Maurice Jackson: Joining us for a conversation is Peter Ball, the CEO of NV Gold Corp. (NVX:TSX.V; NVGLF:OTC).

A pleasure to have you join us, as NV Gold has several updates to provide shareholders, including some breaking news involving Hochschild Mining Plc (HOC:LSE). Before we begin, please introduce readers to NV Gold and the opportunity the company presents to shareholders.

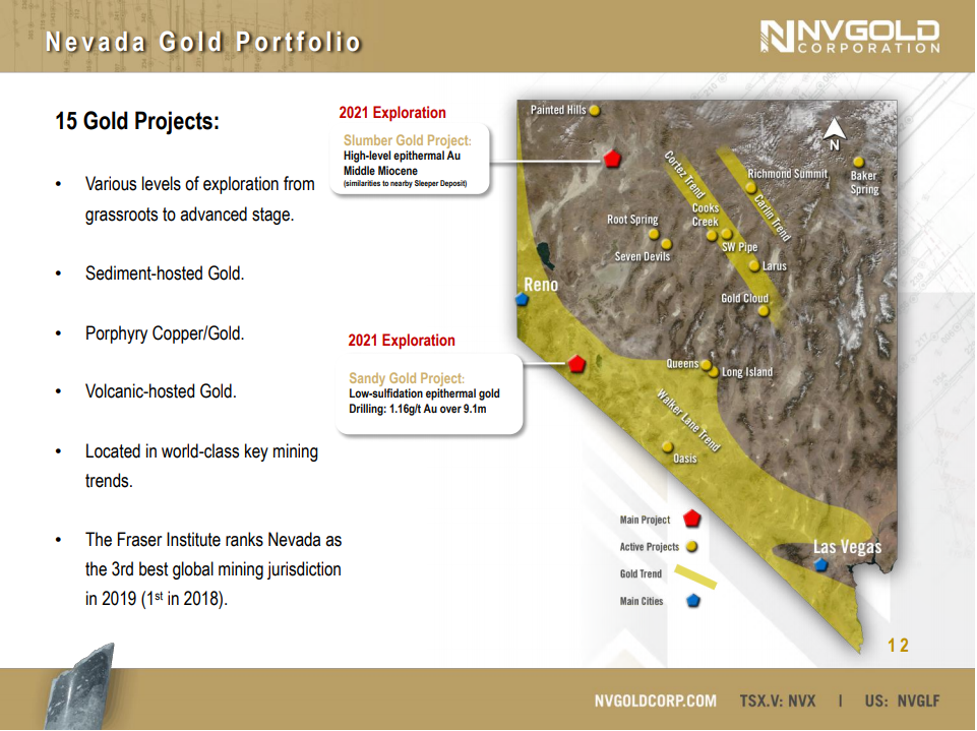

Peter Ball: NV Gold is 100% focused on making a gold discovery in Nevada. It was formed a few years ago by some of the legends of exploration from Nevada, which has attracted several strategic investors that have invested in NV Gold, specifically for the talent, and the project portfolio that we control a hundred percent of in Nevada, and the opportunity that we are 100% focused on…which is making a discovery in Nevada!

Maurice Jackson: In previous discussions, we focused on the Sandy and the Slumber projects, respectively, and I know you have some important updates to share with us regarding them. But I want to jump right into your recent press release, as NV Gold has some very exciting news to share with the market, which involves Hothschild Mining.

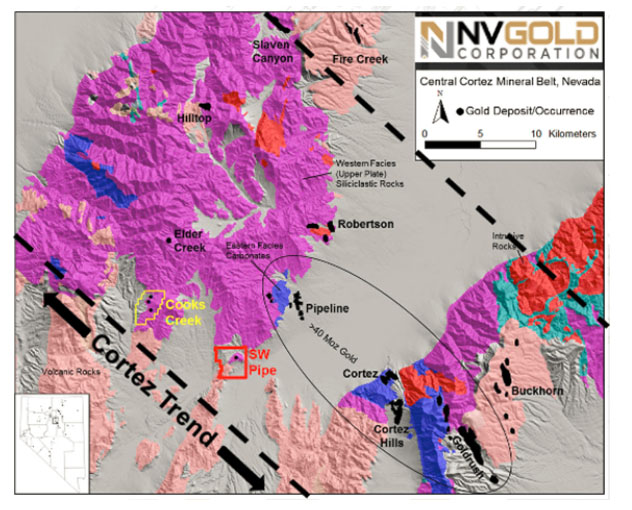

Sir, take us to the Cortez Gold Belt, to the SW Pipe Gold Project, which is located in north-central Nevada, and share with us the company's latest accretive success.

Peter Ball: The SW Pipe Gold Project is going to be an interesting project and we are very excited that Hochschild recognizes the opportunity there. First of all, the SW Pipe project was acquired for staking costs a couple of years ago. We recognized the location, which is immediately adjoining and surrounded by Newmont Corp. (NEM:NYSE) and Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), which, of course, now has formed Nevada Gold Mines as a joint venture in their mining operations in the Cortez Trend and several other areas in Nevada. So location is everything when you are exploring.

The second interesting part of the SW Pipe is that it has a historical, which currently is non-compliant, resource that was drilled off years ago in the range of 40,000 to 45,000 ounces of low-grade gold within the first 300 meters of surface, in strike length about 1.2 kilometers by 800 meters.

First, we got the location. Second, we have gold on the project. And third, we're sitting right next to and within the Cortez Trend. If we focus on our neighbors directly adjoining the project, Nevada Gold Mines, they have the Robertson, Pipeline, Cortez mines, and the Gold Rush and Four Mile discoveries as recent as 2015 or 2016. So they're operating a gold mine. We're right next to them. Hochschild recognizes that sometimes when you see a project sitting next to a major, never a better place to further test a project and get a little crazy in some exploration. So we're excited. It's an interesting and exciting time for NV Gold to partner up on this particular project.

Maurice Jackson: Now, is the goal there to twin the historical?

Peter Ball: The goal is to look at what's happening next door at the Pipeline, which I believe mined 12-and-a-half or 13 million ounces of gold, and to go deep on drilling right next door on SW Pipe. We're chasing the lower plate rocks similar to next door at the Pipeline project. And we'll see what happens. It's a US$10 million option earn-in for 75%, where at the end of the day, after a potential even bigger cash payout, we will still retain a 2% NSR (net smelter royalty), which could be even more valuable. It's going to be one of those programs that investors who invest in the Cortez Trend is going to want to watch. And Hochschild is a great group. They like to swing for the fences per se. So here we go. We're going to get this project going here later this spring.

Maurice Jackson: Now this is one heck of an accomplishment, and it's such a big, big feather in your cap. We referenced the Sandy and Slumber projects earlier. What can you share with us regarding the assay results there?

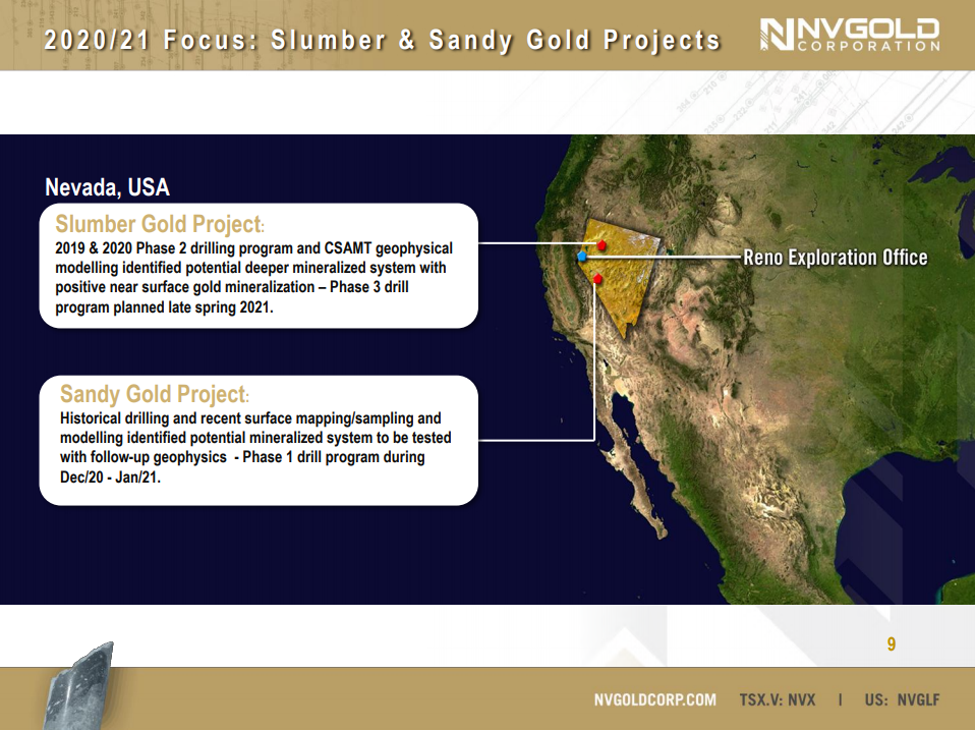

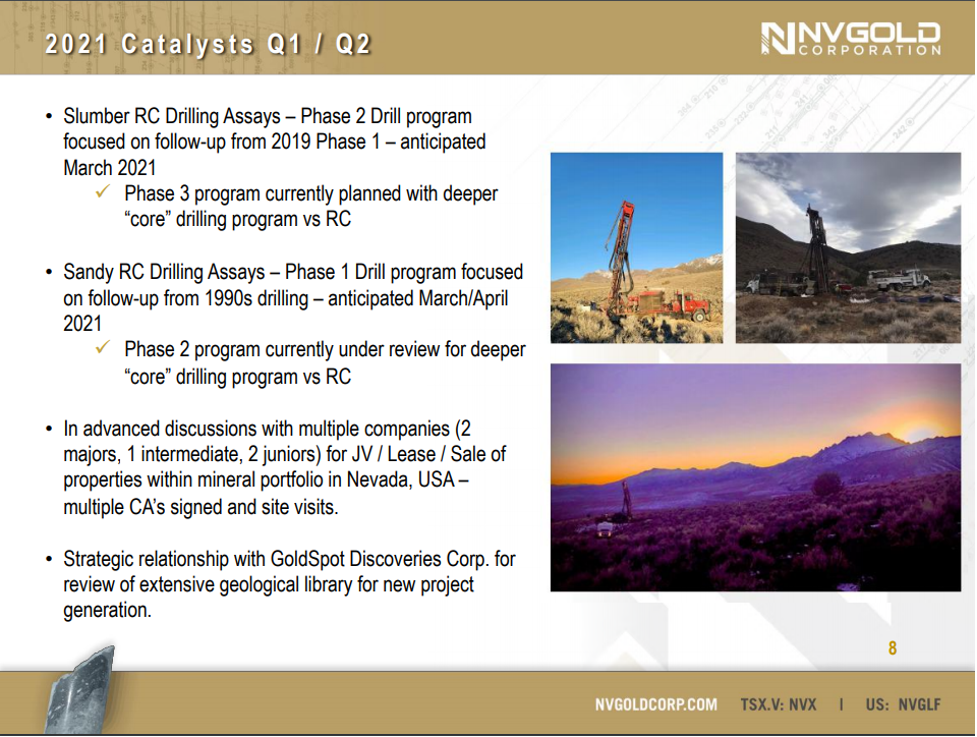

Peter Ball: We finished the Slumber Gold Project in early January, [and] we would look to have the assay results and the internal geological modeling out to the market here probably in the next seven to 10 days. And then we will be onto the Sandy Gold Project, which we're still waiting for the assays, which I suspect will probably be available mid-May.

Just a quick reminder, the Slumber project is in northwestern Nevada, by Winnemucca. It is a similar geological model that we're trying to look at as the old Sleeper project, which is one of the highest-grade gold discoveries and highest-grade gold projects that was ever mined in Nevada.

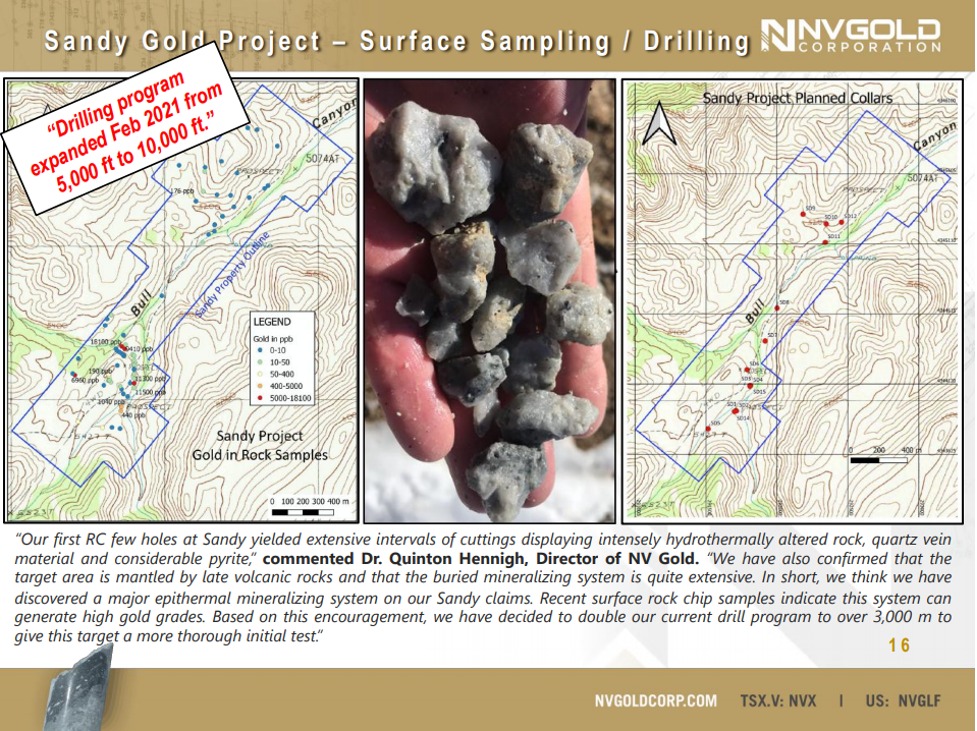

And then the Sandy Gold Project is located just outside of Yerington, or down by Reno, in the southwest portion of Nevada. And that was a very interesting project. We ended up doubling our reverse circulation drill program up to just over 5,000 meters from the original 2,000 meters planned. The rocks looked very interesting. We think we're on to something that may be at depth at Sandy and the assays will tell us where to go, or where to vector. And we'll be doing an IP geophysical program on the project to combine the assays that we'll finally get here the next two to three weeks.

With the geophysics, put them together, and we'll see where the core rig will go in regards to testing the project with some deep holes. And again, it's in the Comstock area. It's one of the most well-known mined areas in Nevada and which built Nevada a hundred years ago.

Maurice Jackson: Peter, you must be an accomplished chess player. As much of the focus has been on the Sandy and Slumber, and then we have today's announcement with the SW Pipe Gold Project. I'm just curious, are there any other pending joint ventures (JVs) out there that are in the works that you might be able to touch on?

Peter Ball: That's a good question. Interesting, I mean, with Nevada being one of the top places to explore with the large portfolio of projects, that we haven't touched in 9 or 10 years as we were focusing on other projects. We have been touring other majors and intermediates and a couple of juniors are sniffing around on our projects. We have signed some confidentiality agreements, or CAs, on these projects. We recently just completed another couple of tours three days ago. These are projects that do deserve the drill bit to further test these projects.

Again, all 14 of our projects have good exploration on them. They all contain gold and have good trenching, drill holes, along with geophysics and some geochemical signatures indicating potential opportunities for the various project. So yeah, I believe that we have the opportunity to get maybe another couple of joint ventures in 2021.

But on top of that, I wanted to touch quickly on our incredible find of our new exploration manager, Thomas Klein. We were lucky enough to steal him from Newmont. He was one of their senior geologists always tasked with finding the next big discovery in Nevada. And with a track record of multiple discoveries to his name, we are looking at some interesting projects to acquire here very shortly that we believe could change the face of NV Gold in 2021, and provide a very aggressive exploration program rollout, testing multiple projects in 2021.

Mr. Klein was a perfect addition to our team. We're so pleased to have him on the team and he knows a couple of our team members very well.

Maurice Jackson: Speaking of those other team members, you have some of the most accomplished names in the resource space serving in management roles and advisory roles. Who are those prominent names on your team?

Peter Ball: Yeah, great question. I mean, as I mentioned earlier, this company was formed really by three individuals and originally founded by our chairman, John Watson, who also is our largest shareholder. John Watson was joined by a couple of his good friends, Dr. Quinton Hennigh, and Dr. Odin Christensen. They've known each other for many years, and when you're good friends and all you love to do is find gold, you're not worried about making money for yourself. It's just making that discovery. They got together, put together a portfolio, which about four years ago. I sold these projects into the company from another company that I was running.

So yes, nothing better than Quinton and Odie and John as our board members and also technical advisors of what to look at. And you now add in Thomas Klein. And of course, we have another great, fantastic geologist/investment banker/broker/individual, Alf Stewart, out of Vancouver, a good friend of mine helping us push forward also over the last couple of years on the board.

Maurice Jackson: Those names don't show up on the balance sheet nor the income statement, but they're so important on the geological and commercial success of NV Gold. We hope that readers appreciate the value proposition that you're not just having the ground, but with the people. The team in many regards must be equal if not important to the project. And you've just done an exceptional job here. I just have to foot-stomp that. That's a big, big feather, again, in your cap as well.

Peter Ball: Thanks, Maurice.

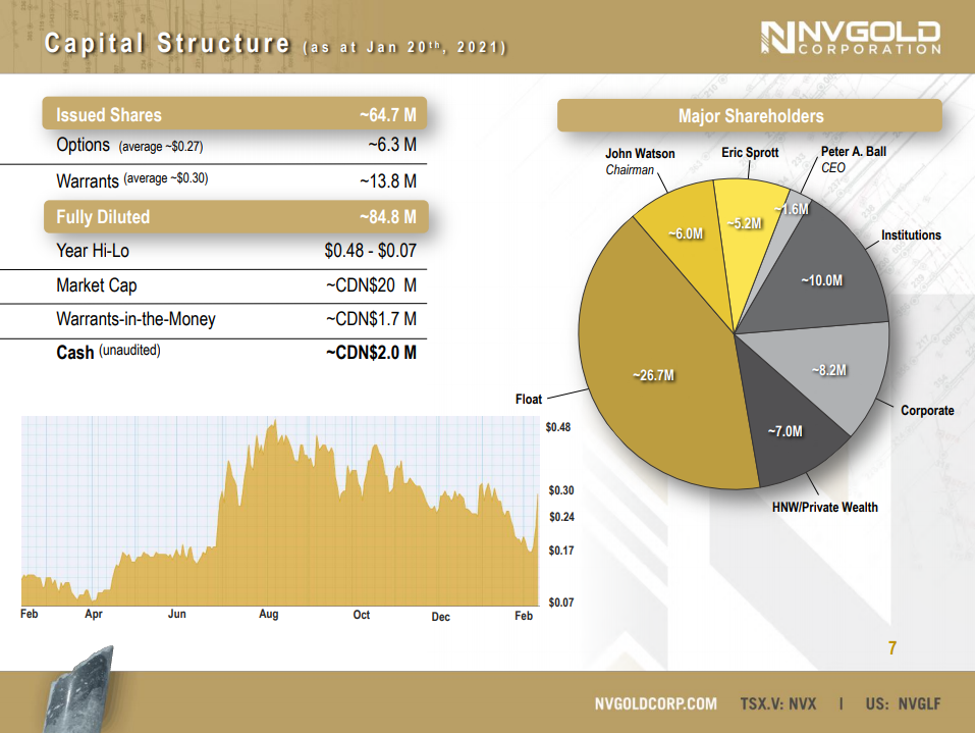

Maurice Jackson: Leaving the people, let's look at some numbers. Mr. Ball, what is the current capital structure for NV Gold?

Peter Ball: Again, as large shareholders, our chairman being the largest shareholder, I'm one of the top shareholders. With Eric Sprott and a couple of great institutions out of the U.S., Crescat Capital, EMA, and another few out of Europe, we focus on ensuring our share structure is tight.

So issued shares right now are about 64.5 million (64.5M) shares outstanding. We've got a number of warrants that are actually in the money. We've got about 13M warrants outstanding, of which about 9M are at $0.20 of those and 4.5M are priced at $0.40 warrants. We have $1.7M of warrants in the money. So fully diluted we are at about 84.5M shares outstanding.

A little quick note on the options. Every time we issue options, we usually issue them at a 35% to a 50% premium to our trading price. So we can chase the price, not give ourselves some nice low options. We're going to have a busy year and some great shareholders. It's a solid share structure, nice and tight.

Maurice Jackson: Before we close, what would you like to say to shareholders?

Peter Ball: At NV Gold, again, we are in one of the best places in the world to explore for gold. We have some of the best technical team members that take ownership of what we do every day at NV Gold. Management has taken a big stake. We have taken a big stake in this company. We have no plan on selling and thus are aligned with the shareholders.

It's going to be probably one of our biggest years. Our goal is to make a discovery and create value. We have several projects and we thoroughly test them. If it doesn't work out, we're onto the next one. We keep our share structure tight for that day when we hit that one project, and we're confident that we're going to hit. We're looking to have multiple projects tested this year. It’s going to be a very busy year, and with a solid share structure, good investors with patience, a good team. . .we are excited.

We see gold having a good push later this year. It looks like it's in the cards. The street, or the herd mentality, is that the market's going to get a bit stronger and we're into a metal supercycle. I don't get into that part of the market, but I've been in the industry since, probably before I was born. So I'm an optimist.

Maurice Jackson: Peter, what do you think are the next steps or upcoming catalysts for NV Gold?

Peter Ball: Well, first of all, we have the news out on Hochschild. That's going to be key and that's going to be a really interesting program to follow along. People are going to want to put us on their radar if you're not an investor currently in NV Gold.

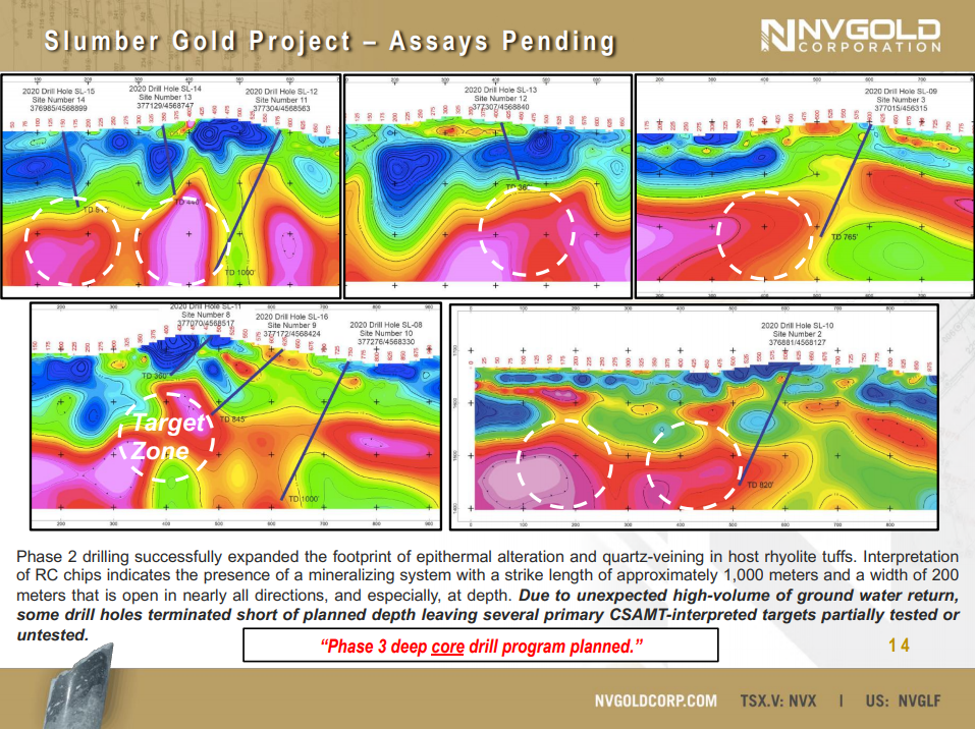

Other catalysts will be some assays coming out soon, project modeling and interpretation on our Slumber and Sandy projects. That's going to give us an idea of how we tackle both of these projects on our follow-up drill programs. I suspect it's going to be some deeper, core-driven programs to test the depth at Slumber, because we've already advised the market on Slumber that we ran into some water problems. In other words, our reverse-circulation (RC) rigs couldn't handle the amount of water that was flowing out of the ground, so we couldn't drill a few of the targets we wanted to, our priority targets.

At Sandy, we are seeing some good visuals in the RC chips at depth. We want to test that project with core also, understand the structures of the veins that we saw the chips in, and allow us to vector in. So you're going to see some news flow in Slumber and Sandy on the next steps.

You usually never make a discovery on a gold project on the first go. We're also looking to add other projects that will also be drill-ready, and we will look to drill them later this year. It's our goal is to accelerate everything on every level.

So lots of newsflow, lots of catalysts, and with a tight share structure and our shareholders know that we put all the money into the ground and we manage the money very well for our shareholders and minimize the dilution.

Maurice Jackson: Peter, if readers want to get more information about NV Gold, please share the contact details.

Peter Ball: Our website is www.nvgoldcorp.com, I may be reached at [email protected] or by phone at (888)393-8993.

Maurice Jackson: Mr. Ball, always a pleasure to speak with you. Wishing you and NV Gold the absolute best, sir.

And a reminder, I'm a licensed broker for Miles Franklin Precious Metals Investments, where we provide unlimited options to expand your precious metals portfolio, from physical delivery, offshore depositories and precious metals IRAs. Call me directly at (855) 505-1900 or you may email [email protected]. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: NV Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: NV Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.