I am very bullish on the short term prospects for gold, both fundamentally and technically on the chart. There are records amount of cash on the sidelines because of Covid-19 and election uncertainty. I commented earlier about the inaccuracy of polls and if they are off similar to 2016, that Trump had a slight lead. Right now it has probably moved to Biden as a slight lead. Whatever, it will be close and it could be weeks or months before the final decision on the election is made because of the increased mail-in ballots. This chaos will be good for gold, but no matter the outcome, the fundamentals for gold will become stronger than ever.

No matter who wins, we face an unprecedented economic collapse that ensures low interest rates, perhaps negative rates and numerous stimulus and money printing sessions in the next few years. I commented that a stimulus package would not be approved pre-election and that is one reason gold has not broken to the upside yet. No matter who wins, it ensures the next stimulus round will soon come. If Trump wins it will be as previously expected and much higher gold prices. If Biden wins, markets will expect much higher stimulus and spending, sending gold higher at a faster pace. As of the end of September, Gold ETFs have surpassed 1,000 tonnes of new demand in 2020 with 10 months of consecutive increases, matching the pace in 2008 and 2016. Stock markets will continue to face the economic problems and poor earnings

On the chart, a nice uptrend is in place, ignoring the oversold condition in March and overbought in August. We have another wedge pattern and when we broke down from the previous wedge in September, I predicted a test of at least $1,850, which we got. The gap up from $1,850 to over $2,000 is now nicely filled, another positive. Momentum remains positive to the upside. Gold is money and it is always investment demand that causes the bull markets. With Covid-19 more investors realize that gold should be part of their portfolio, even Warren Buffet, for the first time. Gold surged $600 this year, so this consolidation is healthy. I believe the next up move will start November/December. Time to buy more gold stocks is now. Here is another excellent Nevada based junior explorer.

Discovery Harbour Resources Corp. (DHR:TSX.V; DCHRF:OTCPK; 4GW:FSE). Recent Price $0.10

52 week trading range $0.03 to $0.17

Shares Outstanding 94.3 million, 37% held by Insiders and Institutions (Richard Gilliam 16%) (Palisades Goldcorp and AlphaNorth Asset Management 19%)

Highlights:

- Richard Gilliam founder of Cumberland Resources is a major shareholder since IPO;

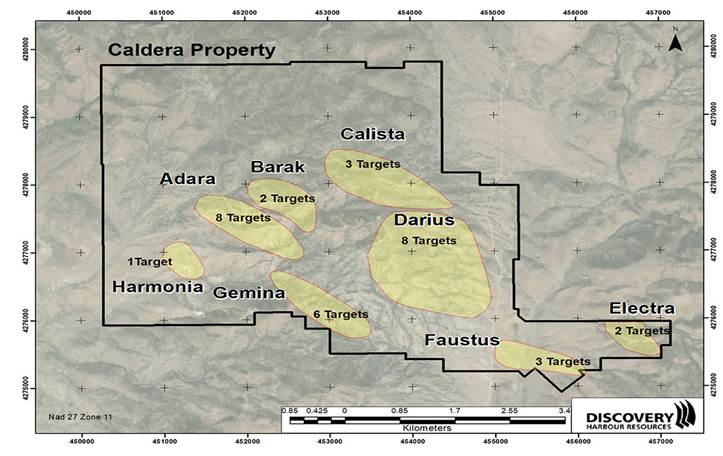

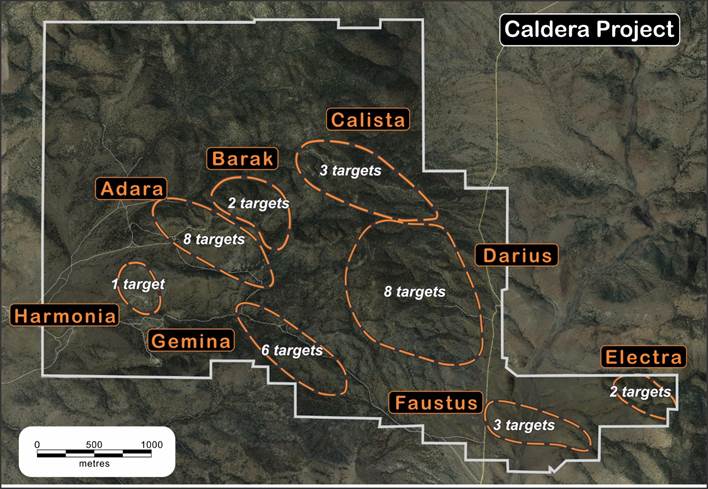

- Caldera Project, high-grade gold target in Tonopah area Nevada;

- Surrounded by epithermal deposits: Round Mountain, Tonopah, Northumberland and Paradise Peak;

- Historical drilling averages less than 100 meter depth, epithermal potential at depth never tested;

- 33 drill targets identified, with 10 to be tested in first drill round;

- Drilling to begin in Q4 2020;

- Stock priced close to recent institutional financing.

Management

Mark Fields, P.Geo, B.Comm (Hons) President, Director - Fields was the president, CEO and director of Geodex Minerals Ltd. from May 2009 to June 2014 and the president of his own consulting company, MC Fields Ventures Inc. since 2007. He received the E.A. Scholz Award for excellence in mine development for his role as executive vice president of Pine Valley Mining while bringing the Willow Creek metallurgical coal mine into commercial production. Earlier in his career he was involved in the acquisition and development of the Diavik diamond mine for the Rio Tinto Group. Mr. Fields holds a B.Sc. in geology from the University of British Columbia and a B.Comm., (Honours) from Queen’s University.

Richard Gilliam, Director and Majority Shareholder - Gilliam has spent 30 years building and operating coal mining companies. He is the past president and founder of Cumberland Resources Corporation, which was one of the largest privately owned coal mining companies in the United States. In March 2010, Massey Energy purchased Cumberland for US$960 million in cash and shares.

Andrew Hancharyk, B.Bus.Admin, JD, LL.M Director - Hancharyk is a consultant who was formerly the chief legal officer at Largo Resources Ltd. in Toronto. He was also a director of CVC Cayman Ventures from September 2010 through the RTO by Discovery Harbour Resources. He served as senior legal counsel and consultant for CHC Helicopter Group of companies in Vancouver. From November 2007 to February 2010, Mr. Hancharyk was national policy manager of the TSX Venture Exchange in Vancouver.

Rodney Stevens, Vice President, Interim CFO, Director - Stevens is a Chartered Financial Analyst (CFA) charterholder with over a decade of experience in the capital markets, first as an investment analyst with Salman Partners Inc. and subsequently as a merchant and investment banker. While at Salman Partners, he became a top-rated analyst by StarMine on July 17, 2007, for the metals and mining industry.

Jason Cubitt, Director - Cubitt has 25 years of experience working with resource companies in various capacities as founder, finance agent and institutional investor. Cubitt is also interim president, CEO and director of Westminster Resources Ltd. and is a principal of Ore Capital Partners.

The Caldera Project, Nevada – A New Approach, 100% option

The Caldera Project lies in a fertile gold region, at the intersection of the Walker Lane and Northumberland Gold Belts, just 66km WNW of Tonopah, Nevada. It is less than 50km from Kinross Gold’s Round Mountain mine, which produced 361,000 oz in 2019 alone and is a deposit of greater than 16 million ounces of gold.

Caldera is a potentially overlooked low sulphidation epithermal-style deposit. Historical operators had mined high-grade veins on a small scale, while previous modern exploration had focused on shallow bulk-tonnage open-pittable targets. Since 2016, Discovery Harbour has compiled all the historical data, and completed detailed mapping and grid soil sampling to identify the deeper source of the high-grade, but discontinuous results at surface. The historical results include rock-chip samples as high as 193 g/t Au, soil samples as high as 1.3 g/t, and drill results such as 7.6 meters of 8.33 g/t Au and 3.0 meters of 37.92 g/t Au over 6.5km of strike length. Historic drilling was at vertical depths averaging less than 100 meters.

I concur with management beliefs that the high-grade historical intercepts represent leakage from the boiling zone (where gold grade enrichment occurs) of a low sulphidation epithermal gold deposit. The boiling zone typically occurs at approximately 300 meters depth. The dominant WNW trending strike is mineralized for at least 6.5km with a series of gold anomalies defined by surface rock and soil sampling and historical shallow drilling. Strong alteration, pathfinder elements and mineral textures associated with the low sulphidation epithermal gold model occur throughout the project area. Based on this favorable combination of factors there is strong potential for a significant underground high-grade gold deposit.

Discovery Harbour has expanded the Caldera property several times since initially acquiring it in 2016 and it now encompasses over 30 square kilometres. The Company has developed 33 targets and submitted a Plan of Operations to drill-test up to 10 separate sites to the required depth to test the boiling zone where gold and silver would be deposited.

I am only going to highlight the targets planned for the first drill round (A through J, shown below)

Calista (Drill Site "A")

The Calista area contains three vein target trends, oriented northwest at 300° strike, defined by historical prospecting pits, underground workings and multi-gram gold in surface samples. The structure extends in excess of 1.5 km. Historical shallow drilling (10 holes, ranging in vertical depth from 104 meters to 194 meters in this area intersected anomalous gold, but the structures remain largely untested. The Calista area structures are strongly developed with a long strike extent, significant alteration, and associated high grade rock samples.

Darius (Drill Sites "B" and "C")

The Darius area contains a total of eight targets. There are a number of structural trends that, in contrast to the Calista area, trend more northerly at approximately 340 degrees. Application has been made for a permit to drill two sites in the Darius area. The following results supported its selection for drilling:

- No historical drill holes. Two historical vertical drill holes in the area would not have tested this target, so that the target is untested by any historical drilling;

- There is minimal outcrop in the area. One rock sample did assay 6.24 g/t Au;

- Soil sampling had anomalous Au, Ag, as well as arsenic and mercury that were coincident with mapped structure in this area;

- Of particular interest is that the anomalous Au, Ag in soils corresponds to bladed silica after calcite, a mineral texture supportive of the gold system being intact below surface.

Faustus (Drill Sites "D" and "E")

The Faustus area contains three targets. Targets within this area demonstrate two contrasting structural trends, one being northwesterly and the other northerly. The Faustus area also marks the southeast extent of a regional magnetic low that underlies much of the Caldera property, which Discovery Harbour has interpreted to represent the alteration zone associated with the low-sulphidation epithermal system. Application has been made for a permit to drill two sites in the Faustus area.

Gemina (Drill Sites "F" and "G")

The Gemina area is typical of a number of the defined target areas in that it possesses numerous targets based on historical workings, well defined structural zones and strongly anomalous gold results in shallow drill holes. Gemina’s six targets are over a notably long strike length that has been defined through exposures and previous drilling. The alteration zone associated with the structures is broad, characterized by a combination of quartz and chalcedony at various locations. Application has been made for a permit to drill two sites in the Gemina area.

In the immediate vicinity of "F" the following results supported its selection for drilling: Highlights of the historical drilling include the following:

Drill Site Target |

Drill Hole |

Best Intercept Results |

F |

CD07-2 |

3.0m @ 2.75 g/t Au, from 19.8-22.9m |

F |

CD07-3 |

6.1m @ 0.99 g/t Au, from 76.2-82.3m |

F |

GW-10 |

7.6m @ 8.33 g/t Au, from 25.9-33.5m |

Adara (Drill Sites "H", "I" and "J")

The Adara area contains eight targets and includes the historical Golden King Mine. Historical drilling intersected sporadic high-grade shallow intercepts, which are interpreted to be associated with west to northwest trending structures. Application has been made for a permit to drill three sites in the Adara area.

In the immediate vicinity of "H" the following results supported its selection for drilling:

- A historical drillhole intersected 6.1m@ 3.97 g/t Au from 13.6 to 19.7m;

- Rock sampling results include assays of 9.63 g/t Au, and 65.5 g/t Au with anomalous silver, arsenic and antimony;

- Soil sampling had anomalous gold;

- Abundance of old workings and the historical Golden King mine, such that the cumulative data makes this an interesting target.

The Caldera project has exceptional potential and we are about to enter the most exciting time with any junior explorer, the drill testing. There is strong potential for high-grade intersects and that is what the company is testing for at depth.

Financial

Last financials at June 30th show $16,387 cash and no long-term debt. Since then, on July 20, Discovery closed a fully subscribed non-brokered private placement for $3 million with a lead order from Palisades Goldcorp Ltd. and a co-lead order by AlphaNorth Asset Management. The company issued 54,545,455 units at a price of 5.5 cents per unit for gross proceeds of $3 million.

Each unit consisted of one common share of the company and one common share purchase warrant, with each warrant entitling the holder to purchase one share at a price of 10 cents per share for a period of three years following the closing of the offering.

Summary

DHR has a great management team with past success. CEO Mark Fields oversaw the sale of Geodex Minerals key asset to Northcliff Resources and built the Pine Valley coal mine. Director Richard Gilliam founded and sold Cumberland Resources to Massey Energy for US$960 million.

Nevada is one of the top gold jurisdictions in the world and DHR has acquired an exceptional project in Caldera. It is very fortunate that the project was never drill tested at depth for a low sulphidation epithermal gold deposit, giving us this opportunity today for a major gold discovery. Long time readers will remember Franco and Euro Nevada, that were predominately royalty companies. However one of the main reasons for their large share appreciation in the 1990s was the discovery of the Ken Snyder Mine (named after it's geologist founder). Franco and Euro Nevada were 50/50 partners and this turned out to be a low sulphidation epithermal discovery. It was their only mine property as the rest of their assets were royalties. However it had an impact on their stock prices because it was very high grade and profitable. The mine grade ran over 1 ounce per ton gold with 16 ounces per ton silver. The silver covered all the costs, so in effect the gold was 100% profit or just like a whopping 100% gold royalty.

I doubt DHR will make a multi million ounce discovery with grades over 1 ounce per ton, although possible. These epithermal deposits are typically high grade though, so it makes the potential for a junior company like DHR quite extraordinary. The current market cap of the stock is low at $9.5 million and no drill speculation has built up in the stock price.

There is an abundance of drill targets with 33 identified to date. They will test 10 in this first round of drilling. Drill permits have been submitted and approval could come anytime. Now is a good time to accumulate a position while things are a bit quiet.

The stock rallied strongly after the March sell off and has come back down to an excellent entry level with the recent correction in gold and gold stocks. The stock is now down to a support level and also very close to the 200 day moving average support. It is currently not much above the recent 5.5 cent financing.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

[NLINSERT]Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Discovery Harbour. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Discovery Harbour is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.