A key element in lithium-ion batteries (LIBs) is cobalt. I have focused a lot on graphite and lithium, but cobalt is unique in its own regard and probably has more bullish factors than graphite, lithium and nickel. There are two major factors that differ cobalt from the other LIB metals. Most of the world's cobalt is currently sourced from an unstable political source, namely Democratic Republic of the Congo (DRC). Wars continue to rage there and currently, The Guardian writes that 13 million Congolese need humanitarian aid. No doubt it is one of the worse places on earth today, very sad. The other factor is cobalt is only mined as a byproduct of other mines, with 98% as a byproduct of nickel and copper mines. Only Moroccan and some Canadian arsenide ores extract cobalt only.

Cobalt is classed as a critical raw material by the EU due to both being an essential mineral in creating a sustainable planet, and 55% of the global supply originating from the politically unstable DRC. The large percentage of cobalt that originates from the DRC highlights the importance for companies to follow Due Diligence procedures with regards to responsible sourcing.

Unlike lithium, graphite and nickel, the major end use of cobalt is already denominated by the LIB market. The other major use is alloys and if you lump together the similar items here such as hardfacing, super alloys and hard materials, it gets close to the LIB demand.

The LIB demand started to heavily influence the cobalt price in early 2017 and it shows no signs of abating yet. It will be difficult to bring new supply on stream because it has to come as a byproduct of nickel or copper. The heavy reliance on the DRC, where China gets a lot of its supply, is very precarious. This graphic comes from a cobalt report by Palisade Research and although it is from 2016, nothing has really changed on this front and is still very relevant.

The cobalt price moved over $15 in February 2017 and shows no sign of slowing. Not long ago I pointed out that copper was the best performing element among base and precious metals. If we add in the battery-tech metals, cobalt up 180% moves to number one ahead of copper.

In the past year lots of junior companies have been rushing around trying to find good cobalt projects. The best place to find cobalt is the mining camp in Ontario in the vicinity of the town called Cobalt. Over 50 million tons have been mined there. At PDAC this year, I was very fortunate to meet, through an associate of mine, "The King of Cobalt" for an anomalous name to use at this time. Talk about foresight, because this fella spent many of the last several years accumulating properties in the camp. For the most part, the majors held the best ground but they let it go as the metals bear market pummeled downward from 2011.

Most of the juniors sourced their projects through this gentleman. As you might expect, he has kept the best properties to himself but they are in a private company. This will go public later this year and as far as I am concerned there is no sense buying the others here, when in due course we can buy into the best.

That is many months away yet and I want to take advantage of the current market correction to buy another cobalt company that is cheap, a new play so not known yet and we can buy in the ground floor. The next best area for cobalt in Canada is British Columbia, and no other than the Golden Triangle near Hazleton where Garibaldi and Jaxon reside. The company just went public in March, has hardly traded and is not known yet.

Primary Cobalt Corp.

CSE:PRIM Recent Price $0.13

Shares outstanding 19.6 million

Management

Patrick CT Morris, CEO and Director, is an entrepreneur and capital markets executive experienced in a number of industries including resource exploration, pharmaceutical cannabis, Blockchain technologies and finance. With 15 years capital markets experience raising funds for microcap companies and executing corporate development strategies, Mr. Morris has taken numerous companies public via IPO, RTO and CPC.

Kenneth Phillippe, Chief Financial Officer, is a Chartered Professional Accountant and received a Bachelor of Commerce degree from the University of British Columbia in 1976 and obtained his professional accounting designation in 1981, after articulating with the firm of Thorne Riddell (now KPMG). In 1981 he established a private accounting practice, which continues to the present. He is currently an officer/director of a number of junior listed companies.

Barry Hemsworth, Director, received a Bachelor of Commerce degree from the University of British Columbia (UBC) in 1964 and a law degree from UBC in 1965. (At the time he was enrolled in a combined commerce/law program at UBC). He was a practicing lawyer and a member in good standing with the Law Society of British Columbia from 1966 to 2009 when he retired. In the past five years, Mr. Hemsworth has acted as a consultant to several reporting issuers and been involved in the establishment of several private companies.

John Michael Mackey Director, received a Bachelor of Arts in International Studies and Political Science in 1961 from UBC and a law degree from UBC in 1964. He was a practicing lawyer and a member in good standing with the Law Society of British Columbia from 1965 to 1991. He was a director of the following two TSX.V companies: Vangold Resources Ltd. from January 2008 to December 2013 and Vanoil Resources Ltd. from January 2009 to February 2013.

Management is very strong in corporate finance and they can leverage this as they have just done in their partnership with ExcoMining in Spain.

Projects

RD Cobalt Property, 100% option, 7,327 hectares, NW B.C. South of Hazelton

The property is approximately 1 km south of the Yellowhead Highway, a major interprovincial highway in western Canada. Paved and gravel roads, rail, and power transmission lines run adjacent to the northern edge of property. The BC Hydro 138 kV supply line for the region passes through the property, with a secured substation at New Hazelton. The west end of the property (the Golden Wonder area) can be reached by a gravel road that links to Highway 16 southwest of Sealey Lake Provincial Park. ATV trails run west from this road north (for ~1,400 m) and south (for ~1100 m) of Denys Lake. The northern section of the property (West’s Knoll, Daley West areas) is mostly accessible from Highway 16 by ATV along trails or by foot. Access to the south-central area of the property above the treeline (Black Prince, Blue Lake, Silvertip Glacier, and Hecla areas) is limited to helicopter.

Most exploration on the property dates pre-2000 and virtually no modern exploration has been done.

In May 2017, Dahrouge Geological Consulting Ltd., on behalf of Primary Cobalt, prospected the area and collected rock and stream sediment samples for analysis. The goal of the exploration program was to confirm historic showings, identify possible new targets, and become familiar with the field conditions. A total of 47 person-days were spent in the field examining rocks, collecting samples and examining familiar with the area. Ninety-five (95) rock samples and 19 stream pan concentrate samples were collected from the property to confirm historical assays and guide in development of potential exploration targets.

As mentioned above, cobalt is mined as a byproduct of mostly nickel and copper. The Golden Wonder showing gives us a clue that this will be a copper/gold system with some good cobalt numbers. This is just one of several zones reporting anomalous copper, gold and cobalt. The outcrop appears to be several meters thick with potential strike of 400 meters. Gold samples ran as high as 17.8 g/y and cobalt up to 0.53%.

Spain

The birthplace of Rio Tinto, Spain has a rich history of mining, dating back to the Phoenicians and Romans. This, along with its large labor pool, has attracted many mining firms to the country and now it is a leading region of the European mining renaissance. The historical Rio Tinto mine, Corta Atalaya, built in 1873 in the town of Minas de Riotinto, which gives the company its name, was once one of the largest mines in the world and was actively mined until 1992. It was reopened by EMED Mining in 2015.

On April 26, Primary Cobalt entered into a strategic partnership with ExcoMining based in Madrid, Spain, subject to signing a final agreement. The agreement forms the foundation for a strategic relationship between ExcoMining and Primary, enabling the joint evaluation and potential acquisition of battery mineral research permits in Spain.

Discussions between the parties are focused on the near-term acquisition of high-value battery exploration permits in southern and central Spain. Spain has one of Europe's most diversified mining sectors, which produces mostly industrial minerals and stone. Spain encompasses almost 90% of the Iberian Peninsula, which is considered to be the most mineralized zone in the European Union. The historical San Carlos Cobalt mine was producing up to 70 tonnes cobalt per year. Lithium is found at other historical mines in Spain.

Patrick Morris, CEO of Primary, commented: "This agreement provides a unique opportunity for Primary to be able to access projects that it may normally not be able to. The agreement also enables Primary to have continued access to local geological and technical expertise of ExcoMining. In turn, we believe that Primary's public company platform will provide access to the capital markets for necessary financing for opportunities which arise under the agreement. Spain is an excellent jurisdiction in which to operate and we believe that the opportunity to enter the country with the latest exploration and development technology and search for a key battery metal commodities at a provincial and national scale."

Financial

With the IPO, a small financing was done at 10 cents for 4 million shares, raising gross proceeds of $400k. This will give the company ample funding for the first work programs at its RD Cobalt property.

Summary

I like to get into good junior companies early and this is right at the start. I mentioned the management is strong on the corporate finance front and they structured this deal right so the stock can appreciate and further financing done at higher prices.

There are just 19.6M shares out and at 15 cents the market cap is only $2.9 million. There are no warrants outstanding and only 1.9M 10-cent options outstanding good for five years. The stock is well held and the recent financing was done through Haywood Securities.

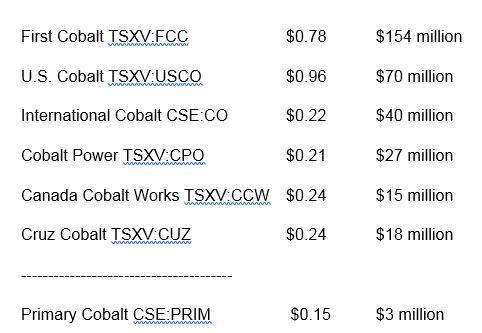

I believe this stock will easily move a lot higher and is very cheap compared to other early stage cobalt companies:

To clarify and for a proper comparison, these other juniors have advanced their properties and some with drilling. That is what Primary will be doing in the months ahead. If we assume a doubling in shares outstanding for further financing to advance projects, Primary would have 40 million shares out and at least be in the ranks of the bottom four companies that have an average market cap of $25 million.

$25 million / 40 million shares = $0.625

It would be quite reasonable to expect the stock over $0.50 and makes a good-first target.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Primary Cobalt. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Primary Cobalt is an advertiser on playstocks.net. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images provided by the author.

Struthers' Resource Stock Report Disclaimer:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.