Maurice Jackson: Joining us for a conversation is Dr. Eric Jensen, the general manager of exploration for EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American), the royalty generator.

Dr. Jensen, welcome to the show, sir.

Dr. Eric Jensen: Great to speak with you again, Maurice.

Maurice Jackson: Last time we spoke, if I'm not mistaken, it was 2017 and that was at the Sprott Natural Resource Symposium. And by the way, EMX at that time, sir, was trading around 90 cents on the New York Stock Exchange. EMX has come a long way since then. Sir, would you please share with us, what is the current price for EMX Royalty on the New York Stock Exchange?

Dr. Eric Jensen: We've been doing very well. EMX is now trading in the US $3.50 range. I believe we closed at $3.67 today in New York. The company has had a good trend. And I think the last time you and I spoke, that was a time when the sector was just emerging from that slump that we went through between 2011 and 2016. And I remember that conversation distinctly because we were sitting there, as you stated, we were hovering in the 90 cent range, and the people inside the company, we could see how much value we've created and we felt we were very tremendously undervalued at that time. And in the subsequent years since we've spoken, EMX Royalty has continued to create a lot of value, grow the portfolio. And yeah, the market's now recognizing that. And I think that we will certainly continue to leverage the strengths of our business approach and business model.

Maurice Jackson: We have full confidence that value proposition of EMX Royalty will continue to reward shareholders. I'm on record. I plan to match my bullion purchases, and anyone that knows me I love my precious metals, for the third year in a row in shares in EMX Royalty. Dr. Jensen, for someone new to EMX Royalty, please introduce the company.

Dr. Eric Jensen: EMX Royalty is a royalty generator. We believe in the long-term value of mineral rights and mineral real estate, and EMX maintains a diverse portfolio of mineral project interests around the world. We now have over 200 project interests. This spans many jurisdictions, commodities, industry partnerships, or commercial frameworks. And with that, we offer our investors exposure to discovery upside, and the optionality, you hear that word a lot now in our sector, of the optionality inherent to the mineral rights. Our project portfolio will continue to grow in value through time as the world economies continue to grow, expand, so we see development in the developing nations. So we are active in obtaining more mineral real estate, mineral rights, as we believe they will become more valuable, and our share price performance certainly reflects that we have been correct.

Regarding royalties, EMX is a bit different than other companies in our sector in that a lot of our exposure, the value that we create in our company, is via the royalty generation model. And this gives exposure to our shareholders to cashflow some royalties without the liability exposures or the capital risk exposures that come with the development and the operational side of the business. It's just a great way to leverage the long-term value of mineral resource production and the value of mineral rights in a global sense.

Maurice Jackson: I couldn't have said it better and that's exactly why I continue to match my purchases in precious metals with the shares in EMX. Dr. Jensen, EMX Royalty just consummated another accretive transaction on five projects located Scandinavia involving nickel, copper, cobalt and platinum group elements. Investors are curious to find out why EMX Royalty has taken a strategic position in these metals. But before we get into the details of the transaction, provide us with some context on these metals from a production and consumption outlook, respectively, beginning with cobalt. What is the opportunity here?

Dr. Eric Jensen: I'll address both nickel and cobalt together because they're part and parcel of the same commercial phenomenon. But now EMX is particularly bullish about nickel and in particular nickel sulfide deposits because those types of deposits are primary sources of both nickel and cobalt. So they occur together in these deposits, but also there's typically a fair amount of copper and by-product PGEs, platinum group elements, which I know is something you're also quite interested in, and also gold. And we just love the optionality of that metal suite that is found in those types of deposits. And so you get all those things together. And as we know, the electrification of vehicle fleets is now a worldwide phenomenon that's not going away.

The batteries that are in these vehicles and the motors will consume quite an amount of nickel and copper. And so that the world's going to continue to consume a tremendous amount of these materials in future years. There's no question about that. Everyone's aware of that. But one of the interesting things is between the years of 2011 and 2018, there was very little to, in some cases, arguably no exploration for nickel sulfide deposits, these kinds of deposits where you get these elements altogether and EMX, during that time, we took a contrarian view. We saw this surge in demand that was inevitable, especially with, again, the electrification of vehicle fleets and some of the new technologies that were being introduced in particular with batteries.

We began to acquire these assets in 2016, 2017, and we built a nice portfolio, especially in northern Europe, of these types of assets at a time when other companies simply were disinterested. And that has now changed. Suddenly everyone is interested in and they should be. We're going to need a lot more of these metals as we go forward.

Maurice Jackson: And speaking of those jurisdictions, are those favorable mining jurisdictions?

Dr. Eric Jensen: We love working there. There are challenges around the world on the social side, the environmental side, that's growing, that's true for every jurisdiction. But what I love about Scandinavia is not only is the geology fantastic, they've been mining for 1,000 years up there. They have deposits scattered all over these countries. Norway was the world's leading nickel producer in the 1800s and people have forgotten about that. There are lots of opportunities there. And in a country like Norway, which switched the focus to petroleum products with the discoveries in the North Sea in the 1960s, as they should have, speculators have kind of forgotten about the mining heritage of Sweden and Norway, for hundreds of years coming out of the Middle Ages and through the Industrial Revolution, they powered the world by provision of copper in particular, and also nickel.

A lot of people have forgotten that. EMX is hoping to revive a lot of that history. Sweden doesn't need to be revived. They've been doing it slowly for 1,000 years, but we're bullish on both jurisdictions. And on the permitting side, I do hear people say, "Well, aren't those tough jurisdictions to permit?" I say, "Absolutely not." What they have is a transparent framework with a very well-defined series of criteria that are applied. You know where you can explore and where you can't explore, shouldn't explore. And places where there are restricted environmental covenants, we simply stay out of those places. We work where we can work. I can permit a drill program in six to eight weeks in these countries, whereas elsewhere in the world, sometimes it takes months or even years. So yeah, there's a big advantage there.

Equally important, they have fantastic fiscal regimes. We're talking about corporate income tax rates in the low 20s, no state royalties, very progressive commercial structures. The power is very inexpensive, which is a third of the operating cost in mining as power consumption. And then when you can buy electricity for 4.5 euro cents per kilowatt-hour versus 20, 30, 40 elsewhere in the world, that's a huge advantage. Therefore, we see some of the lowest cut-off grades in the world, most of those mining operations that are active in the Nordic countries. It's a great place to work.

Maurice Jackson: Speaking of nickel, before we leave there, you have a surging price in nickel. It's starting to get a lot of attention from speculators, but to have the vision in advance to start making those accretive transactions and then also realizing that there's a potential supply deficit in front of us, it's just great business acumen. How about copper?

Dr. Eric Jensen: People sometimes forget about copper in this discussion. After steel, the number one metal component that goes into electric vehicles is copper, by far. It's much greater than nickel and certainly a lot greater than cobalt. So let's not sleep on that one. And again so the electrification of vehicle fleets is one thing, but just the advents of economies in developing nations. As people continue to strive for first-world standards of living around the world, the consumption patterns for copper are very clear and that's reflected in the current price support, and look what the pandemic couldn't do. It couldn't beat the prices down of nickel and copper as we come out of the pandemic, looking very strong as they should be because we need them for this development.

Maurice Jackson: Speaking of copper, the world is going to consume more copper in the next 25 years than in all of recorded history. And here you have a company (EMX) that's exploring for it and discovering it and or creating royalties from it.

Dr. Eric Jensen: I have a slide presentation that I put up and I have a slide that shows exactly what you just said. It shows you a symbol for the amount of copper that's been discovered, produced and consumed in world history, and then the same volume for the next 25 years. That's a very good point. Copper is not going away. We have continued to explore for both nickel and copper during the recent downturn and slump in the industry so EMX shareholders are ahead of the curve and we are well poised.

Maurice Jackson: How about my favorite from a precious metals investment standpoint? That's the platinum group elements. What is the outlook on the production and consumption of these metals?

Dr. Eric Jensen: Oh, that's another good element! In fact, the Platinum Group Elements (PGEs) are really an interesting group. The PGEs' fundamental value is seen as a precious metal, but these also have tremendous industry applications, and the platinum group elements, in particular, have this strange geochemical behavior. These components are very resistant to corrosion and attack by chemical reagents, but yet they're able to catalyze chemical reactions in a phenomenal capacity. And so they have a broad application in industry. This goes from things like aircraft turbines, electronics; they're used extensively in the petrochemical industry, medical field. There's a lot of new medical advances that are using these types of components. But of course, the big one is the catalytic converters in vehicles. Now we talked about the electrification of vehicle fleets, but realistically, if you look at much of the developing world, internal combustion engines are not going away.

Neither are cities. And when those two things are combined, you have smog, you have all the issues with emissions of vehicles, and these elements are critical in the supply of catalytic converter components to help us clean the air and have better emissions from these vehicles. That demand is not going anywhere. And these are critical components for that.

Maurice Jackson: And Dr. Jensen, correct me if I'm wrong, but the demand will also be there for electrification of vehicles because you've got to have them for the fuel cells in regards to platinum.

Dr. Eric Jensen: I'm glad you brought that up. People are pointing to the PGEs as a critical component for fuel cells. As we convert to that new technology, that's also going to drive demand on those metals, but, with their unusual chemical characteristics, there's such a broad use for those. As technology continues to advance, we see new ideas and new technological advancements will continue to identify new applications for those as well.

Maurice Jackson: Germane to platinum, 78% of the world's platinum comes from a very unstable region of the world, and that is South Africa. So that's something that is something that one should consider. Also, platinum is 30 times more rare than gold. And I, if I'm not mistaken but I believe South Africa's cost to extract platinum is the spot price in essence, and thus, again, no profits are coming in.

Dr. Eric Jensen: Those are old mines and older deposits that have been producing for so long, you reach a point where you have diminishing returns to time. And again, we just haven't done enough exploration for these types of deposits. And so it's something that we've been keenly aware of for several years. EMX sees a great opportunity in the metals as the world moves to clean air through the catalytic converters and electric vehicles.

Maurice Jackson: How is EMX positioning shareholders to take advantage of the value proposition before us in all of these said metals?

Dr. Eric Jensen: For several years, EMX has been making, not the primary focus, but a key focus of our exploration efforts globally and our business development efforts to procure projects and royalties for these metals. We have now built a substantial, growing portfolio of royalties on nickel sulfide projects that include, again, exposure to nickel, copper, cobalt and PGEs. Last year we consummated an interesting transaction; we bought a royalty in Palladium One's Kaukua project in Finland, which is a big PGE project that had somewhere just over a million contained ounces of PGEs and the resources, and they're having a lot of exploration success. And that's undoubtedly going to grow.

That looks like a big discovery now, but we've also been active in exploration for battery metal projects, which these projects we have in our exploration side will be converted steadily to royalty interests through time as for our business model. And in fact, I just picked up an interesting nickel-copper-PGE project last week. I can't talk about it yet because they're still putting the land together, but we found another one of these things that were probably forgotten about. We found it in a database of historical information. And so, yeah, we now have several battery metal partnerships established and a growing number of projects that are available for partnership. And we're looking to do more business along those lines. And so, yeah, I expect the heightened interest in this particular metal scooping to continue and to be significant in the coming years.

Maurice Jackson: By the way, that's a 2% NSR with Palladium One. Is that correct?

Dr. Eric Jensen: That's correct. One part of that can be bought down, but that's a solid royalty. We're excited about that one.

Maurice Jackson: Oh, there's nothing wrong with getting some cash upfront either.

Dr. Eric Jensen: Not all (laughing), bonus payment.

Maurice Jackson: Let's discuss the proof of concept in the strategy by getting details on this week's press release, "EMX Royalty executes option agreement for five battery metal projects in Scandinavia." Take us to Scandinavia and let's visit Sweden first and then Norway and provide us with an overview of the commercial terms between EMX Royalty and Martin Laboratories EMG Limited.

Dr. Eric Jensen: This is an interesting one, actually this press release received a good market reaction. This is a neat opportunity. And so this again grew out of just the current interest from the investing sector in these battery metal projects. And so Ellis Martin is someone we've worked with and had a relationship with for many years. He's been a long ardent supporter of EMX. And he has a group of supporters that are looking to back a battery metals exploration company. He came right to us and said, "Look, I know that you guys generate high-quality mineral projects and exploration projects. And we've got a group that wants to back up a spinoff type a company," and we've done this several times in recent years. So we've taken this a commercial approach with a really good result for EMX shareholders. We will obtain an equity block in exchange for a portfolio of assets and also a royalty interest on the assets.

In this particular case, it's going to start on the private side, but I know that Ellis is intending to obtain a public listing rather quickly with this. The support that's behind this, it's going to be a well-capitalized vehicle that allows us to do exactly what we do best and that's to pursue discoveries on multiple assets. And so we put together this portfolio of battery metal assets, both in Norway and Sweden, and this group of assets is interesting. We've been collecting, been putting this together since 2017 this particular group. And these were projects that were originally discovered by Falconbridge in the case of the Norwegian assets and state-run enterprises in the case of the Swedish assets.

The original work was done back starting back in the 1970s in the Swedish assets, but none since the global financial crisis. And so you may recall that Falconbridge was purchased by Xstrata around 2006. And Falconbridge had conducted a lot of regional exploration in the Nordics because they had a presence there, but when they were bought by Xstrata, those programs, the funding for the regional exploration was cut and they abandoned those projects, and they've just been sitting there. And so we were able to come in and pick up a bunch of projects that have seen significant historical work. And so we got a huge head start on these. There are drills to find mineralization. There are resources and several of these properties are a good starting point.

Maurice Jackson: Sir, I know you have intimate knowledge of these projects. Can you provide us with an overview of the Swedish projects first?

Dr. Eric Jensen: So these were projects that were picked up in what's called the nickel line. And so this is an area in which the Swedish government had focused quite a bit of attention back in the 1970s and 1980s. And in that era, all the exploration in Sweden was done by state-run enterprises. And so their modus operandi is they'd come in and look for outcropping discoveries or places where mineralization was exposed to the surface, they'd drill a pincushion of shallow drill holes, and then move on to the next project. And so they left behind a whole series of these probably drilled out, probably explored resources that were never drilled the depth. And they indicate that on their notes. And you read the exploration histories and you look at the records and you can see, yeah, sometimes you just see the tops of these systems.

We have no idea how they projected depth, or even in some cases what happens along strike. It's a really interesting series of opportunities there. And we see all kinds of other indicators of other bodies of mineralization being present in these licenses that have just never been explored fundamentally. So really neat opportunities.

Maurice Jackson: How about an overview of the Norwegian projects?

Dr. Eric Jensen: These projects also go back to the Falconbridge programs. And so this was a group that came into Norway in the 1920s. There's a big refining and processing nickel refinery in southern Norway called Nikkelverk A/S. And that was purchased by Falconbridge back in the 1920s. We have to remember, this was one of the worlds, again, it was probably, I think the world's largest producer of those commodities back in the 1800s. And then Falconbridge owned that for many, many decades. And then they started doing quite a bit of rigorous exploration in the early 2000s before they were purchased by Xstrata. And they assembled a whole series of projects. We conducted geophysics as well as some scout drilling, and a lot of surface work that defined a whole series of opportunities. And then 2006 hit. They pulled up their stakes.

The projects got transferred to a JV partner who never recovered from the subsequent global financial crisis. You may recall it was just right before the wheels came off the global financial system. And yeah, those products have been idle ever since then. And 2012, 2013, 2014, no one cared about a nickel. These products were just sitting there. So EMX began collecting these, going out, and acquiring these mineral rights in 2016, 2017, and as recently as last year.

Maurice Jackson: What are the exploration plans for 2021 on these projects?

Dr. Eric Jensen: We're going to be pretty aggressive. There's financing that's taking place, be taking place now and the coming weeks and then, yeah, we'll put these, so we'll put these exploration dollars to work. There's a lot we can do just picking up where the other teams had left off back in the 1980s or 2000 era exploration programs. We have a bunch of surface work to do, and we're going to refine drill targets. Several of the products have walk-up drill targets. And we're hoping to commence drilling probably in the summer months of 2021, if things go well, and then a whole series of just logical steps that we'll apply that the types of methodologies other companies have used in that region with great success to make other discoveries. And so the nice thing about these is that a lot of the discovery has already been made. We just got to continue to explore them. So that's a great place to start, and there's plenty of plenty to do this year, starting with the surface work.

Maurice Jackson: So we're going to start the surface work. How about assay results? Have there been any delays from that region?

Dr. Eric Jensen: The labs are actually in pretty good shape. Now, we're dealing with the travel restrictions that are in place with the pandemic, but now with the proliferation of vaccines, believe that the travel restrictions that are in place will be hopefully lifted mid part of this year, maybe later this year. So we'll be able to move around freely again in the Nordic countries shortly. So that is a concern right now because things are a little bit delayed. It's hard to go between the countries right now, but the labs seem to be in pretty good shape. And so we've been able to get assays turned around rather quickly on the current products that we're exploring. And so we're excited about this new partnership. We'll get this underway. There's still snow cover on most of these properties, but we'll see that abate in the next couple of months, and then we'll get to work on the surface.

Maurice Jackson: Dr. Jensen, I'm smiling from ear to ear. All of the aforementioned are just great use of optionality and yet another perfect demonstration of the vision, patience, and deployment of the royalty generation business model by EMX Royalty. Before we close, Dr. Jensen, please provide us with the capital structure for EMX Royalty.

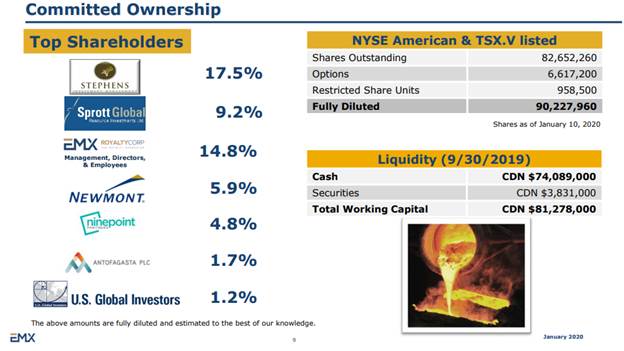

Dr. Eric Jensen: EMX Royalty has 84 million shares issued and outstanding at this point, 92 million on a fully diluted basis. But the key point for EMX, Maurice, as you're aware, we're well capitalized. We have plenty of cash and so shareholders like myself, I'm a key shareholder in the company, we don't have to worry about EMX running out of money and taking a dilute of financing, which happens in the sector at times. We did small financing back in 2017 for a very specific purpose. And I believe that's the only financing we've done since Q1 2011. So it's been a decade since we've had to take down financing. The merits and stewardship provide shareholders with a tight share structure, well capitalized, strong treasury, good revenue streams from multiple sources of funding, and our existing project portfolio. EMX is well positioned.

Maurice Jackson: Now. I'd be remiss if I didn't ask this, you don't have to give me a timeframe. I just wonder if there's a discussion, only a discussion, but any discussions regarding dividends.

Dr. Eric Jensen: Yeah. We get that question a lot.

Maurice Jackson: I'm sure you do.

Dr. Eric Jensen: As we company we are focused right now and just the clever and prudent ways to deploy our capital that we have in the treasury, because our goal, it's no secret that we are all looking for again, good, clever prudent ways to deploy our treasury to secure additional cash flow for the company. That's our primary focus. And so just a side thing, if anyone company with royalties or cash flowing assets should not hesitate to contact us, but yeah, we're on a good path to positive and increasing cash flow within the company. We have several royalty assets that are now reaching the production stage. Again, the core of our business is the organic generation of royalties, and a lot of the projects that we've been working on for years now are now reaching that production stage. So we're seeing that in several cases.

And we expect that those production royalty revenue streams will be a catalyst to reprice our stock in the future. But yeah, we are eager to find additional sources of those types of revenues. And certainly, a dividend is part of the discussion right now. A lot of people have been asking us about that, but our first objective is to make sure that this company is on a really solid financial footing as it has been, but we want to secure that future for our shareholders as well.

Maurice Jackson: Now, you alluded to it there with a future cash flow generating here shortly. Can you tell us anything about the events going on right now in Serbia?

Dr. Eric Jensen: I guess the best thing I can do at this point is to direct the listeners to Zijin Mining website, which is the big Chinese multinational company that's advancing that project in which we have, you're referring to the Timok Magmatic Complex where we have a royalty on the Cukaru Peki discovery, which is one of the world's biggest or ongoing, I should say, discoveries of copper and gold in the past decade. It was a great discovery that's now being advanced by Zijin, a rapidly growing international player in the mining sector. They've put up some news recently in terms of their production schedule. Zijin has been telling the market that they'll be producing from Cukaru Peki in Q2 2021. And that's the latest indications on the website that they're on pace to do that, so pretty exciting news coming out of there, but that's going to be a great royalty for our company for years to come.

Maurice Jackson: Folks, this is a behemoth. I know Dr. Jensen kind of said that little conservatively, I don't know which one excites me more the success EMX has on the Malmyzh Copper project in Russia, which loaded the treasury with Brinks Truck delivering nearly $70M CAD or the opportunity before in Cukaru Peki. They're both just fantastic assets for the company and shareholders.

Dr. Eric Jensen: If you could just build a copper and gold deposit, you'd build it like Cukaru Peki. It's got a real high grade, it's like a big animal with a hat and that hat is a high-grade copper and gold system. As Zijin mines downward they're going to start in this ultra-high-grade material, which they've got some announcements in their website about that, and then there's a big porphyry copper-gold system below it that the bottom of which they've not finished drilling out, it's still expanding. So it's a great system. It's got this full high-grade value driver on top, where they're going to start mining. Then we get this big porphyry system that underlies that. So it's a fantastic discovery, a great story, and we are delighted to have that royalty in portfolio.

Maurice Jackson: And again, a recurring theme, a surge in the copper price, increased demand, and again, a company that's going to be profiting from that. And that's going to be EMX Royalty and their shareholders. This transaction alone has the potential to make to the stock melt up! In closing, multilayered question here, what is the next unanswered question for EMX Royalty? When can we expect a response and what determines success?

Dr. Eric Jensen: I'd come right back to the question of cash flow. Again, we're looking for cash flow, we're looking to augment the value creation, the value drivers for the company. And so that's something that a lot of us are focused on right now. And one thing I want to point out that may not be all that obvious to the market is that we have assembled a very elite team of advanced project evaluators at EMX because we're looking at these royalty interests. We're looking at advanced projects. We've developed a team of eight players with a wealth of development and operational experience. And I would put this team up against any other due diligence team in the world in terms of their ability to quickly decipher value and to see red flags on operations and investment opportunities that other companies may not see.

And so I think a lot of interesting decisions are being made by royalty companies out there right now in terms of buying assets, but we're not going to make any big mistakes. We've got a great technical team. We are keen stewards of shareholder value, and we have our eye on the long run. And so this is a company that's based to, we call it the get rich slow scheme. I call it a crescendo of value creation and that we're on that path and we intend to stay there.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

Dr. Eric Jensen: I'm a terrible sleeper as it is, but what keeps me up at night is just quite simply, it's the thought of missing an opportunity or missing a royalty opportunity, the opportunity to pick up a great project or a royalty. There are times I'll sit up at two in the morning and just think, "Hey, we looked at this project 10 years ago. Maybe that came open and maybe the claims were dropped," and you run to the computer and you get your GIS database, you start flipping through land status and seeing if there's an opportunity there. I hate getting beat to new opportunities. We've got a great dynamic, nimble team that's out there around the world looking for a new value for the company. And so I don't like getting beat to stuff. That keeps me up.

Maurice Jackson: Last question and that is, what did I forget to ask?

Dr. Eric Jensen: I come back again to that technical team. Again, it's what value drivers within EMX are not visible to the market. And I think that this great team of eight players we've put together to assess advanced project opportunities, strategic investments and royalties, people may not be able to see that from the outside, but this is a great value driver for our company. I'm very confident in this team's ability and the willingness of the team also to think entrepreneurially and creatively about where value may lie that other companies can't see. We've had a history of doing that. We've gone to some unusual jurisdictions. You referred to the Malmyzh project in the far east of Russia, and we've capitalized opportunities in ways that other companies have not been able to, and that's a credit to the people we have on this team. It's a fantastic group to work with. We love what we do. We have a lot of fun. It's a great group, a great group of people, and yeah, we're going to continue to deliver value and hopefully in a real big way.

Maurice Jackson: EMX Royalty is just the perfect combination of the tangibles and the intangibles. And again, I'm on record. This is my third year. I plan to match my precious metal purchases with shares in EMX Royalty. Dr. Jensen, for someone listening that wants to get more information about EMX Royalty, please share the website address.

Dr. Eric Jensen: Please visit us at www.emxroyalty.com.

Maurice Jackson: Dr. Jensen, it's been a pleasure speaking with you. Wishing you and EMX Royalty the absolute best, sir.

Before you make your next precious metals purchase (Platinum) make sure you contact me. I'm a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we have several options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium, and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at 855.505.1900 or email [email protected]. Finally, please subscribe to Proven and Probable, where we provide Mining Insights and Bullion Sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: EMX Royalty. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: EMX Royalty is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of EMX Royalty, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.