Because Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) renegotiated their Indiana gold project in Chile not too long ago [with] very favorable terms, I was surprised to recently read about the company dropping the project—"The Company also wishes to report that it is not proceeding with its option of the Indiana Gold-Copper project in Chile."—when announcing in the same news release the acquisition of the Rosales Copper project, located in Chile as well, which is less advanced, and will be discussed later on.

The Indiana project seemed very appealing to me, with a significant but still historic near surface resource of 607,000 ounces at 6 g/t gold equivalent (AuEq), and lots of exploration potential. Management estimated potential for at least 1 million ounces (1 Moz) AuEq, and in this gold environment it would have been a solid flagship project in my view.

They also managed, as mentioned, to amend the definitive agreement with the property owner substantially, bringing down the payments for the first two years from US$3 million (US$3M) to US$350,000, and increasing ownership after production decision from 75% to 100% at no additional costs.

In order to do so, management studied the available drill data in great detail, and obviously spent a lot of time on Indiana. Also keep in mind that a 2,500-meter (2,500m) drill program was defined, budgeted and planned for Q1/Q2, with first results coming out at the beginning of Q2, and a further minimum 2,500m drill program and commencement of preliminary engineering studies was intended before the end of 2021.

Of course, COVID-19 overturned this scheduling, but as all mining juniors have gone back to work these days, I expected Golden Arrow to do the same on Indiana. As I found it remarkable for the company not to proceed with this project, I asked them what exactly the reasons were.

VP Exploration Brian McEwen stated: "The success of Indiana depended largely on being able to put the project into production quickly to make the large vendor payments in the coming years. With the COVID-19 shutdown we were faced with several challenges. One was the vendor would not commit to an extended schedule for the payments, and secondly, there were illegal miners on the property taking ore from the high-grade vein. Rectifying these had costs, and it seemed there was no controllable end in sight. Presented with the options, management took the decision to walk away before incurring any more costs or making the next payment. Also, it should be pointed out that that we believe we have identified several other opportunities without the burden of heavy payments."

Too bad, as I don't see a few months of delay a problem over a period of three to four years, and I viewed the Indiana project as a very good, relatively advanced project to have in this positive metal market.

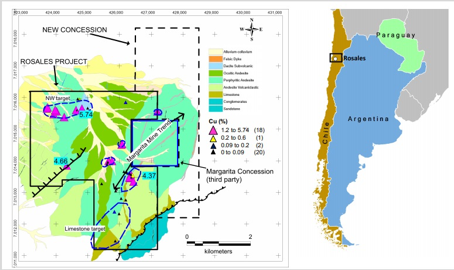

Let's have a look at the newly acquired Rosales copper project. The project was acquired with the view of benefiting the rapidly rising copper prices of late. Rosales is located adjacent to the operating, small-scale, underground Margarita copper mine, and both are positioned on a 3-kilometer-long structural trend called the Margarita Mine Trend.

The Rosales Copper project is situated in the Atacama Region, in a prolific mining region that, besides some of the largest and richest lithium brine deposits globally, also hosts multiple large precious and base metal mines. Large mineral deposit types in the area include: iron-oxide copper-gold (Candalaria, Mantos Verde), porphyry copper-gold (Inca del Oro), epithermal gold-silver (El Peñon, Guanaco) and Maricunga gold deposits (Cerro Casale-Caspiche, Refugio, Marte, Maricunga).

In general, the mineralization type found is stockwork, consisting of breccias, veins/veinlets, fractures and mantos. Management thinks there could be a possible epithermal system at depth. Considering the types of mineralization, it seems width is typically limited, and limited width means two things in general: relatively low tonnage and lots of drilling required. For copper targets, usually high tonnage and continuity are preferred.

I asked management about their motivation to pursue this type of greenfield exploration, which will take lots of time, potentially causing Golden Arrow to miss out on a significant part of the current copper run, over Indiana, which is a copper-gold project, enjoying both gold and copper enthusiasm.

The company stated, "This is high-grade copper, near-surface and could be advanced quickly. With high grade, lower tonnage is required to identify something economic. These types of project fly under the radar and we believe this to be an attractive target that cost us nothing to acquire."

The acquired claims (1,450 hectares) have seen no drilling, but did return high-grade sampling, up to as high as 5.74% copper (Cu). Based on these results, the company applied for another 824 hectares of adjacent mineral rights. Golden Arrow is starting a phase 1 exploration program that is expected to include detailed mapping and sampling, as well as ground magnetics and induced polarization (IP)/resistivity geophysical surveys. Results of this program are expected in August/September and, depending on the results, a drill program could be lined out and could start as early as October.

As the news release didn't mention any deal terms on the Rosales copper project, I asked management [to] elaborate on it.

According to them, this was open land and they staked it. There are other areas like this that they seek to acquire. It is nice to not have to be making payments to vendors instead of putting the money straight into the ground.

The company still has 950,000 shares of SSR Mining Inc. (SSRM:NASDAQ), worth CA$29.99M at the moment (July 23, 2020), after having sold 250,000 shares of the original 1,245,580 shares received from SSR Mining as partly compensation for the sale of the 25% interest in the Puna operation. Golden Arrow has about CA$4M in the treasury at the moment, and is fully funded for their 2020 exploration programs. According to management, the company has sufficient cash and cash equivalents to be able to take any project to preliminary feasibility study stage.

When looking at the chart of SSR Mining, it can be seen why these shares are a great and liquid asset to have, as the company is performing very well and is profiting perfectly of the current record prices of precious metals.

Share price SSRM.TO; 3-year time frame (Source: tmxmoney.com)

Golden Arrow has been slowly recovering now, on the back of a rather viciously developing precious/mining bull market. The share price has been lagging compared to most gold/silver stocks, and has lots of room to run with any half-decent drill result.

Share price GRG.V; 3-year time frame (Source: tmxmoney.com)

Although the 10% buy-back program was timed very well, it probably accounted for at least a part of the increase in share price.

As the company wasn't confined to the Indiana project, it was useful to get an update on the other projects by VP Exploration Brian McEwen.

- Regarding the Tierra Dorada project in Paraguay, the upcoming drill program will be defined shortly. As a reminder, trenching results returned 89.5 g/t Au and 61 g/t Ag (silver) over 0.93 m, and 143.4 g/t Au and 95.8 g/t Ag over 0.58 m.

- The Flecha de Oro project in Argentina has surface mapping and sampling underway, and will be followed by detailed mapping and trenching in Q2/Q3. As a reminder, the following numbers came from trenching so far:

- 24.0 g/t Au over 2 m

- 18.0 g/t Au over 0.7 m, including visible gold

- 13.09 g/t Au over 5 m

- 99 g/t Ag and 2.8% Cu over 0.2m

- 129 g/t Ag, 3.5% Cu and 0.2% Bi over 1.2m

- 24.0 g/t Au over 2 m

Further results will be announced in Q3. Argentina is still shut down for travel between provinces, but management is looking at some new opportunities.

With three exploration projects ongoing, a lot of news flow can be expected from Golden Arrow, and the best news, in my view, in the current environment, would be a set of spectacular drill results, considering the share price explosions of peers enjoying such results.

Conclusion

I had to admit I was a bit confused after reading about Golden Arrow rescinding the option on the Indiana project in Chile, which I clearly viewed as their flagship asset in the making. Especially after the successful renegotiation and the plans made for it, it came as a surprise.

However, according to management, it seemed things weren't proceeding very smoothly. With the new Rosales copper project the company maintains their Chile exposure, and the prominent copper angle seems well timed these days. Since Golden Arrow still owns almost CA$30M in SSR Mining shares, cash is not the issue, so many meters can be drilled. Let's see if management can convert the SSR Mining compensation into tangible drill results—hopefully the type of results that create the kind of enthusiasm that enabled lots of juniors lately to become instant multi-baggers overnight.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Critical Investor Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Golden Arrow Resources, a company mentioned in this article.

Charts and graphics provided by the author.