Maurice Jackson: Joining us for a conversation is David Cole, the CEO of EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American), the Royalty Generator.

What a delight to have you on today, as EMX Royalty has some breaking news for shareholders coming out of Serbia. Before we begin, Mr. Cole, please introduce EMX Royalty and the opportunity the company presents to the market.

David Cole: EMX Royalty is a unique royalty company that accumulates royalties around the world by executing an organic growth of royalty generation, which is the acquisition of prospective mineral rights adding value by building geologic models, and selling those mineral rights onto an industry that's hungry for new discovery opportunities for cash, shares, and, very importantly, royalties. And so we get paid to generate royalties, whereas most of our competitors pay dearly to acquire them. We also buy royalties that are already existing to augment our portfolio, and we make strategic investments, which have panned out very nicely over our 17-year history, putting us in a strong cash position of over $40 million in cash, no debt and exposure 250 mineral property assets around the world.

Maurice Jackson: EMX has been on a roll. I recently had the opportunity of interviewing Dr. Eric Jensen, he's the general manager for exploration on EMX, and we highlighted the company's recent successes in Scandinavia. So if you missed that interview you may read it here. I was on record then, and I'm on record now. I plan to match my bullion purchases this year with shares in EMX Royalty for a third year.

EMX Royalty, in my opinion, is the perfect blend of accretive transactions combined with stellar business and geological acumen. I have confidence that the share price of EMX will melt up. And let me say that again, melt up. And even at today's prices, I'm actively looking to add to my position and let's find out why. Mr. Cole, take us to Serbia, along the Bor Mining District, as EMX has some breaking news regarding one of the biggest ongoing copper, gold discoveries in the past decade that will have a direct impact on the Timok Royalty Property.

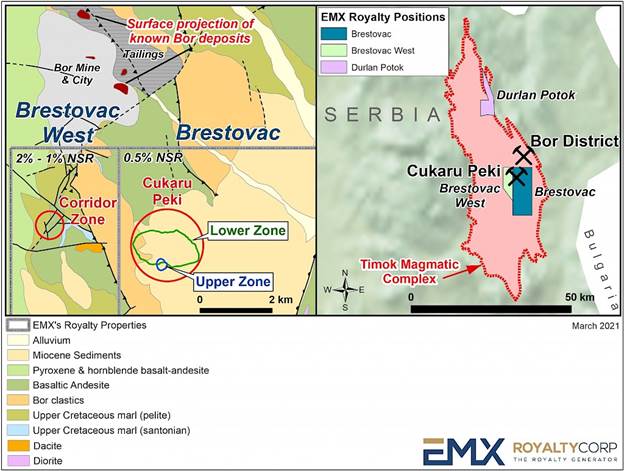

David Cole: Happy to. The history of Timok within EMX goes back to the very beginning. It was our first business unit actually. And we started working in Serbia because we recognized the excellent geology. We advised the Serbian government with respect to their new concession legislation, and their new mining legislation. Consequently, we became the first foreign company to obtain a metals exploration permit in that country. In many decades, we subsequently part parceled to our business model after we built up the geologic models, we sold that off to Reservoir Capital, who did an excellent job on the property. We sold it for a combination of cash, shares and a royalty.

And Reservoir formed a joint venture with Freeport, one of the large copper companies here in the United States, and they made a big discovery. As luck would have it, that discovery was just off of our boundary of the royalties that we had created, through the project sales, but we were aware of the geology. We knew what was going on, and there was an existing royalty owned by a different company over the discovery.

So this is a good example of integrating organic growth of royalties via our prospect and royalty generation methodologies, as well as buying royalties to augment those. In this case, we had the royalties that we'd grown organically in the district. We saw that the discovery being made right next door, we went out and bought that royalty in 2013; a subsequently huge discovery has been made. They ended up selling that to Nevsun. Nevsun was then taken over by Zijin , a major international mining company that is headquartered out of China. They are fast-tracking, as the Chinese often do, this deposit into production, and they came out with a press release recently explaining that their underground infrastructure has intercepted high-grade ores, and they will be in commercial production in the second quarter of '21. And just to remind everybody, we have one half of 1% royalty for that and it's a very big mineral system.

Maurice Jackson: The company also filed a technical report on Sedar. Can you provide us with the details on how this will impact shareholders?

David Cole: It's always good to get that technical information out, and Zijin has information about the deposit on their website, and Nevsun in the past filed what we call 43-101 compliant resource documents. So there's a lot of information that's available to folks to see how this deposit is being advanced. And it's part of our obligation, as a reporting issuer, is to file these technical reports, it's always good to get that information out there. The contractual obligation to the royalty and the royalty contract itself has also been filed. So that's publicly available on www.sedar.com.

Maurice Jackson: Leaving the Timok complex, what would you like to say to shareholders?

David Cole: Well, this business model has been creating royalties around the world for almost two decades now, and around on the cusp of some of the most important ones becoming cash flowing. And this is going to be transformative with respect to our evaluation.

Maurice Jackson: Before we close, Mr. Cole, please share the capital structure for EMX Royalty.

David Cole: We only have about 82 million shares issued and outstanding 94 million fully diluted. We have as much cash in the bank combined with our tradable securities in our long-term investments within our portfolio that would equate to all the money we've raised in the history of the company, and no debt. That's a rare thing for people in the junior natural resource sector to be able to say that we have all the money we've ever raised in the bank, including our tradable portfolio, in addition to 250 mineral property assets, which include over 100 royalties around the world. And this business model works, it's definitive. We've been executing it for 17 years, we just keep adding value by having more and more deal flow.

You can go back and check the press releases and see the deal flow that we've had. We sold 20 projects in the year 2020, which was a stretch goal for us and we're happy to meet that. That's trading 20 new royalties. We're actually being paid royalties where people issue share capital to us, or annual payments, etc., as part and parcel to those deals. Our team is firing on all cylinders, every year we learn how to execute this business even better, and take advantage of the buoyant base metal and precious metal prices in the world today.

Maurice Jackson: Speaking of shares, you've been an active buyer for years, is that correct sir?

David Cole: That is correct. I was particularly active when the company was absurdly undervalued, as we've discussed in the past. And I've only bought the stock, including exercising options, and paying the tax on those, and holding those shares, and buying out of the open market to the tune of a couple of million shares over seven years.

Maurice Jackson: Multilayered question, what is the next unanswered question for EMX Royalty? When can we expect a response, and what would determine success?

David Cole: Well, we just want to see more deal flow, and we will see it both on the organic side, but also some key acquisitions that we're constantly working on combing the earth, looking for opportunities to buy more royalties such as the Timok royalty. I would also point out that our Balya Project, which we made a press release about, and you and I have yet to discuss that in detail, Maurice, but that has lead, zinc, silver, and that's also coming into production this year. So when we see Balya coming into full-scale commercial production, Timok coming into full-scale commercial production, additional deal flow coming from our activities around the world, the market's going to continue to wake up and contribute to the melt-up that you mentioned Maurice.

Maurice Jackson: And the Balya, is that a 4% NSR? Is that correct sir?

David Cole: It is 4% uncapped and unbuyable.

Maurice Jackson: You got to love it.

David Cole: That's right.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

David Cole: Well, when you're diversified nicely, the way we are, then it's easier to sleep better at night, but always concerned about the safety and well-being of our employees traveling around the world, with COVID, etc. So far we've done a good job.

Maurice Jackson: Last question, what did I forget to ask?

David Cole: Well, you're pretty good.

Maurice Jackson: Well, thank you.

David Cole: You can think of something. I'm sure you've got a good idea.

Maurice Jackson: Well, any David Letterman impressions? Last time everyone enjoyed that one.

David Cole: Top 10 reasons by EMX Royalty corporation, number ten.

Maurice Jackson: No, I won't take you there today, but the successes, again, this is why I'm a shareholder and I continue to match my bullion purchases. This is just an astounding business model that is being executed, in my opinion, to perfection. And I'm always looking to add to my positions, and that's just not just myself. All three of my sons are also shareholders of EMX Royalty.

Mr. Cole, it's been an absolute pleasure speaking with you, sir, wishing you and EMX Royalty the absolute best.

David Cole: Thank you very much, Maurice, look forward to next time.

Maurice Jackson: Before you make your next precious metals purchase (Platinum) make sure you contact me. Iím a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we have several options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium, and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at 855.505.1900 or email [email protected]. Finally, please subscribe to Proven and Probable, where we provide Mining Insights and Bullion Sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: EMX Royalty. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: EMX Royalty is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of EMX Royalty, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.