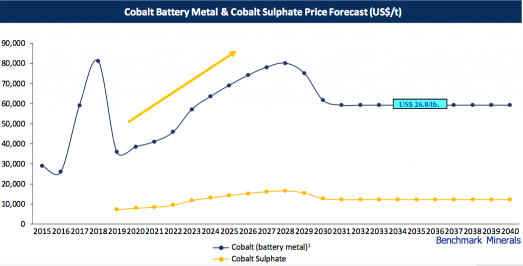

Battery metals lithium, vanadium, nickel, cobalt. . .each has traded at much higher levels, and each is widely expected to increase again (perhaps substantially). Note: unless indicated otherwise, all figures in US dollars.

Will lithium, vanadium and nickel prices rise again? I don't know. This article is about cobalt, which briefly traded at $44/lb. in Q2/2018, but now changes hands at about $16/lb. I believe a rebound to $25/lb. is reasonable within two to three years.

Outlook For EVs and Energy Storage Remains Strong; Good For Cobalt

Even as some predict cobalt's demise, several factors make me bullish. First and foremost, despite a global pandemic, long-term trends in the electronic vehicle (EV) market look as strong as ever. Look no further than Tesla's enterprise value ( also EV) of $400 billion. If one is bullish on EVs, cobalt remains a great way to play that thematic.

In North America there are surprisingly few pure-play cobalt juniors to choose from. Even fewer are anywhere near positive cash flow. A name I've been following for years, First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX), hopes to be profitable in 2022.

Management expects a very healthy $41 million ($41M) of pre-tax cash flow at the refinery level (economics to be split between First Cobalt and Glencore) in its first full year of toll-milling operations.

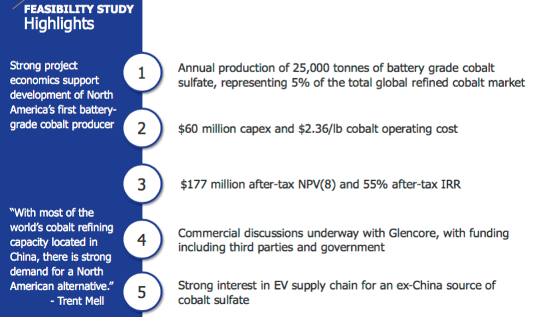

First Cobalt owns 100% of a permitted Ontario, Canada, cobalt refinery that mining giant Glencore International Plc (GLEN:LSE) is backing with debt financing (terms yet to be determined) to restart operations. This refinery has a feasibility study on it delineating a $139M after-tax net present value (NPV 8%) and 53% internal rate of return (IRR) at a $25/lb. cobalt price assumption.

Refurbishing and expanding First Cobalt's refinery is underway and is expected to cost $60M, a meaningful portion in the form of loans from Glencore. Some of the remaining capital needed could come from Canadian government agencies, possibly including grants. First Cobalt and Glencore will share in the refinery's economics (terms to be determined) until loans are repaid.

Why Is the Outlook for Cobalt, Especially from North America, Bright?

COVID-19 has spurred several countries, most notably China, to stimulate weak economies with EV subsidies, rebates, tax breaks, etc. The global economy is in recession, so new car markets are not doing so great. However, EV sales have held up remarkably well.

Signs of global warming have become increasingly prominent across the globe, making it impossible to deny or ignore. This can be seen in intense forest fires in places including; the U.S., Australia, the Amazon, Canada, Europe and Siberia, as well as more powerful and frequent hurricanes (among other phenomena).

This trend is driving the world toward even more rapid adoption of EVs and renewable energy. Wind and solar power require battery storage systems (mostly large, non-portable lithium (Li)-ion batteries), that use cobalt.

Li-ion batteries will be the dominant EV and energy storage battery architecture for at least the next 10–15 years. Expert consultants like Benchmark Mineral Intelligence, CRU and Roskill agree. Roskill recently stated, "[T]he cobalt market is entering a new phase of consolidation and rejuvenation. Medium-term demand is expected to grow steadily once battery and aerospace sectors recover from recent setbacks with the assistance of government subsidy/rescue schemes in China and Europe. As market participants re-focus on supply chain security and sustainability, a more resilient and diverse cobalt value chain could be built. As such, cobalt should continue to play an essential role in the global transition towards clean energy technologies."

Although I'm bullish on EVs, energy storage and cobalt demand, some readers might be concerned about recent headlines that Tesla is using batteries that contain no cobalt. These will only be in a minority of Tesla's vehicles, some low-end Chinese models. Make no mistake, most global EV makers are sticking with cobalt.

Benchmark Mineral Intelligence Expects 15%/Yr. Growth In Cobalt Demand

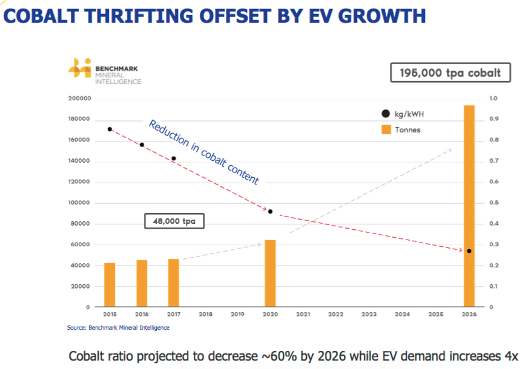

Granted, due to sourcing challenges and cost considerations, the percentage of cobalt used in Li-ion batteries for EVs is declining. From 20+% (on average) cobalt content today, it could fall to ~10%, but probably not lower. Why? Cobalt plays a crucial part in stabilizing the battery structure, which in turn enhances energy density and safety.

Even as cobalt use per EV battery declines, the soaring number of EV batteries mitigates the decline, such that total cobalt consumed (in EVs) will continue increasing, albeit modestly.

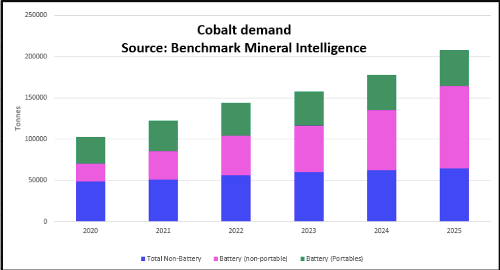

In the chart below from Benchmark Mineral Intelligence, cobalt demand for Li-ion batteries (in non-portable applications, like grid-scale energy storage systems) is forecast to grow much faster than cobalt demand for EV batteries. Overall, Benchmark forecasts cobalt demand from all end uses to rise a robust ~15%/year from 2020-2025.

New applications that require Li-ion batteries are growing by leaps and bounds. This recent Reuters article explains that the rollout of 5G telecom networks will require a significant amount of cobalt: "The need for larger rechargeable batteries and more energy storage for 5G technology will significantly boost demand for cobalt. . .Larger batteries using lithium, cobalt oxide chemistry (LCO), are needed in 5G phones as the antenna, used to transmit and receive radio waves, needs more power than antennas in 4G phones. Base stations for 5G need more power, necessitating widespread use of energy storage systems. In China, the fastest growing 5G market, base stations use LCO batteries."

Refinery Opex Estimate Cut by 13.2%; After-Tax IRR Rises to 55%

Returning to First Cobalt, management recently revealed a 13.2% decline in anticipated opex in its refinery feasibility study's flow sheet. Due to these savings, and two additional years of mine life, the after-tax NPV 8% from the feasibility study increases by ~$38M to $177M, and the IRR rises to 55%. The ratio of NPV to upfront capex improved from an already strong 2.5x to 3.0x.

Importantly, a number of other initiatives are being carefully studied that could potentially cut opex a further 5–10%. Having Glencore on one's technical team helps a lot in this regard! If further opex reductions are forthcoming, the after-tax NPV 8% could rise above $200M. Compare that to First Cobalt's market cap of $41M.

The refinery alone could be worth 4x–5x the current market cap in a few years. Yet, that does not even take into consideration a portfolio of silver assets that management is trying to monetize or its cobalt assets in Idaho (USA). The U.S. cobalt resources are probably not worth much at current cobalt prices, but could become valuable again if the price rebounds.

First Cobalt's refinery has tailings capacity of 26 years, yet the refinery life outlined in the enhanced feasibility study is just 13 years. Instead of 13 years at 25,000 tonnes/year, imagine the economics for an 18-year refinery life at 35,000 tonnes/year output.

North America Desperate for Conflict-Free, Non-Chinese, Battery-Grade Cobalt

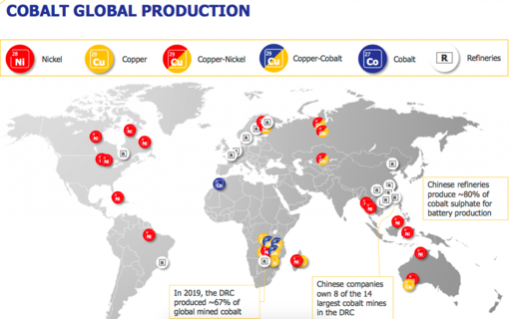

Two thirds of mined cobalt production comes from the Democratic Republic of Congo (DRC) in Africa, and over three-quarters of that production gets refined in China. For security of supply reasons, automakers would greatly benefit from cobalt that, although sourced from a mine in the DRC, is guaranteed by Glencore to be conflict-free.

Glencore's conflict-free feedstock, fed into First Cobalt's refinery in Ontario, would circumvent the need to deal with China, generating considerable cost, time and logistical savings—not to mention, far less pollution from not having to ship feedstock to China and refined cobalt products back to North America.

Given challenging U.S.-Chinese relations, U.S. auto plants would benefit from security of supply from Ontario. Instead of relying on China, refined battery-grade cobalt from Ontario could be delivered to Canada, the U.S., Mexico and even Europe.

Last week Ford Motor Co. (F:NYSE) announced plans to invest CA$1.8 billion to produce, "fully battery electric vehicles" in Canada—not just anywhere in Canada, but in Ontario, ~500 kilometers from First Cobalt's refinery. This is a big deal for the Canadian EV industry.

Conclusion

As compelling as First Cobalt is, there remains a high level of risk. In the next two years, First Cobalt expects to amass ~$50–60M in debt (primarily from Glencore). If the refinery does not approach nameplate capacity by 2022–23, or cobalt remains around $16–18/lb., the ompany could be in trouble.

However, the flipside of a heavily indebted company with Glencore breathing down its neck is First Cobalt's share of cash flow from operations paying off debt in three to five years. This debt payment outcome is the base case, not an aggressive upside scenario.

Once First Cobalt reaches free cash flow positive, with line of sight towards being able to pay down loans, the true value of its hard-to-replicate operating cobalt refinery—feeding battery-grade cobalt to U.S., Canadian and Mexican auto markets—will become a lot clearer.

Upon that substantial de-risking, and the cobalt price hopefully being stronger, First Cobalt Corp.'s share price could be a lot higher than today's CA$0.135/share. Lithium prices remain depressed, but several lithium juniors have recently started rallying hard. Could cobalt names be next?

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker / dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares of First Cobalt Corp., and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.