On Jan. 12, First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) announced two critical long-term (five-year) cobalt hydroxide feedstock arrangements with Glencore International Plc (GLEN:LSE) and IXM SA (a subsidiary of CMOC).

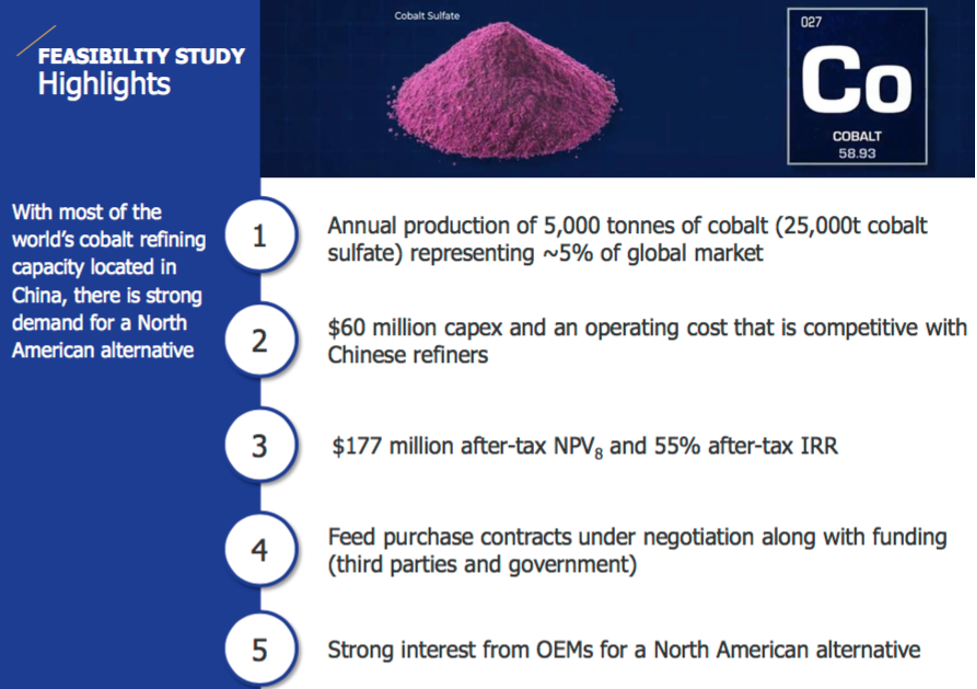

Combined, the agreements call for the supply of 4,500 tonnes of contained cobalt/year, starting in Q4/2022. Once up and running, First Cobalt's 100%-owned refinery will be North America's sole producer of cobalt sulfate for the electric vehicle (EV) market.

Under a binding cobalt hydroxide supply contract, Glencore will supply First Cobalt for five years, beginning in Q4/2022, from its KCC mine in the Democratic Republic of Congo (DRC). Regarding IXM, a memorandum of understanding (MOU) was signed that will need to be finalized. The MOU is also for five years from Q4/2022, with 100% of the cobalt hydroxide feed coming from CMOC's Tenke mine, also in the DRC.

In both agreements, cobalt hydroxide will be purchased based on then-prevailing market prices. An additional 500 tonnes/year of feed will be satisfied through other suppliers or via spot market purchases. The start of shipments is contingent upon First Cobalt obtaining necessary permits and a working capital facility.

The press release covered a number of "ESG" topics (environmental [including life-cycle assessments], social [including ethical sourcing], and corporate governance). Instead of summarizing the impressive manner in which First Cobalt is addressing these important issues, please read the three main paragraphs from the PR below.

As big as this news is, it's noteworthy that First Cobalt will be working with two of the most ESG-friendly cobalt hydroxide operations in the world. Readers should note that both Glencore's KCC, and IXM's Tenke mines run on clean hydroelectric power. These mines will provide 90% of First Cobalt's annual refinery needs, enough to produce 22,250 tonnes/year of battery-quality cobalt sulfate.

Being supplied from large, green mining operations, owned by giant companies charged with upholding the highest ethical and environmental standards, is a key de-risking event. This should not be taken for granted. There are only a handful of feedstock sources as large, credible and reliable.

Further, the fact Glencore and IXM would agree to contract for five years (two years ahead of the refinery being operational) with a cobalt junior that's a tiny fraction of their sizes is a tremendous vote of confidence in First Cobalt's strategy, assets and team.

This news comes soon after the federal government and Ontario government jointly pledged CA$10 million (CA$10M), half as a grant (free money, no repayment) and half as an interest-free, unsecured loan with a 10-year term.

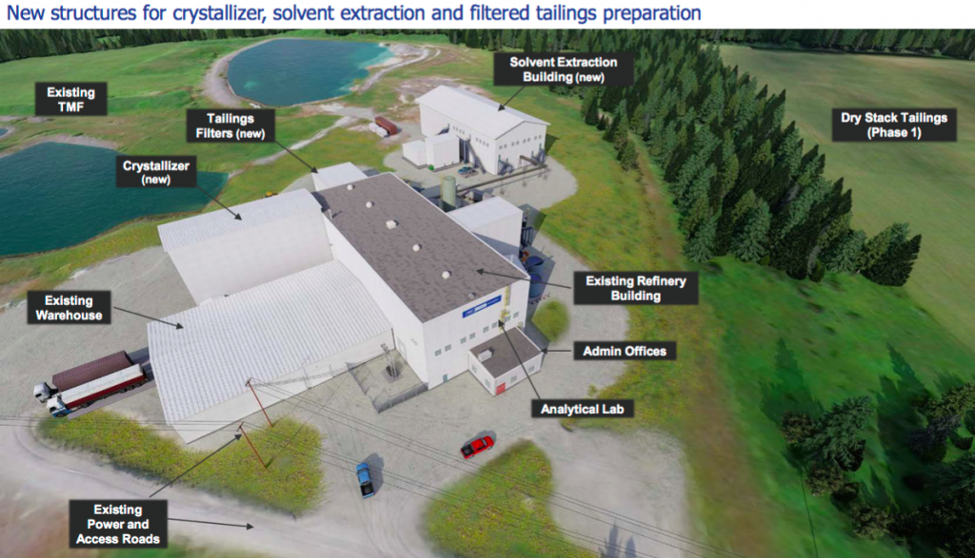

Feedstock procurement and robust government support paves the way for the third leg of the stool—financing roughly CA$76M of upfront cap-ex (~CA$66M remaining after the $10M commitment).

Ongoing warrant and stock option exercises, plus CA$4M from the sale of a non-core silver asset, is steadily chipping away at the formidable capex block. Still, management has been clear that additional equity will be required, even though a significant majority of the funding package will come from debt.

Management has lined up four or five qualified debt providers and will be comparing term sheets in coming weeks to choose the best one or two lenders to move forward with.

The chances of this ambitious refinery project coming together on time and on budget have grown in the past month, with three high-impact press releases, and continued improvement in cobalt prices due to blockbuster expectations for EV penetration later this decade.

These factors suggest that choosing one or more debt proposals will now be easier, and the terms possibly more attractive (lower rates of interest, longer maturity dates, less restrictions). As funding is wrapped up, ongoing work on offtake partners, permitting and construction will become the main focus.

It's my understanding that construction risk is low. And now, with proven government support, I can't imagine getting the refinery permits updated will be that difficult. I'm not sure how hard it will be to place battery-quality cobalt sulfate into the market from 2023 on.

However, it's clear that the amount First Cobalt proposes to sell is not large (<5%) versus the size of the cobalt market for batteries in 2023. Importantly, management believes they can produce a higher quality sulfate than standard benchmark cobalt sulfate specs.

To reiterate, offtake discussions, refinery project financing and permitting amendments are advancing on schedule. Construction could begin as soon as in early summer. Trent Mell, president and CEO commented, "This is a pivotal moment for our North American cobalt refining strategy. Our globally competitive cost structure, and industry-leading ESG credentials, put us in a strong position for the rapidly growing EV market. With feedstock arrangements now in place, we can continue to advance our vision to create a new cobalt supply chain in N. America. . . .EV sales in Europe were up more than 100% in 2020 and the U.S. will be the next large market to take off. We're now focused on off-take arrangements and a financing package with the goal of commencing construction in mid-2021, and full commissioning in the 2H of 2022."

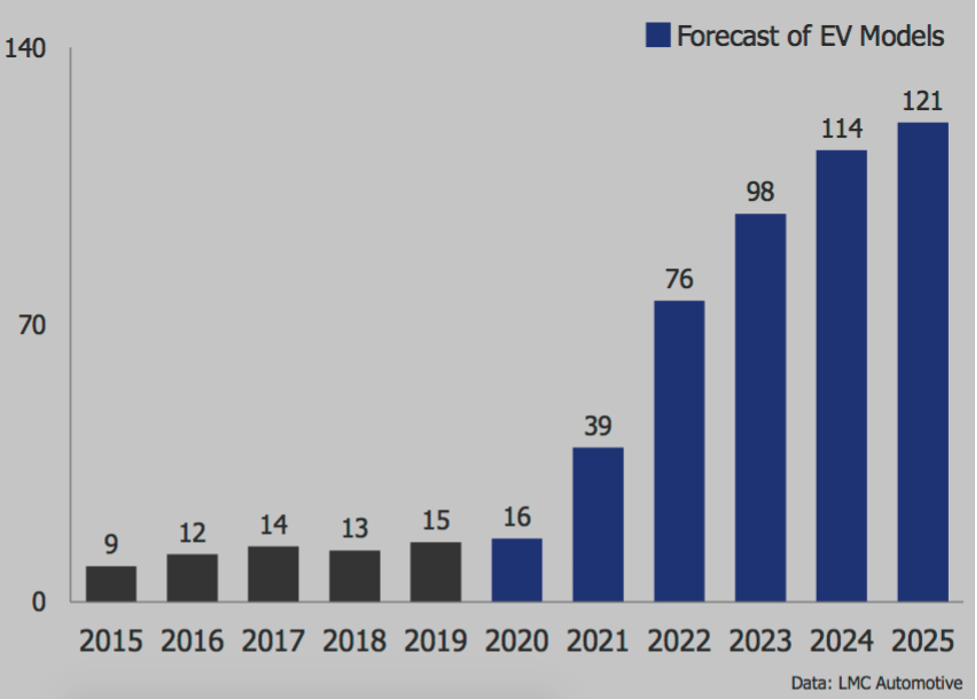

In prior articles I've written on First Cobalt Corp., I discuss the latest news in the EV space, but this time—suffice it to say that the outlook for EVs from 2023 on, when the refinery will be pumping out product, is quite literally stronger than ever.

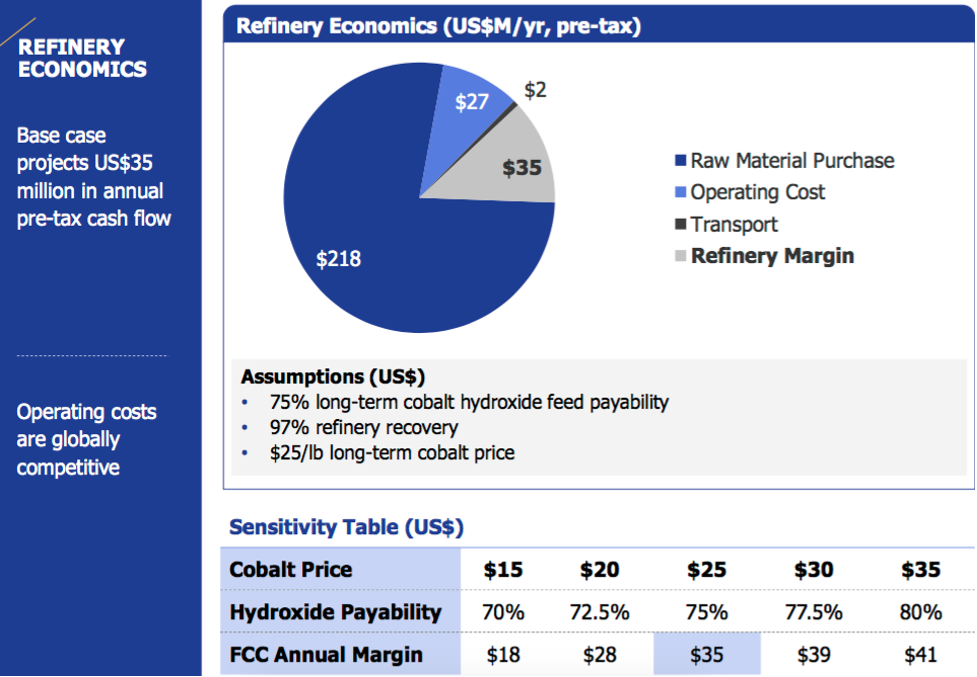

How much is a 15/20/25-year stream of cash flows worth to First Cobalt? How much might those cash flows be worth to a giant like Glencore? The latest corporate presentation shows an after-tax net present value (NPV)(8%) of $226M, assuming a fixed, long-term, cobalt sulfate price of US$25/pound and a 13-year refinery life. I found that an after-tax NPV(5%) would be ~25% higher than a NPV(8%).

Why am I changing the discount factor? Glencore's cost of capital is much lower than First Cobalt's. For Glencore, with multiple potential synergies (market intelligence, lower feedstock cost, better industry contacts, economies of scale, diversification benefits, etc.) a 5% discount rate would be warranted.

In addition to a lower discount factor, margins operating the refinery would most likely be higher under Glencore (due to the above mentioned synergies). Assuming $5M/year of incremental cash flow, at the same US$25/pound price point, the NPV would be roughly $345M. That's 2.7x First Cobalt's enterprise value of ~$130M.

Finally, I suggest that readers consider at least the possibility of a higher cobalt sulfate price than the US$25/pound I've used for the past year. Even if US$25/pound is the best we can achieve in the next few years, the refinery has a long lifespan. The average long-term price could be US$30/pound, which would increase the company's after-tax NPV(8%) to >$200M from $177M.

On an enterprise value (EV)/revenue or EV/EBITDA basis, at US$30/pound, these valuation multiples would be very strong for First Cobalt and its cobalt peers. These metrics would likely support an even higher market cap than the $345M figure mentioned above.

Not many lithium or cobalt juniors could be cash flow positive as soon as H2/2022. Many are four to six years away from initial operations. Some (such as lithium brine projects) have multiple-year production ramp-up periods to reach nameplate capacity.

Readers like me, who feel that global EV penetration will be very strong, perhaps especially strong from 2023 on, should take a closer look at which North American companies can supply the EV battery market with cobalt. I continue to believe there are very few high quality names to choose from! First Cobalt Corp. remains at the top of my list.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Peter Epstein's Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares of First Cobalt Corp., and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.