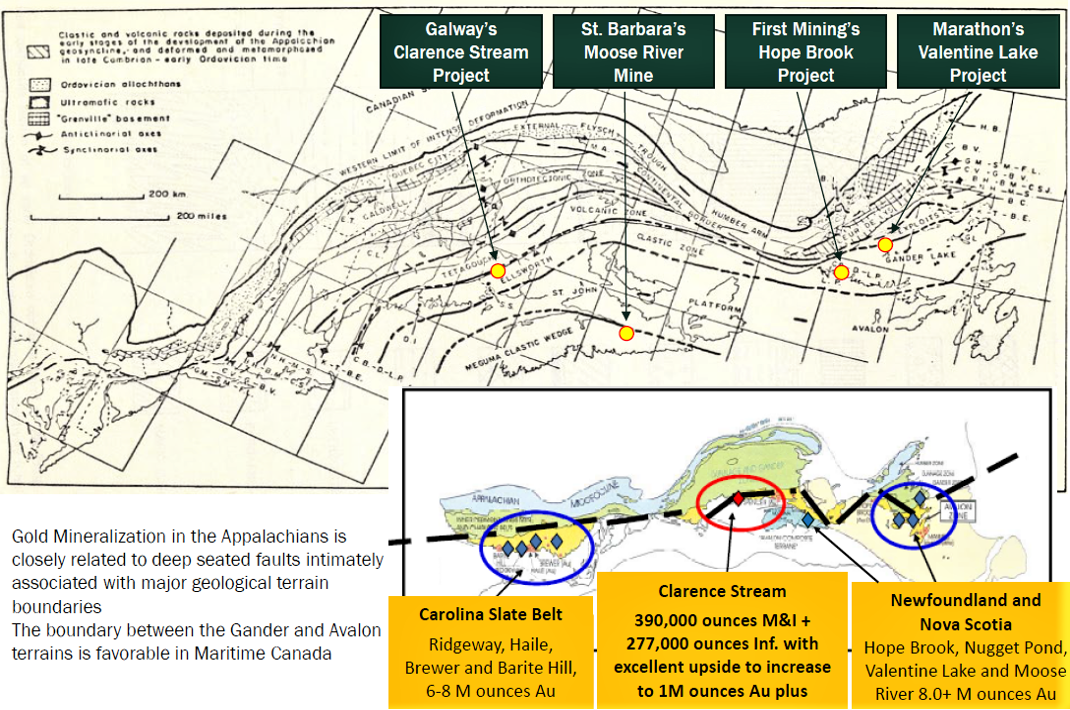

Many investors may not think of New Brunswick with large gold deposits, but it is part of the Appalachian Gold Trend, which includes the Carolinas with 6 to 8 million ounces, Nova Scotia's Moose River and Newfoundland's Hope Brook and Valentine Lake project. In the Carolinas, Romarco Minerals was acquired by OceanaGold Corp. (OGC:TSX; OGC:ASX), and in Nova Scotia, Atlantic Gold was acquired by St. Barbara Ltd. (SBM:ASX), with each acquisition being in excess of CA$800 million.

Clarence Stream is located in the Appalachian Gold Trend

At Clarence Stream there has been historical drilling of 61,703 meters and 80,000 meters completed by Galway. Metallurgic testing reveals 90% gold recovery with gravity, flotation and CIL milling. The Mount Pleasant Mill, on care and maintenance, is adjacent to the property, with a permitted tailings dam.

What stunned me about this project is when I went over the presentation with Larry Strauss, is that they are pretty much hitting on most drill holes all over the property. I have struggled with how I would present the large potential and how undervalued this company is. I strongly advise watching a video on Clarence Stream here and going over the presentation here. If there is a Zoom conference by the company, I will let you know.

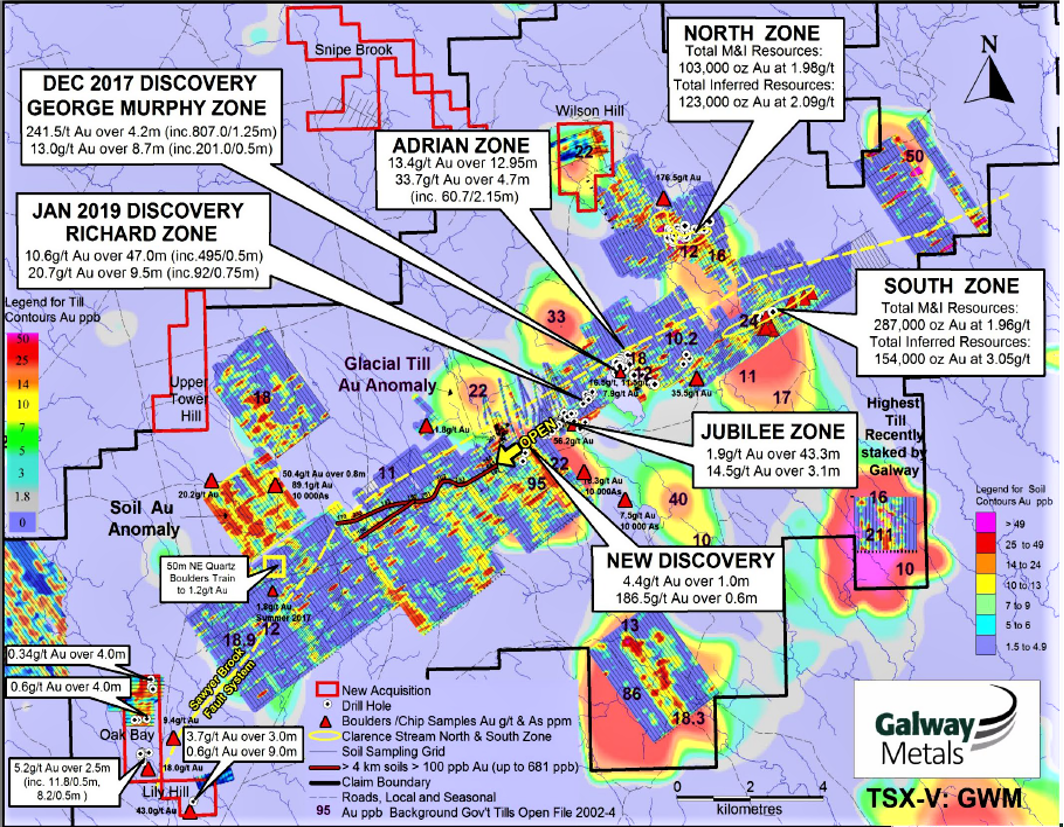

I decided I would list a few drill intersects in the zones discovered outside the NI-43-101 resource and provide that map.

George Murphy zone

• 241.5 g/t Au over 4.2 meters

• 13.0 g/t Au over 8.7 meters

Adrian Zone

• 13.4 g/t Au over 12.95 meters

• 24.3 g/t Au over 6.55 meters

Richard Zone

• 10.6 g/t Au over 47.0 meters + 1.2 g/t Au over 32.0 meters

• 19.8 g/t Au over 9.5 meters +4.7 g/t Au over 29.65 meters

Jubilee Zone

• 1.9 g/t Au over 43.3 meters

• 14.5 g/t Au over 3.1 meters

New Discoveries (neither of these have been followed up with more drilling)

• 4.8 g/t Au over 3.1 meters

• 186.5 g/t Au over 0.6 meters

This map also shows the soil and glacial till anomalies that Galway has found to be very successful exploration tools for this project.

There are numerous high-grade samples and I did not mention any at all outside these zones. They seem to be everywhere. There will be numerous deposits in this belt and some outlined so far might join with each other.

Galway has a 100,000-meter drill program with seven rigs underway at Clarence Stream. The near-term focus is to expand the Jubilee, Richard, GMZ and Adrian zones and test other highly prospective targets. The last drill news was March 30. The main takeaways from drill results are as follows (I made some bold highlights):

- The northern GMZ veins appear to be connecting to the Adrian zone to give a combined horizontal strike length of 450 meters to date. Hole CL20-84, for which visible gold (VG) was previously reported but no assays were received, returned64.6 grams per tonne gold over 0.5 meters (0.5 m) within a broader intersection of 3.0 g/t Au over 15.5 m, located 35 m east of previously reported hole CL20-50 (4.8 g/t Au over 34.0 m, including 20.2 g/t Au over 7.0 m). New hole CL21-51 returned 9.0 g/t Au over 7.4 m, including 20.3 g/t Au over 1.5 m and 19.9 g/t Au over 1.5 m, located 79 m west of hole CL20-50. New hole CL21-53 returned 3.0 g/t Au over 30.5 m, including 26.5 g/t Au over 3.0 m. Other new intersections between the veins to the north of the GMZ and the Adrian zone include 1.3 g/t Au over 41.5 m, 2.1 g/t Au over 7.5 m, 2.9 g/t Au over 7.75 m, 2.2 g/t Au over 9.0 m and 1.7 g/t Au over 13.8 m.

- Two new veins were also discovered in hole CL21-51, returning 70.3 g/t Au over 1.5 m, including 104.2 g/t Au over 1.0 m, plus 7.2 g/t Au over 1.5 m, located 115 m north of the 9.0 g/t Au over 7.4 m intersect discussed above and 290 m west of the westernmost intersection of the Adrian zone. These two new veins are near the interpreted location of the Sawyer Brook fault and extends the depth of the GMZ/Adrian zones by 50 m to 385 m. The previous deepest significant intersects were in hole BL20-88, which extended mineralization on the west side of the GMZ to 321 m and 335 m with 6.5 g/t Au over 14.05 m and 4.9 g/t Au over 2.35 m, respectively.

- High grades continue to be returned from the new Adrian zone, with hole CL21-89 returning 78.4 g/t Au over 3.0 m, including 313.0 g/t Au over 0.5 m, and 147.0 g/t Au over 0.5 m. This intersect is located 7 m above the 24.3 g/t Au over 6.55 m (previously released as 33.7 g/t over 4.7 m) in hole CL20-81 and 28 m northeast of the discovery hole intersect in hole CL20-65 that returned 13.4 g/t Au over 12.95 m.

We can expect a steady stream of excellent drill results from this project. You may find it hard to believe but Galway's second project is also very excellent, with drilling and great results reported and to continue.

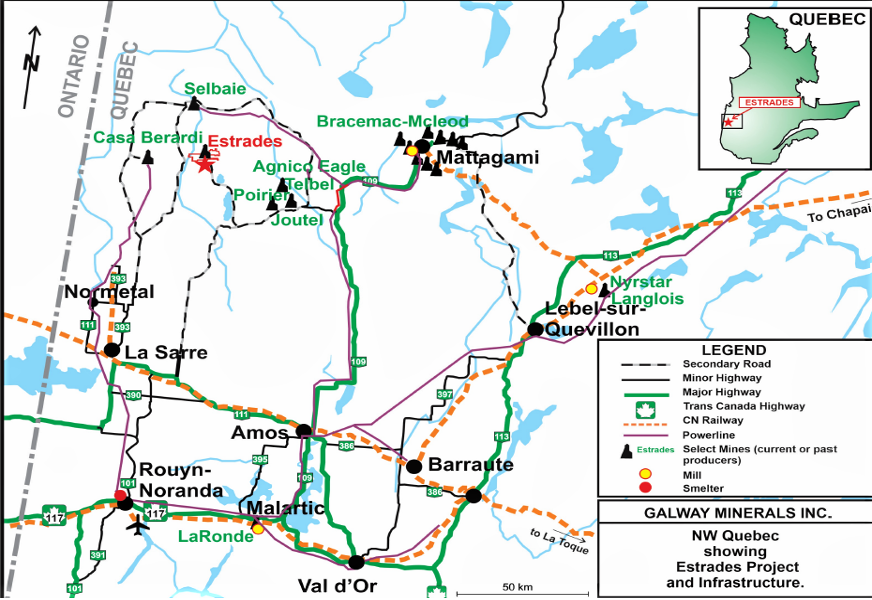

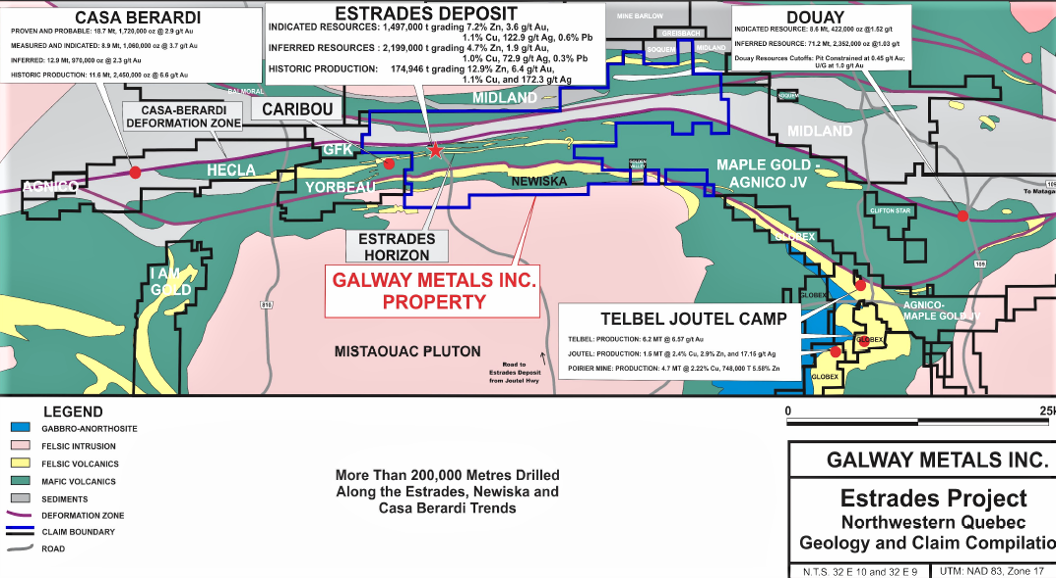

Estrades Polymetallic Project: 100% interest; 20,000 hectares; Abitibi Belt, Quebec

Galway has consolidated about 31 kilometers strike in this high-grade, polymetallic, volcanogenic massive sulphide (VMS) area. It includes the former producing, high-grade Estrades mine, which has be mostly dormant for the last 25 years. Production in 1990/91 was 174,946 tonnes grading 6.4 g/t Au, 172.3 g/t Ag, 12.9% zinc and 1.1% copper.

Breakwater Resources Ltd. (BWR:TSX) spend $20 million on a 200-meter decline and the production has been from relatively shallow depths. There has been 90,000 meters of historical drilling, and Galway has completed over 20,000 meters on the Estrades and Newiska horizons. Galway's land package also contains the Casa Berardi horizon, where over 90,000 meters of historical drilling has occurred. The NI 43-101 resource on the Estrades horizon was last updated and amended in 2018 and 2019, respectively, and is now 540,000 ounces gold equivalent in the Indicated category, plus 520,000 ounces gold equivalent in the Inferred category. From zinc equivalent perspectives, Indicated resources amount to 680 million pounds plus Inferred resources total 660 million pounds.

You can see on the location map that there is excellent infrastructure and there are three mills nearby that can process Estrades' VMS mineralization, plus Hecla Mining Co.'s (HL:NYSE) Casa Berardi mill is closest, but a flotation circuit and additional capacity would likely need to be added.

The property is immediately adjacent to, and west of the Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE)/ Maple Gold Mines (MGM:TSX.V; MGMLF:OTCQB) joint venture, which hosts 2.8 million ounces of gold resources, and where Agnico has agreed to spend $18 million on exploration during the next four years. The property is also 24 kilometers east of Hecla Mining's Casa Berardi gold mine (currently producing; 6.2 million ounces of gold between total production and current reserves and resources).

This will give you an idea of the property location relative to other mines and deposits.

Galway began a 10,000-meter drill program with three rigs in January. They are targeting the three primary horizons of mineralization:

- the formerly producing, high-grade Estrades volcanogenic massive sulphide (VMS) mine;

- the Newiska VMS horizon to the south; and

- the Casa Berardi break horizon (Au) to the north.

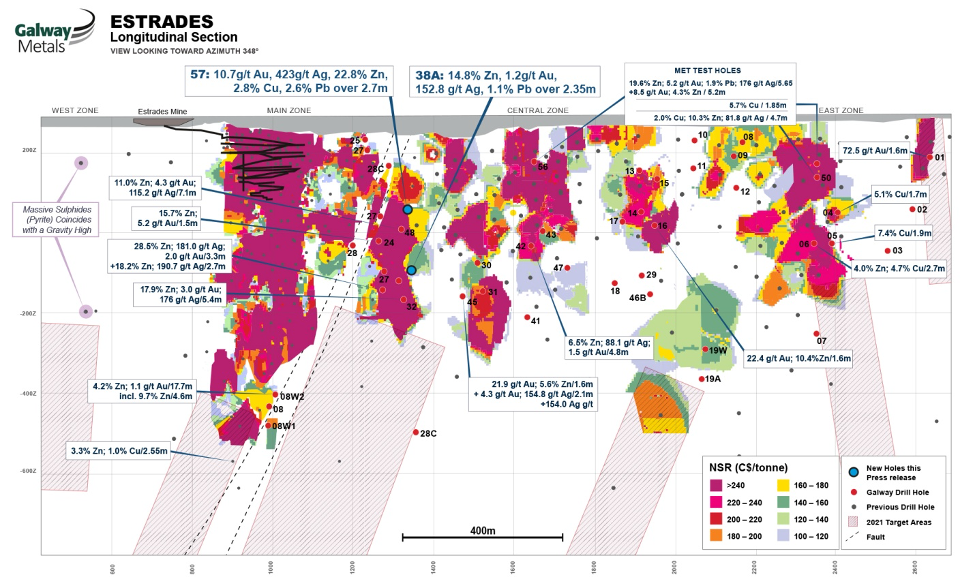

Galway reported the first two drill holes of this program on Monday:

Hole 57 returned 10.7 g/t gold, 423 g/t silver, 22.8% zinc (Zn), 2.8% copper and 2.6% lead (Pb) over 2.7 meters.

Hole 38A returned 14.8% Zn, 1.2 g/t Au, 153 g/t Ag and 1.1& Pb over 2.35 m.

These holes are located 296 m southeast of the mined area.

Hole 57 is located at a vertical depth of 222 m, 66 m above previously released hole 48 that returned 4.3 g/t Au, 115.2 g/t Ag, 11.0% Zn, 0.8% Cu and 0.9% Pb over 7.1 m (5.2 m true width [TW])

Galway's deepest exploration holes that intersected the zone in 2018 are holes 27 and 32. Hole 27 returned 2.2 g/t Au, 181.0 g/t Ag and 28.5% Zn over 3.3 m (2.1 m TW), plus 190.7 g/t Ag and 18.6% Zn over 2.7 m (1.7 m TW) at vertical depths of 435 meters and 453 meters, respectively. Hole 32 returned 5.4 meters (3.4 m TW) grading 17.9% Zn, 3.0 g/t Au and 176.0 g/t Ag at a vertical depth of 456 m.

Galway completed Titan IP/EM surveys and gravity surveys. Along with other geological and drill hole data, it indicates significant resources will likely be found down-plunge from current known mineralization. The big rectangles in this graphic indicate the approximate location of these targets.

I have little doubt that Estrades will become an economic deposit. Most juniors would like one good discovery, Galway has two and the money to advance them.

Financial

Last financial statements indicate CA$18.7 million in cash and no long-term debt. Since then, on March 25, Galway closed a CA$15 million bought-deal financing. Flow-through shares included 5,99,900 shares at CA$1.45 per share and 1,087,000 shares at CA$1.84 per share. They also issued 4,095,400 non-flow-through common shares at CA$1.05 per share. With approximately 24 million cash currently, Galway is in a strong financial position.

Summary

This advanced gold junior should be in everyone's precious metals or resource portfolio. The recent correction in the gold juniors provides an ideal entry point. The stock is even a little below the last finance level.

At an even $1.00 the market cap is about CA$178 million with $24 million cash. Clarence Stream and Estrades have a combined M&I resource of 933,051 gold equivalent ounces. The current stock price is putting an enterprise value on these ounces at US$130 per ounce. This is better than some juniors, but when you consider these ounces are located in areas of strong infrastructure, are high grade and there's very strong upside potential, this valuation is low. There are 870,830 ounces in the Inferred category, and given the strong upside in the current resource, the market is probably giving some value for these, where I am considering zero value with the $130 per ounce number. A Clarence Stream resource update is scheduled for this summer and could dramatically increase valuations

Management/insiders have a 21% interest in the stock so their interests are well aligned with shareholders. Further, there are large active drill programs at both projects so we can count on a steady stream of drill news. I have no doubt we will continue to see high grade and economic results in most drill holes.

So we have great management with past success, two very strong projects with aggressive exploration programs in great jurisdictions and, to top it off, an excellent level and technical entry point on the stock chart.

On the chart you can see the correction since the August highs that coincides with the general correction in gold and the gold stocks. There was a good, wash-out bottom when the financing was announced that saw this RSI go to –20, a very good bottom indicator. The stock is around its natural support level, and has been consolidating there. I indicate with the red lines where I see near-term resistance. These are my first two targets on the upside.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

[NLINSERT]Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Rokmaster, Galway Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Galway Metals is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.