Maurice Jackson: Joining us today is Michael Rowley, president and CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE), which is known for platinum, palladium, nickel, copper and cobalt in the Stillwater district in Montana.

Sir, we have more exciting news coming from Group Ten Metals' flagship Stillwater West project, which is becoming recognized for both the scale and grade of its mineralization. Your current exploration and drilling campaign has been in progress for two months now, with numerous holes completed. But before we get to that, Mr. Rowley, please introduce Group Ten Metals and the opportunity the company presents to the market.

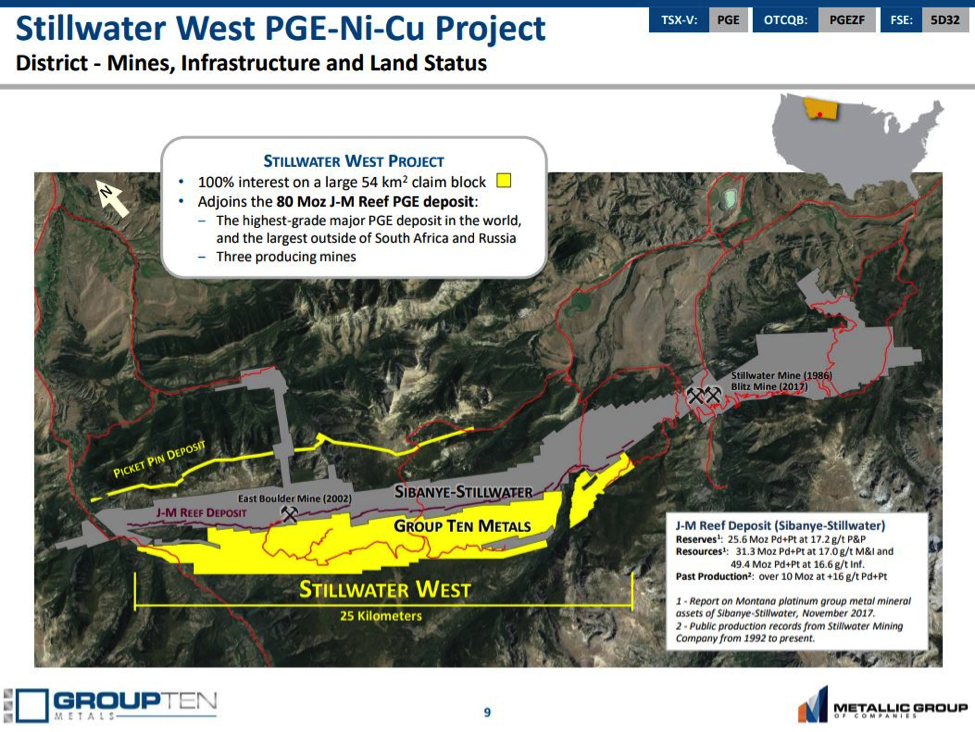

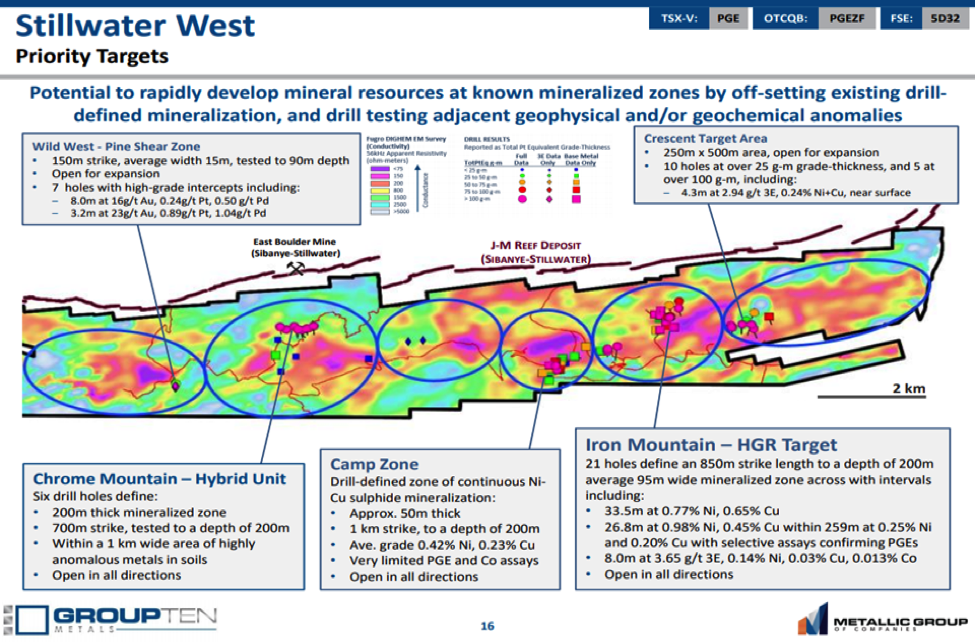

Michael, I have a map displaying Group Ten Metals flagship Stillwater West project. I believe it's paramount for [readers] to understand the strategic advantage Group Ten Metals has over many of its peers, and that is brownfields exploration, which is a term that the lay investor may not appreciate. How does Group Ten Metals' brownfields exploration benefit current and prospective shareholders?

Michael Rowley: The term brownfields means operating in a proven mining district, which is distinct from exploring a greenfields district, which has no existing mineral deposits or mines, and may be remote with no infrastructure. The Stillwater West project is a great example of a brownfields asset as it adjoins three operating mines that are among the very best of their kind in the world, in a district that is known to be rich in minerals. We share that geology, we benefit from all that infrastructure, and we have an extensive database with known mineralization zones to expand upon. The result is greatly increased probability of success, and greatly reduced capital expenditures when it comes time to potentially build a mine.

Maurice Jackson: Let's talk a little about the uniqueness of the Stillwater West asset and what that means for investors. There are very few projects like this globally, so to be developing one in North America in a brownfields setting is a rather compelling story. Tell us about that if you will.

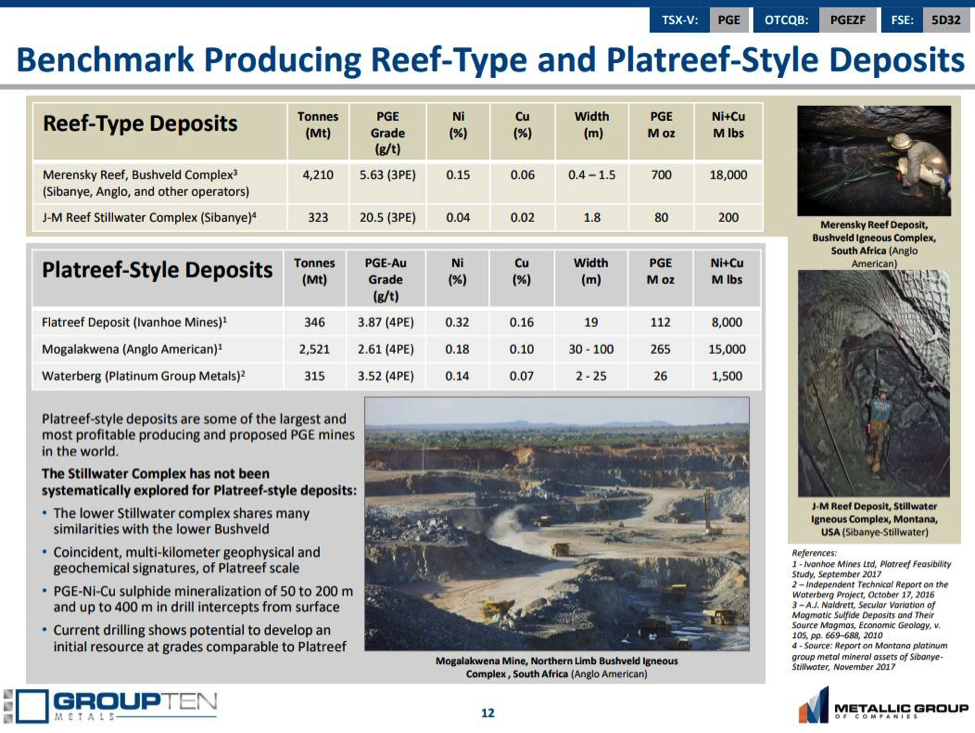

Michael Rowley: It's the size potential of Stillwater West that is truly impressive; it is rare for a junior to have literally half of such an iconic and productive district, in any commodity. It's also location and timing; we are one of few exploration plays outside of South Africa and Russia that are focused on palladium, platinum and rhodium, and we have terrific potential for nickel and cobalt at a time when the U.S. is looking to secure domestic supplies of these commodities. Palladium and nickel are top performing commodities, and platinum is expected to follow with continued mine closures in South Africa. So, in broad strokes, there are very few assets of this type in the world, and in North America they are practically unheard of. The closest analogs in terms of geology are the Platreef mines in the Bushveld Complex in South Africa.

Maurice Jackson: For the readers not familiar with either the Bushveld or Stillwater regions, what can you share with us about the parallels between the two, with reference to your neighbor to the North?

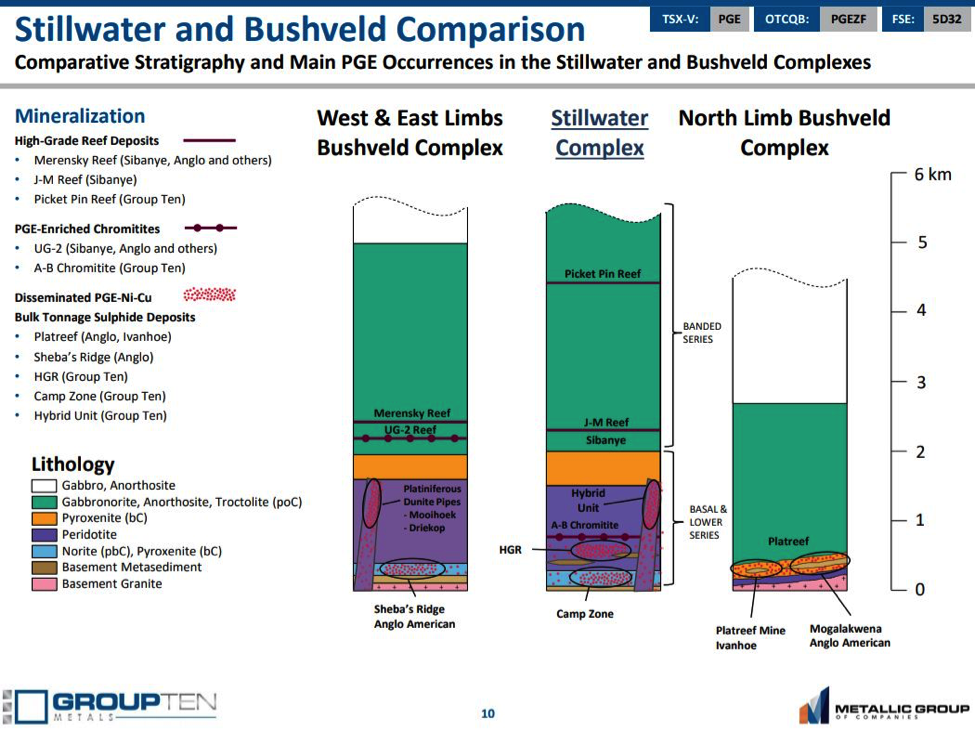

Michael Rowley: The Bushveld and Stillwater complexes are both magmatic intrusions. Magmatic deposits give us give us essentially all our 'battery grade' sulfide nickel globally, and they may also have a number of other commodities including copper, cobalt, gold and platinum group metals. Voiseys Bay is a magmatic deposit, for example, and it is one that happens to be very rich in nickel and copper, but has very low platinum group elements (PGEs).

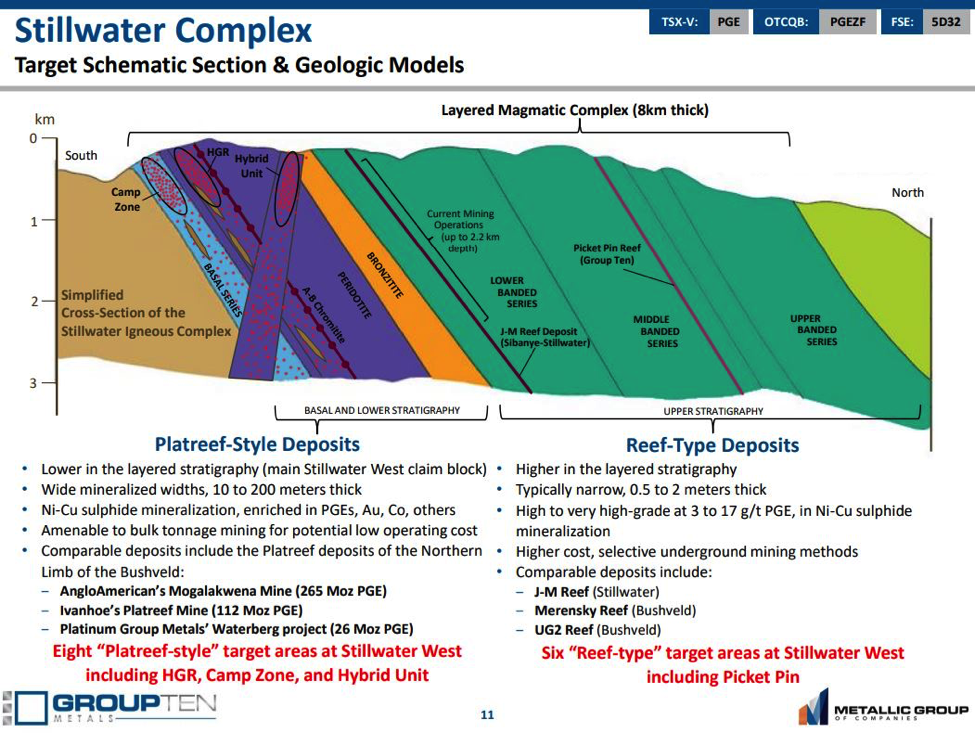

The Bushveld and Stillwater complexes are both layered magmatic systems, a subcategory of the bigger picture of magmatic deposits. They are quite similar; Bushveld is about 2 billion years old; Stillwater is about 2.7 billion years old. Both are rich in platinum group elements plus nickel and copper, and both were created when metal-rich magma was laid down, layer after layer, and allowed to cool, slowly, deep underground. That cooling action creates the narrow Reef-type mines that are now in production in the upper portion of the layers in both districts. In the lower portion, the layering stops and larger magma events occur, with mixing of magma and host rock. That is where these larger deposits occur, with mineable widths of tens to hundreds of meters across kilometers of strike length. That is what we are calling 'Platreef-style' deposits, named for the Platreef district of the Bushveld complex.

The Platreef district is some of the richest real estate in all of mining, with over 400 million ounces (400 Moz) of platinum group elements plus gold, plus tens of billions of pounds of nickel and copper.

They are actively mining both the narrow 'reef-type' mines and the bulk minable 'Platreef'-type mines now at the Bushveld. Much of the world's platinum now comes from the reef-type mines, however they are deep, hot, dangerous, and have been underfunded for many years now. Closures are ongoing, and continued closures are expected to drive the platinum price in the coming year. The mines of the Platreef district, by contrast, are highly economic and produce platinum (Pt) at less than $400/ounce ($400/oz), plus palladium (Pd), nickel, copper and other commodities.

At Stillwater, in the Stillwater district, a company called Sibanye-Stillwater is actively mining one reef-type deposit with three underground mines operating some hundreds of meters to the north of our main claim block. That deposit is the highest-grade PGE deposit in the world, with more than 80 Moz at over 16 g/t Pd+Pt. Sibanye Gold Ltd. (SBGL:NYSE) purchased the Stillwater mines just two years ago for $2.2 billion and has since emerged as the world's largest platinum producer.

Group Ten was the first group to consolidate the land package and database to enable a systematic approach to exploration for massive 'Platreef-style' deposits at Stillwater. Our early work, starting in 2017, attracted a highly qualified team and quickly showed the potential of the project based on a remarkable database. Our first ground programs expanded on that, in 2018, and that further confirmed the potential for remarkable scale across the 25-kilometer wide property. Now, in 2019, we are completing our first drill program at priority target areas and I'm pleased to report that the geologic model is holding up very nicely.

Maurice Jackson: We covered some good basics; let's find out what Group Ten Metals has discovered since our last interview. The company issued a press release last week providing an exploration update including drilling progress on the company's flagship Stillwater West Project in Montana. Mr. Rowley, take us behind the scenes and share the stated goals of the 2019 exploration campaign.

Michael Rowley: 2019 has been a break-out year for us, starting with our debut at the trade shows back in February, where we displayed historic core for the first time to introduce the application of these new geologic models to the Stillwater district, and that culminates with our first drill program at Stillwater West.

Our 2019 exploration program is our biggest yet, and it has several objectives. We are conducting ground-based geological sampling and mapping programs to advance less advanced target areas to drill-ready status for next year, and we are completing soil mapping across the western portion of the property—a huge area—to advance targets in those areas for next year, as soils have been a very effective tool on the eastern 15-kilometer width of the property.

We are also drill testing the three most advanced target areas, and the drill programs in these areas have been designed to provide a proof-of-concept of the Platreef setting while also advancing mineralized zones toward formal mineral resources. We have over 28,000 meters of drilling in the database, and eight Platreef-style target areas in total. Five of those have sufficient past drilling and show enough continuity of mineralization that we can work up a geological block model as a starting point for those mineral resources. This year, we've focused initially on the three most advanced areas and expect to move those quickly forward toward formal mineral resources of platinum, palladium, nickel, copper and cobalt. We have essentially all the core from the 2000s-era work in our possession, and we have relogged it and assayed it, sometimes for the first time, as necessary, with the new geologic model in mind. The older data, mostly drilling from the 1960s and 1970s, was primarily assayed for nickel and copper only, so we are redrilling those areas, as necessary, to bring those holes into a NI43-101-compliant resource with complete suite of assay data to go along with it.

Maurice Jackson: We touched on Platreef and bulk tonnage. Let's visit the Iron Mountain Target Area, where the company has been active recently. What can you share with us?

Michael Rowley: Iron Mountain is the most advanced of the eight Platreef-style target areas on the project. It has a mineralized zone defined by 21 past drill holes. It is open for expansion, within a multi-kilometer, conductive, high anomaly and has soils that are lighting up with palladium, platinum, gold, copper (Cu), nickel (Ni) and cobalt (Co) across a similar kilometric-scale area. In our block model work to date, these 21 past drill holes define a mineralized zone that is 850-meter (850m) strike length to a depth of 200m at an average width of 95m. Drill intervals in that mineralized zone include 26.8m at 0.98% Ni and 0.45% Cu. That entire hole was mineralized top to bottom, with 259m running 0.25% Ni and 0.20% Cu, which is remarkable. Another similar hole within about 100m returned 33.5m at 0.77% Ni and 0.65% Cu.

Those holes were drilled in the 1960s and '70s, and have very limited precious metal assay data, although we do have selective assay results running up to 2.7 g/t palladium, which is very encouraging.

Also, in that area, we have a hole drilled in 2002 that has complete assay data, which reports 8.0m starting right at surface with 3.65 g/t 3E, 0.14% Ni, 0.03% Cu, and 0.013% Co. These are very attractive grades, and they are over an 8-meter width.

So, compare that to our target, the mines of the Platreef, in South Africa. Ivanhoe Mines Ltd. (IVN:TSX; IVPAF:OTCQX) and Anglo American Platinum Ltd. (AMS:JSE) are running 0.2 to 0.4% combined nickel and copper, with several grams of precious metals on top of that, across tens to hundreds of meters in width and kilometers in strike length. It is early days, but our results from Iron Mountain are right in line with those numbers in terms of grade and the potential for scale.

Iron Mountain also shows good rhodium results, which is timely these days, with rhodium almost $5,000 an ounce. We had one rock sample that returned almost 6 g/t rhodium, which I don't recall seeing in exploration results from other companies.

Maurice Jackson: Group Ten Metals was active on two more target areas. Take us to the Camp Zone Target Area and provide us with an update.

Michael Rowley: Like Iron Mountain, the Camp Zone target area includes a drill-defined zone of continuous Ni-Cu sulphide mineralization that we expect to quickly move to a formal resource through our work this year. Again, we have untested conductive highs that are kilometric in scale, with coincident, highly elevated levels of precious and battery metals shown in the soil survey, across a similar length.

Known mineralization at Camp Zone is about 50m thick and runs about 1 km in strike, with an average grade of 0.42% Ni and 0.23% Cu, which is very high relative to Platreef grades. Like Iron Mountain, we have very limited PGE, gold (Au) and Co assays in the older holes, but have good indications where we do have data for those commodities.

Like Iron Mountain, it is open in all directions and had been tested to just 200 meters depth at Camp Zone. This year's program went deeper than that to identify new zones, and will add complete assay data, as well as working to bring older data into a modern resource estimate.

Maurice Jackson: Before we leave the Stillwater West, take us to the Chrome Mountain Target Area and update on the latest developments there.

Michael Rowley: Much of the interest at Chrome Mountain, to date, has centered on the Hybrid Unit, which appears to be a later magmatic event from much of the rest of the lower Stillwater Complex. It may be what is known as an intrusive dunite pipe. . .which gets very interesting because some of the earliest and highest-grade PGE mines in the Bushveld were of this type.

To date, the Hybrid Unit is defined by ten drill holes that delineate a 200m-thick mineralized zone across 700m of strike. Entire holes are mineralized, top to bottom, with 100- and 200-meter intervals, and more, grading 1, even 2, g/t Pt-equivalent, including base metals at up to Platreef grades. To date, the target has been tested to a depth of 200m and it sits within a 1 km wide area of highly anomalous metals in soils. Like Camp Zone and Iron Mountain, it is open for expansion in all directions and our work this year will be moving that along nicely.

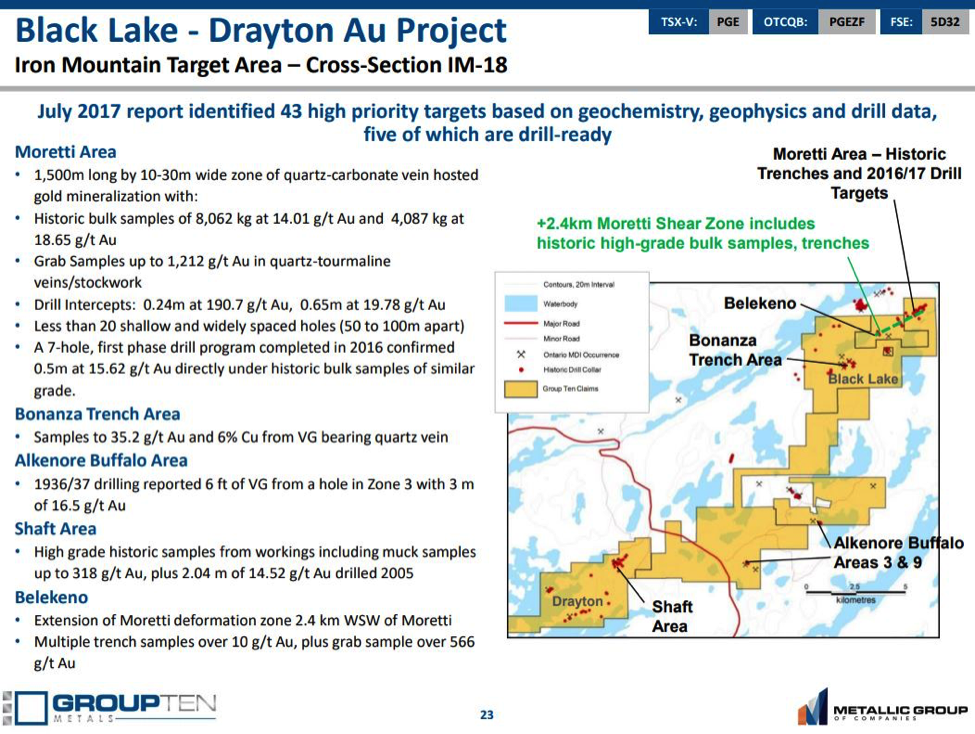

Maurice Jackson: You have other assets. Would you care to touch on those for our audience?

Michael Rowley: We were strategically acquiring brownfields mineral properties throughout the recent bear market cycle, so we've been able to acquire 100% interests in some remarkable land positions.

In Ontario, we own the Black Lake Drayton gold project, which shares geology with the adjoining Goldlund and Goliath projects, owned by First Mining Gold Corp. (FF:TSX) and Treasury Metals Inc. (TML:TSX: TSRMF:OTCBB), respectively. There's almost 4M high-grade ounces of gold in those assets alone, and that figure climbs over 10Moz in the broader Rainy River belt that they're all part of. We have low carrying costs on the asset and, when the time is right, we'll do a deal based on the fact that we have over 30 km of highly prospective strike in a neighborhood that, in our opinion, must be a consolidation target for a major operator.

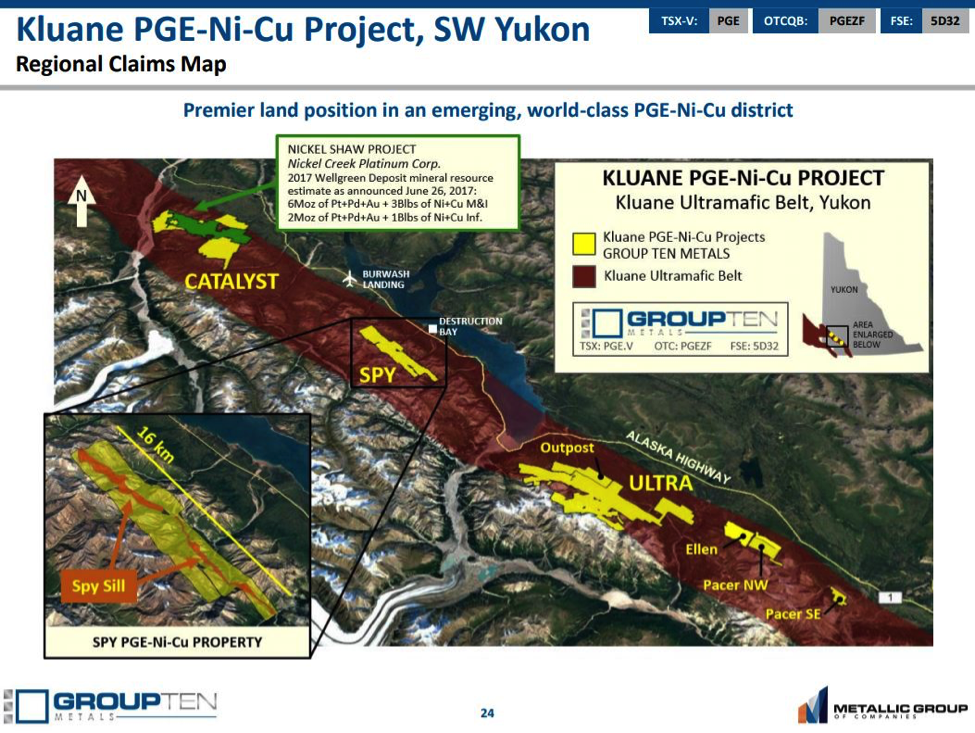

Turning back to black rocks and PGE-Ni-Cu projects, we were also active in consolidating the largest land position in the Kluane Ultramafic Belt, in the Yukon Territory. This is highly prospective ground adjoining, and on strike with, the Wellgreen deposit, which one of the largest undeveloped PGE-Ni-Cu deposits in the world.

It's worth noting that back in July of this year we announced an earn-in deal by which Mount Cairnes Resources can earn a 51% interest in our Ultra project, which is part of the overall Kluane package, by completing cash payments totaling $750,000, issuing three million shares to Group Ten, and completing $3.75 million in work over four years to earn that 51% interest in the Ultra project. That deal speaks to the value of the assets we have acquired through the bear market years, and we expect to complete more like it as part of our focus on Stillwater.

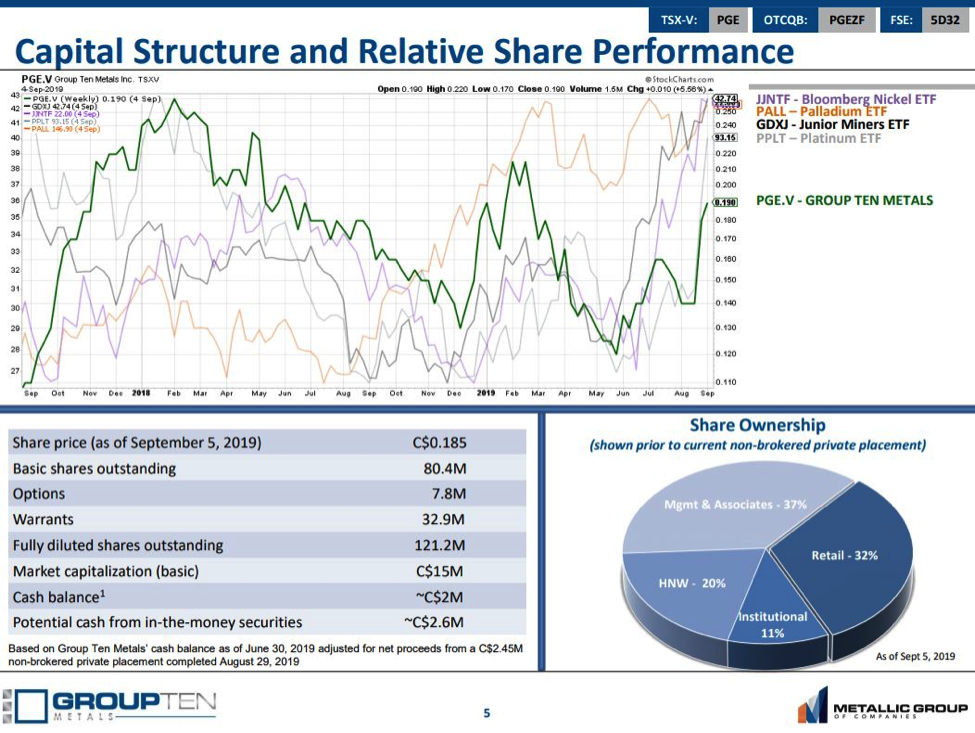

Maurice Jackson: Mr. Rowley, please provide us with an update on the capital structure of Group Ten Metals.

Michael Rowley: We currently have a market cap of about $13M, with about 80M shares outstanding. And that follows a private placement we completed in August where we raised $2.45M at $0.14/share.

Maurice Jackson: In our last interview, you made reference to warrants that may be exercised, providing the company an additional $2.4 million in working capital. Do you have an update for us?

Michael Rowley: Exercises are ongoing, and we're glad to see that. They are presently in the money and they are coming in, and that provides the company with additional funds for exploration and promotion.

Maurice Jackson: In closing, sir what is the next unanswered question for Group Ten Metals? When should we expect results, and what determines success?

Michael Rowley: Assay results from our 2019 programs are one major driver that is expected in the coming weeks and months. This year's program returned some really encouraging visual sulfide mineralization, as shown in some pictures we posted a few weeks ago. That core has gone to the lab and those results will be out in the coming weeks as they become available. We're excited about that.

In addition, we will be working hard updating our block model at our flagship Stillwater West project. We continue to get real interest in our non-core assets and will be announcing deals on those as they get done.

Maurice Jackson: What keeps you up at night that we don't know about?

Michael Rowley: I think a lot of folks are not aware of how much of the world's platinum and palladium is mined. There really are two different production models there. Three-quarters of the world's platinum is mined from narrow reef-type mines in South Africa. You can basically think of these reef deposits as being like veins. Even though they are geologically different, they are similar in terms of the mining effort and the nature of mining. Thousands of workers, kilometers underground, working mineralized widths that are less than one meter, with rock temperatures hitting 75 degrees centigrade. These mines have been losing money for years, they are undercapitalized, and they are closing and will continue to close.

And it's interesting that the South African mining companies that own these operations are diversifying. We saw Sibanye buy Stillwater for $2.2B in 2017, and just recently Impala Platinum bought North American Palladium for $1B. That trend of closing reef-type mines and corporate diversification outside of South Africa will continue through 2020 and beyond.

Now, let's look at the Platreef district, also in the Bushveld complex but to the north of the reef mines and blessed with very different geology. The deposits at Platreef are tens to hundreds of meters thick and start at 26 Moz at Waterberg and run up to 265 Moz at Anglo American Platinum Ltd.'s (AMS:JSE) Mogalakwena mine. That operation is producing platinum at less than $400/oz. Ivanhoe Mines Ltd.'s (IVN:TSX; IVPAF:OTCQX) adjoining Platreef mine is now in construction and will have very similar attractive economics. The key is that they are bulk mining operations, and they have healthy co-product values of nickel and copper.

The setting is correct for multiple potential Platreef-style deposits at Stillwater. It's there based on the known parallels between the Bushveld and Stillwater districts, and it's there in our work to date. We are excited to be bringing that new age of platinum, palladium, nickel, and copper mining to an iconic American mining district.

Maurice Jackson: Last question sir: What did I forget to ask?

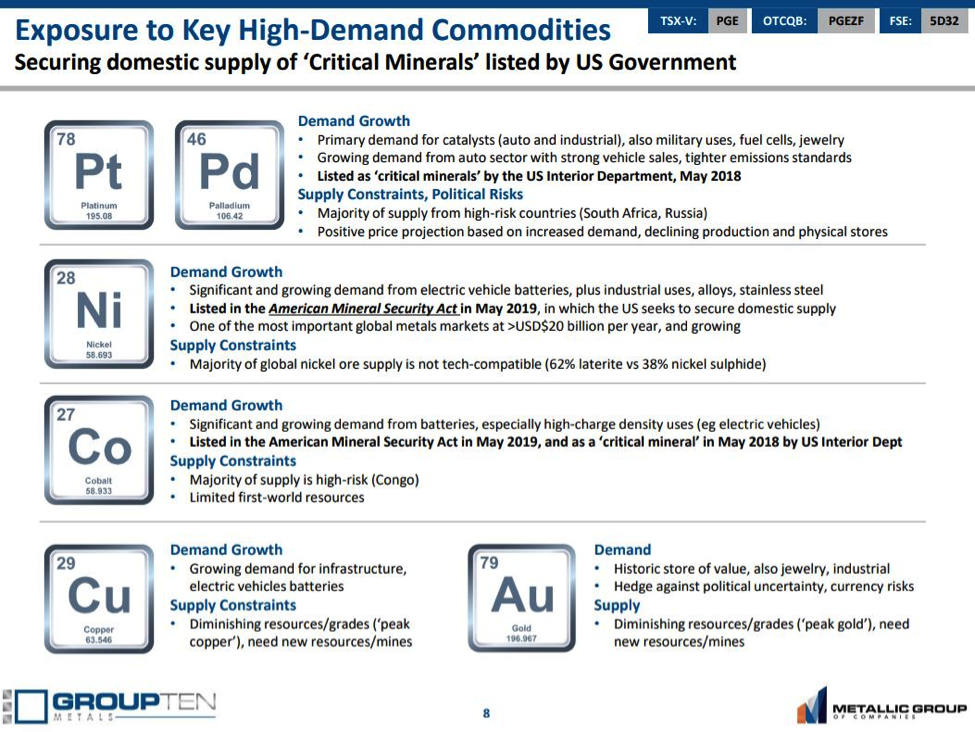

Michael Rowley: Let's touch on our target commodities as several of them have made interesting moves lately. Palladium continues at record highs based on shortage of physical supplies. It ran an 800,000-ounce deficit last year, and is expected to run a 1 million-ounce deficit this year, driven largely by its use in catalytic converters, so that price can be expected to stay elevated for some time.

Nickel is getting a lot of press lately based on increasing demand in the battery and steel markets, especially after a large purchase by a Chinese group drew down inventories rather suddenly, just recently.

Platinum is starting to move and is expected to follow gold at some point, and that most likely driven by diminishing supplies out of South Africa due to mine closures, as we talked about a minute ago.

Overall, we are bullish on the price outlook for both those commodities and glad to be targeting them in America at a time when the U.S. government is looking to secure domestic supplies.

Maurice Jackson: To get more information on Group Ten Metals, the website address is www.grouptenmetals.com. And as a reminder Group Ten Metals trades on the TSX-V: PGE and on the OTCQB: PGEZF. For direct inquiries please contact Chris Ackerman at (604) 357-4790 ext. 1, and he may also be reached at [email protected].

As reminder Group Ten Metals is a sponsor and we are proud shareholders for the virtues conveyed in to today’s interview.

Before you make your next bullion purchase, be sure you call me. I'm a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio, from physical delivery, offshore depositories, precious metal IRAs, and private blockchain-distributed ledger technology. Call me directly at (855) 505-1900 or you may e-mail [email protected].

Finally, please subscribe to provenandprobable.com, where we provide mining insights and bullion sales. Subscription is Free!

Michael Rowley of Group Ten Metals thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Group Ten Metals. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Group Ten Metals, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.