With the growing concern of the theft of intellectual property from the likes of Huawei cell networks and Chinese made drones—and following the attack on the oil fields of Saudi Arabia—there's been a lot of talk about drone technology, particularly of a military nature. Meanwhile, the entire drone market is hot and getting hotter. According to recent Canaccord Research, there is an $8 billion market with a 30% compound annual growth rate to $25 billion by 2025; the largest share of that market, about 70%, is in military applications. Venture capital investment in the space in the last four years is beyond $2 billion, a welcome home since the whooping investors took in the cannabis, bitcoin and blockchain meltdowns.

The Tech Sector Never Cooled…

In the midst of this, a small North American-based company, which is actually the world's oldest operating drone manufacturer, is seizing on a well-positioned opportunity for significant revenue gains as the Chinese, who to this point have dominated the global drone market, are increasingly being barred from supplying its foreign-made technology at the U.S. government level. Draganfly Inc. (DFLY:CSE; DFLYF:OTCQB), recently listed in November on the Canadian CSE under the ticker DFLY, following a $7 million $0.50 financing, is a company that is poised for exponential growth in this next stage of its 20-year existence. The company is also now publicly listed in the U.S. on the OTCQB as DFLYF.

The move against Chinese technology started last October when the U.S. Department of the Interior grounded its 800+ drones—all made in China or with Chinese parts—pending review of their data security. Since then, more divisions of the U.S. military and government are actively considering to further bar Chinese made drones. The market is now taking notice of Draganfly given its "pole position" to replace much of the up to $1 billion void left by the now-banned Chinese drone technology. After all, Draganfly already does contract-engineering for U.S. military contractors. Now its stock is gaining momentum, surging in early February 2020. Still with a market cap of under US$50 million, Draganfly has more room to take flight.

As recent as February 13, General Aviation reported Draganfly is evaluating a sensor package and artificial intelligence software that could be used to screen large area crowds for symptoms of dangerous contagions such as the coronavirus. "The company already has received a "serious inquiry" from a potential, unidentified customer for this service package, according to CEO Cameron Chell."

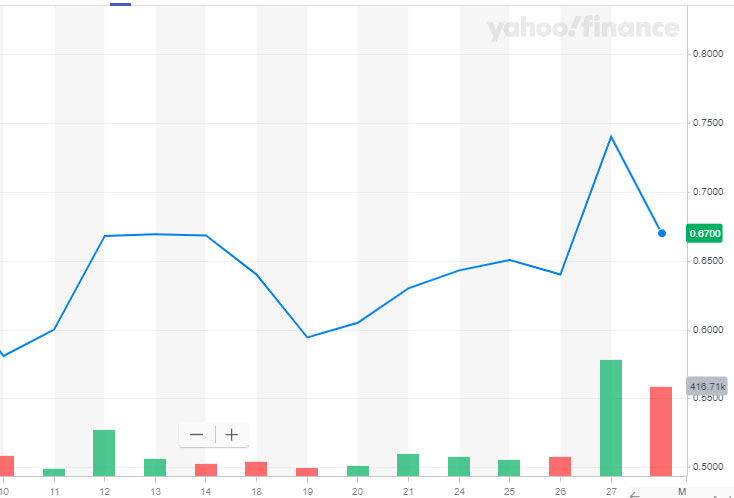

DFLYF has caught the attention of investors, seeing near doubling since the end of January to a high of US$0.83 and volume increasing steadily before settling back to the US$0.65 range on February 25. (See chart below). As commented on Born2Invest, "Draganfly Inc. has positioned itself perfectly. Spying fears and tensions with China are unlikely to cool anytime soon and it is very likely that the U.S. will follow through on its full ban of Chinese drones. This will open upon an enormous opportunity for one of the drone industry's most consistent innovators."

DFLYF Stock Chart

The recent correction poses a new buying opportunity as John Del Vecchio's Hidden Fortunes rightly called back in November for CSE: DFLY / OTCQB: DFLYF to run to $0.70, suggesting investors "Go slow. Dip your toe. Let it mature a bit in its trading and then start to build a position. If it ends up being a winner and hits $10 per share, will trade through $2 first. There's plenty of time here."

"It's the industry rallying around Draganfly," says Draganfly President and CEO Cameron Chell. As he commented in a December 9 article in Defense Daily, "There's about $1 billion in revenue right now for strategic commercial, military and government work that is being done that comprises drone sales or services that now can't be done by Chinese drone companies. There are maybe three or four companies that can capture that work, and Draganfly is one of them." He says the move by the U.S. military and government sets the company's sights for the next few years on a least $100 million of that $1 billion dollar opportunity. Defense Daily's Frank Wolfe agrees, stating, "If the Department of the Interior ban on Chinese drone technology continues, Draganfly and other North American companies will likely benefit."

Financial News Now writer Blake Desaulniers agrees with the potential of Draganfly given its market position. He had this to say in his January 22 article: "Draganfly is the oldest and one of the most experienced North American commercial drone design and manufacturing companies operating in the world today. Now that the company is publicly traded, any potential shareholder interest could be securing a ground-floor position in a company that, in my opinion, seems destined for explosive growth, in a market that is projected to soar over 10-fold in the coming five years."

In the competitive military drone landscape, here's the thing: Of course, Draganfly is up against well-connected multibillion-dollar U.S. military technology giants to displace the Chinese technology, but, "There are no large U.S. defense companies that do drones that don't do "ordinance"—that are not weaponized," says Chell, who adds that ordinance brings about an entirely "different" (as in more complicated, regulated and expensive) cost structure. "And, therefore, there are no major defense companies that have a cost structure that can compete with what Draganfly does in the non-weaponized military drone space."

Acquisition Strategy to Support Growth

After its pending acquisition of Vancouver-based Dronelogics was announced January 16, the company—at the minimum—expects the transaction will generate combined pro forma revenue of between CA$6 to CA$7 million for the fiscal year 2020, representing an increase in Draganfly's revenue of between 23% and 43%. "Dronelogics is a successful reseller, integrator and service provider of drone products with strong sales and distribution. But when you are reselling and integrating other people's drones you have a thin margin. Our synergy is where we can introduce our drones, thus giving us greater distribution while increasing their margins at the same time."

But more importantly, Chell is excited about the management and engineering skill set his company is acquiring and claims this is merely the beginning of an acquisitive feeding frenzy, "We're not acquiring revenue, we are acquiring talent—it will come with revenue which will help but it's really been all about the talent that can help us scale our organic growth, feeding an organic demand." He says investors can look forward to a steady stream of high-level endorsements, innovations and acquisitions of talent, technology and distribution on the road ahead.

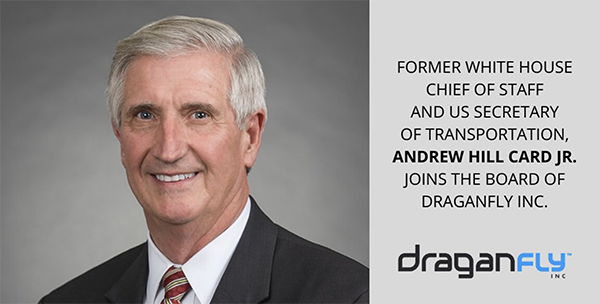

To help achieve further penetration into the U.S. government and military, for example, the company has made friends in some very high places. In November, former White House Chief of Staff and U.S. Secretary of Transportation Andrew H. Card joined the board. This is after the former General Counsel of U.S. Department of Homeland Security and Raytheon Senior Executive John M. Mitnick signed on as consultant to Draganfly. Adding influential door-kickers such as these should help Draganfly to gain more inroads into already established relationships with key U.S. government and military suppliers. The company currently provides high-level engineering and product development for Tier 1 contractors supplying the U.S. Department of Homeland Security, Department of the Army and Department of Defense, contracts that are expected to grow significantly as these relationships further develop.

Card explains his endorsement in a November 25 Bloomberg interview, "Draganfly is the oldest drone company in the business and they have the intellectual property that is second to none. They understand the private and the government marketplaces and can provide some of the technology needed in terms of our intelligence communities, building a network of business around the globe but particularly in North America."

As cited in a January 25 article in General Aviation News, "The sky is the limit for drone tech today, and the folks at Draganfly are raising the bar as they have for two decades now. It will be exciting and interesting to see how things will grow and advance in the coming years."

First to Market—Two Decades Ago!

Draganfly has a fabled history in the drone world as the oldest operating company that developed the first quad copter, commercialized the first quad copter, and employed the first quad copter to help save a human life—that one is in the Smithsonian. Draganfly's recent innovation is the Tango2+ Fixed Wing drone. A December 4 news release reveals the Tango2+ can expand its commercial use as it offers long-duration flight times, and its innovative design allows for lower airspeeds, which translates to lower altitudes and higher resolution data capture. This high endurance, multi-battery, small RPAS is capable of carrying a wide array of payloads and is ideal for tactical operations, search and rescue, agriculture, industrial inspection, and surveying and mapping, including aerial 3D modeling. This perfectly positions Draganfly's Tango2+ fixed wing drone for border security applications, among other applications.

Tango2 Fixed Wing Drone

Over the years, the company has secured a number of patents for its cutting-edge drone technologies, including folding landing gear, folding rotor arms and image-tracking systems and has made recent announcements (January 22) on new payloads to increase efficiency and data collection quality.

Currently Draganfly supplies three key markets: 1) its primary market is public safety, first responders, police forces, with its largest share being contract engineering for military contractors in the U.S.; 2) its product line, which includes quad copters, fixed winged drones, ground robots, universal controllers, autopilot systems and software; and 3) managed services for large industrial companies that are launching their own drone fleets with security, autopilot system and closed data collection.

These divisions serve significant markets, with public safety currently at $2.7 billion in the U.S., survey and mapping at $11 billion globally including $1.3 billion in the U.S., and other markets, such as media/broadcasting, infrastructure, agriculture, industrial, rounding out to $1.7 billion including $300 million in the U.S. alone.

The Price Is Right

With this kind of expected excitement and growth in the marketplace, not to mention Draganfly's unique position in the public safety/military market, Draganfly has a window of opportunity to take advantage of its head start and capitalize fully. With a fabled history and current market capitalization of around $50 million, it could be considered an educated bet that it could march toward X times multiples of that in the next few years.

Share-wise, Draganfly (CSE: DFLY / OTCQB: DFLYF) is structured with about 70 million shares of which 10% are held by management with three-year lock-down provisions. There are 3.5 million options and 3.1 million restricted shares under similar lock-down and, according to the company, 14 million of the 18 million warrants are mostly in a few friendly hands from the $0.50, $7 million November financing. This leaves about 50 million free trading shares, with no nasty iceberg selling in the near-future.

Consider Draganfly with a 2020 projected revenue of between $6 and $7 million with a near 50% gross margin versus Drone Delivery Canada (TSX.V: FLT / OTC US: TAKOF), another company with drone IP and patents. FLT.V currently has no revenue as it pursues the drone delivery space, with a nine-month net loss of $10 million and trades at a market cap of about $175 million. Clearly, the opportunities ahead are showing room for Draganfly to fly further. . .much further!

Knox Henderson is a journalist and capital markets communications consultant. He has advised for a broad range of small cap companies in the resource, life sciences and technology sectors for more than 25 years.

[NLINSERT]Disclosure:

1) Knox Henderson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Draganfly. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Draganfly, a company mentioned in this article.