With a surprise press release this morning, NervGen Pharma Corp. (NGEN:TSX.V; NGENF:OTCQX) adorns its stable of consultants and advisors with a U.S. Department of Defense-affiliated expert on traumatic brain injury (TBI). Worldwide, in 2016, there were approximately 27 million new cases of TBI with an age-adjusted incidence rate of 369 per 100,000. This represented a 3.6% increase from 1990. That same year, prevalence was 55.5 million individuals, an 8.4% increase from 1990.

Retired Colonel Michael David, MD, FACS, former director of the U.S. Combat Casualty Care Research Program, is now consulting with NervGen to explore use of lead agent NVG-291 in traumatic brain injury and to help the company procure non-dilutive funding for such efforts. Described by NervGen CEO Paul Brennan as "a heavy hitter in the Department of Defense when it came to head trauma," during Dr Davis's military career he oversaw the disbursal of over $1 billion in planned funding to study brain trauma and possible modes of treatment.

For decades, the American military has spent relentlessly on studying and treating TBI, many of those efforts chronicled at BioPub, and with little, indeed mostly nothing, to show for that in terms of either patient improvement or investor results. One year ago, announcements were made of plans to add to spending $50 million in a desperate quest for new treatments for the condition. The problem was that heretofore understanding of the underlying neuroscience was insufficient to provide a solid theoretical platform from which to generate strategies.

Yet according to NervGen CEO Paul Brennan, interviewed for this article, just as spinal cord injury represents the problems incurred by microglial elaboration of chondroitin sulfate proteoglycan and its agonizing effects on receptor protein tyrosine phosphatase-sigma, so can TBI be viewed as a problem with diffuse, point by point elaboration of chondroitin sulfate by glial cells throughout the brain, incurring the same consequences as in the spinal cord of non-healing, non-regeneration. "At the cellular level, TBI behaves as if it were diffuse spinal cord injury," Brennan said.

To be a student of medicine is to be ever bemused by medicine's pivots and pirouettes, by its about-faces. We were dutifully tutored that the extrinsic pathway of coagulation didn't matter and that the work of clotting was borne by the intrinsic pathway. Ten years later, we were re-taught that the extrinsic pathway was the sole one of relevance and that we could nearly forget about the complexities of the intrinsic pathway. And that gastrointestinal ulcers were from gastric acid--—no acid, no ulcer, full stop—until we were forced to accept that the acid we blamed was driven to oversecretion by a bacterial culprit and that ridding it could heal a duodenal ulcer even if you ignored the acid. That mitochondria were the boring power plants of cells and of no significance beyond this, now giving way to the reluctant recognition of mitochondria as ur-orchestrators of life itself, that indeed to be eukaryotic means, if not to be mostly prokaryotic, to be ever in thrall to the prokaryotes. In medicine, it's dangerous to ask about truth, to presume it as destination and endpoint, and safer simply to accept the posture of philosopher Karl Popper: "Truth is transient."

We could continue in this vein for another 20,000 synoptic words or so, but won't, pausing to catch breath at the remembrance that as medical students, we were told that microglia were of dubious importance, mere extras on the movie set of the neurological system. The truth, now less grudgingly accepted, is stupefyingly more complex, with glial cells playing critical roles not only in spinal cord injury but in multiple sclerosis, Alzheimer dementia, now traumatic brain injury too and probably other conditions, too, not limited to stroke.

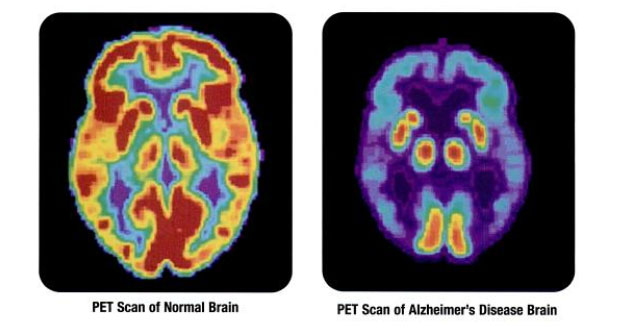

We believe that NervGen is nearing investigational new drug (IND) approval for its lead agent NVG-291.....although of course the FDA doesn't "approve" INDs. It either clears its throat and expresses objections, as it did in early 2020 to the chagrin of NervGen investors, or lets the "reject by" date pass without comment. The FDA did not of course reject the company's lead agent, a modified version for optimized biological behavior of founder Jerry Silver's original rPTP-sigma antagonist ISP, but objected to certain reversible toxicities at certain dose ranges (details have never been made public). When NervGen's version of ISP returns to the clinic, as we believe it soon will, the plan is to complete phase 1 and move immediately into among the most ramifying neuroscience work ever conducted by a biotech company, chasing up to five major phase 2 indications: acute spinal cord injury (with an approach to chronic cord injury being studied), multiple sclerosis (ISP drives remyelination in animal models of that disease), Alzheimer dementia (which may in part owe to microglia needing to be "reset" from an inflammatory state to a quiescent, less reactive state), stroke (ISP has been shown to hasten learning and performance recovery in artery ligation models of animal thrombotic or ischemic stroke) and traumatic brain injury. The addition of TBI to NervGen's stable of planned clinical programs adds urgency to the already highly compelling case for investing in the firm, which is not yet two years old.

Proof of concept in any one of the five diagnostic categories could plausibly catapult NervGen's market cap 1,000% from its present nanocap, sub-$100 million level. Better yet, the novelty and progressiveness of the work, the persuasiveness of existing animal data, and the progressive winning of converts among the neuroscience community may be harbingers of non-dilutive funding, joint ventures and partnerships. A survey of collaborative arrangements in Alzheimer's work for the pharma industry, most dead-ended by its own refusal to accept the insufficiencies of the amyloid hypothesis, reveals that an early-phase JV in Alzheimer dementia is generally worth around $750 million or more at inception, with milestones and benchmarked add-ons to follow. And indeed, NervGen's proposed approach to Alzheimer dementia, effective in animal models, represents the most radical departure, the greatest bolus of ideological freshness, the neuroscience biopharma space has ever seen. Though we don't speak secretly imbued with insider knowledge, it would hardly be going out on a limb to postulate that biotech investing institutions have now picked up the scent of NervGen. Marc Antony in Shakespeare's Julius Caesar: "Cry 'Havoc!' and let slip the dogs of war," and let them chase share price back to $5 and beyond during 2021.

NervGen and new collaborators and key opinion leaders will be the subject of two additional BioPub webcasts in 2020. Meanwhile, it's certainly an interesting time to be a NervGen investor or think about becoming one. As always, we're not an investing advisory and not soliciting your investment, and cover the company not because it pays us to but because of our firm reckoning that the neuroscience on which it is premised is both unimpeachable but also poised radically to shake up the industry and the approach to human therapeutics. CSPG and rPTP-sigma are the critical "final common pathway" to so much neuropathology that one will long wonder how it could have been missed so perennially, and then denied with ever more ramped-up vehemence the more overwhelming its veracity became. The seminal work on which NervGen's clinical plans are premised emerged not from MIT or Harvard or Oxford but from the credible, honorable but decidedly non-bombastic Case Western Reserve University.

The editors congratulate NervGen, CEO Brennan, chairman Bill Radvak, and founders Dr. Harold Punnett and Jerry Silver for the addition to their ever more compelling penumbra.

Dr. KSS is the founder and editor-in-chief of BioPub.co. He is an MD with an additional PhD in biochemistry, and for the past 20 years, in addition to practicing, being a researcher, and conducting clinical trials, he has been investing in biotech companies with great success. Dr. KSS earned his degrees at a top 10 U.S. institution, where he was an NIH scholar and graduated with top honors. He has extensive post-doctoral research experience and am board certified in internal medicine and also gastroenterology. His goal is to discuss companies and use discussions of their technology, their drugs or planned drugs, as ways of teaching about physiology and disease states, along with their issues and opportunities.

[NLINSERT]Disclosure:

1) Dr. KSS: The author discloses a long position in NervGen as a top five holding and will not trade in shares of this equity for 72 hours, reckoned in business days, after publication.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

Copyright 2020 by the author and Helixir Media, LLC. All rights reserved. May not be copied or disseminated without permission.