Maurice Jackson: Joining us for conversation is Michael Thompson, the CEO of Kesselrun Resources Ltd. (KES:TSX.V).

It's a pleasure to be speaking with you today to share the opportunity before us in Kesselrun Resources. Before we delve into company specifics, Mr. Thompson, please introduce us to Kesselrun and the opportunity the company presents to the market.

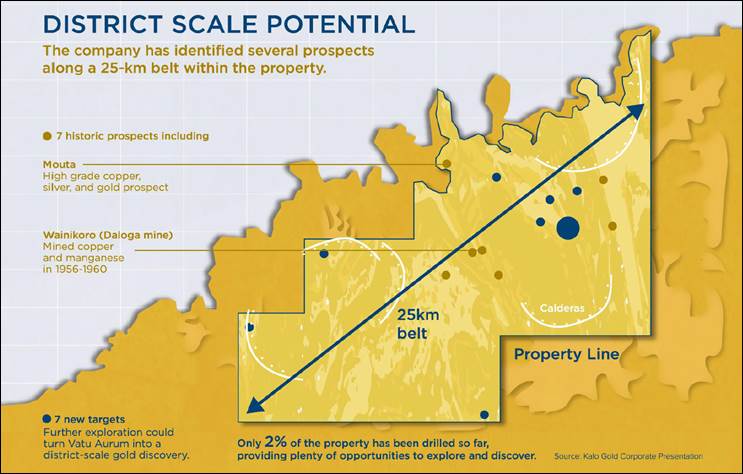

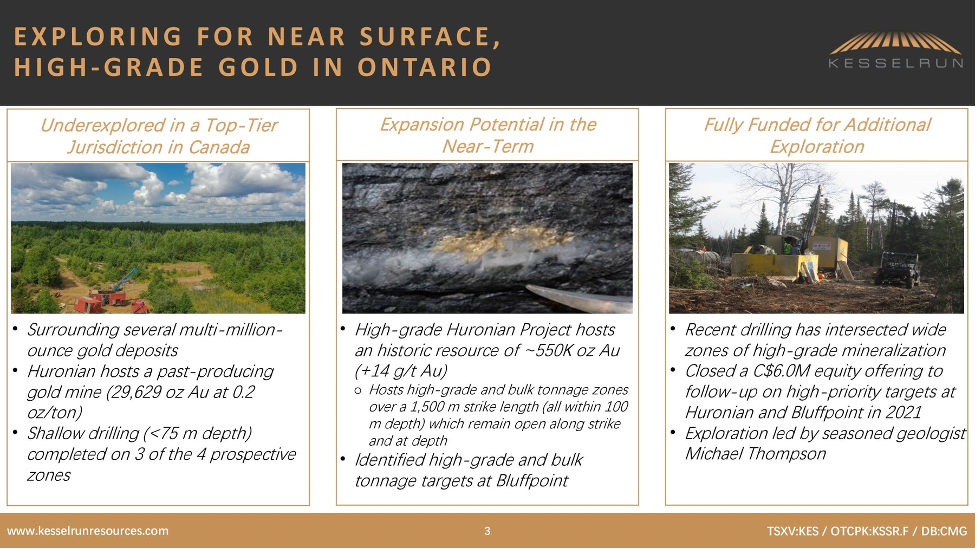

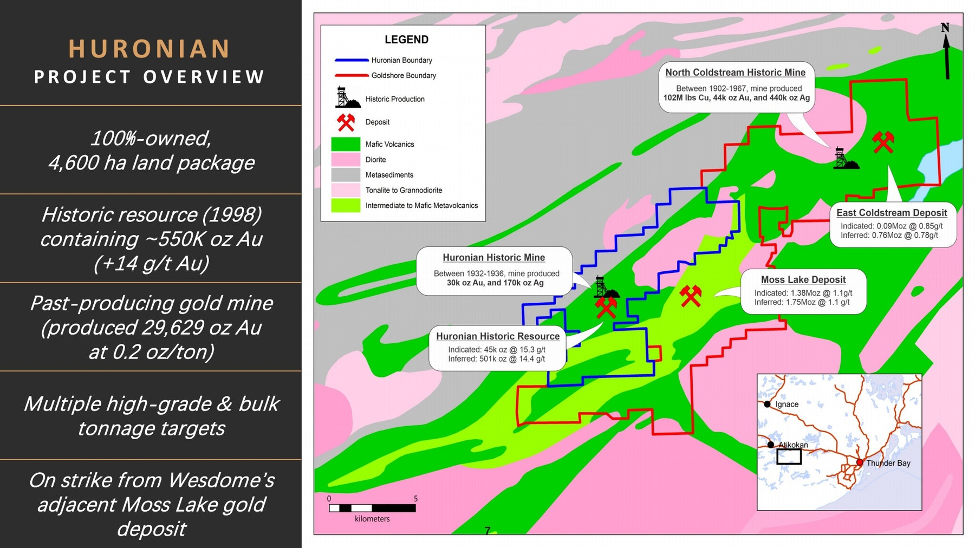

Michael Thompson: Well, Maurice, we're focusing on our 100%-owned Huronian Project. It's an underexplored near-surface gold project. It's host of a high-grade former producer and a host to a high-grade historical resource. And it's located in northwestern Ontario, a top-tier jurisdiction with excellent infrastructure and excellent geological potential.

Maurice Jackson: Kesselrun has several virtues that provide the company a competitive advantage that we plan to cover today, such as multiple high-grade and bulk tonnage gold targets, limited exploration in a top-tier jurisdiction with a highly experienced management team and board of directors, and the company is fully funded. Mr. Thompson, let's go onsite. Take us to northwest Ontario, which is an emerging district known for numerous multimillion-ounce development and advanced-stage exploration projects, and introduce us to the company's flagship Huronian gold project.

Michael Thompson: The Huronian Gold Project is located in the northwest of Ontario, which is a prolific gold district hosting multiple high-grade advanced exploration projects hosting multimillion ounces. It has excellent infrastructure with a supportive mining community. And as you said, we're fully funded and we're drilling right now on Huronian.

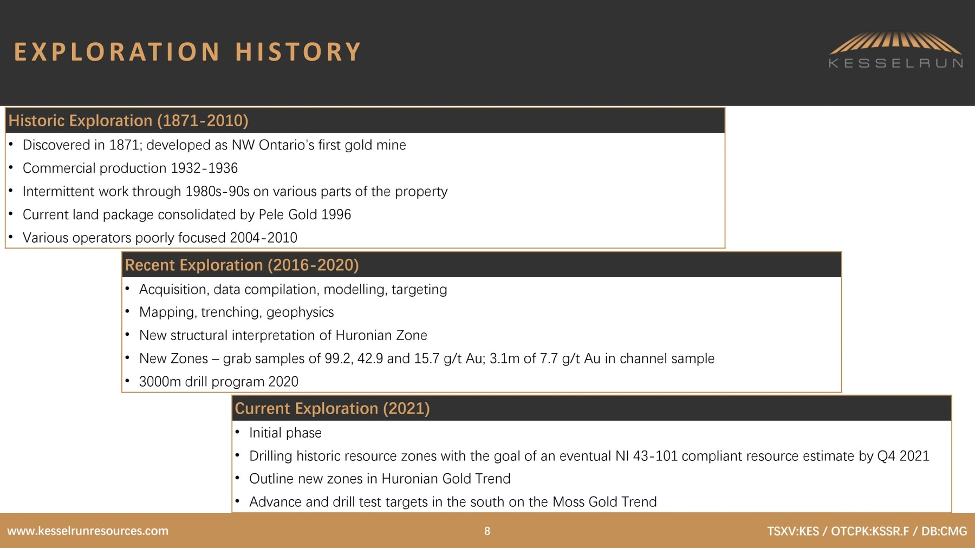

Maurice Jackson: The location looks very compelling, but the Huronian Project also has a very rich history. Before we move forward into more project specifics, take us to the genesis of the project and share the exploration history of the Huronian Project.

Michael Thompson: The Huronian Project itself is a 4,600-hectare land package. We own it 100%. We have a great historical resource, just over 500,000 ounces, and it was a past producer that produced a high-grade gold, and we're adjacent to Wesdome Gold Mines Ltd. (WDO:TSX) and now a company called Gold Shores, which hosts the Moss Lake Project, which has over 4 million ounces of gold.

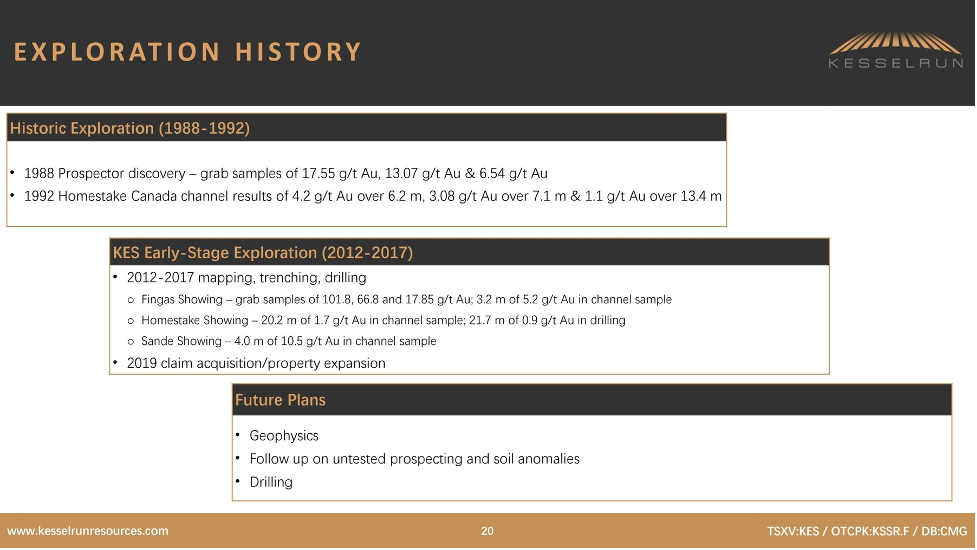

The exploration history of the project: It was the first discovered gold mine in northwestern Ontario in 1871, with commercial production in the 1930s. The project sort of went through intermittent work in the 1980s–90s. And then the package was put together by Pele Gold in 1996, just before the gold market busted in '97. So they never really gave it a good kick at the can. And the project sort of bounced back and forth between people auctioning through the last gold boom in the early to mid-2000s.

So we acquired the project in 2016 at the bottom of the market. I like buying projects when the bottom's in and we can buy low. We spent the last few years getting all the data compiled, doing some geological modeling and targeting, and mapped the entire project. We also did overburden trenching and geophysics, and we've come up with a new structural interpretation of the Huronian zone. Through our work, we've discovered a couple of new zones with grab samples. And then we raised a bit of money and in the summer of last year and drilled a 3,000-meter program.

Maurice Jackson: Now that we have some context, let's get some content because exploration is a research-and-development exercise. I'm interested in learning how Kesselrun arrived at their thesis, which has given the company confidence that the upside is just before some making additional discoveries and increasing shareholder value. Please walk us through the genetic model and then the exploration model.

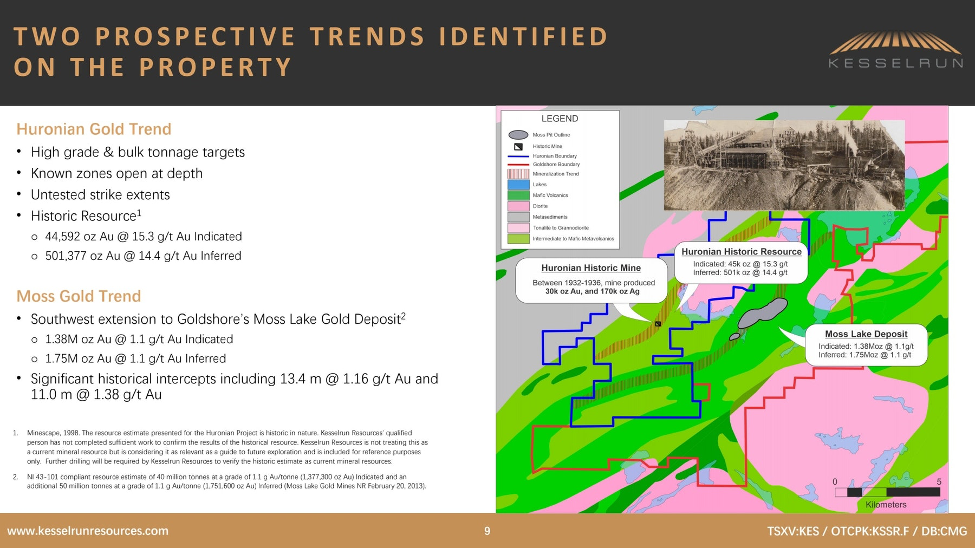

Michael Thompson: So the project has two gold trends. The adjacent Moss Lake deposit is hosted in the Moss Gold Trend. That trend comes onto the southern part of our project. And then we have the Huronian Gold Trend, which is the host to the historical resource and to the historical producer. The genetic model, essentially in a simplified form, is the flexures in the shear zones that are the key to focusing gold mineralization into economic concentrations. And so that is where our focus is, on the southern part of the property. In the Moss Gold Trend we have been working hard to try to find another flexure. We believe we have, and we look forward to testing that down the road. But right now we're focusing on that flexure in the Huronian gold trend, where the historical resource and the historical mine is.

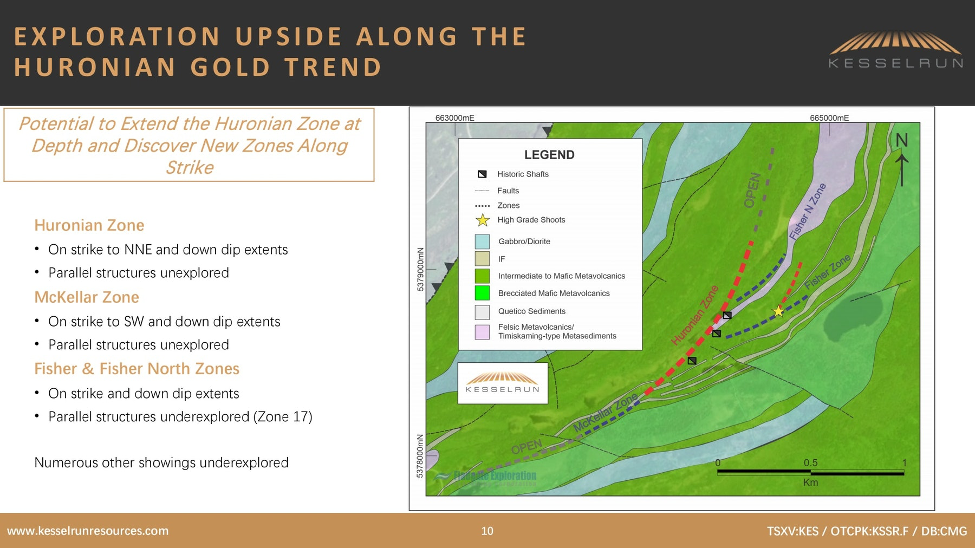

Maurice Jackson: Speaking of that trend, there's a lot of blue-sky potential before us. Can you discuss that a little further?

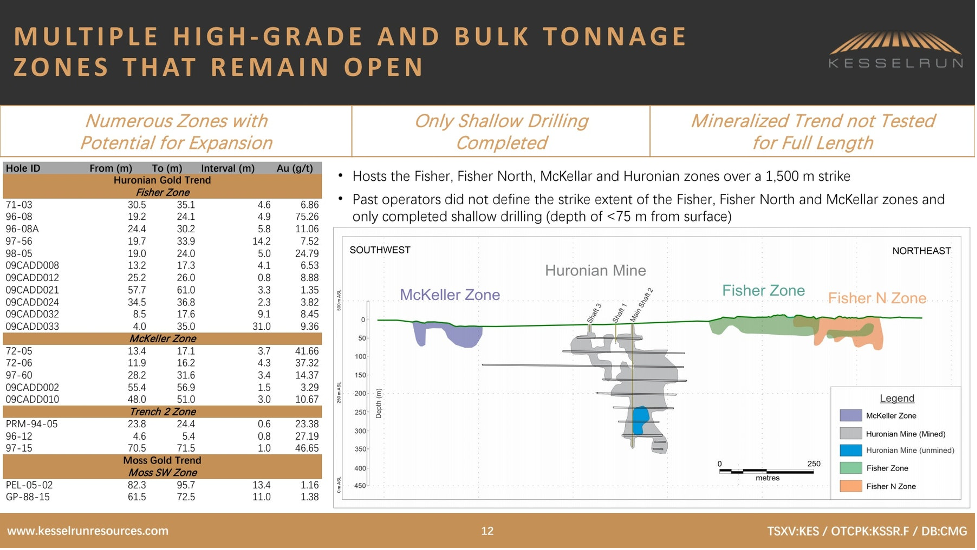

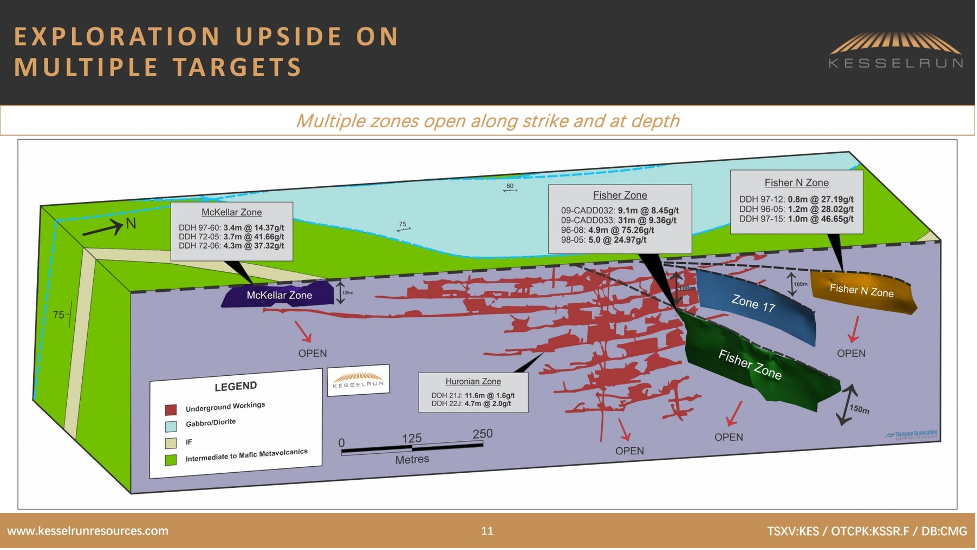

Michael Thompson: Absolutely. We see tremendous blue-sky potential before us, not only on the Moss and Huronian Gold Trends, but on that zone strike that continues up to the north end of the property, which is very underexplored, where there has been virtually no drilling for kilometers. Kesselrun is going to work hard on developing new targets, but in the immediate mine area, there are numerous zones to be followed up on and, of course, the potential to find new zones. We've been discovering new zones through our work, and in particular in the 2020 drilling. So we're quite excited about that.

Maurice Jackson: Speaking of the 2020 drilling and 2021, let's find out about your proof of concept and walk us through the highlights, sir.

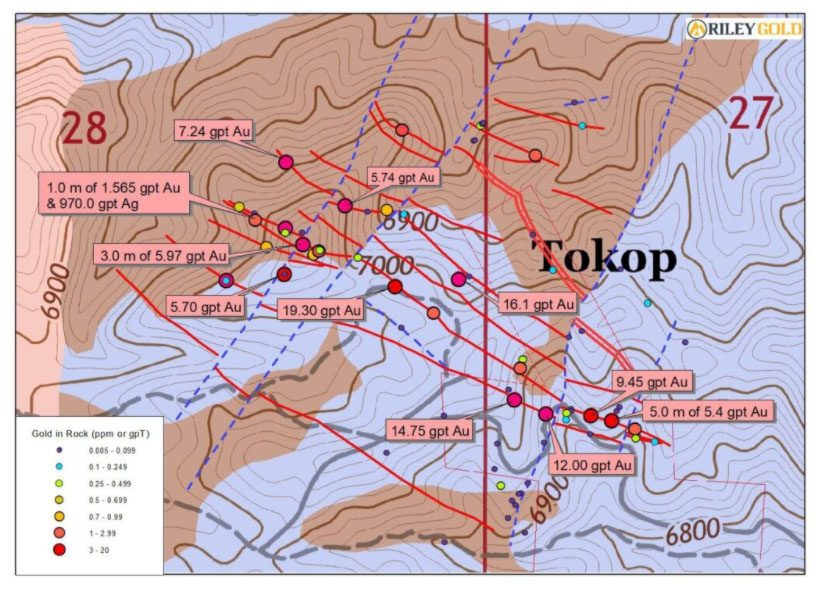

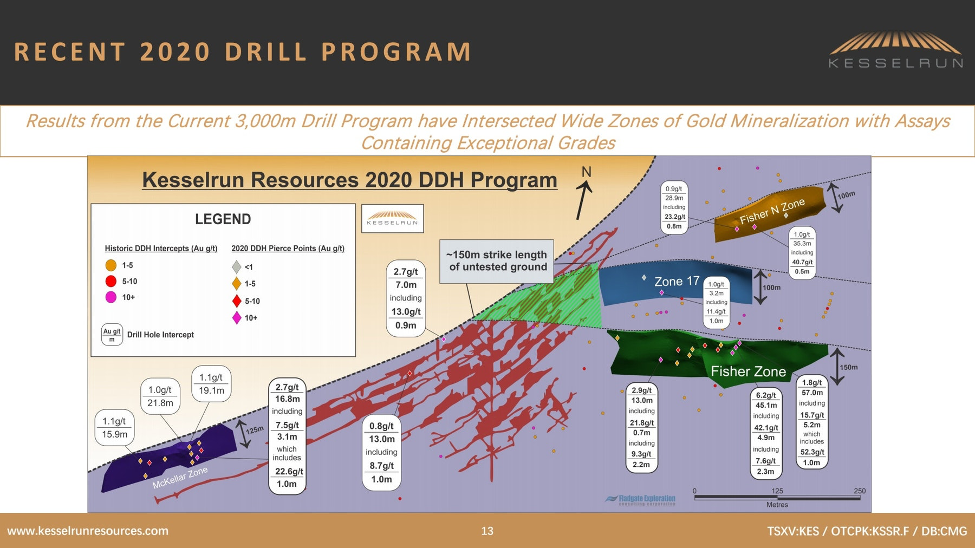

Michael Thompson: So the 2020 drilling: We've got three zones that host the historical resource: the McKeller, the Fisher, and the Fisher North zone. And then the Huronian zone itself does not host any of the historical resource, but has tremendous potential. By the way, that's where the old timers mined, so more than likely where the best mineralization lies.

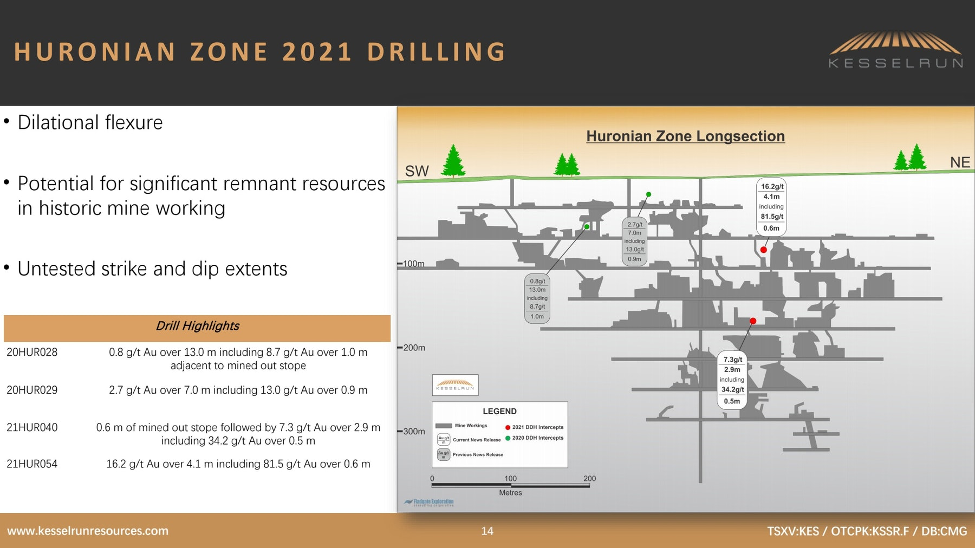

And that Huronian mine trend, when it crossed that orientation, we think may be multiple sheer zones. We noticed when they crossed the more east-west Fisher, Fisher North and McKeller zones, you get fantastic load-outs. And that's where we're getting those, those big widths and high-grade drill intercepts last year. So last year we tested that, we tested a couple other zones, the Fisher North and the McKeller, and we got the first drill holes into the Huronian mine since the 1930s. So we're quite excited about following up on the Huronian zone as well.

Maurice Jackson: Kesselrun had a press release this week (click here). Walk us through that press release; the numbers are pretty exciting.

Michael Thompson: We were quite excited as well because we drilled the first holes into the actual mine area in between stopes. We think there's tremendous potential to outline a remnant resource within that zone. And we wanted to see what the mineralization looked like and get an idea of what it's doing so we could better target elsewhere down plunge and on strike on the Huronian zone. And so we got quite a nice 4-meter zone grading about 16 grams, including 0.6 meter at 81 grams. Quite significant that there's still that much mineralization remaining in between stopes that were unmined.

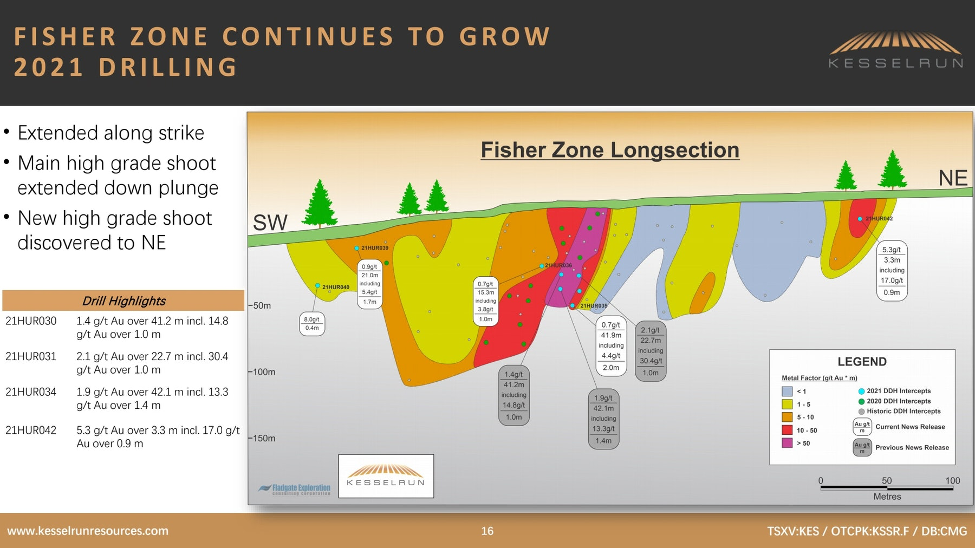

Maurice Jackson: Now you were discussing the Fisher zone previously. Is there for expansion on the Fisher zone?

Michael Thompson: There is. All the historical zones have only been outlined to about 75 meters depth historically, previous to Kesselrun working them. We're working on extending the strike extents, which in the last news release we did—we extended it a total of about 150 meters on strike. And we're working hard to trace this high-grade shoot that is known, and that we've been working at further depth. So, tremendous strike extent potential, tremendous down-dip potential.

Maurice Jackson: I've got a two-pronged question here for you, sir. Did you twin the historical resource, and how far along is Kesselrun in making the Huronian NI 43-101-compliant, and in what category?

Michael Thompson: Last year we did twin a few holes. We don't have access to any of the historical core. We wanted to get our eyes on the mineralization—part of that process of getting that historical resource area into NI 43-101 compliance is to prove that the results, the historical results, are true. More than likely the category that we'll first cross will be inferred. Our goal is to have that by the end of the year. That's an aggressive goal, but I'm an aggressive exploration geologist. So that's the way we roll.

Maurice Jackson: I like it. Is there any active drilling being conducted or in the plans for 2021?

Michael Thompson: There is. We're drilling right now. We started at the end of January and we've got one rig on site. We're considering putting a second rig on site. There are just so many targets to drill. But to achieve our goal of getting to that compliant resource by the end of the year, we need to be drilling aggressively.

Maurice Jackson: Kesselrun is not a one-trick pony. You have another very compelling project in your property bank. Sir, please introduce us to the Bluffpoint Project.

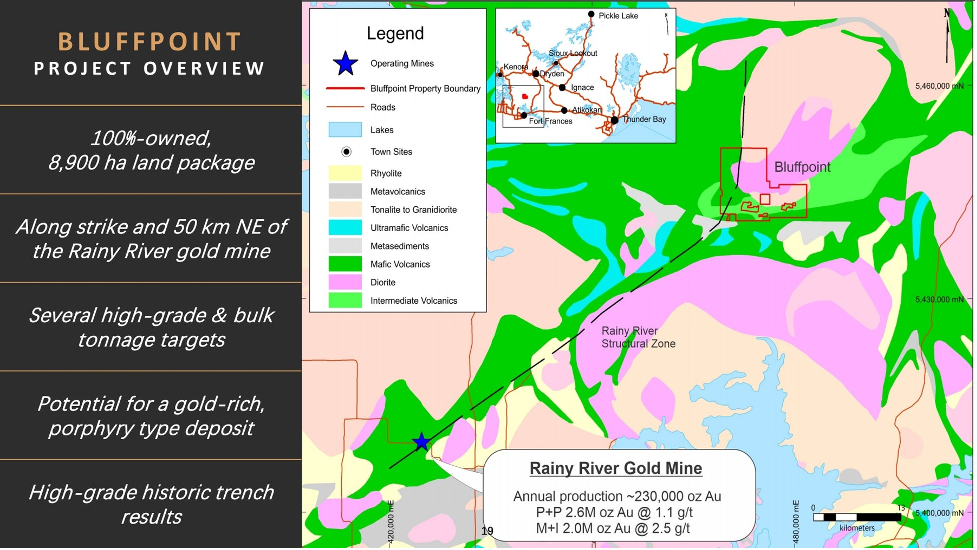

Michael Thompson: The Bluffpoint Project was the first project we acquired back in 2012. It's 100% owned as well. It's just under 9,000 hectares, about twice the size of the Huronian project. It's on strike from the Rainy River Gold Mine that New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) has in production. It's a mine that produces about 230,000 ounces a year, and that Rainy River structural zone runs to the northeast. And that's where our project is, about 50 kilometers northeast of the mine. We're looking at a porphyry-rich gold deposit. It's a granite-hosted gold deposit, but it has tremendous potential. There are multiple high-grade and bulk tonnage targets on the project.

Maurice Jackson: What can you share with us regarding the exploration history there?

Michael Thompson: The Bluffpoint is quite an interesting project. It was discovered by a prospector in the late eighties. Historically, most people didn't explore northwestern Ontario in these types of rocks. And so having a prospector make this discovery was quite significant—significant enough to attract Homestake Canada, the predecessor company of Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), which worked it in the late eighties into the early nineties. At the time, it was a remote project. There was no road access. They had to floatplane in onto the lake, and they did just preliminary work, or they mapped it and did some hand trenching.

We acquired the project in 2012 and we mapped the entire project. We did overburden trenching along with one small drill program. We've got some quite encouraging results thus far, such as 20 meters at 1.7 grams on surface from channel sampling, and just under a gram on 22 meters in drilling. Through 2019, ground has been coming open. We've been acquiring ground through staking. In the future, we're looking at following up with some geophysics to prove up our targets and to follow up with drilling eventually.

Maurice Jackson: And that answers my next question. Is there any activity going on right now at the Bluffpoint?

Michael Thompson: There isn't. Right now we're mostly just doing desktop studies. We're trying to concentrate on Huronian and putting our full efforts there. But at some point soon, we will be doing some work to follow up on getting, drill ready.

Maurice Jackson: I believe that the market cap has the potential for a significant upside, which bodes readers joining us today. Why has the company been under speculators' radars?

Michael Thompson: Well, we were sort of in hibernation through the downturn. We tried to keep the burn rate low, and we didn't want to raise money at low prices and continually do that just to keep the lights on. I was working with no salary. I was footing a lot of the bills for some of the work we wanted to do through the downturn. We're trying to reintroduce ourselves to the market, essentially, with this initial drill program. We're working hard to get the word out.

Maurice Jackson: Let's discuss some important topics germane to the projects. To reconfirm, are your projects 100%-percent owned, or do they have any earn-in options?

Michael Thompson: 100% owned.

Maurice Jackson: I love to hear that. We're going to get into some numbers later in this discussion, but from a capital expenditure standpoint, how is infrastructure on your projects?

Michael Thompson: Infrastructure is great. In northwestern Ontario, where both of our projects are located, there are two arms; the Trans-Canada Highway and many secondary highways. There are major logging roads, along with secondary and tertiary logging roads, all through the projects. Huronian, as an example, is, only about 15 kilometers south of Trans Canada, and the hydro grid is being upgraded. It's just a great place to be exploring and eventually to be developing.

Maurice Jackson: What is your relationship with the indigenous people?

Michael Thompson: It's good. We have a good relationship with the local indigenous communities in the areas of both projects.

Maurice Jackson: Are you fully permitted?

Michael Thompson: We're fully permitted on Huronian. The permit is good until December of 2022, and Bluffpoint is in the process of renewing its exploration permit. We're hopeful that it should be, and we have expectations it should be done shortly.

Maurice Jackson: Is the ultimate goal for Kesselrun to build a mine or arbitrage?

Michael Thompson: I get asked that question a lot. I'm an exploration geologist. So that's what I do. But ultimately, whatever path that the project takes will be the best value for our shareholders. If we want to go down the road to building a mine we'll bring on management that has expertise in building mines. As I said, I'm an exploration geologist. My expertise is finding mines.

Maurice Jackson: We've discussed the good. Let's address the bad. What can go wrong? And what are your action plans to mitigate that wrong?

Michael Thompson: The results may disappoint. That's what can go wrong. So far, so good. We have high expectations and I think we're living up to those expectations so far.

The market can certainly turn on a dime. But that is out of our control.

Our action plans to mitigate the aforementioned: we could stop the exploration pretty quick because I run a consulting company that provides the services. We can start and stop as we see fit pretty quickly.

Maurice Jackson: Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Thompson, please introduce us to your board of directors and management team. And what skill sets do they bring to Kesselrun resources?

Michael Thompson: As I said, myself, I'm the president and CEO and the director. I'm a partner at a consulting company based in Thunder Bay, near the projects, the major city near the projects. I'm a professional geologist with over 20 years of experience, specializing in structural interpretation and gold deposits. I've worked with Teck Resources, Placer Dome and Goldcorp in the past.

John da Costa is the CFO. He's also a director. He runs a management consulting firm in Vancouver. He has over 25 years of experience in corporate management and compliance.

We have Caitlin Jeffs as a director. She's also a professional geologist with over 15 years of experience. Brings a lot to the table in advice and in targeting. She's the president and CEO of a company called Red Metal Resources.

And finally, we have Yana Silina as a director. She's a chartered accountant and CFO of several public companies.

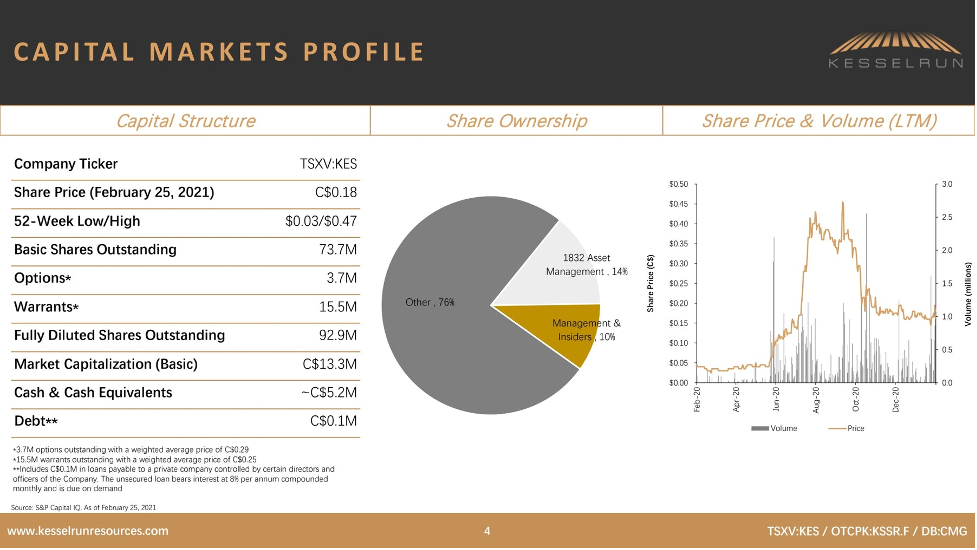

Maurice Jackson: Let's get into some numbers, sir. Please provide us with the capital structure for Kesselrun Resources.

Michael Thompson: We're trading just under $0.20, and we've got about 74 million shares outstanding; about 93 million fully diluted. Our market cap is in the $13 million range. In my opinion, we're quite undervalued, and we're fully cashed up.

We began after we raised $6 million with cash and cash equivalence. We were north of $6 million and we're still just over $5 million left in the till after we just paid a bunch of bills. So it's a fairly accurate number.

Maurice Jackson: Well, you're not alone in your assessment of the share price. I have a Rolodex of names that I correspond with within the space, and they took a look at the company. They shared the same sentiment that you and I share regarding the potential upside here that the market has not recognized. How much cash and cash equivalents do you have?

Michael Thompson: We're just over $5 million, about $5.2 million, right now in the bank.

Maurice Jackson: How much debt do you have?

Michael Thompson: There are still $100,000 on the books. That's to my consulting company that had been doing work through the downturn and, we still haven't cleared up.

Maurice Jackson: What is your burn rate?

Michael Thompson: With the drill program ongoing we're looking at about $500,000 to $600,000 per month.

Maurice Jackson: Who are the major shareholders?

Michael Thompson: Well, I'm a major shareholder. Management as a whole owns approximately 10%. Then we have 1832 Asset Management, which owns 14%. We have other institutions that are combined at about 18%, but individually they're still under 10%. So they don't report.

Maurice Jackson: And what is the float, sir?

Michael Thompson: Seventy-four million shares outstanding; 93 million fully diluted.

Maurice Jackson: Are there any redundant assets on the books we should know about?

Michael Thompson: No.

Maurice Jackson: Are there any change of control fees? If yes, what is the compensation?

Michael Thompson: None.

Maurice Jackson: Is management charging a consulting fee for any services? I believe you stated yes on that.

Michael Thompson: Yes. So the consulting company, the exploration consulting company, provides the services at industry-standard rates. And then I charge a management fee to be president/CEO.

Maurice Jackson: In closing, multilayered question. What is the next unanswered question for Kesselrun Resources? When can we expect a response and what determines success?

Michael Thompson: Well, I think the next unanswered question is proof of concept, which we were just starting to do with the drill program. We need to start showing continuity and mineralization, and depth and strike extents. We're working hard to get the story out to the market. And I think that's the biggest explanation of why we're undervalued.

Maurice Jackson: What keeps you up at night that we don't know about?

Michael Thompson: The drill breaking down. There's lots of stuff that keeps me up at night. It's a risky business, but that's why we like it. So you worry about the results. You worry about the logistics. I worry about the safety of my guys and my team. I've got a great team that is working hard, and they're very smart and doing a great job. But you know, in this pandemic and exploration can be a risky endeavor. So I worry about their safety.

Maurice Jackson: Last question. What did I forget to ask?

Michael Thompson: I don't think you forgot to ask anything. I think we've covered everything. The big one is the market. We need to work hard to get our story out to the market. That's the big one for us. We need to tell this great story to more people.

Maurice Jackson: And I want to footstep. It's just not my opinion, nor is it Mr. Thompson's. Some of the most respected names that I have spoken to about Kesselrun believe the market cap is low based on the merits, which we've covered today. Mr. Thompson, for readers that want to learn more about Kesselrun, please provide the contact details.

Michael Thompson: Visit us at www.kesselrunresources.com. You can contact me at [email protected] or give us a call at (866) 416-7941.

Maurice Jackson: Mr. Thompson, it's been a pleasure speaking with you today. Wishing you and Kesselrun Resources the absolute best, sir.

And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRA's. Give me a call at (855) 505-1900 or you may email: [email protected]. Finally, please subscribe to www.provenandprobable.com, where we provide mining insights and bullion sales; subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.