The correction in gold ended with the drop to the $1,460/ounce area. We see these spikes up of higher highs. It is like the gold market is a pressure cooker, trying to explode upward, and soon it will.

Ridgestone Mining Inc. (RMI:TSX.V)

- New, well-structured deal with strong shareholder base;

- Strong management team with recent success in Mexico;

- Rebeico project is in prolific Sierra Madre belt (80 million [80M] ounces Au and 4.5 billion [4.5B] ounces Ag);

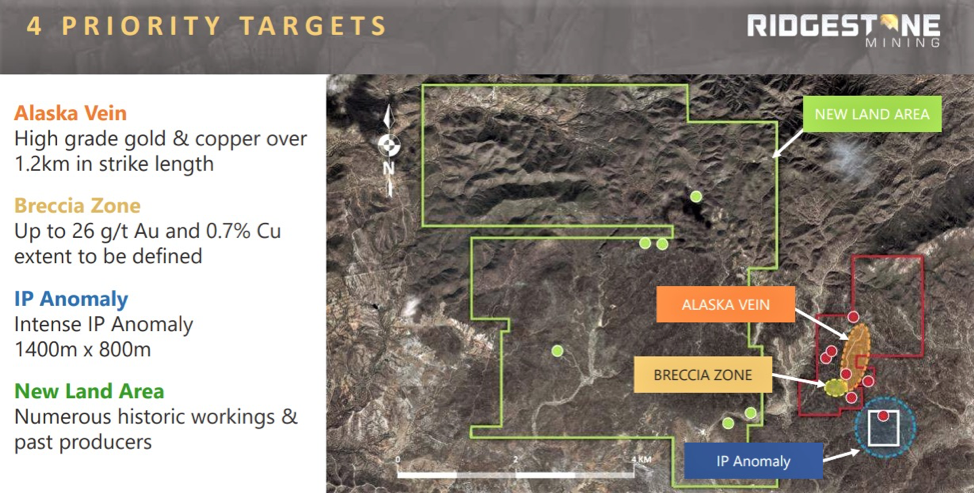

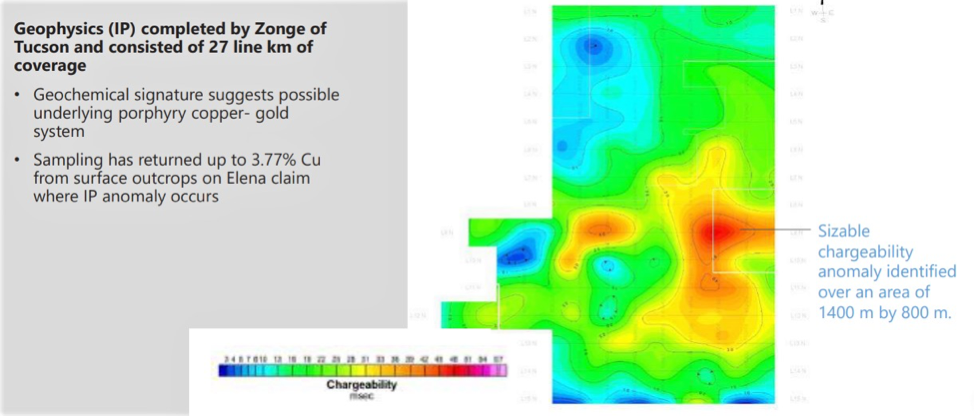

- Four targets with numerous historical workings (veins, IP [induced polarization] anomaly and breccia zone);

- Initial high-grade drill results from the Alaska vein, up to 36.1 g/t gold over 1.5 meters;

- Attracted the likes of Dr. Steven I. Weiss, PhD, CPG, as adviser; Glamis Gold Inc. (GLG:NYSE) and Newmont Goldcorp Corp. (NEM:NYSE) Mexico

- Project has very little modern exploration; was acquired based on vendor's expertise and past success;

- March 23: commenced a 10-hole, 1,500-meter phase 1 diamond drilling program on breccia target;

- You will be familiar with some of the management team because they discovered the mines now run by Argonaut Gold Inc. (AR:TSX) in Mexico;

- Recent price: $0.21/share;

- Shares outstanding: 42.2 million;

- Fully diluted: 58.1 million;

- 9.3 million warrants, all exercisable at $0.25m expire June and October 2023

Management

Ridgestone is headed up by Jonathan George, CEO and director. George is a geologist and mining entrepreneur with over 35 years of experience in mineral exploration, development and financing of projects globally. From the Ridgestone website: "Mr. George cofounded Creston Moly and served as president and CEO, where he spearheaded over $40 million in equity financing to acquire and advance the El Creston project in Mexico. Under his leadership, the El Creston project advanced to become Mexico's largest molybdenum deposit, advancing through to prefeasibility in under two years, and was subsequently acquired by Mercator Minerals for $195 million.

"Mr. George also previously served as president and CEO of ESO Uranium, which subsequently became Alpha Minerals, and was instrumental in both assembling and exploring one of the largest land packages in the Athabasca Basin, Saskatchewan. This land package was where Alpha Minerals and its partner, Fission Energy, made one of the basin's most significant uranium discoveries—the Patterson Lake South project.

"Mr. George also founded Dynasty Gold Corp., serving as president and CEO, where he and his team secured the largest land package of exploration rights held by a foreign company in China, conducting gold and base metals exploration in Xinjiang, Gansu and Qinghai provinces."

Ridgestone is partnered with YQ Gold de Mexico S.A. de C.V. for their exploration expertise. YQ Gold was founded by three accomplished geologists to acquire and explore promising projects in northern Mexico [also from the website]:

"Alfonso Daco, BSc. Geology, President, has had a long and illustrious career in mineral exploration since graduating from the University of Philippines in 1967. After working for Nippon Mining and Metals exploring for copper and gold in the Philippines, Alfonso immigrated to Canada and was hired by Ned Goodman's Campbell Resources and sent to Chibougamou, Quebec. While with the Goodman Group of companies, Alfonso was instrumental in the discovery of the El Castillo Gold Mine (more than 1 million ounces gold), the La Colorado gold Mine (more than 2 million ounces gold and 18 million ounces silver) and the Lluvia de Oro/Jojoba Gold mine (more than 500,000 ounces of gold).

"Francisco Navarro, BSc. Geology, Country Manager, received his BSc in Geology from the University of Sonora in 1986 and has been actively involved in mineral exploration and project management since then. Born and raised in Hermosillo, Sonora, Francisco has held senior management positions with numerous subsidiaries of Canadian junior resource companies, including Creston Moly Corp., Morgain Minerals Inc, Valdez Gold and Columbia Metals. Francisco's extensive network within the Mexican mining community, particularly Sonora, is invaluable to all aspects of the Company's endeavors in Mexico."

In early March Ridgestone appointed Dr. Steven I. Weiss, PhD, CPG, is chief independent technical adviser for its Rebeico gold and copper project. From the website: "Mr. Weiss has worked as an exploration geologist since 1979, in roles from generative through to senior project management. Mr. Weiss began work in Mexico in 2003 when he joined Glamis Gold to lead their exploration team at the El Sauzal gold mine (total of 1.7M oz gold produced) and in the surrounding Sierra Madre Occidental. He continued working in Mexico for Goldcorp, following their acquisition of Glamis Gold in 2006, where he built and led the team at its Camino Rojo gold-silver deposit, which proved up an initial 1.6M oz gold in reserves and more than doubled its gold resource from 3.4M oz to 7.5M oz gold. Steve held the position of Mexico Exploration Manager when he departed Goldcorp in 2013. Since 2014, Mr. Weiss has been a senior associate geologist with Mine Development Associates, headquartered in Reno, Nevada."

Projects

Ridgestone has a lot of experience, success and connections in Mexico, and that is where they are focused with an exceptional property. I have little doubt that this will be another significant discovery.

Rebeico Copper-Gold Project [from the company website]

The project is located in Mexico's famed Sierra Madre Gold belt, one of the world's largest and most prolific mineral districts, credited with production of over 80 million ounces of gold and over 4.5 billion ounces of silver. It is located 115 kilometers east of Hermosillo, Sonora, Mexico, and is easily accessed by paved and all-weather roads.

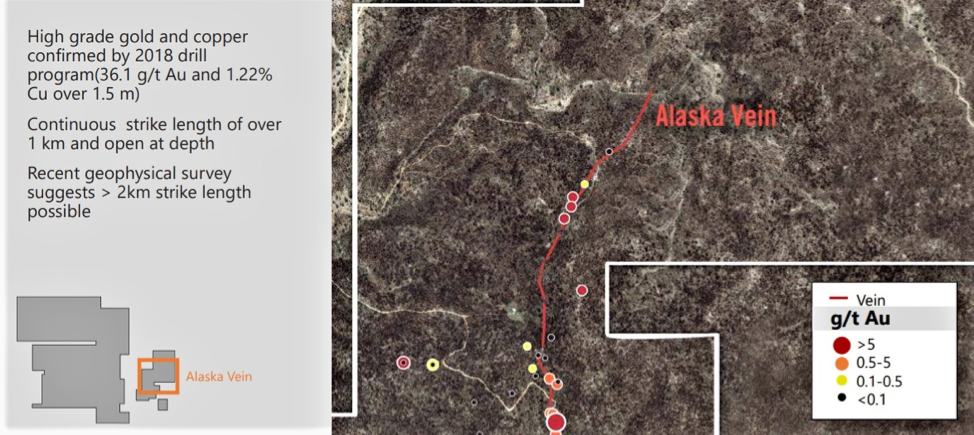

Rebeico is the site of numerous, historical, small underground mines that were developed along a one-kilometer, steeply dipping vein referred to as the "Alaska" vein. Old workings along the Alaska vein were developed to depths of approximately 70 meters over widths of 1.5 meters and occur intermittently along strike. The mines were developed to extract gold, copper and silver ores during the early 1940s, and were sent for refining to El Paso, Texas

Since that time, little activity took place on the properties until they were consolidated in the mid-2000s by a local Mexican geologist, Ing. Francisco Navarro, who founded YQ Gold de Mexico S.A. de C.V. with two other accomplished geologists, to further explore and develop the promising prospect. YQ Gold undertook a compilation of all available historical data and determined that the property had exceptional potential for the discovery of multiple styles of gold, copper and silver mineralization.

In June last year the company acquired a significant land package adjacent to the original property to enhance the project. The new acquisition area is 3,292 hectares to the west of the original claims and in green on the next graphic. Initial reconnaissance encountered numerous artisanal workings and mineralized outcrops which were sampled and tested for copper and gold. Based on a review of government records, little to no modern exploration has been undertaken in recent years.

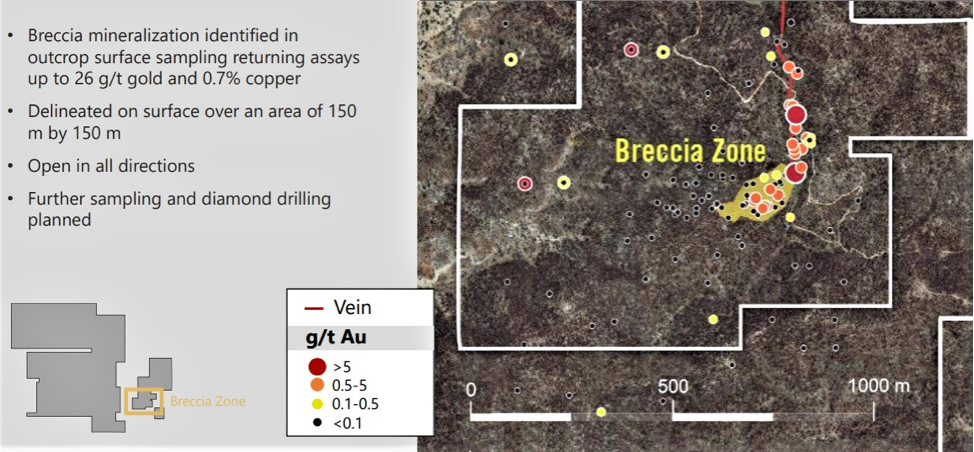

I am going to use the graphics from their presentation to highlight the three main targets before the land acquisition. [Here is] the Alaska vein, breccia zone and the IP anomaly.

Financial

The company is well structured and has strong shareholder support. They just raised funds ahead of the recent market turmoil, which did not seem to affect the share price much at all. In late February, Ridgestone closed a $1.05 million private placement at $0.15 per share with a half warrant exercisable at $0.30, good for one year.

Summary

YQ Gold de Mexico originally acquired the claims containing the known Alaska vein, a high-grade gold and copper vein bearing similar characteristics to their past discoveries.

Surface sampling and prospecting has demonstrated continuity of the Alaska vein over one kilometer. An initial eight-hole drilling program in 2018 returned several good intersects on the Alaska vein, including 8.31 g/t Au, 17.7 g/t Au and 36.1 g/t Au, and up to 2.41% copper.

The project is in the prolific Sierra Madre gold belt, which has produced over 80 million ounces of gold from dozens of mines. There is excellent infrastructure including paved highway access, power and water.

Alfonso and Francisco (YQ Gold) are confident about reproducing past successes with this project. They have determined that there are likely parallel veins associated with the Alaska vein, and possibly a large, deep-seated mineralized source. Their recent success at La Colorada began with two veins, but in between was a large area of disseminated gold that enabled a successful low-cost heap leach mining operation.

Now, Ridgestone Mining has the opportunity to reap the benefits of Alfonso and Francisco's expertise by earning 100% in the Rebeico Copper/Gold Project.

In addition to the well-defined Alaska vein, a newly discovered mineralized zone to the south presents a significant new form of mineralization. This new style of mineralization, identified as an oxidized breccia zone, has been identified on surface over an area of 150x150 meters, and with surface sampling ranging from 1.0 to 26.0 g/t gold and 0.2 to 0.7% copper. A recently completed geophysical survey has indicated this structure could be part of a significantly larger mineralized structure at depth.

On March 23, Ridgestone commenced a 10-hole, 1,500-meter, phase 1 diamond drilling program at the newly discovered gold-bearing and copper-bearing New Year zone at its Rebeico gold-copper project. From the press release:

- First-ever drilling at the New Year Zone will be focused on the potential continuation at depth and sub-surface geometry of high-grade gold-copper mineralization discovered with 2019 surface sampling that returned up to 12.95 grams per tonne (g/t) gold (Au) and 0.65 per cent copper (Cu);

- Drilling will also test the southern portion of the nearby Alaska vein, south of hole 18REB10, which in 2018 returned 36.10 g/t Au over 1.5 meters at 103.64 to 105.14 meters;

- Specifically, the potential subsurface junction of the New Year Zone with the southern part of Alaska vein will be targeted.

On April 7, RMI put out a news release about progress on the first the holes and all of them showed mineralization in the core. We will have to wait for assays, but there could be a discovery hole in the making. The first three diamond-core holes in the New Year Zone completed for a total of 435.7 meters with visible sulfide mineralization observed in all three holes. From the release:

- Drill hole 20REB014D was drilled vertically and initially planned for a depth of 100 meters but was extended to 170 meters due to the continued presence of visible sulfide mineralization.

- Drill hole 20REB015D was collared at the same site as 20REB014D and drilled due west at an inclination of –55 degrees. The hole was initially planned for a depth of 150 meters but was extended to 167 meters due to the continued presence of visible sulfide mineralization.

- Drill hole 20REB013D was drilled vertically and reached a total depth of 98 meters with sulfide mineralization observed in the core.

I believe the odds are very high that this drilling, and future drill rounds can prove up a significant discovery. The stock is tightly held and not much volume until the past month. It has been mostly in a trading range between $0.20 and $0.26, and I would be accumulating up to $0.30. A move above $0.30 would mark a clear breakout, and the stock could then make a significant move higher, which means more aggressive buying at that point could be a good strategy.

And one last key point, someone like Steven Weiss does not just join any project or company.

I participated in the last financing and currently own 82,000 shares. I may also aid the company in future finance rounds.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

[NLINSERT]Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Ridgestone Mining. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: I helped Ridgestone Mining raise funds in last financing and may do so in future ones. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Author's Disclosures: Copyright 2020, Struthers' Resource Stock Report. All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.