You don't often hear about it, but bladder cancer is the sixth most common cancer in the U.S., with approximately 80,000 new cases reported every year, and some 600,000 Americans living in fear of recurrence. Bladder cancer is also the most expensive cancer to treat due to the more that 50% recurrence rate and the need for life-long surveillance to the tune of $4 billion per year spent in the U.S. alone.

Marching ever closer to taking a giant slice of that market is Vancouver/Boston-based Imagin Medical Inc. (IME:CSE; IMEXF:OTCQB). The company has made a significant new advancement in one of the mission-critical procedures used in urological surgery, that will enable physicians to clearly more clearly visualize cancerous tumors during endoscopic procedures, receiving overwhelmingly positive feedback from leading members of the American Urological Association. Recently its i/Blue product entered the verification stage of the medical device design control process.

"Imagin Medical stock is great value here with the potential to make big percentage gains from the current very low price." - Clive Maund

With that kind of response, this CSE/OTCQB-listed company, with a market cap of a little over $7 million, has huge catalysts ahead and is poised for a significant breakout. What kind of catalysts? The product is defined, doctors like it and the company is in the final six months of development. "Imagin has all the component parts to put together a functional product, and we will have verifiable units available by year-end," stated Jim Hutchens, Imagin's CEO.

Take note: Since Imagin's last financing of CA$3.9 million in April of 2018 at CA$0.22, its shares have been battered down to CA$0.05 by impatient investors. At this juncture, there is strong support at CA$0.05 for returning to the CA$0.22 level with room to move to the ceiling set by the related warrants at CA$0.38 due April 2020. Post-FDA approval levels should run well beyond the dollar ranges.

The company has caught the attention of investment analysts. Technical analyst Clive Maund wrote on November 8, "Whilst we cannot be 100% sure that the company's key product will gain final approval, which is why the stock price is at a very low level, the signs are that it will and it is well along the road to getting it. So this look like an excellent point to accumulate the stock—even better than when we last looked at it."

In September, when Imagin's stock was trading at CA$0.06, Maund wrote, "Imagin Medical stock is great value here with the potential to make big percentage gains from the current very low price."

To Chris Temple, editor and publisher of the National Investor, who gave the company a strong "Buy" in 2018, the global market is enormous: "I'm sure you won't be surprised to learn that, globally, nearly $50 billion a year is spent on endoscopic procedures. This is not always to treat maladies or to eradicate cancerous tissue, but sometimes to just confirm that further medical attention is not needed." He adds, "If successful here—Imagin may well be poised to disrupt the market."

Doctors have jumped on the bandwagon. In an oversubscribed financing last year, investors included Dr. Stan Swierzewski, Chief of Surgery and Director of Urology at Holyoke Medical Center in Massachusetts, and Dr. Roger Buckley, Division Head of Urology at North York General Hospital in Toronto.

Upon making his investment in IME, Dr. Swierzewski publicly stated, "As a practicing urologist, I invested in Imagin because I have a duty and responsibility to advance any improvements in treatment and technology that will benefit my patients and save lives. Current technology is cumbersome and time consuming … making it less effective as a screening or follow-up tool. Bladder cancer patients are basically monitored for life with in-office cystoscopies, which are not effective in differentiating between inflammation and cancer. To be safe, we perform surgery on many patients which often turns out to be negative. Imagin's i/Blue technology, given its potential speed and sensitivity, will help us assess the patient's condition more quickly and accurately and avoid unnecessary surgery. It will also make necessary surgery more successful, ultimately saving lives and reducing medical expenses. I'm confident that using the i/Blue system will become the standard of care. . .I cannot wait to use this technology in treating my bladder cancer patients."

Imagin has already met key milestones as reported with its Q3 financials, which included a $659,836 spend on R&D. Pay attention the second bullet!

- In April, 2019, Imagin reached a major product development milestone with completion of the i/Blue imaging system's initial functional unit.

- At the American Urological Association's annual meeting, held in May in Chicago, Imagin held private focus groups, where leading urologists assessed the initial functional product and provided overwhelmingly positive feedback that was used to finalize the i/Blue product's user needs.

- In July, 2019, Imagin reported that it had moved to step five of the seven-step development process that the FDA defines in its design control guidance for medical device manufacturers: (1) user needs; (2) design input; (3) design process; (4) design output; (5) design verification; (6) device realization; and finally, (7) device validation.

- Imagin has met with the FDA on two occasions to discuss the i/Blue Imaging System's regulatory path and is using the content and feedback from these meetings to refine its strategy. Imagin will continue to meet with the FDA until it submits its official application for approval.

With this kind of momentum, Imagin is planning to initiate the commercialization of the i/Blue Imaging system during late 2020. Keep in mind the technology is also relevant for other cancer treatments, so there is more "'blue sky"' upside in store. Once commercially available for urological indications, Imagin plans to expand its product platform to laparoscopic (abdominal) colorectal, thoracic and other medical procedures.

Trading on the Canadian Securities Exchange (CSE:IME) and listed on the OTCQB (IMEXF), IME has about 140 million shares out currently trading at around CA$0.05 for a market capitalization of about CA$7 million. Around 18 million warrants are out at CA$0.38 and with 10.8 million options (weighted average CA$0.29), while insiders hold about 6.31% of the company. Cash on hand is $3.4 million as of June 30. CEO Jim Hutchens says the company will require additional financing to see it through to FDA approvals and, once approved, the company anticipates fast ramp-up of revenues, marching toward positive EBITDA after 18 months post commercialization.

A quick glance at the three-year IME.C chart shows that technically this stock, now at CA$0.05 has hit a historical support level and is just waiting for a catalyst ... refer back to bullet #2 above!

Keep in mind, Imagin's i/Blue Imaging System is pairing up with two elements that are already FDA approved: the endoscope, which has been around forever, and fluorescing agents that have been approved since 2010. Imagin is not reinventing the wheel, it's consolidating the instrumentation with advanced optics.

While full FDA approval for Imagin's i/Blue system is advancing forward, it is important to understand bladder cancer surgery using blue-light endoscopes is a technique that is already FDA approved, as is the contrast agent used to fluoresce, to illuminate, the cancer. IME's patented advanced optical designis tweaking the procedure, using its state-of-the art components to greatly improve the existing technology and significantly reduce the cost with its groundbreaking method.

So let's talk about that method.

In typical white-light endoscopy, a small camera is mounted on an endoscope, which enters the body and projects images onto a monitor of the bladder and any tumors that protrude above the wall that the surgeon evaluates for possible removal.

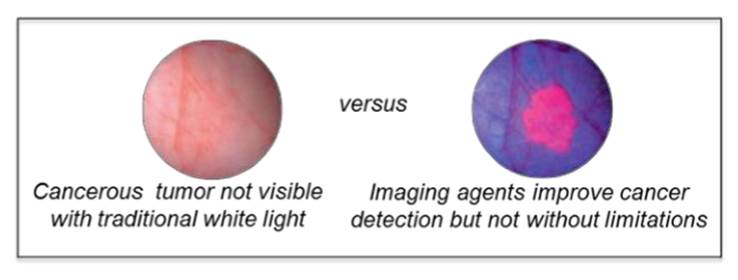

However, the challenge of using white light is that a surgeon cannot easily differentiate flat or tiny malignant and premalignant tumors from normal tissue or see the borders/margins of the tumor. Consequently, some cancer cells may remain behind undetected, contributing to the more than 50% recurrence rate in bladder cancer.

The remedy has been to use a "blue" light in conjunction with fluorescing imaging agents. The agents are absorbed by the cancerous cells in the bladder. When exposed to blue light, they fluoresce, improving the surgeons' ability to detect flat cancers and visualize the margin for removal.

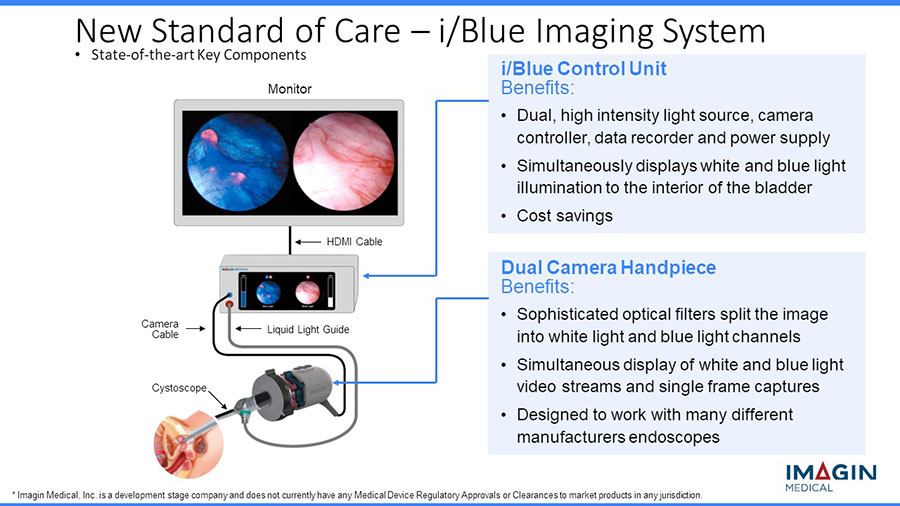

Surgeons still need to see both white- and blue-light images during surgery because the white light image shows the full landscape of the bladder but doesn't highlight the cancer, and the blue light shows the cancer but doesn't show exactly where it is, so the surgeon loses orientation. In addition, the current blue-light technology gives the surgeons only one image at a time on the monitor, so surgeons have to switch back and forth between the two and compare them from memory to remove the cancer. Imagin's i/Blue Imaging System addresses this problem because it shows both images on the monitor at the same time, side-by-side, and in real time. So now, the surgeon won't have to switch back and forth and rely on memory to locate and remove the cancer. The procedure has the potential to dramatically reduce bladder cancer recurrence rates.

Today, there is only one company that offers blue-light cystoscopy, and its system can only be used with its proprietary endoscopes. For this reason, as well the system's expensive price tag, blue-light cystoscopy, although the recommended treatment for Non-Muscle Invasive Bladder Cancer (NMIBC) by the American Urological Association (AUA), has not become the norm, or even available in all major cities in the U.S.

The i/Blue System, however, can be used with almost any endoscope on the market, making it more accessible, while dramatically increasing the size of the market and is less expensive, reducing cost to the healthcare system.

Another groundbreaking aspect of Imagin's technology is the consolidation of instrumentation. The current blue-light method, which needs a system tower that houses multiple units, including the light source, camera control unit and the video data recorder, is purchased as a "bundle" and, depending on accessories, can cost well over $100,000. The i/Blue system, on the other hand, using state-of-the-art technology, combines the three modules into one device, taking up a much smaller footprint, and offering a much lower price tag.

Imagin currently has three issued patents with additional patents pending.

Imagin his helmed by an experienced management team, with direct medical device experience moving products from concept through development to commercialization, including managing the FDA process. One of its medical advisors, Dr. Ashish Kamat, Endowed Professor of Urologic Oncology and Cancer Research at University of Texas MD Anderson Cancer Center, has been named by Expertscape as the world's top-rated expert in urinary bladder neoplasms.

Like all medical device companies, Imagin's fate rides on FDA approvals, but given team's deep experience in this market, a proven concept utilizing instruments and agents already approved by the FDA and a glowing endorsement by leading members of the AUA, this is an advancement that likely could—and for the sake of bladder cancer patients, really should—move forward.

Knox Henderson is a journalist and capital markets communications consultant. He has advised for a broad range of small cap companies in the resource, life sciences and technology sectors for more than 25 years.

Read what other experts are saying about:

Disclosure:

1) Knox Henderson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Imagin Medical. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Imagin Medical. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Imagin Medical. Please click here for more information.

An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Imagin Medical. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Imagin Medical, a company mentioned in this article.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

Additional Disclosures

Clive Maund does not own shares of Imagin Medical and neither he nor his company has been paid by Imagin Medical.

National Investor: The Editor may have positions in some securities discussed. Subscribers are encouraged to investigate any situation or recommendation further before investing. The Editor receives no undisclosed kickbacks, fees, commissions, gratuities, honoraria or other emoluments from any companies, brokers or vendors discussed herein in exchange for his recommendation of them. None of the content of this newsletter is to be considered as an offer to sell or a solicitation of an offer to buy any security.