1. Introduction

At a time when tax loss selling is at its peak, Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) seems to have bottomed, and is regrouping after the sale of its interest in the Puna operation. New exploration projects have been acquired and exploration is on its way, and with a new focus on gold this time combined with a robust gold price, and by owning a large amount of SSR Mining Inc. (SSRM:NASDAQ) shares, the company seems ready to generate interesting news starting in Q1 2020. Who else than President and CEO Joe Grosso to ask about proceedings and plans at Golden Arrow Resources, as I will do in the interview below.

All pictures are company material, unless stated otherwise.

All currencies are in US dollars, unless stated otherwise.

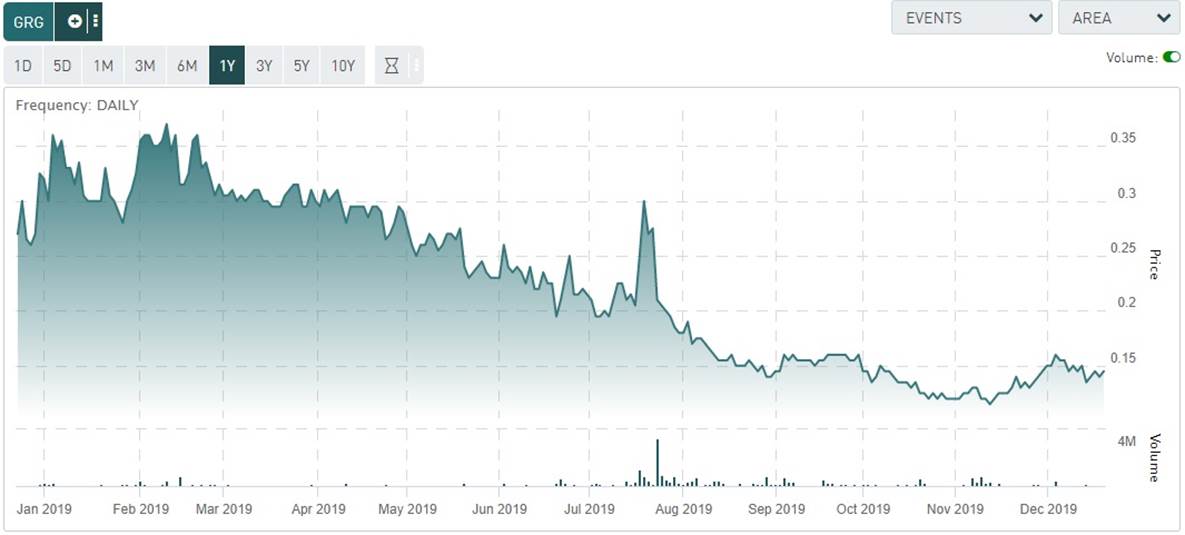

Share price; 1 year time frame (Source tmxmoney.com)

2. Argentina in general

The Critical Investor (TCI): Thank you for taking the time, Joe. Let's start with the Argentina situation. The newly elected President Fernandez appears to be mining friendly, as he wants to set up a dedicated Ministry of Mines. Have you seen progress on this front, are you in contact with government officials about this, what is your opinion?

Joe Grosso (JG): Thank you for this opportunity. We are in continuous contact with the newly elected government. Our group was invited about a month ago to a meeting with the president where we were reassured of the government's dedication to the maintenance and support of mining in Argentina. Our organization has been active in mining in Argentina for 26 continuous years and has seen many different elected governments. If the past would serve as our guide, our opinion is that the present government will be very supportive of mining in that country.

TCI: As I see GRG branching out seriously to other jurisdictions outside Argentina for the first time in many years (Chile, Paraguay); was this done out of fear for a return to Kirchner politics, which shut down foreign interest almost completely? If not, what was the reason for this? Why Paraguay and Chile in specific?

JG: Absolutely not, Golden Arrow's foray into Chile and Paraguay is a natural extension of our expertise in Argentina. Well-known mining trends that occur along the borders of Argentina lead one to logically ask the question: does this geological trend cross the border and into the neighboring country? Our technical team has pointed Golden Arrow to promising projects in these countries so our company will follow through with our investigation.

3. Financial

TCI: The dust has settled around the sale of the Puna interest to SSR Mining, and everything has been said and done around this transaction, I guess. However, I had one question: why didn't you retain a royalty on Chinchillas, as you usually do when selling projects?

JG: Retaining a royalty on Chinchillas was a matter of negotiation with SSR Mining. While we would have liked to have one, we still negotiated a great deal with SSR. The $26 million worth of SSR shares gives our shareholders exposure to not only Chinchillas, but also to SSR's other, well-performing gold mines. In essence, it is an improvement on a royalty.

TCI: The 4-month hold period for the SSR shares is ending at January 18, 2020, if I'm not mistaken. What is your current cash position, and what is your expected needed budget for 2020, and could you break it down for us?

JG: At the end of the 3rd quarter, Golden Arrow had $1.3 million in the treasury. Our exploration plans are still being finalized, in the first quarter of 2020 we plan approximately $1.6 million in exploration. The follow-up work is dependent on the results, so it would not be meaningful to contemplate at this stage.

TCI: How are you planning to monetize the SSR shares for this year? Are you hoping for a higher precious metals price and sell bits and pieces when needed, or do you want to have a solid amount of cash in the treasury?

JG: We would materialize a small amount to ensure that our exploration programs are sufficiently funded. Our shares of SSR provide the company with great exposure to a rising mining market—which we feel is forthcoming in 2020.

TCI: For how long do you expect not to have to raise money in the markets?

JG: We have sufficient cash and cash equivalents to be able to take a project to a Pre-Feasibility stage. A market financing would only be considered if Golden Arrow shares were considerably higher and fully reflected the value of the company's assets.

TCI: Do you expect to acquire/option more assets in 2020?

JG: Given the current state of the mining market, there are many quality assets that are available at significant discounts. We are always reviewing new submissions and assessing if they fit our acquisition criteria.

TCI: If so what kind of assets are you looking for, early stage, and/or with a (historical) resource? In which jurisdictions and why?

JG: We typically seek advanced assets that have exceptional potential to expand any existing resource. The jurisdictions we typically focus on are Argentina and surrounding countries—regions where we have sufficient experience so that we can ensure effective management of these assets.

TCI: According to the presentation, a payment decision on Indiana will be made this month. Are there other deadlines on decisions for other projects in 2020?

JG: We are in negotiation with the vendor of Indiana to adjust the terms so that they are more reflective of current mining market conditions, prior to the next payment. Our other projects have very modest payment commitments in 2020.

4. Company

TCI: Before the sale of Puna, there were plans to spin out the new exploration arm called New Golden Explorations. Now the presentation doesn't mention New Golden anymore. As Golden Arrow has turned into a full time explorer again, it doesn't make sense anymore to have a separate exploration arm. Could you tell us what happened to this subject?

JG: Your observation is correct. Now, there is no need for a spin out, as Golden Arrow will conduct all the exploration work.

5. Paraguay project

TCI: The news release of October 10 indicated the following about the Tierra Dorada project:

"the team has been busy with the logistics of setting up in a new jurisdiction, including establishing an office, contracting local staff and acquiring equipment. Goals for the next six months include completing surface access agreements, developing detailed targets via mapping, surface sampling, a ground IP/magnetic geophysical survey, and trenching."

Could you give us a status update on all these subjects? When can we expect results?

JG: As announced on December 5th, we have commenced the work program at Tierra Dorada and already started publishing results from surface sampling. Mapping and sampling at the Alvaro target area identified a new quartz vein prospect 250 meters northwest and parallel to a known prospect, and returned a chip sample with over 47 g/t gold.

TCI: I suppose exploration permits have to be applied for before drilling can start. Could you give us information about the status of this, what the permitting process is like in a nutshell in Paraguay (timelines, etc., how long a permit is valid, large areas at the same time or a few holes at the time, etc.)?

JG: Our current permits allow shallow drilling (up to 20 meters depth) and are valid for one year, with an additional year extension available. We have commenced the process of acquiring a full exploration permit, which will include deeper drilling. As with any jurisdiction, the timelines are not set in stone, but our first stage went relatively smoothly so we are optimistic that there will be no undue delay. In the meantime we have a lot of detailed surface and near-surface work to complete to define targets.

TCI: What is the budget for this reconnaissance exploration, when are you planning to start drilling and with what budget? What is the cost per meter of diamond drilling?

JG: The planned budget at this point is $1.3 million for 2020. Of course this will depend largely on what we find with our sampling, trenching and geophysics. This first phase is about $300k. We plan to start drilling in Q2. We are budgeting $300 per meter for diamond drilling.

TCI: Information so far indicates outcropping vein systems, but also near-surface mineralization; what do you expect the exploration strategy will be, will it be limited drilling in order to kill it asap, or are you planning on drilling a lot? Looking for high and/or low grade mineralization, open pittable or underground?

JG: We have a large land package that offers a lot of opportunity but also needs to be systematically reviewed. The amount of drilling will be decided by the targets as our program progresses. The geology indicates the potential for high-grade orogenic style deposits, but that does not preclude the opportunity for lower grade bulk-tonnage style deposits as well. With a land package this large, we will keep an open mind! Whether anything we may discover develops into an open pit or underground operation will depend on the depth and style of mineralization as well as the grades.

TCI: The project is described as a district-scale high-grade gold opportunity based on sampling, but when I look at historical drill results it seems more like a low-grade near-surface opportunity:

- 6.1m @ 1.12 g/t Au, including 1.5m @ 3.32 g/t Au in SM-H3 starting at 12.2 meters depth

- 3.05m @ 2.87 g/t Au, including 1.5m @ 3.74 g/t Au in SM-H4 starting at 19.8 meters depth

- 4.57m @ 1.72 g/t Au, including 1.5m @ 2.85 g/t Au in SM-H5 starting at 9.2 meters depth

- 3.05m @ 1.35g/t Au, including 1.5m @ 3.6g/t Au in SMH6 starting at 27.5 meters depth

What is your comment on this?

JG: There are numerous high-grade occurrences at surface, including those we have reported recently. Those drill results were from one prospect area and part of only a six-hole reverse circulation program, so clearly the area was not fully tested. There really has been very little work done on the existing prospects, and in the district.

TCI: Do you have a deadline in mind as you have set for Indiana, for example, which involves the $1 million option payment this month?

JG: We have very modest payment requirements in the next three years, which gives us a good amount of time to do a systematic review and delineate resources.

6. Argentina projects

TCI: Flecha de Oro is at the same stage as Tierra Dorada, and reconnaissance exploration is ongoing here as well, so my questions revolve mostly around the same subjects:

"The Company now has a program underway that has been planned to include mapping at both properties, surface sampling, and additional ground magnetic surveys, with follow-up trenching budgeted, in order to delineate and prioritize targets."

Could you give us a status update on all these subjects here as well?

JG: As detailed in the December 3rd news release, ground magnetic surveying, surface mapping and sampling are underway and will be followed by detailed mapping and trenching in the new year. We have reported our first results from the Esperanza property including 24.0 g/t Au over 2 meters, 4.16 g/t Au over 2 meters, and 4.21 g/t Au over 1 meter in samples collected across individual veins.

TCI: I noticed results at the Flecha De Oro Project Puzzle property indicated a brecciated vein structure; could you explain why this is positive?

JG: Hydrothermal breccias can be the result of an epithermal event that carries mineralization, which is often of greater widths than in veins and structures.

TCI: When can we expect further results on the Flecha De Oro Project?

JG: These will be announced in Q1 2020.

TCI: I suppose exploration permitting in Argentina is no issue for the Grosso Group with their multi-decades long experience. Notwithstanding this, could you inform us about the needed permitting in the Rio Negro province, and more in general if there are consequences with the election of the new president, the new ministry of mines etc?

JG: Permitting for exploration work in Rio Negro requires "environmental impact reports" to be submitted, which are routine reports that give an overview of the type of work to be completed. Our group is adept at completing these (our sister company Blue Sky Uranium has worked in Rio Negro for years) and they are generally approved expeditiously. We have not seen any changes to the process since the recent election.

TCI: What is the budget for this reconnaissance exploration, when are you planning to start drilling and with what budget? What is the cost per meter of drilling?

JG: Reconnaissance exploration prior to drilling is $160k; with good results we plan to start drilling around the end of Q2. Total budget for the year is $1.1 million. Diamond drilling is estimated at $280 per meter.

TCI: What is the exploration strategy for Tierra Dorada?

JG: We are using the Cerro Vanguardia district as an exploration model, high grade veins and vein clusters, which can contain up to 1 million ounces. Our strategy is to find several of these, adding up to a multi-million ounce target.

7. Chile projects

TCI: What was the reason not to continue with one of the Atlantida projects, especially as the one relinquished had the historical resource? Be as specific geologically as possible, in terms of expectations and potential vs. exploration results.

JG: The historical resource was in a porphyry with associated skarns. It is deep and needed additional higher-value resources to realistically provide future value. Our work programs focused on finding higher grade, near-surface mineralization that would provide an appropriate sweetener, with expansion potential. After completing the program the appropriate action was deemed to be relinquishing those areas. Continuing would have required large payments to vendors which we felt could be better used elsewhere

TCI: What was the reason to stake the new claims to the south, historical sampling results?

JG: The area itself has a lot of potential, and it is rare to have opportunities for direct staking arise, so we took advantage of the opening. This area in particular has old workings that caught our interest.

TCI: I see the Indiana project as the flagship project at the moment because of the potentially very economic but still historical near-surface resource of 607koz @6g/t AuEq. Do you concur with this? If not what is the flagship project for GRG and why if you have one?

JG: Our work on Indiana was limited this year because of lack of funding so we did not complete the work needed to confirm the resource. We hope to be doing that in Q1 2020. Indiana is a different type of target, which has the potential of early production. Golden Arrow's success in the past has been in exploration where there may be huge upside potential. Flagship status will be defined in Q2 when we see the results of the exploration work we completed.

TCI: What are the plans to convert the historical resource into an NI 43-101 compliant resource (timeline, budget, amount of infill drilling needed)?

JG: We are looking at a 2,500 meter program in Q1 to provide additional detail to validate the resource potential in the area of the Bondadosa vein; this could define a viable mining target. This will be followed by a 3,000-meter resource definition program and could form the basis of an NI 43-101 resource. The timing of the first phase of drilling is Q1,2020, and we have budgeted $1 million.

TCI: What is the overall strategy for drilling at Indiana, first try to make it as large as possible before converting into NI 43-101, or drill it until you reach a certain threshold, for example 1 Moz?

JG: We optioned the property with the belief that it is indeed a 1 million ounce gold equivalent target. There are many veins on the project that have never been drilled.

TCI: Are you looking at underground drilling from the ramps?

JG: Not for the first phase of drilling. They will likely be used in the future

TCI: Can you buy out the 25% option by MSA, and if so for how much?

JG: As previously stated, we are currently renegotiating the terms but in fact we would be looking to be a minority partner at the mining stage, the 25% could be purchased for $7 million under the original contract.

TCI: The aerial pic in the presentation shows hilly terrain; does this complicate setting up rigs, increasing costs? What are the drilling costs per meter?

JG: For Chile this terrain is almost flat! So no, setting up drill rigs is not an issue, also vertical veins can work to your advantage with tunneling and drilling angle holes. At Indiana we estimate $200 per meter for diamond drilling.

8. General

TCI: I view this stock as very undervalued, as the enterprise value at the moment is almost double the market cap. The shares of SSR Mining are trading strong, and are liquid with an average daily volume of 285k shares, so a discount on selling potential seems unwarranted. Why do you think there still is such a discount, after initial disappointment about Puna should have subsided by now, as we have progressed three months since then?

JG: The reason is partly the current market and partly because we have been unable to carry out any exploration programs in the last year (as a condition to receiving a credit facility from SSR). We believe that as Golden Arrow continues to announce result from our work programs in Argentina, Paraguay and Chile, the market will begin to attract investors again.

TCI: Do you have catalysts for 2020?

JG: The ongoing work programs will quickly generate drill targets which will serve as catalysts for potential multiple discoveries. As we are fully funded to carry out all this work, we hope to be at drilling stage by the first quarter of 2020. We have three projects all with programs underway so there will be multiple value catalysts at each as we progress. At Tierra Dorada and Flecha de Oro this will start with more surface sampling results. We have hit some great grades at both projects and all indications are we will continue. That could lead to the announcement of drill programs at both projects by the end of Q1. For Indiana, drill results in Q1 and Q2 will be key drivers. Positive results could be followed by the announcement of resource update and the start of a Pre-Feasibility program.

TCI: On a closing note, are there any other subjects of interest for the investing audience, or things you would like to tell us?

JG: Yes, keep in mind that while we have the projects and the funds to carry out our exploration programs, the people behind this company deserve special mention. Golden Arrow, managed by the Grosso Group, has over a quarter of a century of experience in Argentina where it has made three world-class discoveries. There are few management teams that can tout such a track record. With all the above, we feel we have all the ingredients required for the next discovery (or two) from this organization.

9. Conclusion

This concludes the interview with President and CEO Joe Grosso. I view the Golden Arrow stock as undervalued, as it currently trades at almost half the enterprise value, by owning very liquid SSR Mining shares and assigning no value to the exploration assets whatsoever. If exploration will be successful, I especially view Indiana as a future potential 1 Moz Au flagship project, and when gold remains robust, this could generate a pretty economic project. It is still early days, but it seems the potential is there, and 2020 looks like it could be a busy and revealing year.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website, http://www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Golden Arrow Resources, a company mentioned in this article.

Charts and graphics provided by the author.