- Elon Musk the dreamer to Dahn's reality

- Can Tesla Model 3 catch Chevy Bolt

- Interest in Global Lithium X soars

- Promising junior lithium/graphite plays

Tesla Motors Inc. (TSLA:NASDAQ) reported its Q4 production and delivery numbers on Jan. 3, and it was in line with my expectations. Tesla delivered 29,870 vehicles, of which 15,200 were Model S, 13,120 were Model X, and 1,550 were Model 3. Model S and X deliveries continue to grow with a 27% increase over Q4 2016, and a 9% increase over Q3/17.

My previous article that included Tesla was about gigafactory issues and the supply constraints they may cause on various commodities. It appears Tesla is making progress with its battery bottleneck as the company reported its Model 3 production rate increased significantly towards the end of the quarter. In the last seven working days of the quarter, Tesla made 793 Model 3s, and in the last few days, hit a production rate on each of their manufacturing lines that extrapolates to over 1,000 Model 3s per week. Previously I calculated at current production rates all three Tesla models were only consuming about 10 GWh/year of lithium ion batteries (LIBs) and storage products less than 1 GWh/year. Considering Model S and X have batteries supplied outside the gigafactory, the factory's current output is a fraction of the initial 35 GWh design.

Forget what Musk says about expansion to 100 GWh and additional gigafactories; let's see if it can get 35GWh up and running first. Elon Musk is a dreamer or visionary and he reenforced this at the end of 2017 with his idea or plan to put a Tesla Model S in orbit around Mars playing David Bowie's Space Oddity on repeat. I like it and we need these kinds of people for the planet to progress, but as investors we have to be able to distinguish dreams from reality.One of the best things that came along to aid the gigafactory was a dose of reality from Dr. Jeff Dahn. This guy is a no-nonsense scientist that I have followed for three to four years now in regards to LIBs. I suggest you watch this lecture he gave in 2016 a while after he joined Tesla where he explains things in layman terms that anyone should be able to understand. He comments in the article that Fortune magazine called him a new weapon, that Tesla was very optimistic so it started constructing the gigafactory and it has the largest footprint on the planet. Dahn only speaks of reaching 35 GWh, enough to produce 400,000 EVs per year.

If Tesla can get the gigafactory humming and can maintain its year-end production rate on Model 3, it has a chance to catch up to Chevy Bolt. The Bolt has seen a nice steady increase in sales, ending December 2017 with 3,227 Bolts sold according to insideevs.com. Since Bolt has come onstream, I decided to start tracking sales numbers for the bigger EV producers and will probably revamp this chart somewhat as time progresses and other EVs join in. Pictures are wonderful and this chart revealed a few things for me. Tesla's monthly sales fluctuate a lot from month to month compared to Chevy Bolt that has seen steady increases. I suspect this reflects GM's stronger manufacturing experience and its network of 4,219 dealerships according to autonews. This compares to about 100 U.S. Tesla stores in 2016 and even with increases in 2017, still a fraction of a GM. It also appears Nissan Leaf sales have suffered at the expense of Tesla Model 3, Chevy Bolt and another newcomer, Honda BEV.

General Motors (GM) delivered 3,002,241 vehicles in the United States in 2017, including more than 43,669 electric vehicles in 2017, including 23,297 Bolt EV crossovers and 20,349 Volt sedans. While the Bolt is currently less than 1% of GM sales and not a significant factor to its bottom line, it will become a significant factor in the EV world and LIB demand.

GM is using LIBs from LG Chem and has been assembling its battery packs in its Michigan plant for the Chevy Volt and other hybrids. Sales of the new Bolt are already outpacing Volt and I doubt the Michigan plant will be able to handle the demand, despite an expansion in 2017. The last news I saw a couple years ago from insideevs.com was the Bolt batteries would be manufactured in South Korea, however LG Chem is opening a new plant in Michigan sometime in 2018. I suspect this is for Bolt and demand increasing elsewhere.

While Tesla is ramping up to 35GWh and GM will have to do at least the same, combined they are just a small slice of a big pie. According to Bloomberg New Energy Finance, global battery-making capacity is set to double by 2021 to more than 278 GWh per year. Lithium-ion batteries are also expected to be 43% cheaper by that same year.

I believe the better investment opportunity is with LIBs and the commodities that benefit from them. It is much like Intel in the 1990s where the stock ran from $1 to $50 because of the chip demand in personal computers (PCs). That was a 5,000% increase compared to the PC manufacturers like IBM, Apple, HP/Compaq who still had respectable returns ranging from 300% to 1,300%. However, comparing Intel's silicon chips to LIBs is much different. As it sounds, silicon chips are made from silicon, which next to oxygen is the most abundant element on Earth. Some of the most common elements in LIBs are graphite, lithium, cobalt and nickel that are much more difficult to come by.

That was highlighted in a Financial Times article "There's a pivot," says John Kanellitsas, vice-chairman of Lithium Americas, a miner that is developing a lithium project in Argentina. <"i>There's much more consensus on demand; we're no longer even debating demand. We're shifting to supply and whether, as an industry, we can deliver."

I highlighted Volkswagen's concern previously and here is another from BMW in an article just last week on Bloomberg "It's gotten more hectic over the past year," said Markus Duesmann, BMW's head of procurement, who's responsible for securing raw materials used in lithium-ion batteries, such as cobalt, manganese and nickel. "We need to keep a close eye, especially on lithium and cobalt, because of the danger of supply scarcity."

Many investors are piling into the Global X Lithium & Battery Tech ETF (LIT).

The top two holdings are Albemarle Corp. at 17.9% and FMC Corp. at 16.4% that are among the top lithium producers. Albemarle has seen strong growth in lithium sales driven about 50% in price and the other half in volume growth. Net sales in Q3 2017 were $755 million with lithium accounting for $269 million or about 36% of net sales. FMC Corp.'s revenue is mostly driven by the agriculture sector with Q3 2017 total revenue of $646 million and only $94 million from lithium or about 15%. Other holdings around 5% are LIB producers, LG Chem, Samsung and Panasonic and also Tesla at 4.18%.

Global X is a combination of lithium and battery tech, but does not offer much direct exposure to lithium, especially considering that the major positions only have a fraction of revenues driven by lithium. It has proven to be an effective investment this year and the one thing for certain that you can see in the chart is the huge surge in volume from investor interest.

In 2016, Deutsche Bank produced an in depth 172 -page report on lithium that you can easily find and worth reading if you set some time aside. One of the summaries in the report was that Global lithium supply needs to triple in 10 years.

"Global lithium demand was 184kt in 2015, with battery demand increasing 45% YoY and accounting for 40% of global lithium demand. Based on our analysis, global lithium demand will increase to 534kt by 2025, with batteries accounting for 70% of global demand. We have reviewed over 70 companies and 125 lithium projects to forecast how the supply market will respond."

Deutsche Bank is forecasting very strong demand for lithium driven by EVs and energy storage. While demand will try to go up in a linear fashion as the chart suggests, most likely supply constraints will not allow for it. LIB manufacturers can easily bring more LIB production machines on line but as Markus Duesmann of BMW comments, the scarcity of lithium and cobalt could be a challenge. It is not surprising that lithium prices have been very strong and so have related equities.

Benchmark Minerals has its own price index that combines the various types of lithium and prices look to be heading higher.

The angle I have approached this opportunity is buying a basket of junior lithium, graphite and cobalt miners along with up and coming LIB start ups. The juniors are much more volatile and risky but with that comes higher potential rewards. My junior lithium pick for 2017 was Quantum Minerals Corp. (QMC:TSX.V; QMCQF:OTC; 3LQ:FSE) and I was very surprised at the market response and stock performance from 10 cents to $1.40, but it was not out of line with valuations of other juniors. In my search for a similar situation, I found:

Redzone Resources Ltd. (REZ:TSX.V; REZZF:OTC): Shares outstanding 23.2 million

Redzone is run by Mike Murphy who ran Gleichen Resources from 2007 that acquired the Morelos Gold project in Mexico from Teck Resources in 2009. The stock moved from under C$0.20 to C$1.50 after the acquisition; Mike stepped aside as CEO in 2009 but still remains a director. Gleichen's first raise was C$240 million and changed its name in 2010 to Torex Gold that many of you probably know. Torex hit a high of C$35 in 2016 (considering a 10 to 1 consolidation relates to $3.50), but has run into some labor problems at the mine of late.

Gary Brown, Senior VP and CFO of Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), is a director of Redzone along with two seasoned mining engineers/geos, Alan F Matthews and Craig Roberts along with Jean-Phillippe Paiement who did the 43-101 report. They have over 70 years combined experience.

Recently, Cameron Bell M.Sc P. Geo joined the board. He has over 30 years of experience working as a geologist and exploration manager. He was a Regional Exploration Manager for Vale from 2007 to 2016, with periods as North American Manager and Australasia Manager. Prior to that, he worked with Inco Technical Services where he was responsible for project generation and managing its grassroots nickel exploration in North America. Additionally, he held the role of Senior Geologist at Voisey’s Bay and Sudbury. This is the first project he has become involved with since his retirement.

Management of this caliber do not get involved in junior companies unless they believe the odds of discovery and success are very high. Besides the success of Mike Murphy, another attractive aspect is the location and quality of its lithium project in Arizona.

Fortner Boyd Lithium—100% earn in option, 4,132 acres

The company announced it expanded the project by over 600% last week; the project is located in Maricopa County, Arizona, approximately 10 km southwest of the city of Wickenburg. The area is easily accessible through the public road network and favorable to work year round. Geologically, it is a good location at the junction of the Mexican Highland and the Sonora Desert and is part of the Arizona Pegmatite Belt.

The project has seen historic work since the 1950s that gives us a very good indication that there are lithium bearing dykes on the project that could be of size and grade to be economic. From the 1950s to 1980s, there was trenching, 75 shallow drill holes and a 10-meter shaft sunk. Watt, Griffis & McQuad from 1980: "The Vulture Pegmatite is a very large, nearly continuous group of pegmatite bodies which trend north-south for 1,350 feet. The bodies range in width from 10 feet to 50 feet. The Vulture Pegmatite is lithium-rich, containing spodumene, lepidolite, and possibly amblygonite." The historic resource outlined mineral potential of 330,000 to 552,000 tonnes at grades between 0.3 and 2.5% Li2O on just one of the dykes.Note, that these are historical numbers and not 43-101 compliant.

In December 2016, Redzone retained SGS Canada Inc. (SGS) to complete a 43-101 Technical Report on the project. The historical work outlined above was only done on the Lucky Mica dyke. However, in the limited 2017 field exploration program 10 new pegmatite outcrops were identified and 35 samples assayed with better results ranging from 0.69 to 7.5% lithium oxide. This work identified seven more dykes.

In the process of staking additional claims noted above, the company found two additional lithium prospects known as the Ambly and Dove claims. Historical reports from the Arizona Geological Survey indicate that several railcar loads of lithium ore were mined at the Dove Claims (report 1980) and records from the Mineral Resources Data System (MRDS) indicate that Ambly was explored historically for lithium (report 1978).

Financial

Cash position at Nov. 30 was C$540,000 and since then Redzone closed a C$1.2 million financing. This will give the company ample funds for a first round of exploration that includes mapping and sampling, trenching and a phase 1 drill program.

Summary

The project has seen very limited work, but based on historical data, we have very good evidence that the one explored dyke is mineralized and has good odds of being economic. With just a small exploration program the company was able to demonstrate much more potential on the property with several new dykes discovered.The limited amount of sample assays thus far indicates that seven of the dykes are mineralized.

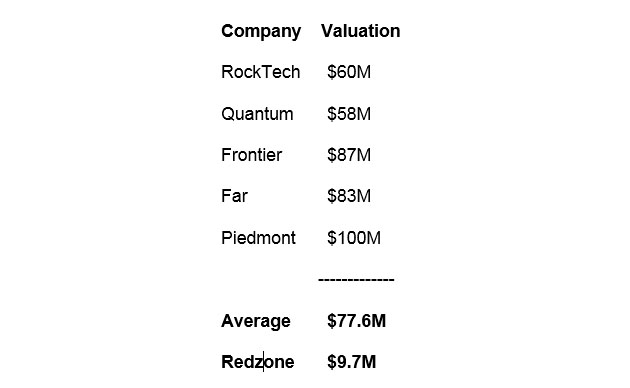

Redzone's project is very comparable to QMC Quantum I own, Rock Tech, Frontier and Far Resources that I have used as comparisons earlier. Market valuation are in Canadian dollars as most trading is on the TSX Venture.

Rock Tech Lithium Inc. (RCK:TSX.V; RCKTF:OTCPK; RJIA:FSE) valued at C$60 million, is in the same area as Quantum and in 2017 did some sampling and started trenching in November, pretty much at the same stage as QMC Quantum, valued at C$58 million, which has done similar work.

Frontier Lithium Inc. (FL:TSX.V; HLKMF:OTCPK), valued at C$83 million, is not far away in Ontario. In December, Frontier released results of one drill hole it completed and came back with very good results, intersecting 118.9 meters of pegmatite averaging 2.47% lithium oxide (Li2O)

Far Resources Ltd. (FAT:CSE; FRRSF:OTCPK ), valued at C$87 million, also has a Manitoba lithium project. The Zoro I Claim covers a significant lithium pegmatite occurrence known as the "Principal Dyke." It contains an historical "reserve" based on 1956 drilling of 1.8 million tonnes grading 1.4% Li20, to a depth of 305m. The company plans to drill this winter.

All four of these juniors are hard rock lithium showing similar grades and early exploration with no recent drilling other than one hole at Frontier. Rock Tech did drilling five or six years ago and has a small, 3.19 million tonne resource at 1.10% Li20.

A lot of exploration in the U.S. is focused on Brines in Nevada. Hard rock in lithium bearing spodumene has been mined for decades and has less processing time, higher recoveries and less capex compared to brine evaporation. Historically hard rock lithium projects in the U.S. were mostly in South Dakota and Colorado, and some in New Mexico and Arizona. North/South Carolina had the largest historical resources with known spodumene reserves in tkaim-gpodumeiie belt at the border of North and South Carolina near Kings Mountain.

An Australian company, Piedmont Lithium Ltd. (PLL:ASX; PLLLY:OTCPK) is exploring its WPC project in North Carolina. The project had 19 historical drill holes for only 1,200 meters in 2009/10. Piedmont did a phase 1 drill program of 12 holes in 1,500 meters and found grades of 1% to 1.5% Li20. The company just completed a phase 2 program of 90 holes and has reported on 76 holes so far with similar grades of 1% to 1.5% over widths of 10 to 20 meters roughly. It has 454 million shares outstanding and market cap around C$100 million.

Piedmont currently trades on the OTC Pinks as an ADR that is equivalent to 100 common shares and the company intends to list the ADRs on NASDAQ. The stock currently trades little volume on the OTC and I doubt that Canadian/U.S. investors know much about Piedmont in Australia. It is a little farther advanced but I think fair as the only hard rock U.S. property based junior to use as a comparison.

Redzone will have to increase about 8-fold to $3.00 per share to have a similar valuation as its peers. I expect it will soon complete more sampling and new trenching that would put it exactly at the same stage of exploration as QMC Quantum, plus Redzone can work a lot easier in the winter months at its location. If we assume more dilution in 2018 to 30 million shares, a $75M market cap would be $2.50 per share. Quantum recently hit a high $1.80 and Rock Tech is currently $1.70, so it does not appear an unrealistic target for Redzone, especially considering stronger management at Redzone and a project in the U.S.

The Redzone chart is C$ on TSX Venture and one can see that it has just come to life in early December 2017. The stock appears to be consolidating now in the 40s after its second move higher.

Graphite

I have also bought into a new graphite junior that I see strong potential and near-term production.

DNI Metals Inc. (DNI:TSX.V; DMNKF:OTCPK; DG7:FSE) Shares outstanding 98.3 million

DNI has two projects adjacent to each other in Madagascar on a highway and just 50 km to the seaport. The company already has a mining permit and its deposits are on surface in soft saprolite. Cougar Metals of Australia was advancing one project, the Vohitsara, but had difficulty with funding and could not make property payments and work commitments. DNI Metals terminated the agreement after allowing some extensions, so DNI will retain 100% ownership.

DNI owns two permitted, saprolite-hosted graphite projects in Madagascar, Vohitsara and Marofody that was recently acquired on October 25, 2017. These projects are contiguous, with the bulk of their respective mineralization located between two kilometers and four kilometers from the paved national highway which is 50 kilometers from the country's main seaport. DNI intends to develop both the Vohitsara and Marofody projects in conjunction.

Vohitsara Project

Earlier in 2017, 45 air core drill holes and five diamond core holes were completed with an average depth of the saprolite being approximately 28 meters on the property. The best intersect was 51 meters of 6.37% Cg. Highlights of other intersects include:

- VHT0025: 11.5 meters at 7.23 per cent Cg (graphitic carbon) from surface;

- VHT0016: 12 meters at 4.14 per cent Cg from 8.5 meters, and 4.5 meters at 5.2 per cent Cg from 25 meters;

- VHT0019: 19.5 meters at 6.12 per cent Cg from 10 meters, including 4.5 meters at 10.59 per cent Cg from 19 meters.

On Jan. 10, DNI Metals announced the third and fourth batches of drilling assay results from its recent diamond core drilling program at the Vohitsara project, incorporating four additional assayed diamond core holes from the Main zone. Drilling continues to encounter free-dig saprolitic weathered material developed to depths of up to 42 meters below the surface outcrop elevation, averaging 28 meters.

Highlights:

- VHTDD017: 12.90 meters of 4.71% GC (graphitic carbon) from 3.20 meters (including 5.40 meters of 7.44% GC from 10.70 meters);

- VHTDD014: 11.25 meters of 5.38% GC from 38.64 meters (including 3.46 meters of 7.42% GC from 43.54 meters).

The remaining work from 2017 is currently in the assay labs and further results are expected near term. Detailed topographic surveying of the Main and SW zones as well as all drill collars and trenches have been completed. Additionally, 57 density measurements have been collected from drill core. This data will be combined with assay data for compilation of a mineral resource for the Main and SW zones.

Adjacent Marofody project 100% owned

Marofody is registered as mining permit No. PE8904, at the Madagascar's national mining cadaster (the BCMM). Initial development plans include Topographical and Ground geophysical surveys, a multiphase targeted drilling program along with trenching. The environmental impact study (EIS) has been completed and filed. This project has strong potential to add more tonnage to DNI's more advanced Volhitsara project.

DNI is advancing quickly to production.

In late 2017 a bulk sample of 90 tonnes was collected with 45 tonnes from the main zone and 45 tonnes from the southwest zone in the Volhitsara project. This was sent to India to be tested by a potential offtake partner.

Meanwhile DNI Metals announced January 15 a binding supply letter agreement, with Korea Graphite Co. Ltd., a 100% owned subsidiary of Peninsula Mines Ltd. The agreement includes a commitment by DNI to supply up to 24,000 tonnes per year of flake graphite to Korea Graphite, subject to Korea Graphite finalizing off take agreements with Korean end users commencing Q4 2018.

Peninsula's Managing Director and director of Korea Graphite, Jon Dugdale, said, "This binding supply agreement with DNI is a key pre-cursor to establishing binding off take agreements with Korean flake-graphite end users. Peninsula has established strong relationships with Korean end-users that are looking to secure flake-graphite supply for lithium-ion battery anode production as well as for cutting-edge new technologies such as expandable graphite, a non-flammable building cladding/insulation product. Madagascar has been producing high-purity, large-flake graphite for over 100 years and DNI's large-flake graphite deposits are saprolite hosted and close to port."

DNI is manufacturing a pilot plant to start small-scale production with a design criteria at 6,000 tonnes per year of production. The plant is to be built in Ontario, Canada, containerized and shipped to Madagascar.

DNI has a combination of competitive advantages that I have found quite compelling compared to other graphite juniors.

- The graphite is hosted in soft saprolite material that is near surface which means easy and low mining costs.

- Grades look to be quite good ranging from 2% to 7% Cg.

- Strong evidence the adjacent Marofody project hosts the same ore body as Vohitsara.

- Located just 50 kilometers from a major seaport to access the booming Asia markets.

- DNI has been operating a graphite wholesale business for a number of years, which buys and sells high-quality graphite. This has helped establish rapport with end users.

- The company just announced a supply agreement and have other potential agreements/partnerships in play.

The stock just broke out above resistance around 11 cents and I expect that near term it could test the 15-cent highs of last August.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Redzone Resources, DNI Metals and QMC Quantum and participated in recent private placements in Redzone Resources and DNI Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Redzone and QMC Quantum are advertisers on playstocks.net. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Wheaton Precious Metals. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Redzone Resources, DNI Metals and Wheaton Precious Metals, companies mentioned in this article.

Charts and images provided by the author.

Struthers' Resource Stock Report Disclaimer:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.