We are extremely pleased to present Sierra Madre Gold and Silver Ltd. (SM:TSX.V) as our core holding in the precious metals space. And the opportunity that presents itself here is a rare one these days, and we'll explain why.

Many new juniors that go public today have paid a hefty price for their project as they have bought it from a major/mid-tier when gold is trading around $1,700ľ1,900/oz, which sets the price, of course.

Sierra Madre purchased the Tepic Project a few years ago when gold was completely out of favor around $1,200/oz. That makes a world of difference.

We will be making several comparisons to another fantastic holding of ours, Prime Mining (PRYM.V). We've struggled with this internally, because Sierra Madre is its own deal, just as Prime is its own deal. But with so many similarities between the two, it makes things easier for us to paint the picture and for you as a reader to better understand the Sierra Madre story.

Management

We want to start here because although other things are very important too, people are in many cases the most important ingredient, even more so when investing in a junior mining company.

The "main" founder of Sierra Madre is Alex Langer, part of the younger generation of mining executives that we will hear lots of in the future as well. Despite his young age of 38, Alex has many years in the industry under his belt and started out in his early days with Canaccord as an investment advisor, but then moved on to the corporate side.

In his earlier days, Alex helped raise funds for well-known silver names like Endeavour Silver, Fortuna Silver and Great Panther, to name a few.

Alex's most recent endeavors have been as co-founder of both Millennial Lithium (ML.V) and Prime Mining (PRYM.V). As it happens, a common denominator in both those deals have been Andrew Bowering, also a co-founder of PRYM and ML. Andy is currently part of the Sierra Madre Advisory Board as well as a shareholder.

There is more common ground as the "head geologist" in both Sierra Madre and Prime is none other than Greg Liller. In his career, he played a key role in the discovery and development of more than 11 Moz Au and 600 Moz Ag combined reserves and resources.

Greg Liller shares the geological work with another seasoned and extremely well-respected gentleman by the name of Greg Smith. Prior to joining Sierra Madre, Greg was the CEO and VP Exploration for Calibre Mining (cxb.to).

Overall, this management team impress us. The combined experience of these gentlemen is in our mind at a different level compared to most new junior mining companies we have looked at.

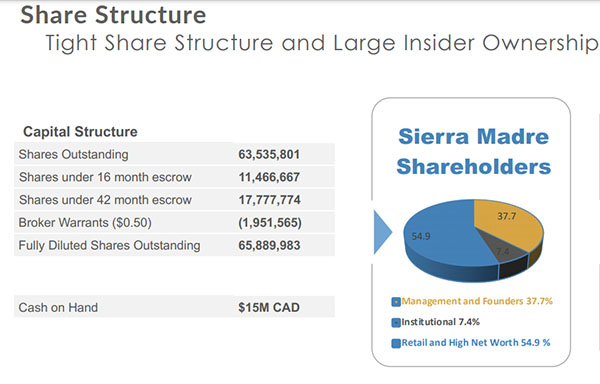

The team of founders and management has plenty of skin in the game, owning just over 37% of the company. And it's not all cheap founders' shares either; members of this team have participated in every financing, including the IPO.

When assessing a junior management, what you want to see are two main parts: experience and skin in the game.

There are too many examples of so-called "lifestyle-companies" in this industry and it still amazes us how retail investors never seem to grasp the importance of this.

If you are able to identify a team like this, half the battle is won, that's how important it is to bet on the right jockey.

Prime's Los Reyes

Let's circle back to Prime Mining. When Prime initially got listed, their objective was to define a new resource and swiftly move the Los Reyes to production with a low capex. As readers of this newsletter very well knows, Prime quickly realized that they had found a hidden gem, much larger than any previous operator had discovered. Both Greg Liller and Andy Bowering were instrumental in what we'd like to call a "new discovery."

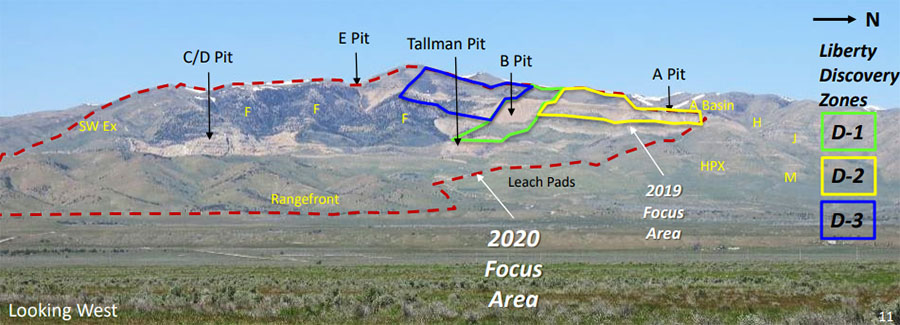

Sierra Madre's Tepic Project

The Tepic project is a high-grade, near-surface project. Silver is the predominant metal (2/3) with gold as a by-product (1/3). The historical 43-101 resource is roughly 10 million ounces of silver equivalent resources grading just shy of 200g/t AgEq. In metal value, and perhaps easier for readers to get a handle on, that would be roughly a 3 g/t AuEq resource sitting at surface.

Some of you might remember Capital Gold which had a Mexican open pit gold mine, very profitable, with a head grade just below 0.5 g/t Au. Put that half a gram in context with Tepic's 3 g/t AuEq and you can imagine the potential. There's obviously more to that equation, but the point we're making hereŚTepic is a very high-grade open pit project.

The Tepic Project has more than 31km (!) of drill core still sitting in the core shed, providing a huge amount of data and knowledge about the project. An updated resource could very well be announced later this year. With the work that has been ongoing constantly in the past many months, we not only expect a larger resource, but we're assuming this should also provide lots of news flow in the near future.

Tepic has a short path to production with a very modest capex, and when Tepic was in the hands of the previous operator, a large mid-tier silver producer tried to buy the project.

So, what does it mean for a project like Tepic to have had a cash offer from a larger silver producer? It means that a group of very smart people have gone through a very thorough and tedious due diligence process that led them to a conclusion that Tepic is a mine in the making.

This validates the high quality of Tepic and it gives us great comfort that this project is now in the hands of very experienced and competent people. We can only assume their objective were to put Tepic into production.

Which raises several questions: Will Sierra Madre become a near-term silver producer? Will the project be up for sale once again? CEO Alex Langer will for obvious reasons be very busy this spring, but we will try to schedule an interview shortly, in order to get a better handle on Sierra Madre's plan for Tepic.

What we do know is that Tepic is drill-ready with 67 holes currently being permitted and ready to go. The infrastructure is excellent and a paved highway takes you to the front gate of Tepic.

Share Structure & Capital Raised

First of all, let's get the "disclaimer" out of the way. Gecko Investor Group (GIG), with its high-net-worth investors, invested in Sierra Madre at the 50 cent IPO round. We also invested in the round before that at 15 cents.

The interest in Sierra Madre, even while private, was huge. We know this because, just like everyone else, we got cut back significantly. Despite the large cutbacks, Sierra Madre raised C$15 million in its IPO, which makes it one of the best capitalized new juniors to the market.

Despite the large raise, the share structure is really tight and lean, only ~64 million shares outstanding. Management and insiders own almost 40% of the company. Add to that a large number of institutional shareholders, including several international gold funds.

Institutional Shareholders

Institutions rarely come in early in a junior mining deal, but they do occur. If Robert Friedland or the Lundin family put together a new deal, you know that will attract institutional investors. There are a few more examples, but the groups that can attract these types of investors so early in the game can probably be counted on five fingers, that's how rare it is.

Sierra Madre doesn't have one or two institutional investors as shareholders when the company lists on Monday, Sierra Madre has no less than TEN (!) institutional investors, which makes it very unique in that sense.

According to the corporate presentation, institutions hold 7.4% of the shares. On average, that makes their holding of Sierra Madre less than 1% each, which we suspect is far from enough to move the needle for any of them. This is great for Sierra Madre and it also puts the company in a very strong position as these institutions will want to add to their position.

Why is institutional interest so important and what could it mean for a small company going forward? As long as Sierra Madre delivers good results and create value for shareholders, these institutions will (usually) want, at a minimum, to maintain their percentage ownership in the company. In this case and on the back of how little these +10 institutions currently own, we have a feeling that they would like to increase their ownership in Sierra Madre. Therefore, we make the assumption that the next financing is more or less guaranteed. Not many junior mining companies can compare, and for us as retail shareholders, this limits our downside.

Our Conclusion & Summary

We are in a bull market for precious metals and by the look of things, the timing for this new listing could prove to be impeccable as gold and silver show signs of breaking out of an 8-month long consolidation.

Out of the gate, Sierra Madre has a $32 million market cap with $15 million in the bank, giving them an enterprise value of a mere $17 million. We don't want to try to guess where the stock will trade going forward, but with the institutional backing, the quality of asset and management and the large cash position, we suspect that Sierra Madre fairly quickly will trade in the dollars rather than in the cents.

Sierra Madre is our BIG BET in this precious metal bull market and it will be our CORE SILVER holding going forward. We will probably be adding to our position.

Webinar on Wednesday, April 21st

Sierra Madre's IR firm, Adelaide Capital, is hosting a webinar at 11am (EST) on Wednesday April 21. To register, use this link.

Team Gecko Research

www.geckoresearch.com

If you like our work, feel free to share this link with your friends for our free newsletter:

https://geckoresearch.com/newsletter/

Gecko Research is composed of a small group of private investors whose aim is to broadly share knowledge and investment ideas. Its research is independent and is based on its view of the company or sector based on publicly available information.

[NLINSERT]Gecko Research:We are not investment advisors and what we write is our own view only. Please read our disclaimer.

Disclosure:

1) Statements and opinions expressed are the opinions of Gecko Research and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Sierra Madre. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre and Fortuna Silver, companies mentioned in this article.

Additional disclosures:

Gecko Research: All information found on our website or in any of our newsletters, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice.

Gecko Research (ôthe Authorö) is not licensed to act as investment advisor or to deal in securities in any jurisdiction. The information contained here is not intended to be advice and any information contained herein should not be relied upon for any investment decision. In the event that a reader wished to propose investment in any public issuer referred to herein, they should consult with their own legal and financial advisors before making such investment. Gecko Research is not a registered financial advisor and investors should seek professional advice before making any investment decision. Our research is independent and is based on our view of the company or sector based on publicly available information.

Factual errors might still occur, and it is every reader┤s obligation to do their own research and not to solely rely on information given by the Author. The article/newsletter is our view about the stock and do not constitute advice to buy or sell shares in the companies we discuss or any other company. The Authorĺs mission is to provide transparent viewpoints on companies we believe provide good investment opportunities.